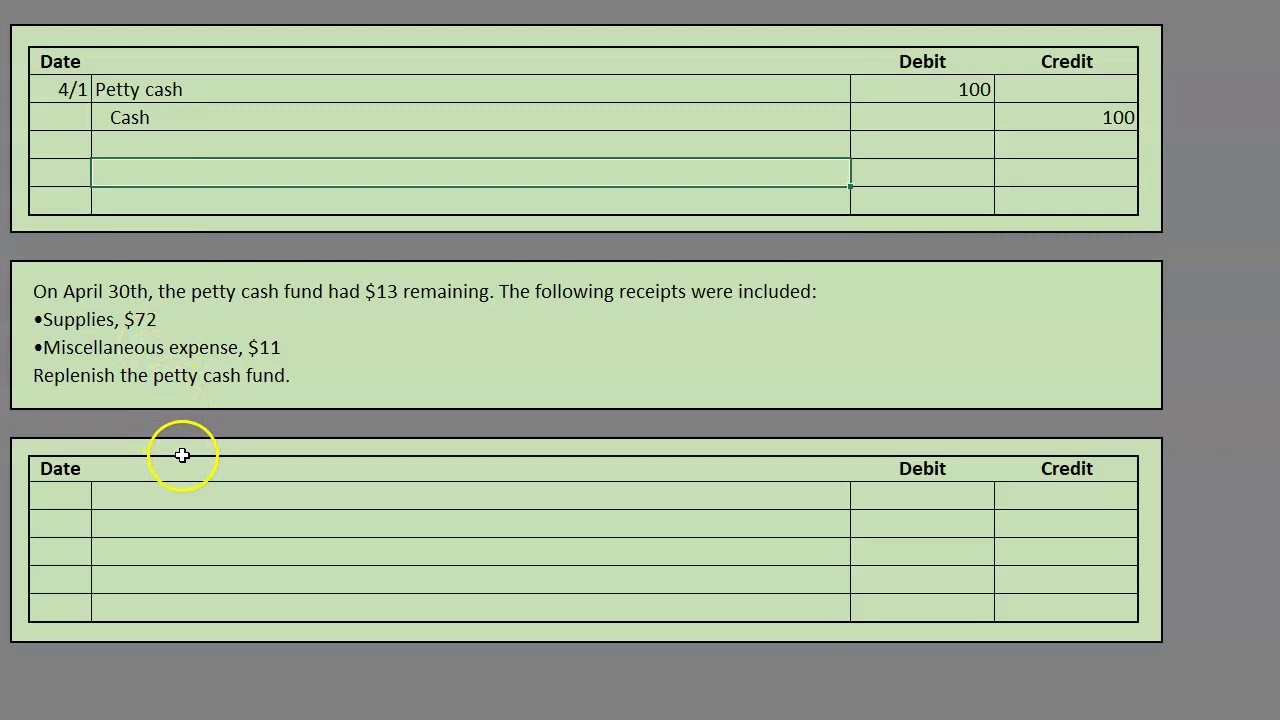

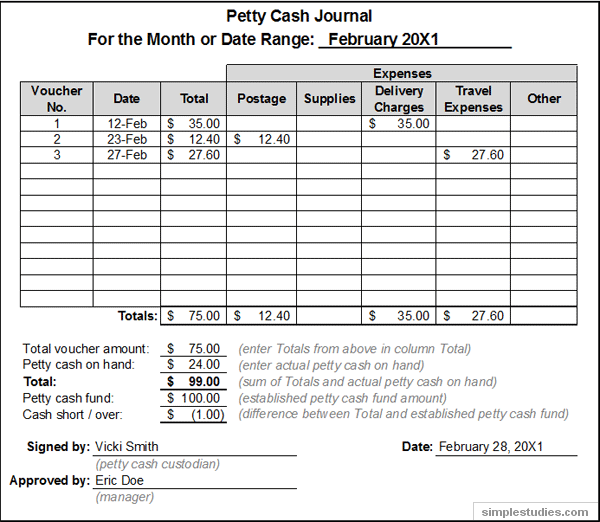

Replenish Petty Cash Journal Entry - Web for petty cash accounting, you must create a log detailing your transactions. Petty cash replenishment journal entry. Web companies replenish the petty cash fund at the end of the accounting period, or sooner if it becomes low. Web petty cash accounts are managed through a series of journal entries. The reason for replenishing the fund at the end of the accounting period is that no record of the fund expenditures is in the accounts until the check is written and a journal entry is made. Web to replenish the petty cash fund to its $100 balance, a check is drawn for $84.52 and cashed. There is no need to make an entry to the petty cash account because it still shows a balance of $100. It requires replenishment to refill the petty cash balance. Many bookkeepers prefer to combine the second and third journal entries above if the cash is replenished at the same time as expenses. Web how to record the petty cash replenishment.

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint

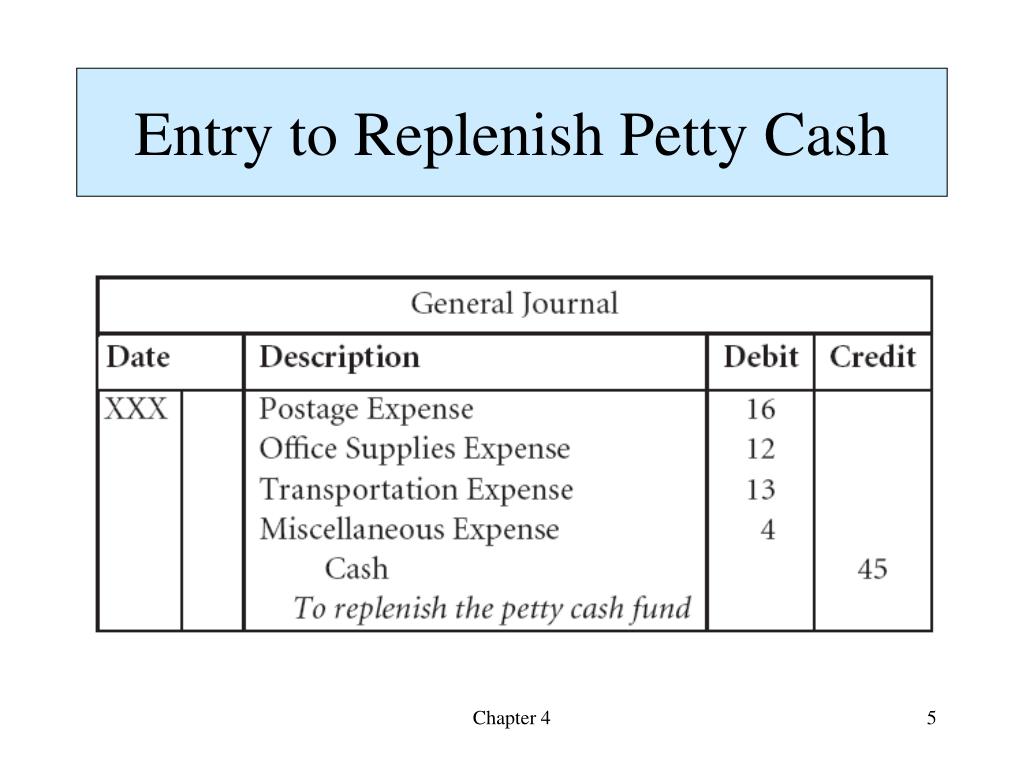

The accounting records will show the following bookkeeping entries when the business withdraws cash to replenish the petty cash fund. Consider recording petty cash transactions.

PPT PETTY CASH PowerPoint Presentation ID2630549

Many bookkeepers prefer to combine the second and third journal entries above if the cash is replenished at the same time as expenses. Web for.

Petty Cash Journal Entries YouTube

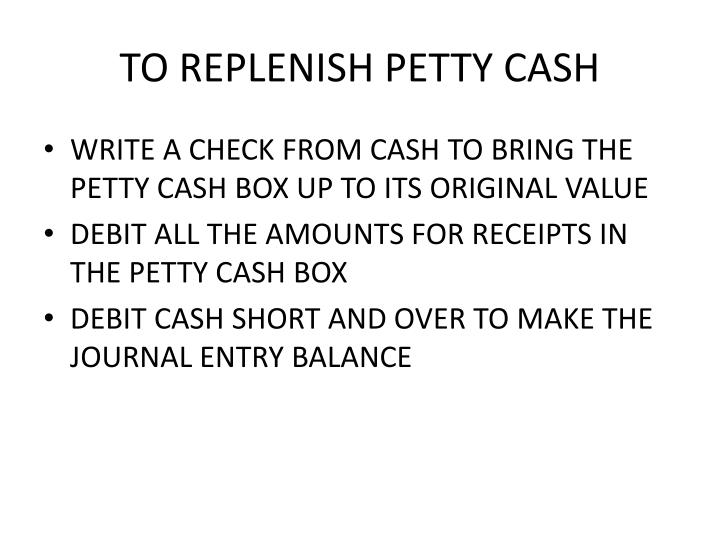

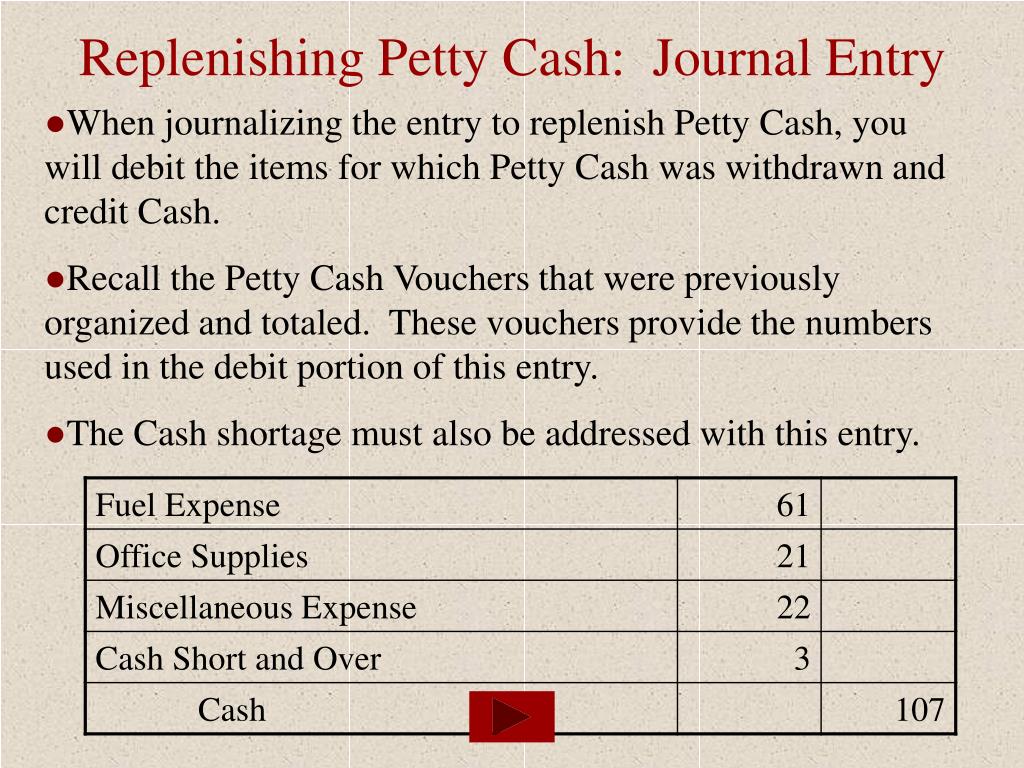

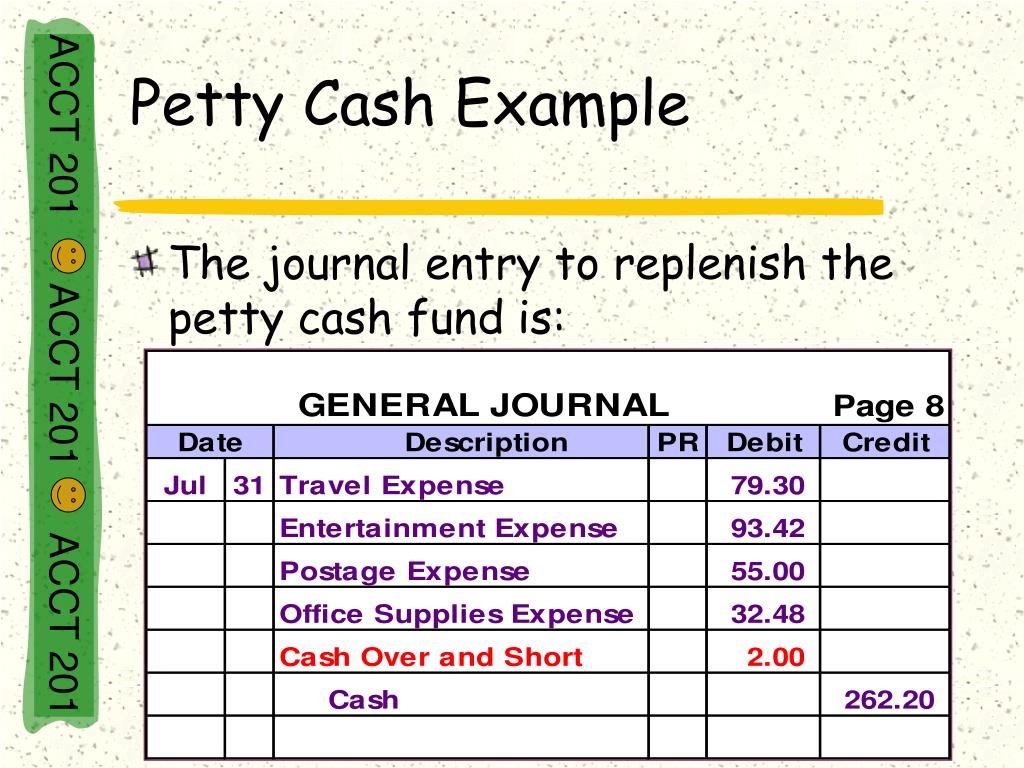

Web the journal entry to record full replenishment may require an additional debit (for shortages) or credit (for overages) to cash short (over). The following.

PPT Accounting for Petty Cash and Cash Short and Over PowerPoint

Sometimes the petty cash custodian makes errors in making change from the fund or doesn’t receive correct amounts back from users. Review the company’s petty.

Chapter 5.4 Establishing and replenishing a petty cash fund YouTube

Web for petty cash accounting, you must create a log detailing your transactions. Web to replenish the petty cash fund to its $100 balance, a.

Cash l

Web to replenish the petty cash fund to its $100 balance, a check is drawn for $84.52 and cashed. Petty cash replenishment journal entry. These.

Accounting and procedures for petty cash Accounting Guide

Review the company’s petty cash policy and determine the stated petty cash balance for the fund to be reviewed. Web the journal entry to record.

Accounting and procedures for petty cash Accounting Guide

Sometimes the petty cash custodian makes errors in making change from the fund or doesn’t receive correct amounts back from users. Web companies replenish the.

PPT Reporting and Analyzing Cash and Internal Controls PowerPoint

Web for petty cash accounting, you must create a log detailing your transactions. The accounting records will show the following bookkeeping entries when the business.

Web Journal Entry To Replenish The Petty Cash Fund.

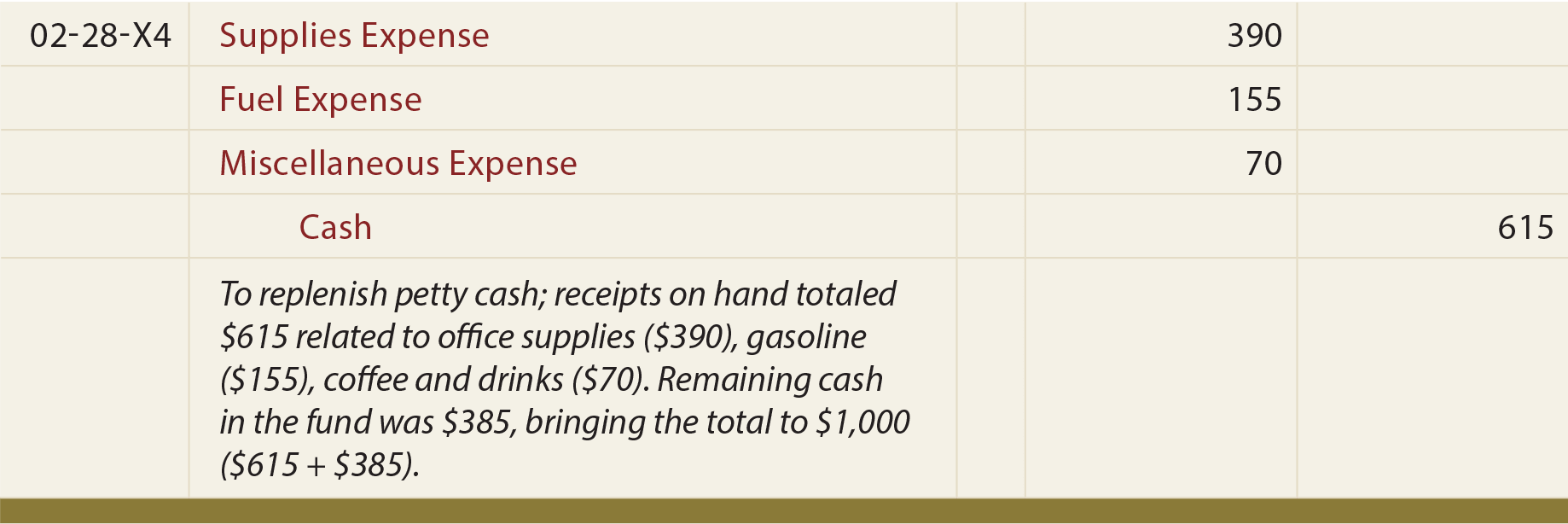

Many bookkeepers prefer to combine the second and third journal entries above if the cash is replenished at the same time as expenses. Company abc uses the petty cash for the expense amount $ 400 and the remaining balance is only $ 100. Web to replenish the petty cash fund to its $100 balance, a check is drawn for $84.52 and cashed. Web how to record the petty cash replenishment.

These Errors Cause The Cash In The Fund To Be More Or Less Than The Amount Of The Fund Less The Total Vouchers.

The difference is debited to cash short (over): Web the journal entry to record full replenishment may require an additional debit (for shortages) or credit (for overages) to cash short (over). Web for petty cash accounting, you must create a log detailing your transactions. Web to record check #1041 replenishing petty cash.

There Is No Need To Make An Entry To The Petty Cash Account Because It Still Shows A Balance Of $100.

The accounting records will show the following bookkeeping entries when the business withdraws cash to replenish the petty cash fund. Consider recording petty cash transactions in your books at least once per month. The reason for replenishing the fund at the end of the accounting period is that no record of the fund expenditures is in the accounts until the check is written and a journal entry is made. Web please prepare a journal entry for petty cash replenishment.

Entries Are Needed To (1) Establish The Fund, (2) Increase Or Decrease The Balance Of The Fund (Replenish The Fund As Cash Is Used), And (3) Adjust For Overages And Shortages Of Cash.

Notice that the appropriate expense accounts are debited and that cash is credited. Review the company’s petty cash policy and determine the stated petty cash balance for the fund to be reviewed. In the following entry, $635 is placed back into the fund, even though receipts amount to only $615. And, you must record a petty cash journal entry when you put money into the petty cash fund and when money leaves the fund.