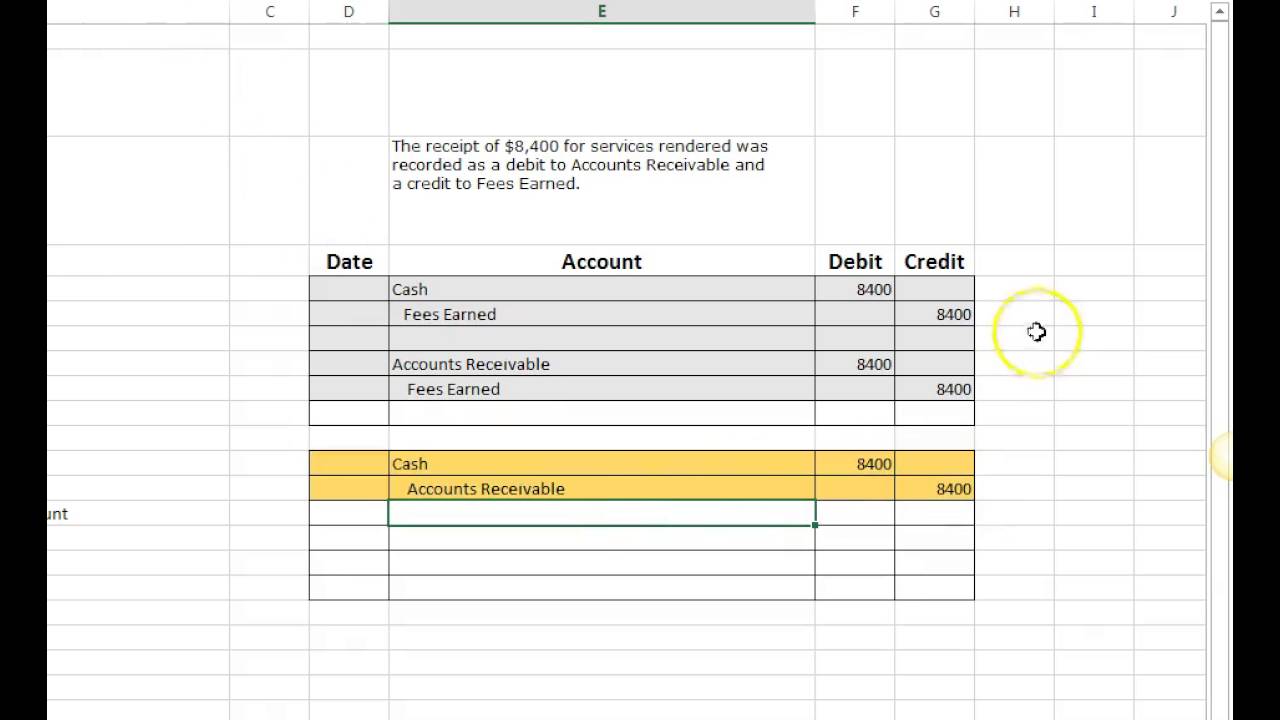

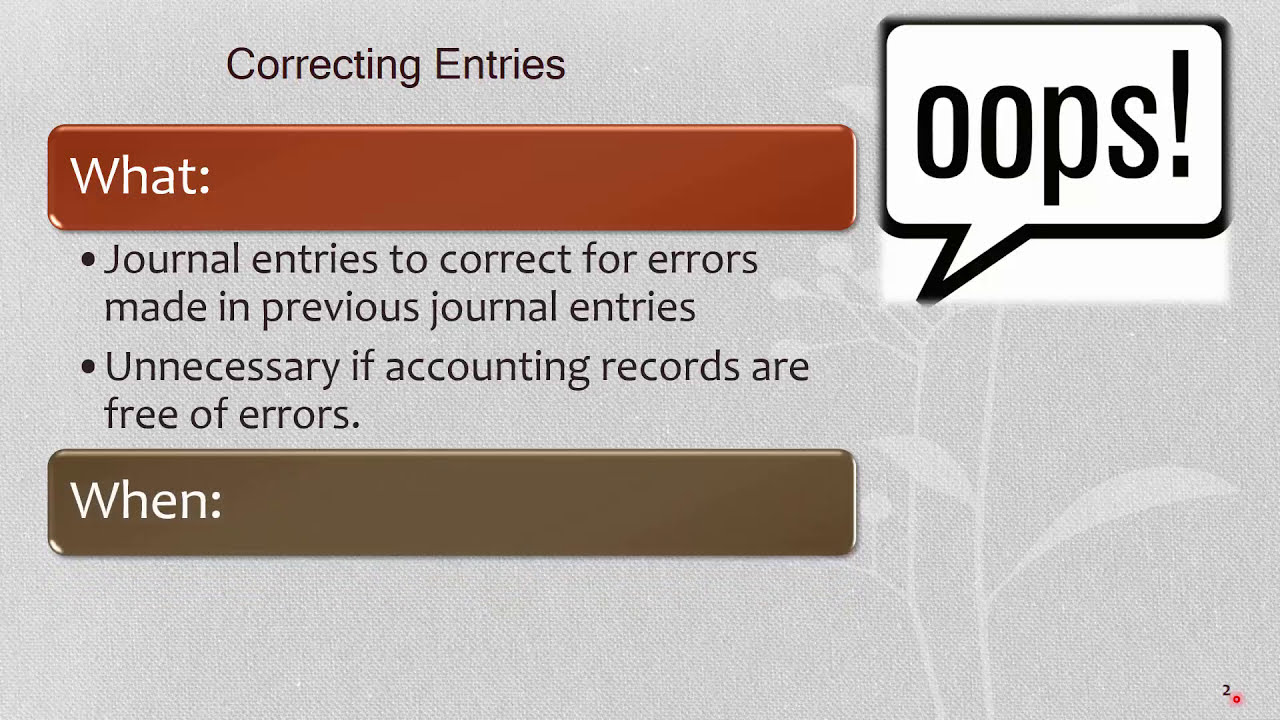

Correcting Journal Entries - A correcting entry is a journal entry that is made in order to fix an erroneous transaction that had previously been recorded. According to dual aspect concept every debit entry has a corresponding credit entry with the same amount. There are two ways to make correcting entries: Web correction entries is a journal or entry that is specifically compiled to fix the errors in a financial statement. What is a journal entry? Steps 1 and 2 may be interchanged. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. First, the business transaction has to be identified. Web prepare journal entries to correct errors and clear out a suspense account. Each one of these entries adjusts income or expenses to.

7 Acct 201 Correcting Journal Entries YouTube

Web the best way to master journal entries is through practice. For example, a supplier invoice may have. Steps 1 and 2 may be interchanged..

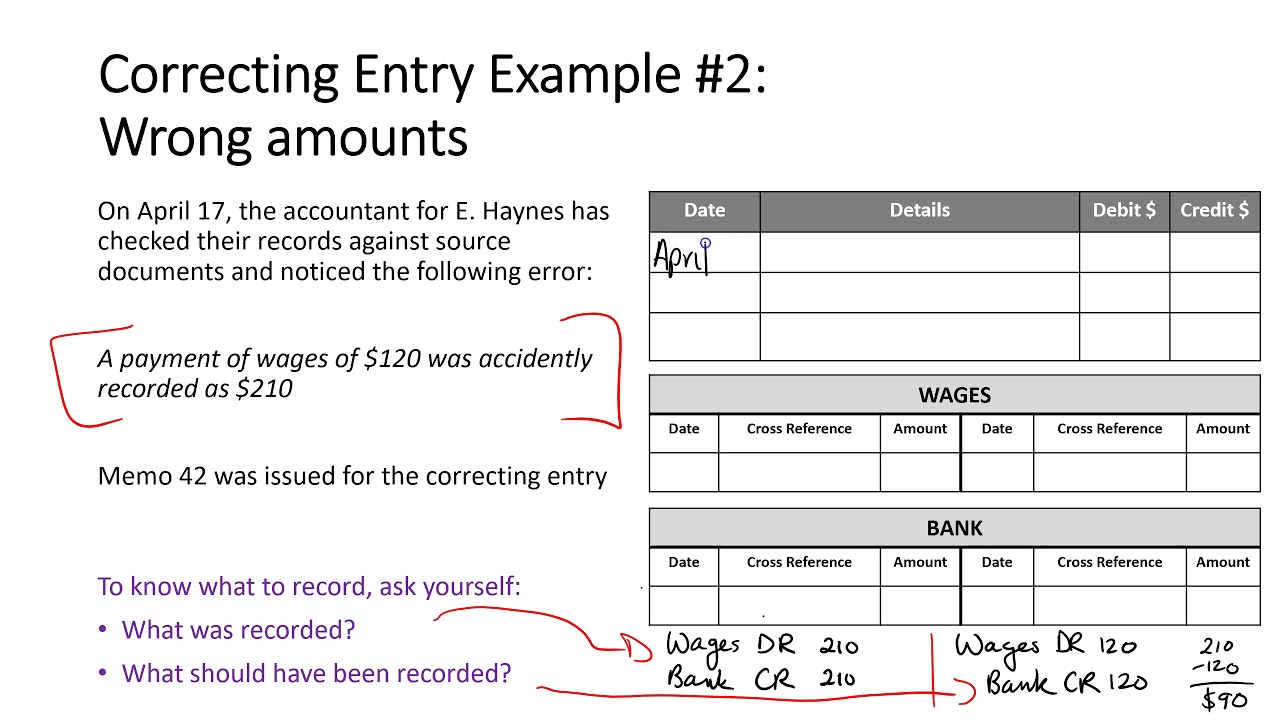

Year 12 Accounting How to record correcting entries 2 YouTube

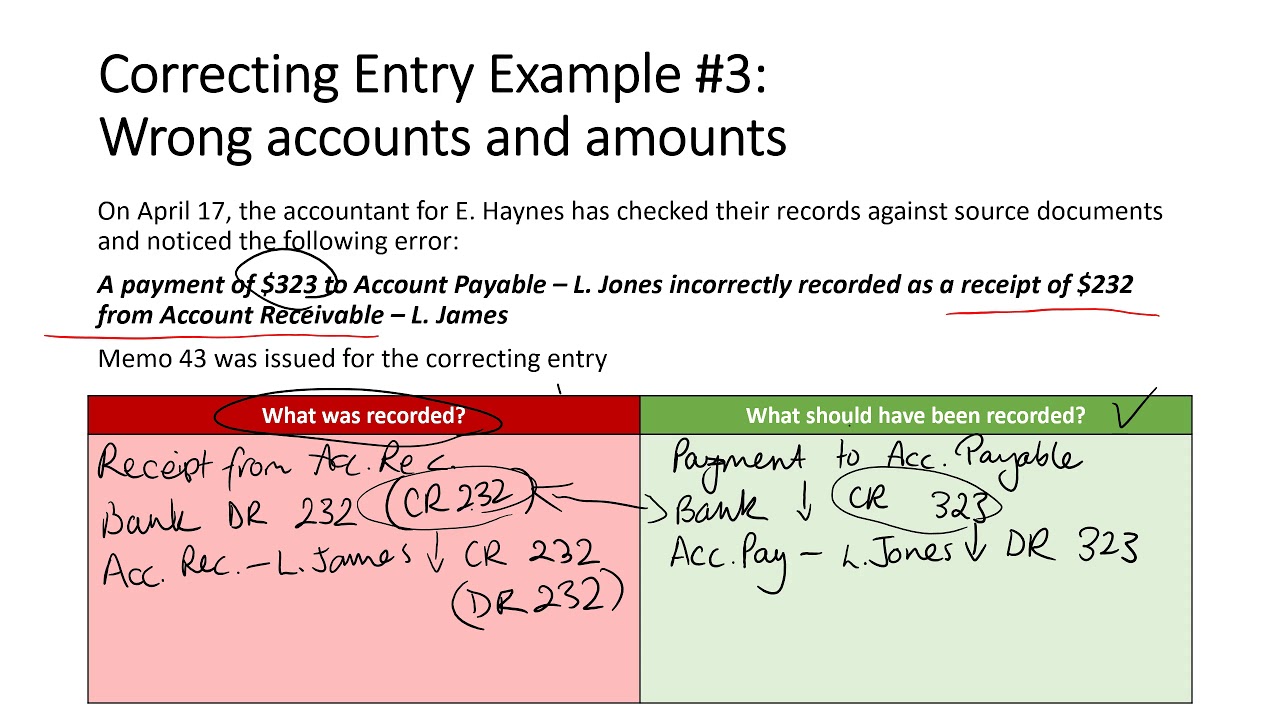

Analyze #1 and #2 to come up with the correcting entry. By making the second journal entry to rectify the erroneous one. Reverse the incorrect.

Correcting Entries YouTube

Web there are three different types of adjusting journal entries as follows: Steps 1 and 2 may be interchanged. In this case, the error is.

Year 12 Accounting How to record correcting entries 3 YouTube

First, the business transaction has to be identified. Here are numerous examples that illustrate some common journal entries. The methods are 1) write a correcting.

Adjusting Journal Entries Defined Accounting Play

In this case, the error is when classifying an account or. What is a journal entry? After that, pass the required entry. Web there are.

Correcting Entries Accountancy Knowledge

Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any.

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

Steps 1 and 2 may be interchanged. According to dual aspect concept every debit entry has a corresponding credit entry with the same amount. The.

How to Prepare Correcting Entries Accounting Principles YouTube

There are two ways to make correcting entries: Each one of these entries adjusts income or expenses to. The first example is a complete. According.

Correcting Entries Accountancy Knowledge

A correcting entry should be entered whenever an error is found. Web the best way to master journal entries is through practice. First, the business.

Web Describes The Two Methods Of Correcting Journal Entries.

Prepare statements correcting profit for errors discovered. If errors are found at the end of the year, while preparing financial statements,. Here are numerous examples that illustrate some common journal entries. Web the best way to master journal entries is through practice.

Accountants Must Make Correcting Entries When They Find Errors.

Reverse the incorrect entry and then. In this guide, we’re going to cover: By making the second journal entry to rectify the erroneous one. There are generally three steps to making a journal entry.

The Methods Are 1) Write A Correcting Journal Entry, And 2) Reverse The Incorrect Entry And Then Wri.

In this case, the error is when classifying an account or. Each one of these entries adjusts income or expenses to. For example, a supplier invoice may have. What is a journal entry?

Obviously, If You Don’t Know A Transaction.

Web prepare journal entries to correct errors and clear out a suspense account. There are two ways to make correcting entries: The steps in preparing correcting entries may be summed up as follows: Firstly record the incorrect entry, then record the entry as you think it should.