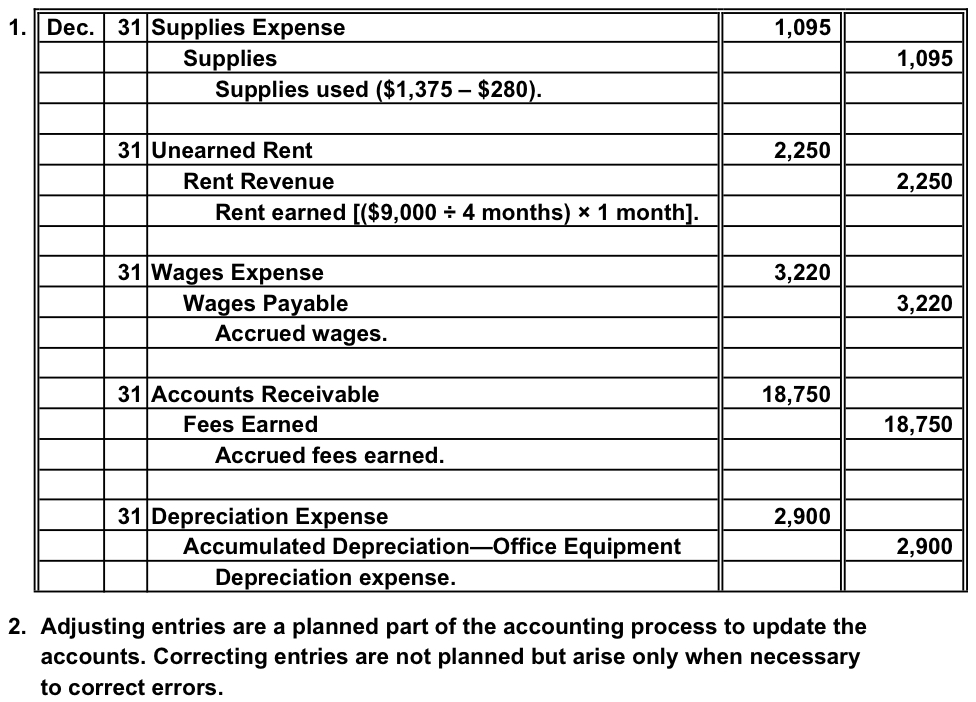

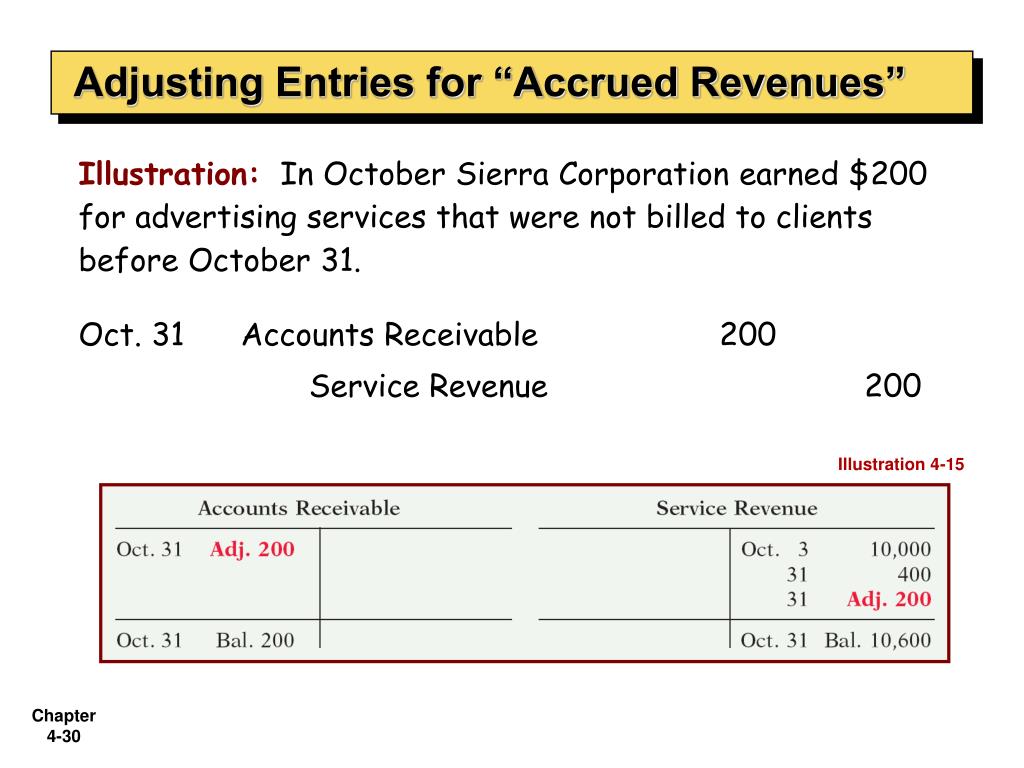

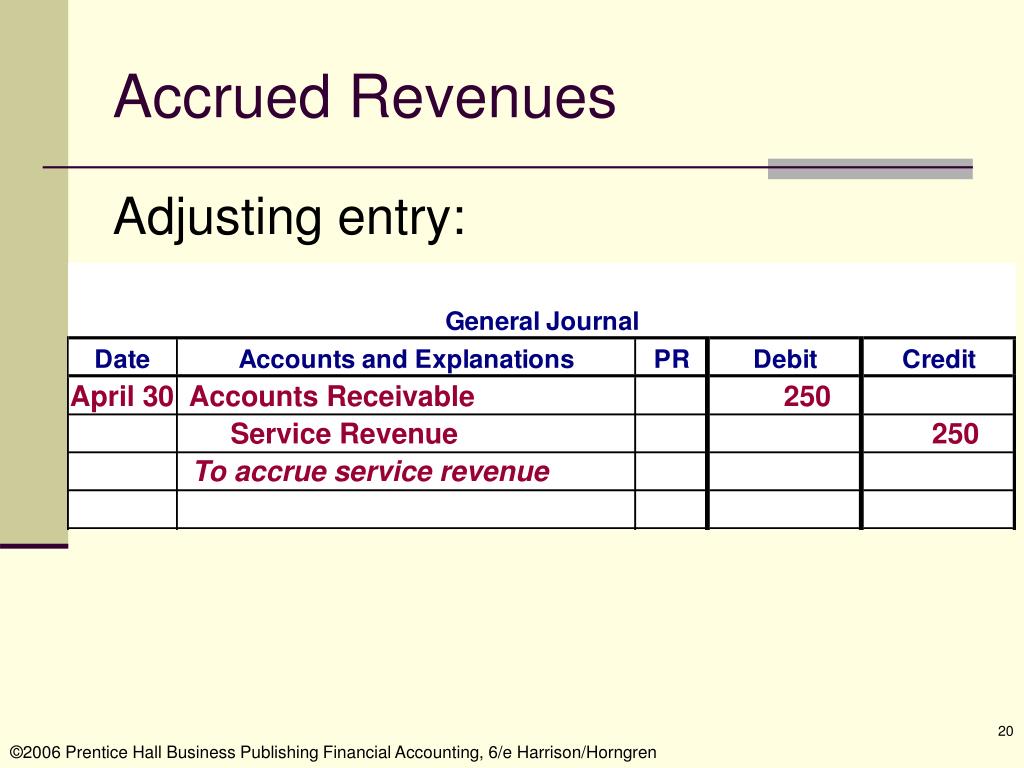

Example Of Accrued Revenue Journal Entry - On the income statement, you'll record it as earned revenue. Web what is accrued revenue? Now, you can record the journal entry in your accounting system. Recording adjustments for accrued revenue. Web accruals are created by adjusting journal entries at the end of each accounting period. Like accrued revenue, the consultation fees are recognized on the income statement in the current period despite the company still being in possession of the cash. In this case, the debit and credit entries are made for the amount of income already earned. Accrued revenue is revenue that is recognized but is not yet realized. The interest is charged at 1% per month. Accrued revenue journal entries are passed and accounted under the amount receivables in the balance sheet of the company to reflect the value that their clients owe.

Lasicamping Blog

A company, xyz ltd, has paid interest on the outstanding term loan of $1,000,000 for march 2018 on 5th april 2018. However, you won’t get.

PPT Accrual Accounting Concepts PowerPoint Presentation, free

Accrued revenue is revenue that is recognized but is not yet realized. When you receive the payment, record it. The interest is charged at 1%.

Accrued revenue how to record it in 2023 QuickBooks

Accrued revenue vs deferred revenue. Web journal entry for accrued income/revenue. However, to simplify the accounting process, they are recorded only at the end of.

How to use Excel for accounting and bookkeeping QuickBooks

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Consider the example.

Accruals and Prepayments Journal Entries HeathldDunn

An accrual is a record of revenue or expenses that have been earned or. Web this journal entry is to record the collection of receivables.

PPT Accrual Accounting and the Financial Statements Chapter 3

It is also known as unbilled revenue. Web with cash basis accounting, you'll debit accrued income on the balance sheet under the current assets as.

Accrued Revenue Definition, Examples, and How To Record It

By obaidullah jan, aca, cfa and last modified on oct 15, 2014. Journal entries record the entire spectrum of monetary transactions. Web how to enter.

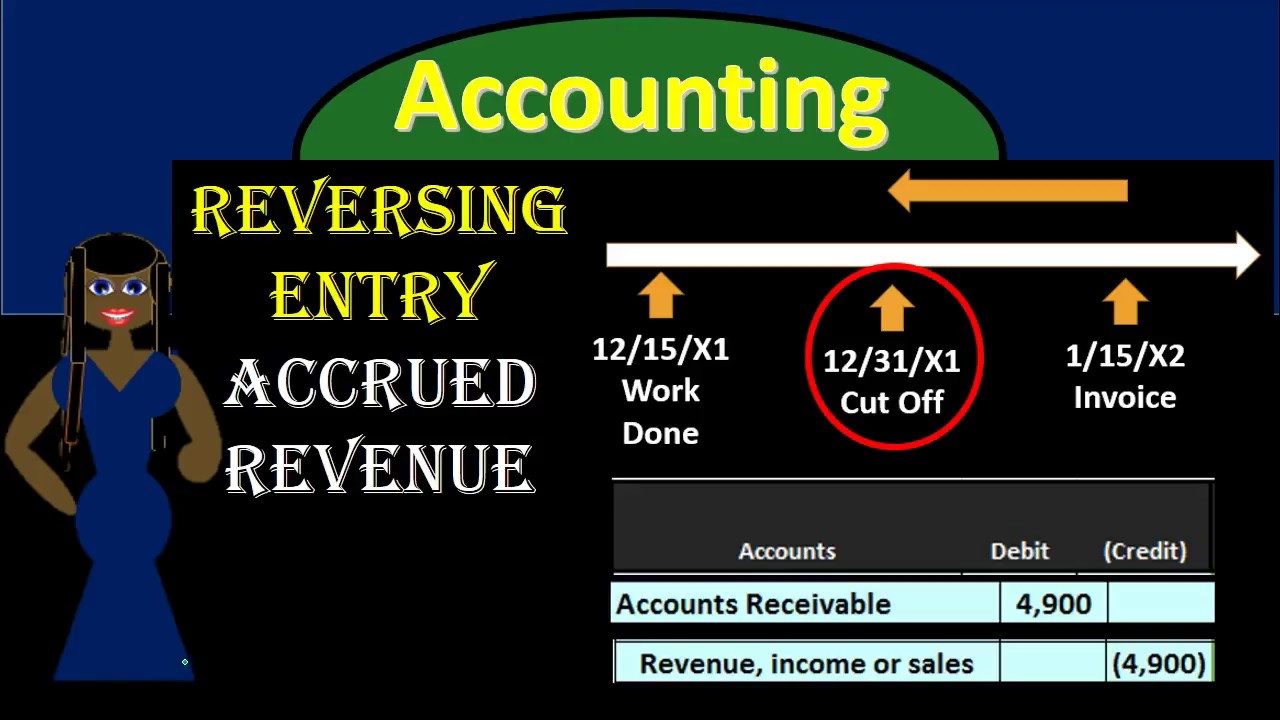

300 Reversing Journal Entries Accrued Revenue YouTube

Web for example, under contract terms, a company can provide a customer with a service for several months and record the agreed amount as accrued.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

Example on jul 1, 20x4, company a obtained a loan of $50,000 for five years at interest rate of 8% per annum from company b..

Web Like Accrued Revenues, The Accrued Expenses Occur Continuously.

Web accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable. As an example, a company could hire a consultant and receive their services before an actual cash payment is processed. Revenue is accrued in order to properly match revenue with expenses. A typical example is credit sales.

Web How To Enter Accruals In Journal Entries.

Web accruals are created by adjusting journal entries at the end of each accounting period. By obaidullah jan, aca, cfa and last modified on oct 15, 2014. However, to simplify the accounting process, they are recorded only at the end of the accounting period. The revenue is recognized through an accrued revenue account and a receivable account.

On The Income Statement, You'll Record It As Earned Revenue.

Now, you can record the journal entry in your accounting system. A company, xyz ltd, has paid interest on the outstanding term loan of $1,000,000 for march 2018 on 5th april 2018. In john's case, the journal entry for. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee.

Web This Article Has Been A Guide To What Are Accrued Revenue Journal Entries.

The interest is charged at 1% per month. The first step in the accounting cycle involves recording all the money earned and spent, paid and owed, as soon as expenses are incurred or payment is received. Web journal entries to record the payment of expense on payment date involve debits to expense account and relevant accrued liability account; Web how is accrued revenue recorded in journal entries?

:max_bytes(150000):strip_icc()/accrued-revenue-Final-ae2075d1acbb46d18adb27838b33751c.jpg)