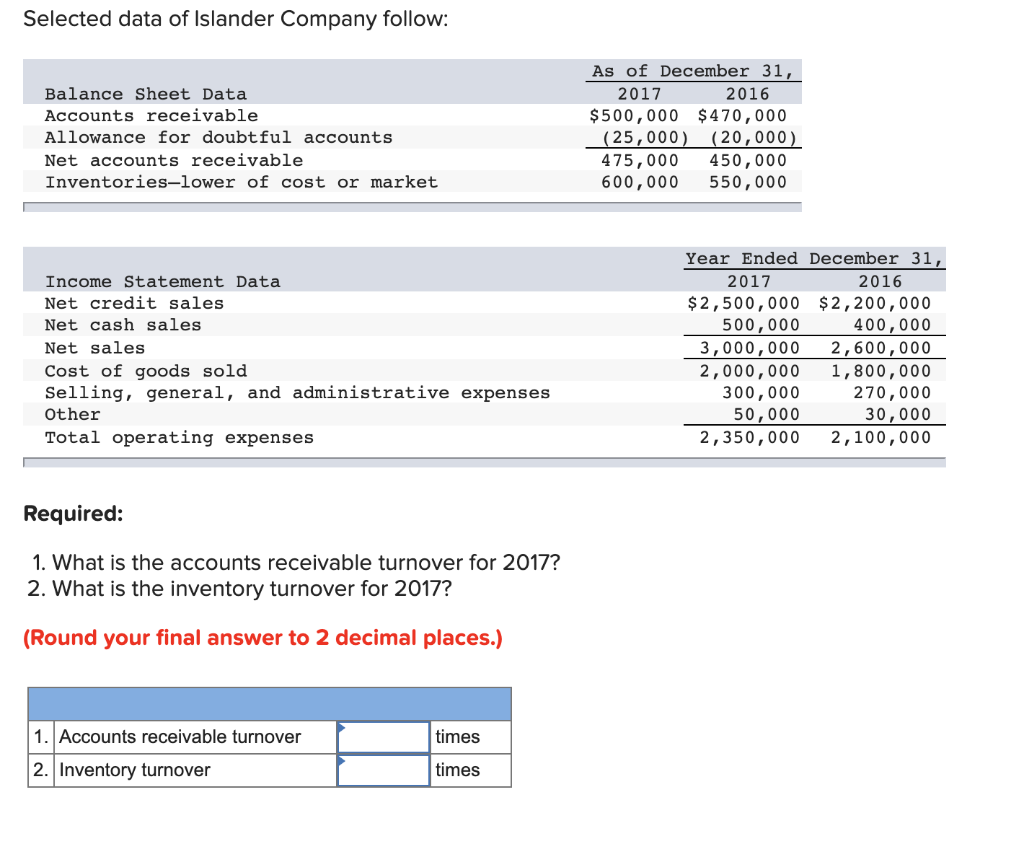

Sold Inventory For Cash Journal Entry - Web making accounting journal entries for cash are fundamental for a business. Receiving cash from a charge customer: This journal entry needs to record three. A second journal entry reduces the account inventory and. Web a sales journal entry is a journal entry in the sales journal to record a credit sale of inventory. Web the first entry is to recognize the sale revenue that the company makes by debiting accounts receivable or cash and crediting sales revenue account. A sales journal entry records the revenue generated by the sale of goods or services. Web what is a sales journal entry? Has 50,000 cash as its capital. Web 10.2 calculate the cost of goods sold and ending inventory using the periodic method;

journal entry format accounting accounting journal entry template

Web a sales journal entry is a journal entry in the sales journal to record a credit sale of inventory. This $5,000 of the goods.

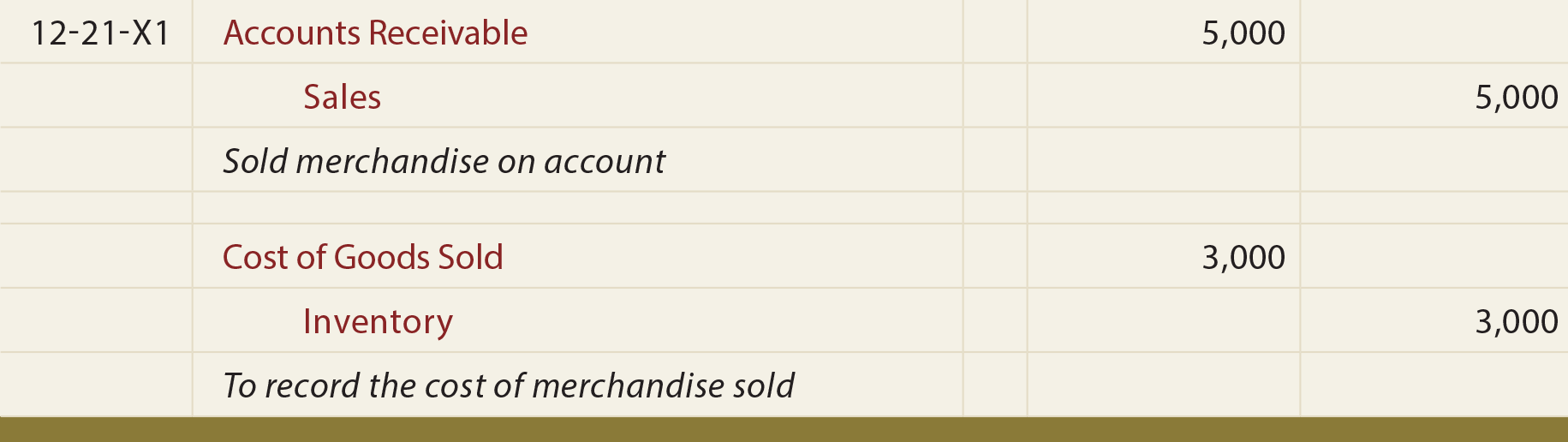

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web when goods are sold for cash, the first step in creating a journal entry is identifying which accounts are impacted by the sale. A.

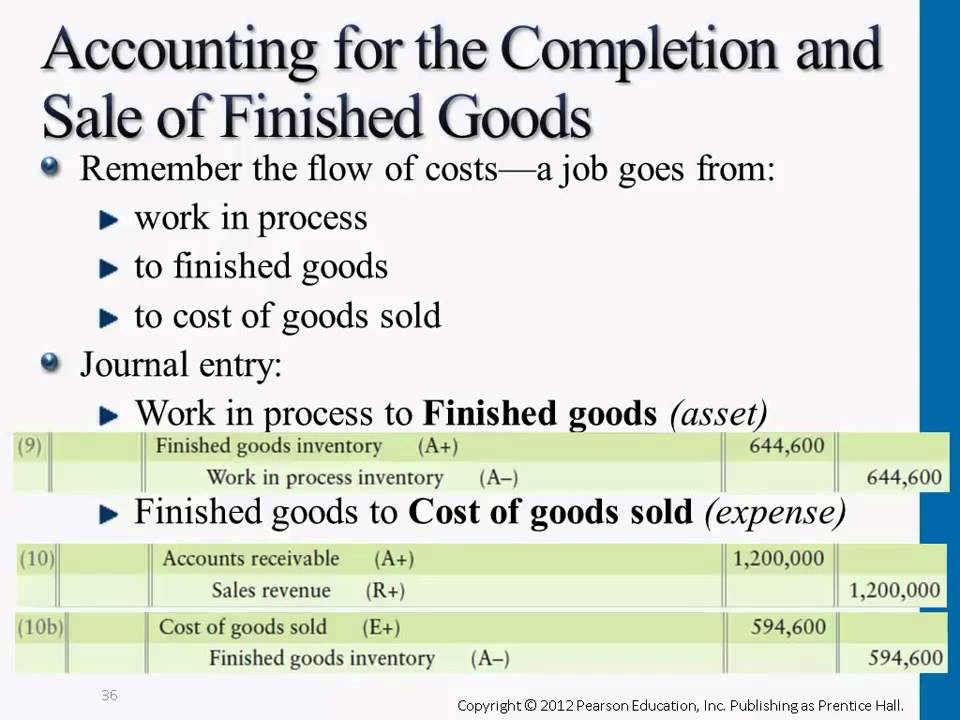

Perpetual Inventory

In this case, we’ll say that: Learn how to keep inventory accounting records and calculate sale amounts. A sales journal entry records the revenue generated.

6.4 Analyze and Record Transactions for the Sale of Merchandise Using

Likewise, we will need to make the journal. To understand it more clearly, let us take an example. Web a sale of goods will result.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

This increases the inventory asset on the balance sheet, reflecting. Collect information ahead of time, such as your beginning inventory balance,. Web the first entry.

Perpetual Inventory Systems

Collect information ahead of time, such as your beginning inventory balance,. Web a sales journal entry is a journal entry in the sales journal to.

[Solved] Develop journal entries and find out the cost of goods sold

Web to record an inventory purchase journal entry, follow these steps: This increases the inventory asset on the balance sheet, reflecting. A sales journal entry.

Recording a Cost of Goods Sold Journal Entry

This increases the inventory asset on the balance sheet, reflecting. The transaction, goods sold for cash, has an effect on both sides of the accounting.

Journal Entry for Purchase of Inventory YouTube

Learn how to keep inventory accounting records and calculate sale amounts. This increases the inventory asset on the balance sheet, reflecting. The transaction, goods sold.

The Customer Paid A Total Of $770 In Cash,.

In this case, the $5,000 will directly add to the balances. It does more than record the total money a business receives from. This $5,000 of the goods sold had an original cost of $3,000 in the inventory. Web the periodic inventory system recognition of these example transactions and corresponding journal entries are shown in appendix:

The Exact Double Entries We Do Depends On Which Inventory System The Business Uses.

Receiving cash from a charge customer: Web when goods are sold for cash, the first step in creating a journal entry is identifying which accounts are impacted by the sale. Can make the journal entry for inventory purchase on october 12, 2020, as below: A sales journal entry records a cash or credit sale to a customer.

Likewise, We Will Need To Make The Journal.

Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. A second journal entry reduces the account inventory and. Web making accounting journal entries for cash are fundamental for a business. Has 50,000 cash as its capital.

The Journal Entry For A Cash Sale Actually Involves Two Possibilities.

Gather information from your books before recording your cogs journal entries. All of the cash sales of inventory are recorded in the cash receipts journal and all non. For example, on january 1, we have sold $5,000 of goods for cash. Web understand inventory sales and journal entries for cash sales and credit sales.