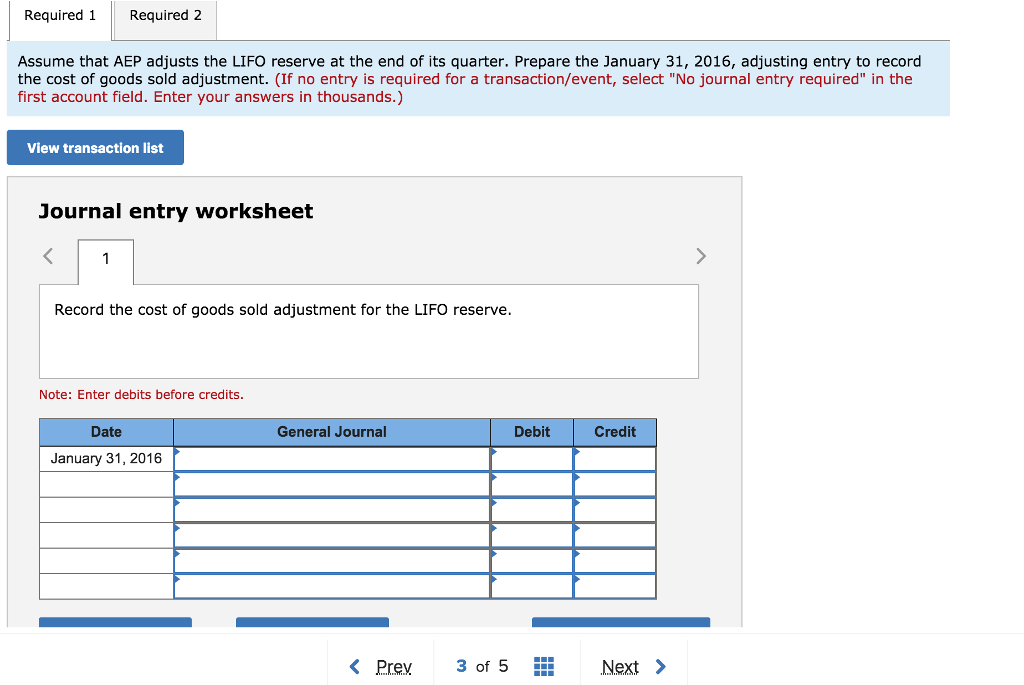

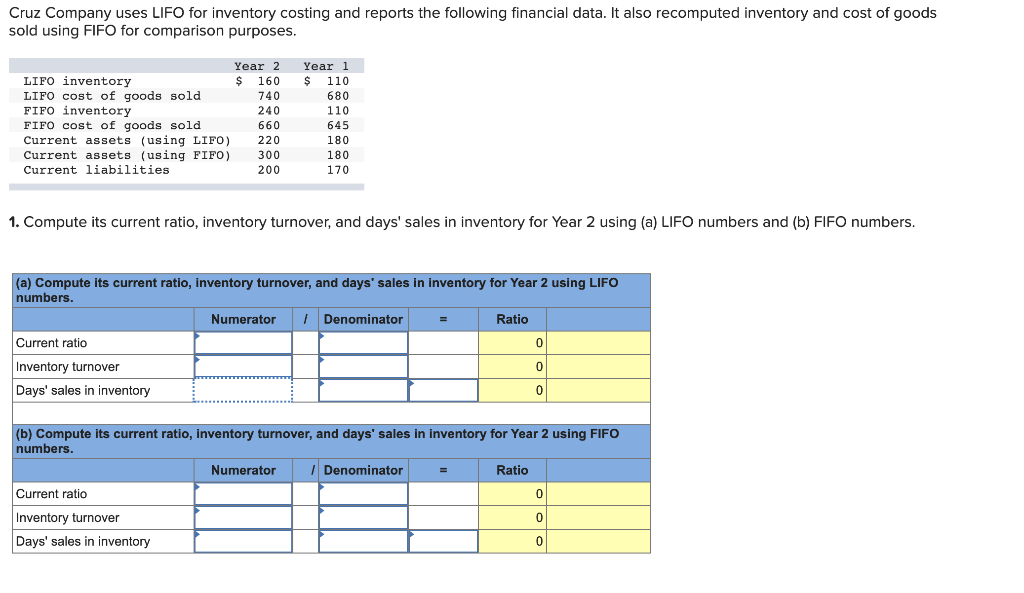

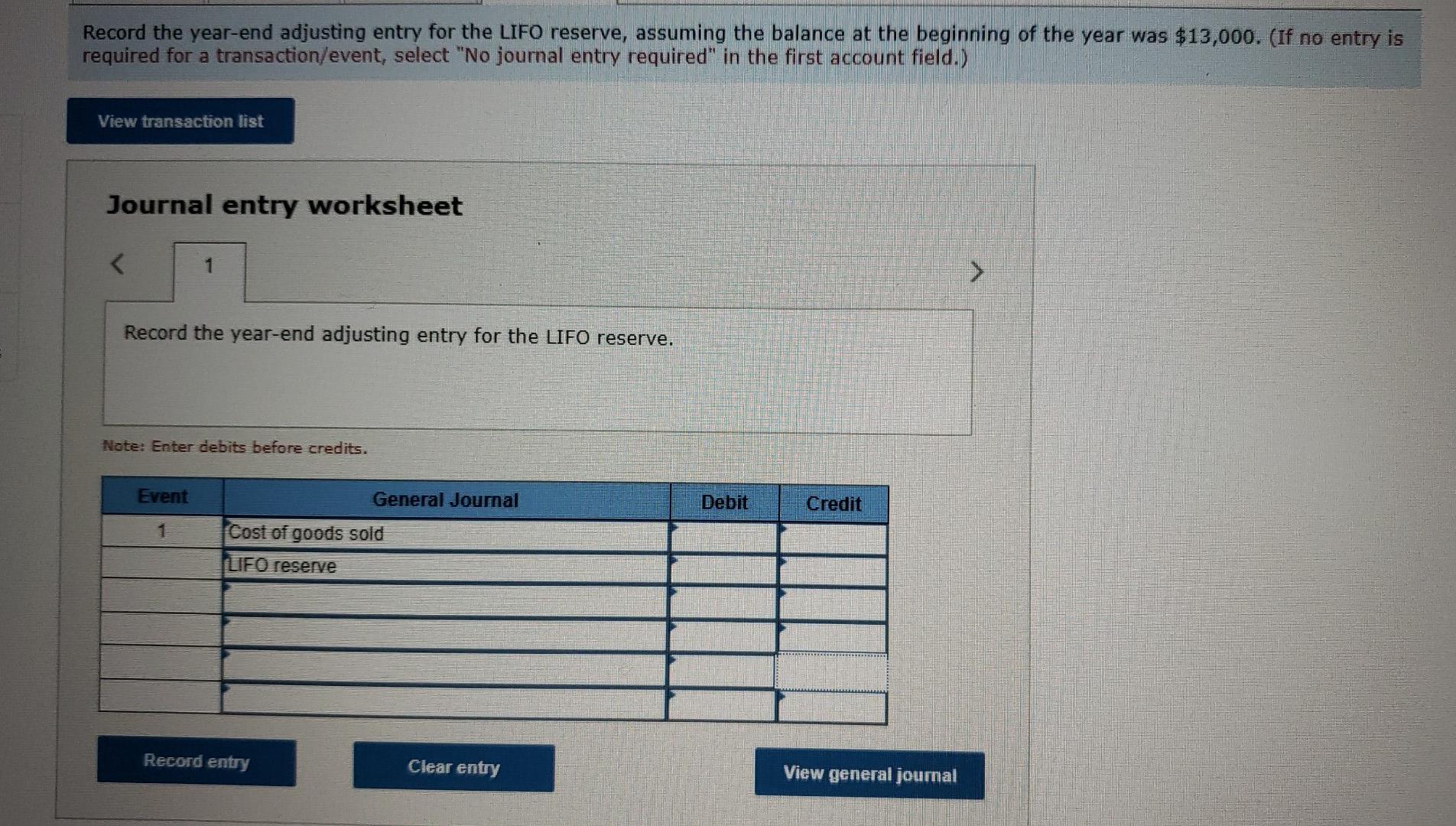

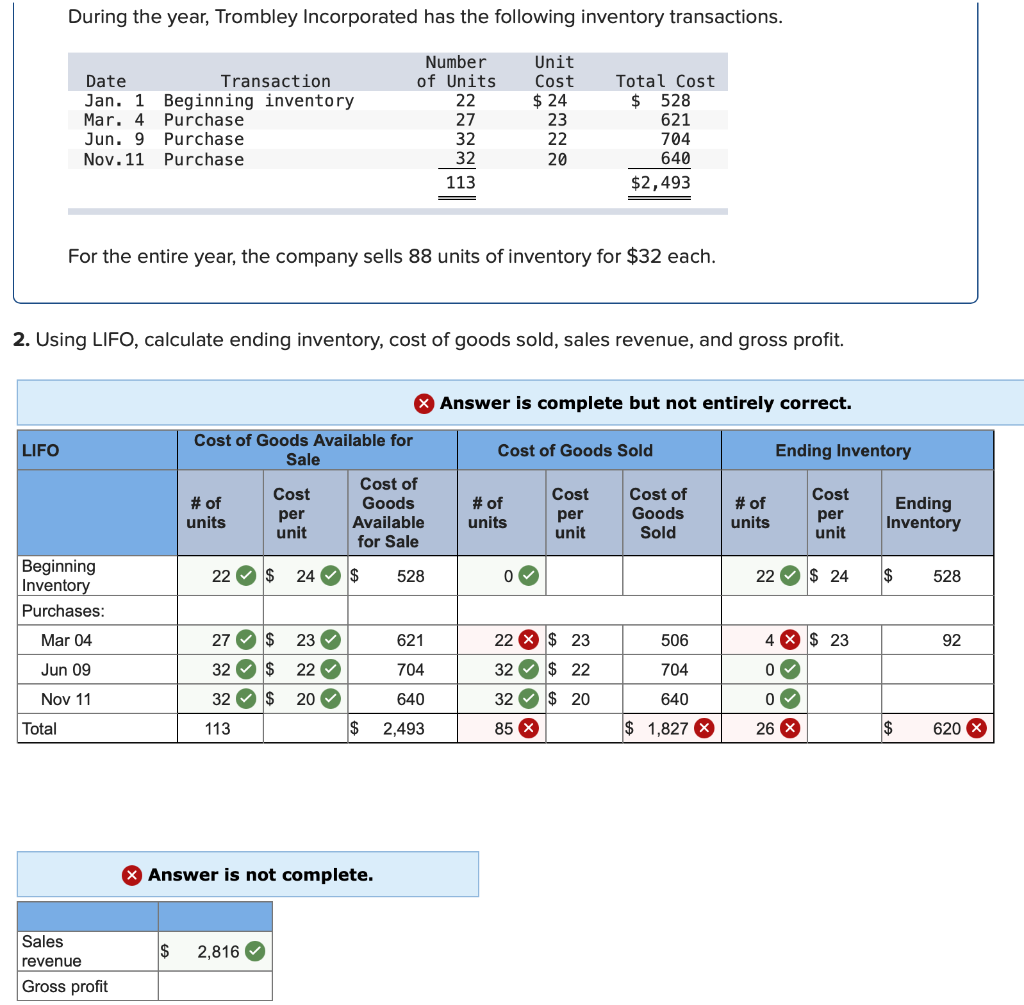

Lifo Adjustment Journal Entry - Web 6 months ago by marketsplash team • 4 min read. Web the journal entry would be: Web the lifo reserve account is a contra inventory account that reveals the discrepancy between the lifo and fifo calculations of inventory costs. 40k views 8 years ago chapter 9: Web journal entries are not shown, but the following calculations provide the information that would be used in recording the necessary journal entries. Calculate the valuation of inventory as per the normal accounting method, i.e., valuation as per the regular method adopted by the organization. The inventory at the end of. A change to lifo from another costing method or a change to another costing method from lifo is a change in accounting. Accordingly the lifo reserve formula is as follows: Web definition and explanation.

Solved Exercise 818 Supplemental LIFO disclosures; LIFO

Web how to make adjusted journal entry in accounting. A change to lifo from another costing method or a change to another costing method from.

Adjusting Journal Entries Defined Accounting Play

Some firms keep two sets. Web how to make adjusted journal entry in accounting. The difference between the cost of an inventory calculated under the.

Perpetual Inventory Systems Mont Blanc

Some firms keep two sets. 40k views 8 years ago chapter 9: Web adjusting for lifo reserve. Under lifo, the costs of the most recent.

Solved Cruz Company uses LIFO for inventory costing and

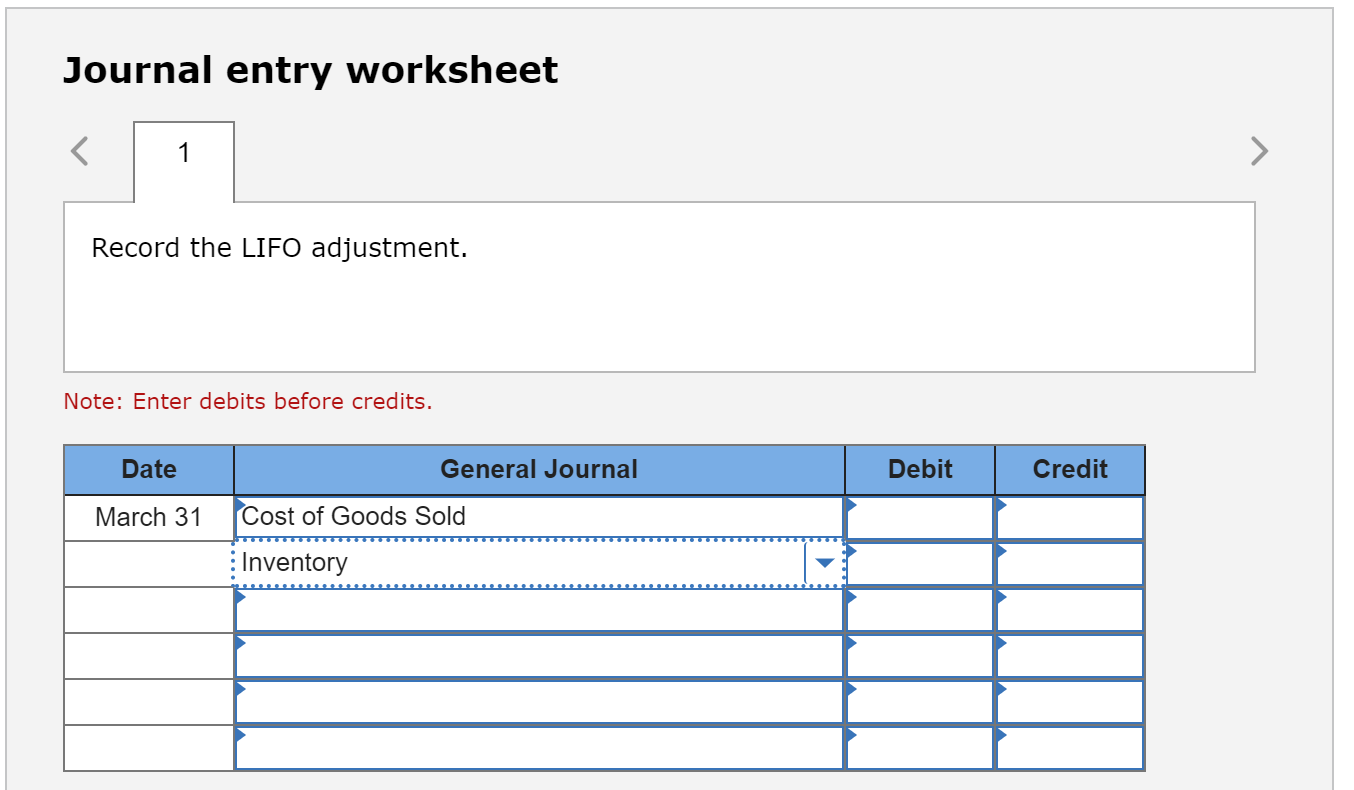

What entry would need to be made to reflect the change in the balance of the lifo. In the notes to final accounts entity disclosed.

Adjusting Journal Entries Examples

40k views 8 years ago chapter 9: Inventory cost reported on the balance sheet under. Calculate the valuation of inventory as per the normal accounting.

Solved ONLY ONE QUESTION...Record the year end adjusting

Last in, first out (lifo) is a method used to account for inventory. Download free ebooks at bookboon.com please click the advert current assets: Some.

Inventory Journal Entries, LIFO Reserve & Dollar Value LIFO YouTube

Calculate the valuation of inventory as per the normal accounting method, i.e., valuation as per the regular method adopted by the organization. The balance on.

LIFO Method Measuring Ending Inventory & Cost of Goods Sold

Web to reflect this increase, an adjusting entry should be added to the books. Under lifo, the costs of the most recent products purchased (or.

Solved Using LIFO, calculate ending inventory, cost of goods

Inventory cost reported on the balance sheet under. A change to lifo from another costing method or a change to another costing method from lifo.

Web How To Make Adjusted Journal Entry In Accounting.

Inventory cost reported on the balance sheet under. Web the change in the allowance from one period to the next is called the lifo effect. The lifo effect is the adjustment that must be made to the accounting records in a given year. Under lifo, the costs of the most recent products purchased (or produced).

In The Notes To Final Accounts Entity Disclosed The Figure Of Lifo Reserve Which Is 76,000.

Web adjusting for lifo reserve. Download free ebooks at bookboon.com please click the advert current assets: Web adjusting journal entries for net realizable value | financial accounting. Brett johnson, avp, global enablement.

Web The Lifo Reserve Account Is A Contra Inventory Account That Reveals The Discrepancy Between The Lifo And Fifo Calculations Of Inventory Costs.

And the change in the lifo reserve for an accounting period reflects the difference. Part ii 4 contents contents part 1: Web to reflect this increase, an adjusting entry should be added to the books. Calculate the valuation of inventory as per the normal accounting method, i.e., valuation as per the regular method adopted by the organization.

Create Journal Entries To Adjust Inventory To Nrv.

Some firms keep two sets. Web the adjustment in the accounting books is made to reflect (1) an increase in the opening balance of inventory, (2) an increase in retained earnings, and (3) an adjustment for. Dr cost of goods sold $60,000 cr lifo reserve $60,000 this increased cogs directly reduces net income in the current year. What entry would need to be made to reflect the change in the balance of the lifo.