Capital Lease Journal Entries - Web n a p a r o t apartnership and corporation partnership formation on april 8, 2022, tolentino who has her on retail business and tan, decided to form a partnership wherein they will divide profits in the ratio of 60:40, respectively. Web to account for a capital lease, familiarize yourself with the terms of the arrangement and make the appropriate journal entries. The new lease accounting standard, asc 842, has. Web the borrowing must enter the associated value of the assets, and the associated liabilities within in its accounting journal entries, which specifications are included in the. The statement of financial position of tolentino is as follows: Last updated january 7, 2024. Tolentino marketing statement of financial. At the commencement date, the lessor must recognize the lease receivable and the residual asset. Calculate the initial lease liability. All apc candidates, especially those practising competencies such as landlord and tenant, leasing and letting, property management and purchase and sale, will need a robust understanding of lease terms.

How to Account for a Capital Lease 8 Steps (with Pictures)

All apc candidates, especially those practising competencies such as landlord and tenant, leasing and letting, property management and purchase and sale, will need a robust.

Capital Lease Definition Examples and Forms

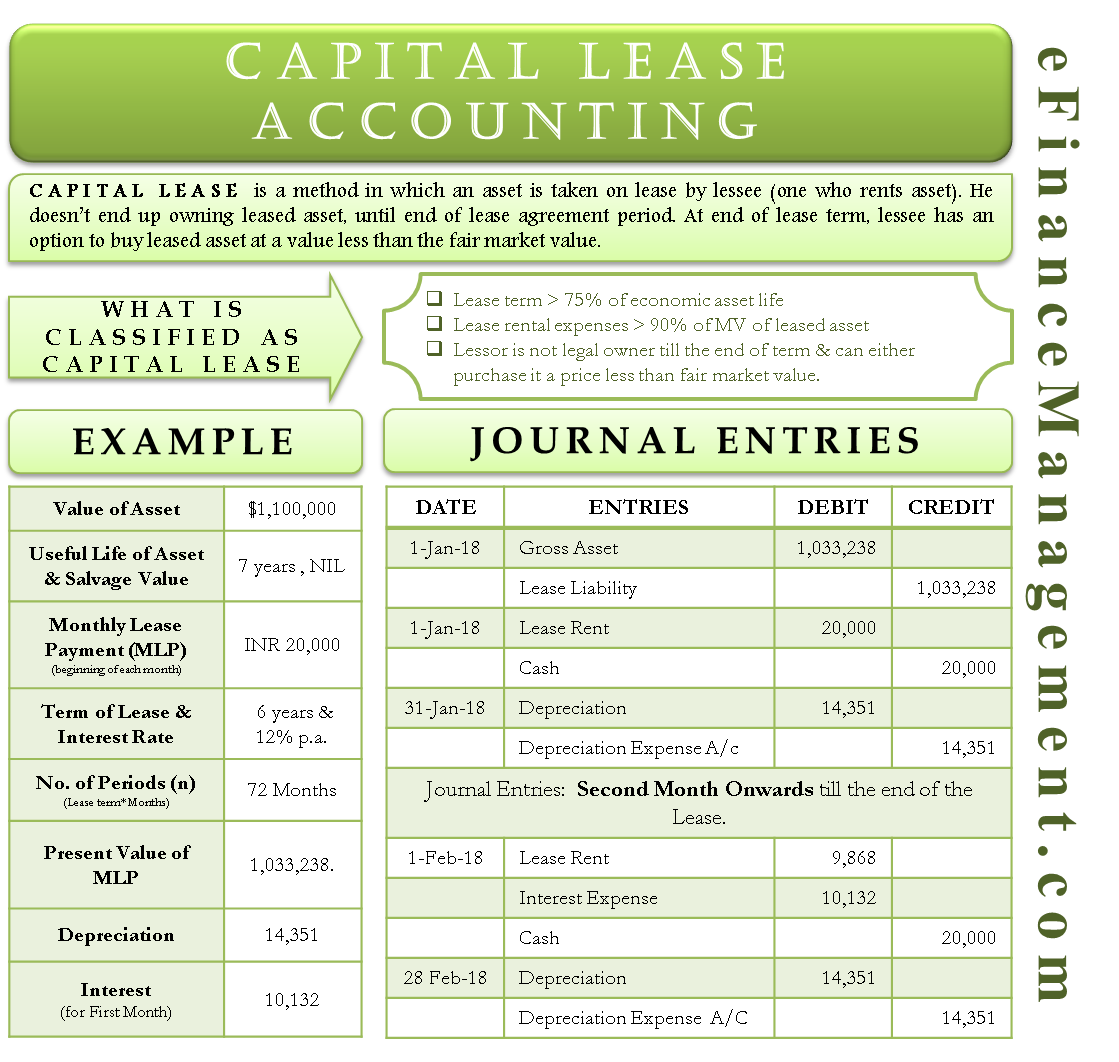

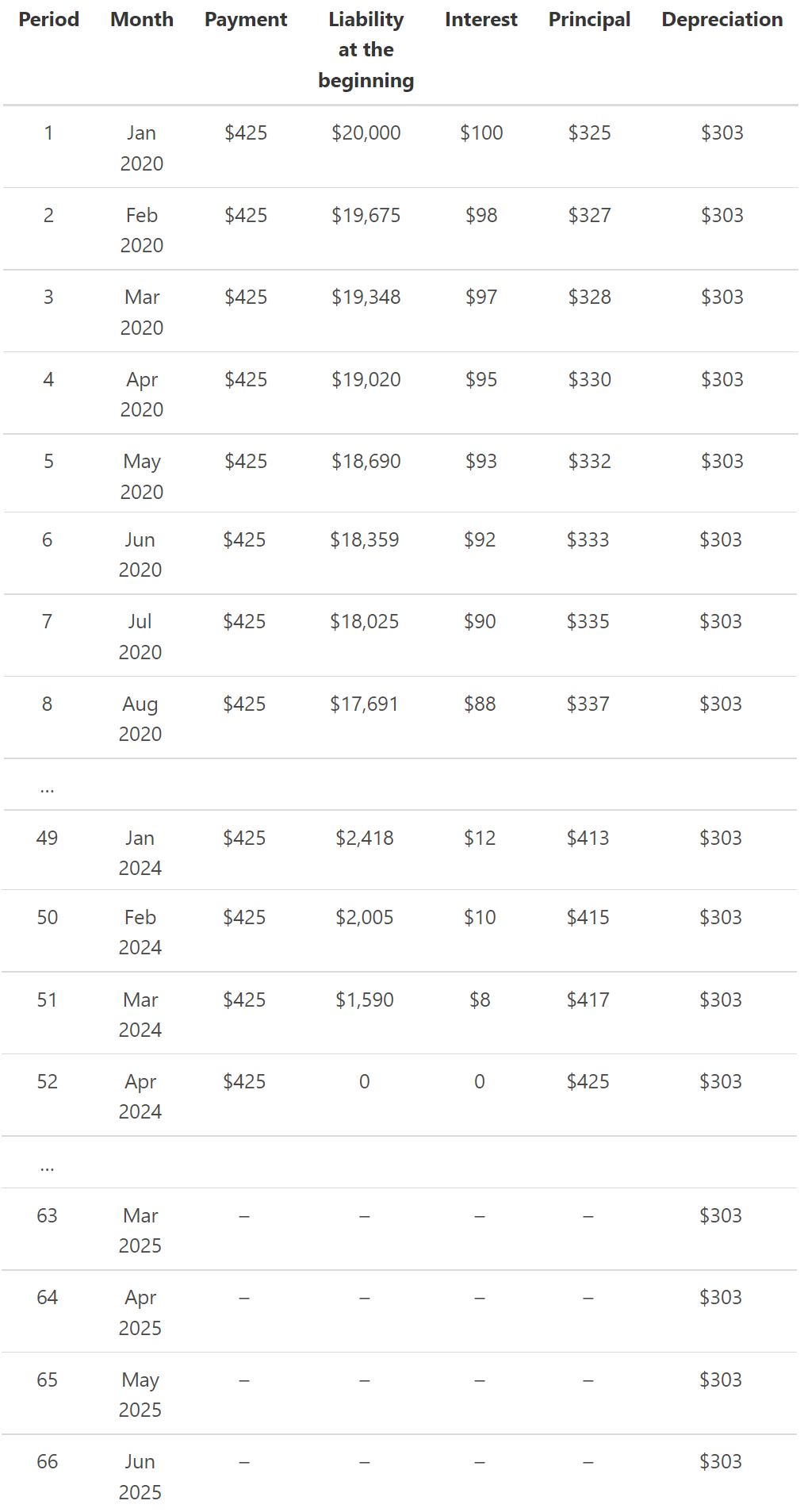

Web as documented above, the present value of the minimum lease payments is $15,293, so the initial journal entry to record the finance lease at.

Capital Lease Accounting Example, Preparation, Explanation & Criteria

Calculate the initial lease asset value. Find out the steps to calculate. Tolentino marketing statement of financial. To start, if you're not familiar with the..

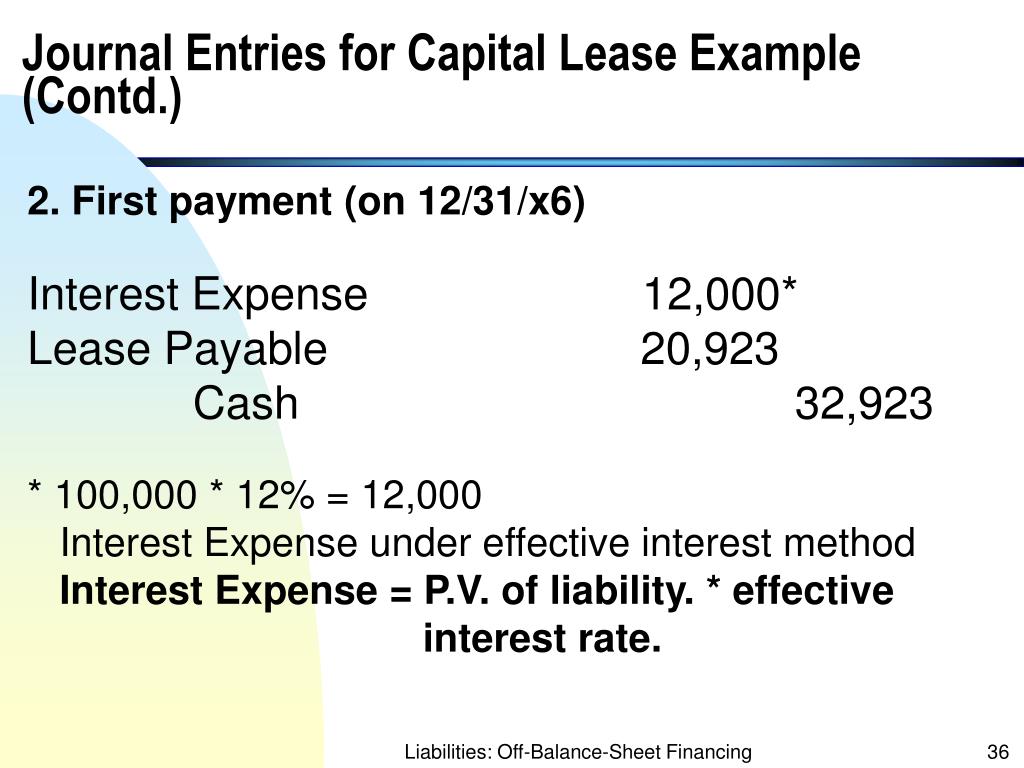

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

To start, if you're not familiar with the. The lessee is required to book the assets and liabilities connected to the lease if the. Web.

Journal entries for lease accounting

Capital lease and operating lease. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset..

Check this out about Capital Lease Accounting Journal Entries

The leased asset is recorded as a fixed asset, and a corresponding lease liability is recognized on. Find out the steps to calculate. Record the.

Capital Lease Definition Examples and Forms

Web how to calculate the journal entries for an operating lease under asc 842. Calculate the initial lease liability. A capital lease is a lease.

Journal entries for lease accounting

All apc candidates, especially those practising competencies such as landlord and tenant, leasing and letting, property management and purchase and sale, will need a robust.

Capital Lease Accounting With Example and Journal Entries

Web the borrowing must enter the associated value of the assets, and the associated liabilities within in its accounting journal entries, which specifications are included.

Last Updated January 7, 2024.

Web as documented above, the present value of the minimum lease payments is $15,293, so the initial journal entry to record the finance lease at lease commencement. Web aspe 3065 addresses the two different types of leases recorded for accounting purposes: Web understanding asc 842 journal entries for lease accounting. Web the borrowing must enter the associated value of the assets, and the associated liabilities within in its accounting journal entries, which specifications are included in the.

Keep In Mind That New Rules.

Web under aspe and gaap, a finance lease is called a capital lease. All apc candidates, especially those practising competencies such as landlord and tenant, leasing and letting, property management and purchase and sale, will need a robust understanding of lease terms. A capital lease is a contract entitling a renter to the temporary use of an asset. Otherwise, it is an operating lease, which is similar to a landlord and renter contract.

Web How To Calculate The Journal Entries For An Operating Lease Under Asc 842.

To illustrate the capital lease accounting treatment, consider the following example: Calculate the initial lease asset value. Calculate the initial lease liability. This means that the lessee is assuming the risks and.

Record The Opening Journal Entry Under Gasb 87.

Web a lessee must use the capital lease accounting method in their new lease accounting journal entries and subsequent records if the rent contract entered into. Capital lease and operating lease. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. At the commencement date, the lessor must recognize the lease receivable and the residual asset.