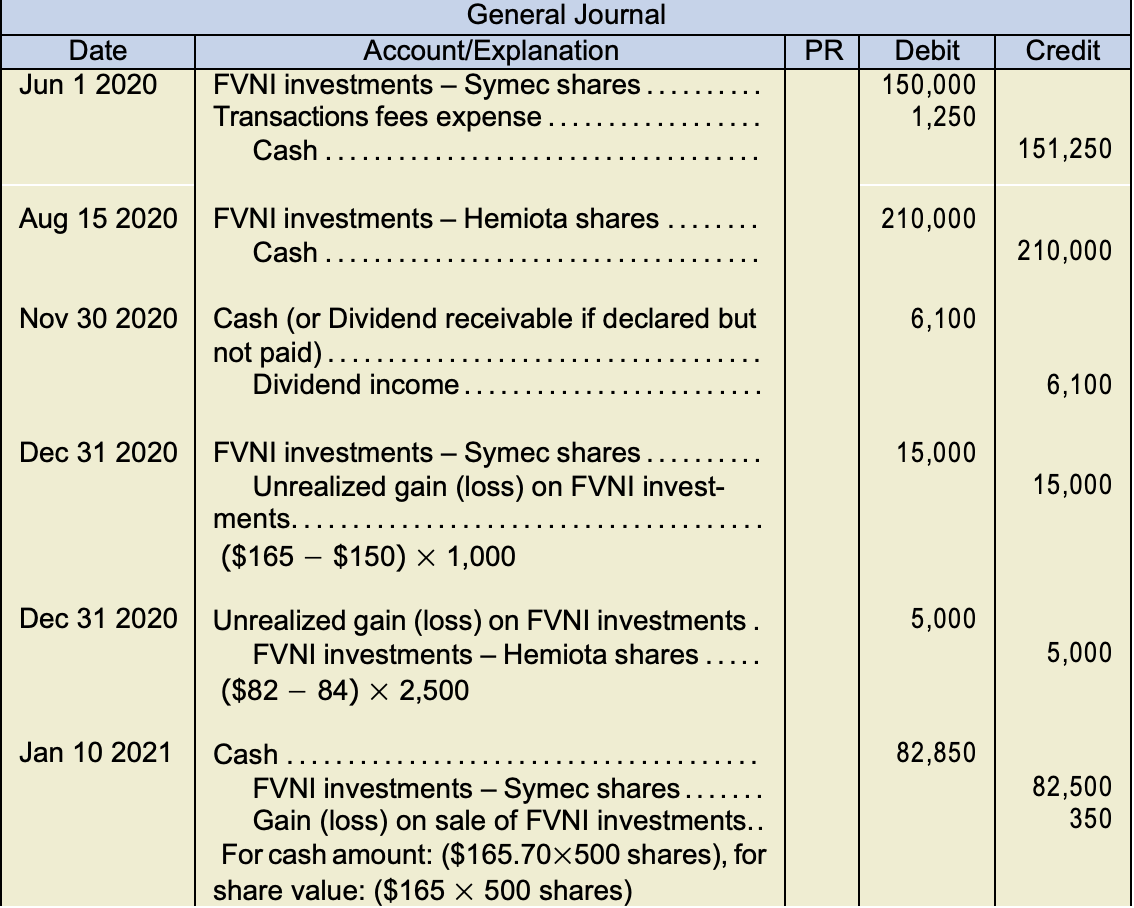

Journal Entry Unrealized Gain - Temporary change in fair value) are recorded to other. Web an unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position. View a — first report the unrealized gain or loss as a component of other comprehensive income and then determine the reclassification adjustment. Web there are two methods of accounting for an unrealized gain or loss on a security during the period in which it is sold. In the case of an increase in the fair value, the journal entry will. It is, in essence, a paper profit. when an asset is sold, it becomes a realized gain. Once they are sold the gain or loss is “realized.” the accounting treatment depends on whether the assets are: Web gain or loss on investment is the profit or loss that investors receive from their investment such as shares, bonds, and other investments. The fair value adjustment for these investments will be a $700 holding (unrealized) gain. Web an unrealized gain is an increase in the value of an asset that has not been sold.

Accounting Q and A EX 1521 Fair value journal entries, availablefor

Your ask joey ™ answer. As the fair value of the equity security changes during its holding period, the unrealized gain or loss is reported.

Unrealized gain and loss Step by step guide to record unrealized

Web an unrealized gain is an increase in the value of an asset that has not been sold. An unrealized loss is a decrease in.

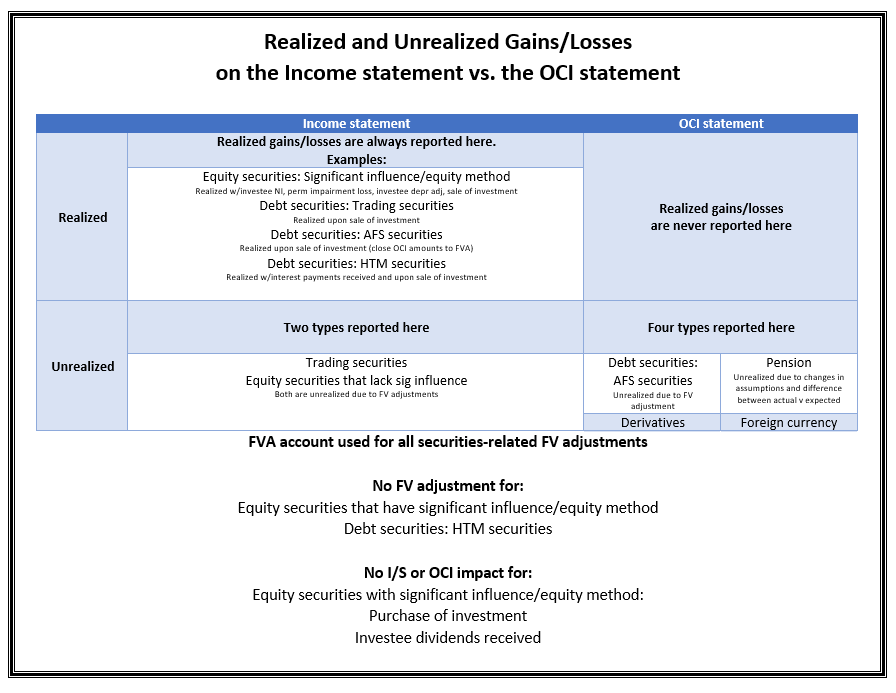

Realized and unrealized gains and losses on the statement vs OCI

They are a critical component of an entity’s financial health, reflecting increases in value across various assets without actual transactions taking place. Web gain or.

Unrealized Gains (Losses) on Balance Sheeet Examples Journal

The gain is not guaranteed; Unrealized gains represent potential financial benefits that have yet to be converted into cash. The value might go back down.

Unrealized gain (loss) Accounting Play

Web gain or loss on investment is the profit or loss that investors receive from their investment such as shares, bonds, and other investments. This.

Solved I need details not only the answers. Required

Web many smaller organizations record them in a single investment income account, but i recommend showing the realized separate from the unrealized so the governing.

8.2 NonStrategic Investments Intermediate Financial Accounting 1

Web unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet. Web.

Foreign Currency Revaluation Definition, Process, and Examples

In the case of an increase in the fair value, the journal entry will. Your ask joey ™ answer. Web many smaller organizations record them.

Accounting Journal Entries For Dummies

The presence of an unrealized gain may reflect a decision to hold an asset in. Imagine the stock you bought at $10 is now worth.

The Value Might Go Back Down Before The Shares Are Sold.

Unrealized gains represent potential financial benefits that have yet to be converted into cash. Since the investment is classified as “trading”, unrealized and realized activity is recognized in the income statement and not to other. It is, in essence, a paper profit. when an asset is sold, it becomes a realized gain. As the fair value of the equity security changes during its holding period, the unrealized gain or loss is reported on the income statement as an unrealized holding gain or loss.

The Journal Entry Is Debiting Security Investment $ 50,000 And Credit Unrealized Gain $ 50,000.

Unrealized gains exist only “on paper” and are excluded from income: Abc has a total unrealized gain of $ 50,000. Web there are two methods of accounting for an unrealized gain or loss on a security during the period in which it is sold. Web unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet.

Web On June 30, 20X9, An Interim Financial Statement Is Published, The First Financial Statement Published Since The Purchase Of The Above Securities.

Web an unrealized (paper) gain, on the other hand, is one that has not been realized yet. Web unrealized gain is the excess of the fair market value (fmv) over the basis—usually the purchase price—of an asset. This is the same as the method used for fvoci equities. It is the price difference between the initial investment cost and the selling price.

What Is The Journal Entry To Record An Unrealized Gain On A “Trading” Security?

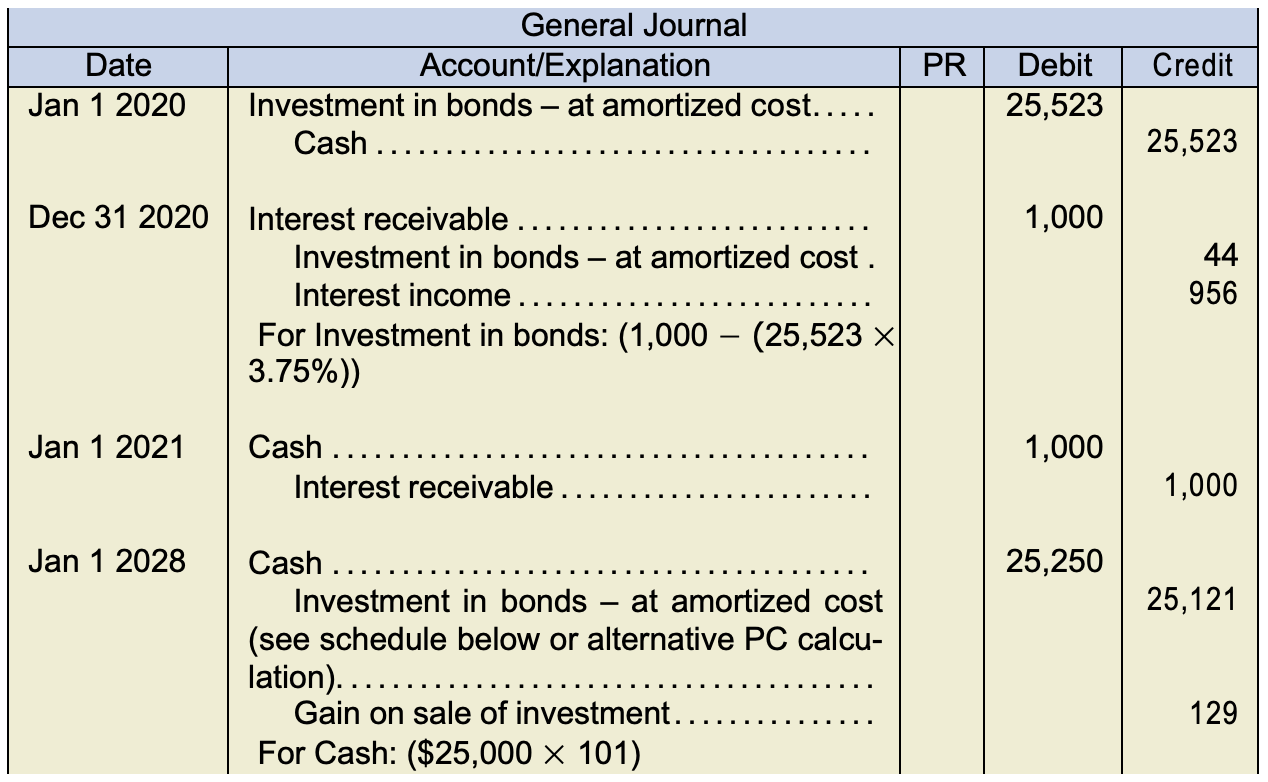

These gains and losses flow through the income statement, and the carrying value of the bonds are adjusted accordingly. This gain must be included in the report to increase the investment account. In the case of an increase in the fair value, the journal entry will. Web unrealized gains and losses are recognized [1] at each balance sheet date.