Journal Entry For Service Revenue - A journal entry must be made each time a business makes a sale. Web the sales journal entry is: You use accounting entries to show that your customer paid you. Web what is a sales journal entry? A sales journal entry is a bookkeeping record of any sale made to a customer. Impact on the financial statements: Revenue is reported on the. Offering flexible return policies can differentiate a business from its competitors, enhancing customer experience. The entry will record accounts receivable if the sale is on credit. The company paid a 50% down payment and the balance will be paid after 60 days.

Adjusting Journal Entries Defined Accounting Play

On december 7, the company acquired service equipment for $16,000. Cost of services = usd700,000. Cash is an asset account hence it is increased by.

How to use Excel for accounting and bookkeeping QuickBooks

On january 10, 2019, provides $5,500 in services to a customer who asks to be billed for the services. The company paid a 50% down.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web what are accrued revenue journal entries? On december 7, the company acquired service equipment for $16,000. Web getting the journal entries for asc 606.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web what are accrued revenue journal entries? The entry will record accounts receivable if the sale is on credit. Think of “posting” as “summarizing”—the. If.

Journal Entries Accounting

Web getting the journal entries for asc 606 correct means we first need to define revenue recognition. Web what is a sales journal entry? Think.

What is Unearned Revenue? QuickBooks Canada Blog

Posted on january 2, 2021 by online accounting guide. Revenue is reported on the. The entry will record accounts receivable if the sale is on.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Web service revenue is exactly what it sounds like: Posted on january 2, 2021 by online accounting guide. Accrued revenue journal entries refer to the.

1.10 Adjusting Entry Examples Financial and Managerial Accounting

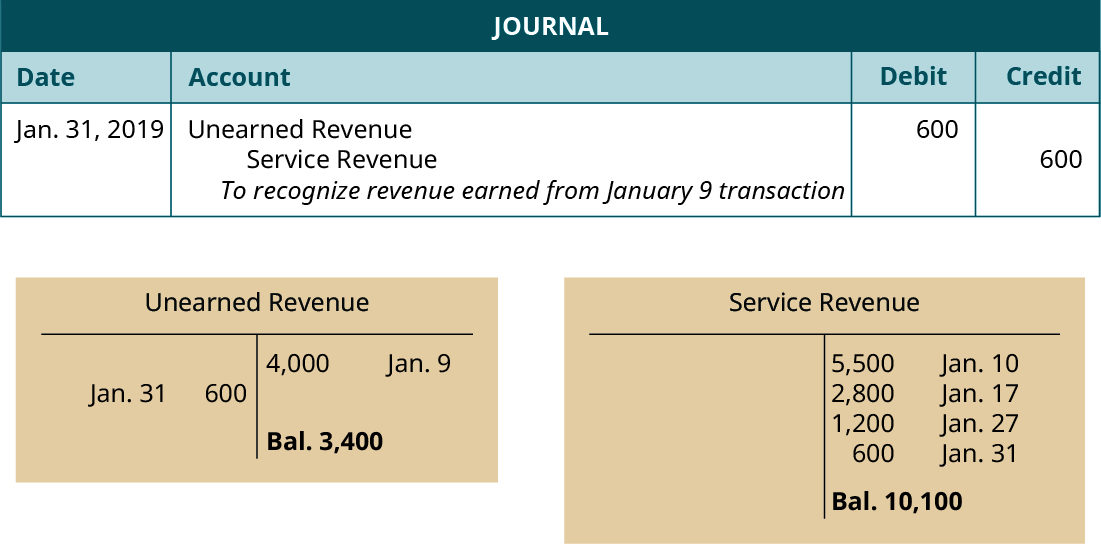

Service revenue would increase on the credit side. Web to write a journal entry you need to figure out which accounts are affected, which items.

Journal Entry Examples

In the journal entry, accounts receivable has a debit of. Web the sales journal entry is: [debit] accounts receivable for $1,050. Thus, this journal entry.

The Company Paid A 50% Down Payment And The Balance Will Be Paid After 60 Days.

Think of “posting” as “summarizing”—the. Web when the service is delivered and you have earned the revenue, you record another double entry with credit and debit reversed. Web the journal entry for services rendered for cash is to debit cash and credit service revenue. Web what are journal entries for?

Demonstrate Journal Entries For Sales And Payments On Account.

There are two ways of recording unearned revenue: Impact on the financial statements: [debit] accounts receivable for $1,050. If cash has been received, but.

If You Want To Learn More About Making.

Let’s look at three transactions from neatniks: In the journal entry, accounts receivable has a debit of. Cost of services are considered as the expenses element. Web printing plus provided the service, thus earning revenue.

Cost Of Services Journal Entry:

A journal entry must be made each time a business makes a sale. Recording revenues when they are earned. Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to. Under cash basis accounting, customer sales are recognized as sales.