Journal Entry Bank Loan - It is important to realize that in each of these journals there are two debit entries. Early loan repayment should be reflected in the journal. Web the journal entry is debiting cash and credit loan receivable. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. On december 31, 2022, the interest accrued on the loan must be. He spends all of the money on improving and updating. *assuming that the money was. Web enter the date and journal entry number. Web journal entry for loan taken. A business can take an amount of money as a loan from a bank or outsider.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web the journal entry to recognize the receipt of the loan funds is as such: A business may choose this path when it does not.

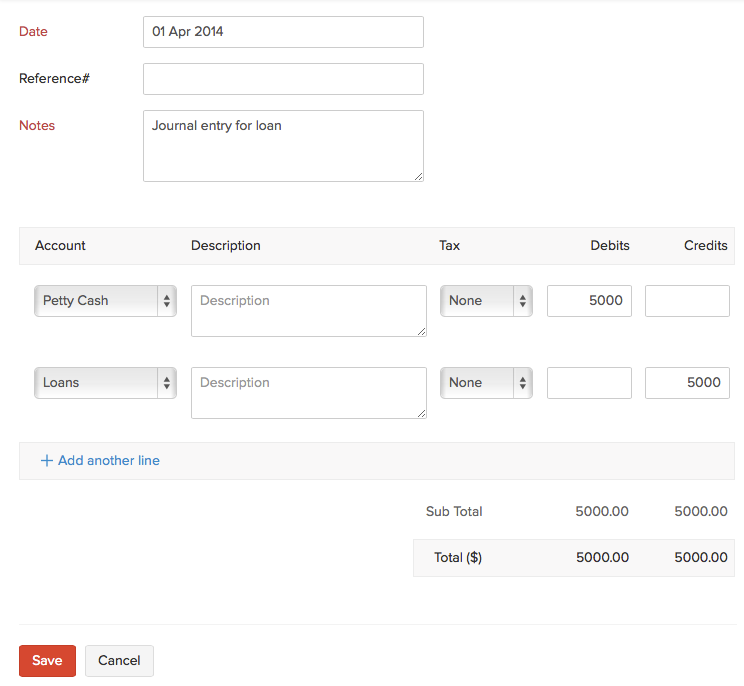

Record loans

Web start recording loan payment journal entries now. You’ve got a busy day today. It involves recording your initial loan,. A business can take an.

Loan Journal Entry Examples for 15 Different Loan Transactions

Debiting cash and crediting loan payable accounts are the key journal entries for recording a bank loan. You’re going to meet up with a client,.

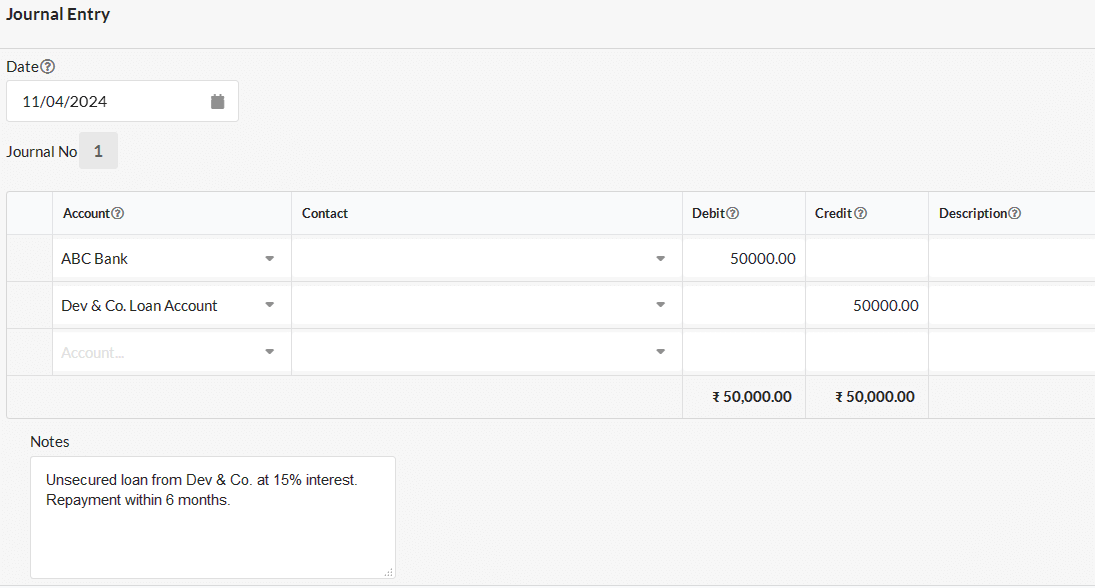

Receive a Loan Journal Entry Double Entry Bookkeeping

A business can take an amount of money as a loan from a bank or outsider. In return, the business has. Banks and nbfcs are.

Bank Loan EMI Entries in Tally ERP9 Loan installment entries Journal

Such a loan is shown as a liability in the books of the company. Web start recording loan payment journal entries now. Company abc is.

Bank Loan Repaid Journal Entry Info Loans

You’ve got a busy day today. Web journal entry for loan taken. Web the journal entry to recognize the receipt of the loan funds is.

Journal entry for Loan Payable Output Books

Firstly the debit to the interest. Web the journal entry is debiting cash and credit loan receivable. It involves recording your initial loan,. Banks and.

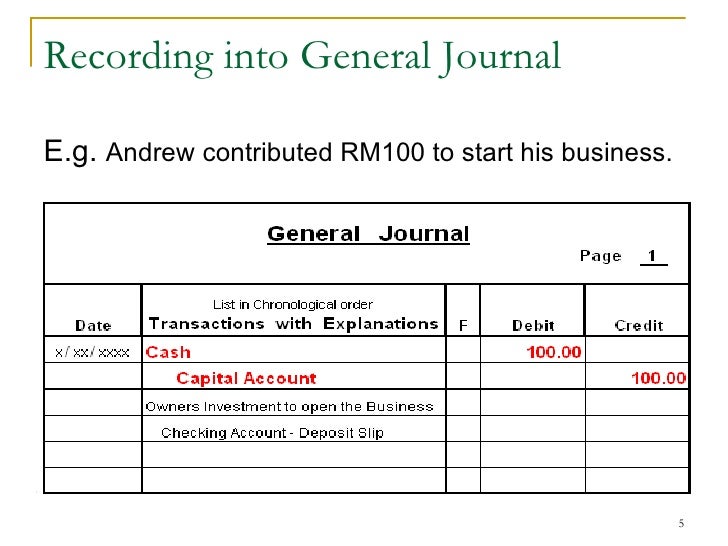

Journal Entry Examples

It involves recording your initial loan,. Then, select the second line and credit the liability account. Company abc is making a loan to its business.

Journal Entries of Loan Accounting Education

Another way to visualize business transactions is to write a general journal entry. A business can take an amount of money as a loan from.

Another Way To Visualize Business Transactions Is To Write A General Journal Entry.

Such a loan is shown as a liability in the books of the company. A business can take an amount of money as a loan from a bank or outsider. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Web start recording loan payment journal entries now.

Web Journal Entry For Loan Taken.

When recording your loan and loan repayment in. You’ve got a busy day today. Web the journal entry is debiting cash and credit loan receivable. He spends all of the money on improving and updating.

Firstly The Debit To The Interest.

Bank (or cash) is an asset. In return, the business has. Company abc is making a loan to its business partner for $ 70,000. *assuming that the money was.

Select The First Line And Debit The Loan Asset Account.

Web now the journal entry for repaying the loan is as follows: After 3 months, the business partner. Web in this journal entry, both total assets and total liabilities increase by $20,000 as a result of borrowing a $20,000 loan from the bank on january 1, 2021. Web here are four steps to record loan and loan repayment in your accounts: