Write Down Inventory Journal Entry - Their current cases won't fit this new phone. So, the cases they have aren't as valuable anymore. The inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and eventually sold to customers. Last updated january 7, 2024. The journal entry is debiting inventory shrinkage and. A number of inventory are. Imagine an online store called case haven. Web updated march 24, 2021. This process is essential for maintaining accounting accuracy and ensuring that a company’s financial statements reflect the actual worth of its inventory. It captures the drop of the inventory's market value below its value on the balance sheet.

Write Down of Inventory Journal Entries Double Entry Bookkeeping

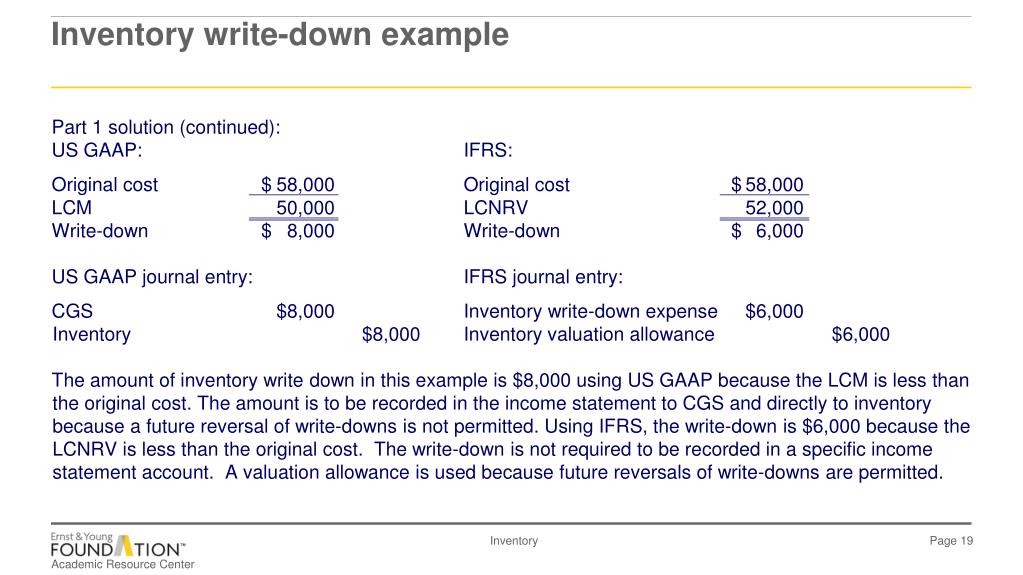

Inventory is written down when its net realizable value is less than its cost. Market or economic conditions can cause a drop in value. It.

Perpetual Inventory System Journal Entries Double Entry Bookkeeping

Read on to learn more. There are two aspects to writing down inventory, which are the journal entry used to record it, and the disclosure.

PPT Inventory PowerPoint Presentation, free download ID276252

It captures the drop of the inventory's market value below its value on the balance sheet. A number of inventory are. Market or economic conditions.

Perpetual Inventory System Journal Entry

Under ifrs, zoom will write up inventory to $210 per unit and recognize a $7 gain in its income statement. There are two aspects to.

Inventory Write Down Double Entry Bookkeeping

The journal entry is debiting inventory shrinkage and. Imagine an online store called case haven. Last updated january 7, 2024. Web there are two ways.

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

Last updated january 7, 2024. The journal entry is debiting inventory shrinkage and. This process is essential for maintaining accounting accuracy and ensuring that a.

Inventory Writedown Journal Entry YouTube

Inventory is written down when its net realizable value is less than its cost. The value of the inventory has fallen by 1,000, and the.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Web when the balance of actual inventory is less than the balance on the financial statement, they need to write down the inventory balance. It.

Inventory write down accounting YouTube

Their current cases won't fit this new phone. Inventory is written down when its net realizable value is less than its cost. It will reverse.

It Is A Common Accounting Practice Used To Adjust The Value Of Inventory To Reflect Its True Worth.

Their current cases won't fit this new phone. Read on to learn more. A number of inventory are. Web inventory write off journal entry.

Web When The Balance Of Actual Inventory Is Less Than The Balance On The Financial Statement, They Need To Write Down The Inventory Balance.

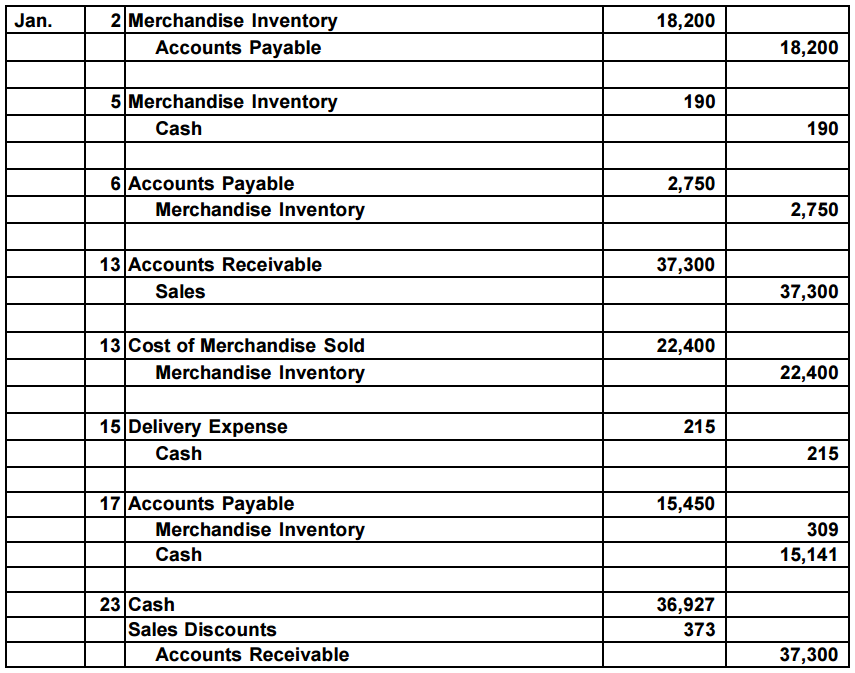

Imagine an online store called case haven. We also share our simple framework with examples on how to record it accurately. Market or economic conditions can cause a drop in value. The inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and eventually sold to customers.

There Are Two Aspects To Writing Down Inventory, Which Are The Journal Entry Used To Record It, And The Disclosure Of This Information In The Financial Statements.

Web there are two ways to write down inventory. The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. The carrying value cannot exceed original cost. Under fifo and average cost methods, if the net realizable value is less than the inventory’s cost, the balance sheet must report the lower amount.

So, The Cases They Have Aren't As Valuable Anymore.

This process is essential for maintaining accounting accuracy and ensuring that a company’s financial statements reflect the actual worth of its inventory. It will reverse the inventory balance to an expense account. It captures the drop of the inventory's market value below its value on the balance sheet. However, there are some key differences: