How To Record 401K Employer Contributions Journal Entry - Web payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings. Web this situation requires the company to record an adjusting entry in order to match the expense to the proper accounting period. Web by law, 401 (k) plan contribution limits are adjusted every year. Anyone age 50 or over is eligible for an additional catch. I'll make sure that you can record an employer 401k. The journal entry is essential to ensure compliance with government regulations and to accurately report the financial records of. Web also, there are other ways on how you can record these payroll expenses in quickbooks desktop (qbdt). Web but take note: This financial move could lead to a tax bill. Determine the last date of.

How To Record 401K Employee Contributions Journal Entry LiveWell

Web you can post the 401k contribution without quickbooks payroll by using a journal entry. Some of these options include. Web also, there are other.

401k Basics Strategy To Increase Contributions And Your Paycheck

Web payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings. I'll make sure.

How To Record 401K Employee Contributions Journal Entry LiveWell

Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. I think the main thing.

Sample Payroll Journal Entry

Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. Employees can contribute up to.

Basic Accounting for Business Your Questions, Answered

I'll make sure that you can record an employer 401k. Web by law, 401 (k) plan contribution limits are adjusted every year. Employer contributions to.

How To Record 401K Employee Contributions Journal Entry LiveWell

Web how to record a payroll journal entry in 5 steps. If you are unsure on how to use the account, you can refer to.

Payroll Journal Entry Example Explanation My Accounting Course

I'll make sure that you can record an employer 401k. Recording a payroll journal entry can either be done manually or through the use of.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

Web you can post the 401k contribution without quickbooks payroll by using a journal entry. Employer contributions to pension plans. Employers have the option to.

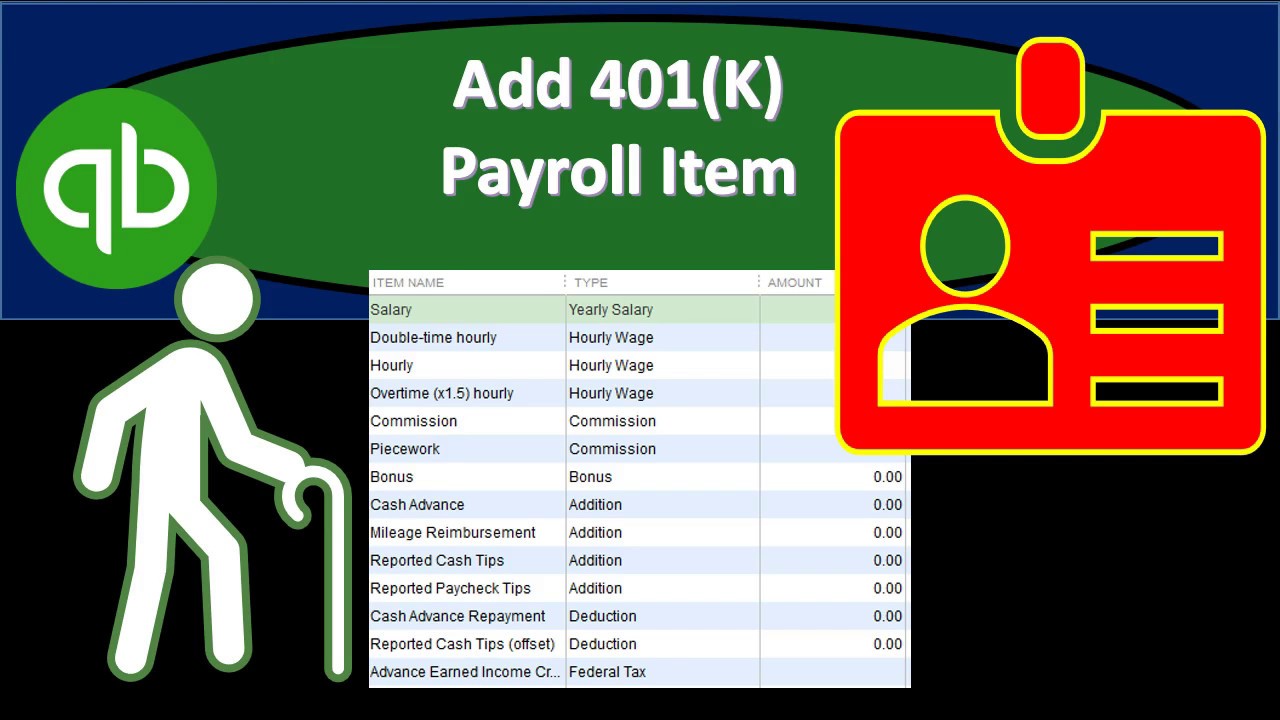

Add 401(K) Payroll Item In QuickBooks Inflation Protection

Web as the employer, you can record a journal entry for 401k expense to reflect the amount your company will contribute for a payroll period..

Web How To Record A Payroll Journal Entry In 5 Steps.

If you are unsure on how to use the account, you can refer to your. I'll make sure that you can record an employer 401k. This financial move could lead to a tax bill. Thank you for reaching out to the community.

Web Employer Contributions To A 401K Account Must Be Recorded In The Company’s Books Using A Journal Entry.

The easiest way to capture your employer's contribution to a 401 (k) account is to set up a. That way, you can look back and see details about employee. Web the company has set up a 401k expense account to track their contributions, and each employee has an individual 401k contribution account. Web this situation requires the company to record an adjusting entry in order to match the expense to the proper accounting period.

I Think The Main Thing To Consider Is Matching What Actually Happens In The 401K Account.

Determine the last date of. Web but take note: Web in order to record employee 401k contributions, a journal entry is required to debit salary and 401k expenses and credit payables to the respective authorities. Web by law, 401 (k) plan contribution limits are adjusted every year.

It’s A Good Idea To Know Those Limits And Plan Your 401 (K) Contribution Strategy Accordingly.

Secure act 2.0, which passed in december 2022, allowed employers for the first time to match roth 401. Anyone age 50 or over is eligible for an additional catch. Web recording the payroll process with journal entries involves three steps: Web also, there are other ways on how you can record these payroll expenses in quickbooks desktop (qbdt).