Record Transactions In A Journal - You use accounting entries to show that your customer paid you money and your revenue increased. It records all payroll transactions within a company, ensuring every aspect of payroll—from salaries and wages to withholdings for taxes and benefits—is captured accurately in the company’s financial statements. This recording is the building block for the business’ financial statements, which are created at the end of the fiscal year. Web the first step is to record transactions in a journal. Web a journal entry is the recording of a business transaction in the journal. Scroll down to see this week's noteworthy activity or. Web a sales journal entry is a bookkeeping record of any sale made to a customer. We just haven't collected it yet.) hence, we record an increase in income and an increase in a receivable account. Former president to be convicted of a crime when a jury found that he had falsified business records to conceal a sex scandal. Web a journal entry is a method of recording increases and decreases to accounts.

How to write a general journal in accounting

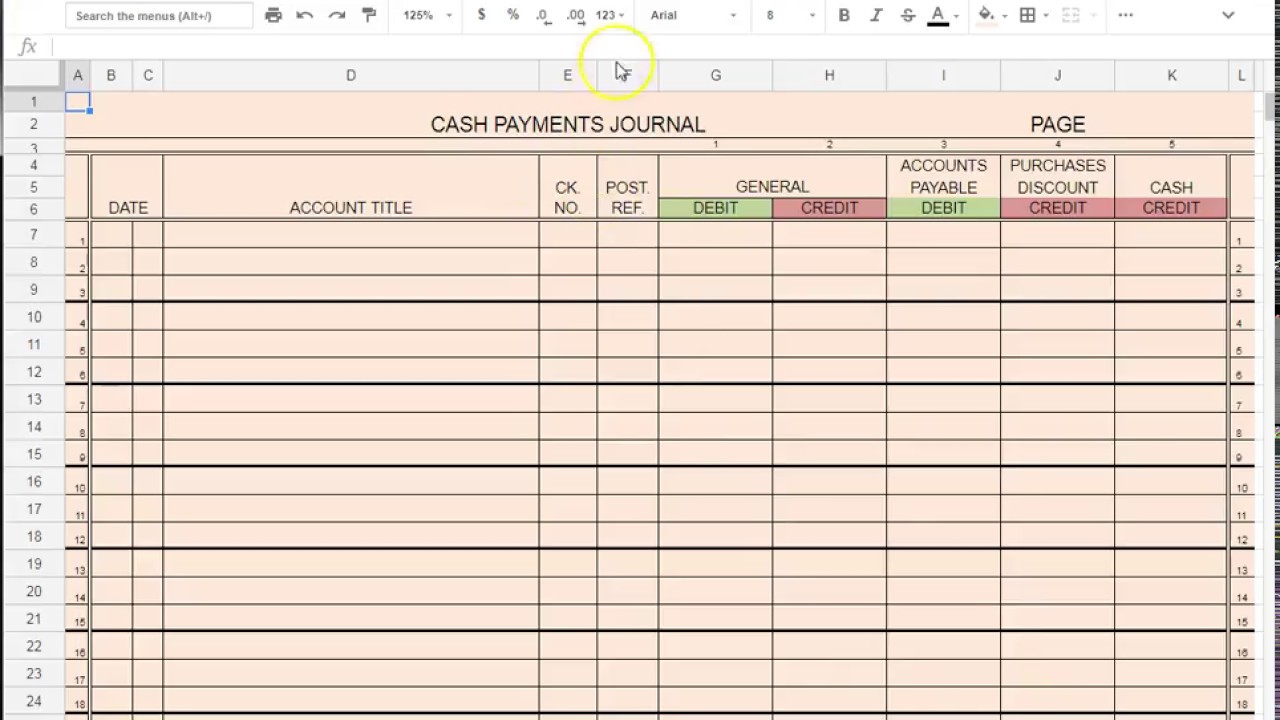

Scroll down to see this week's noteworthy activity or. The major sources of cash receipt in a business include: A journal entry details the accounts.

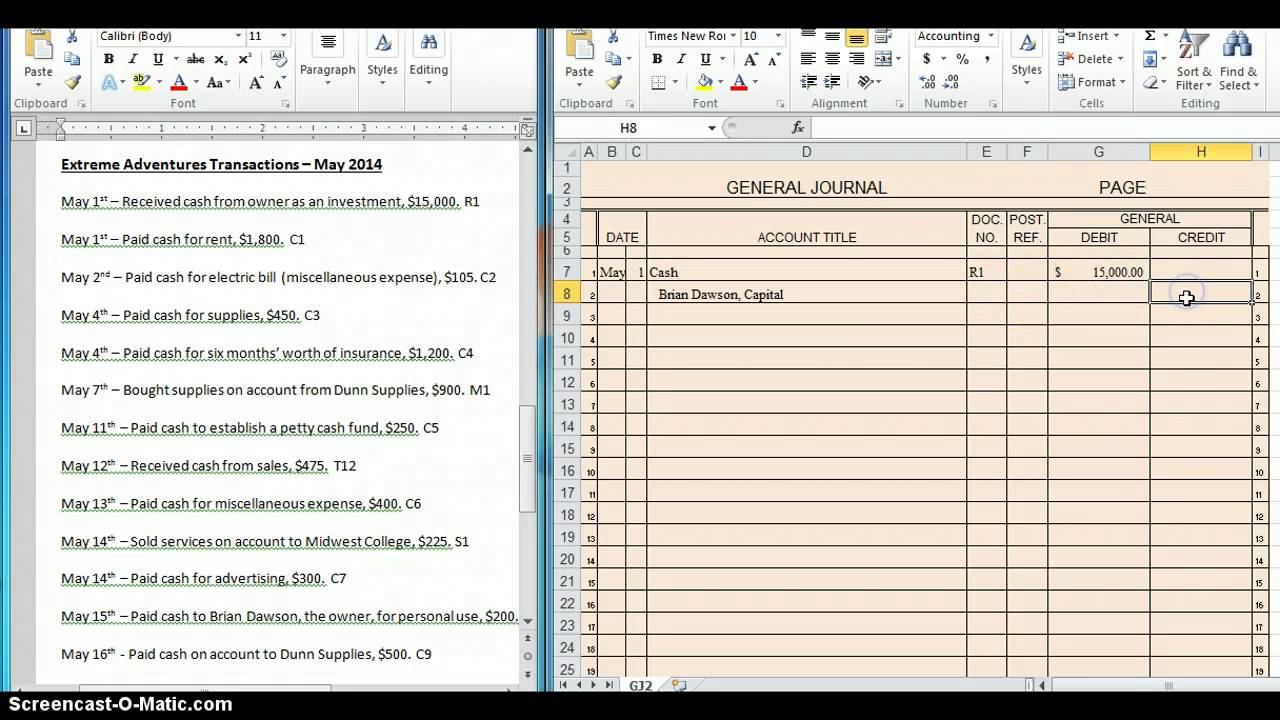

Recording Transactions into General Journal YouTube

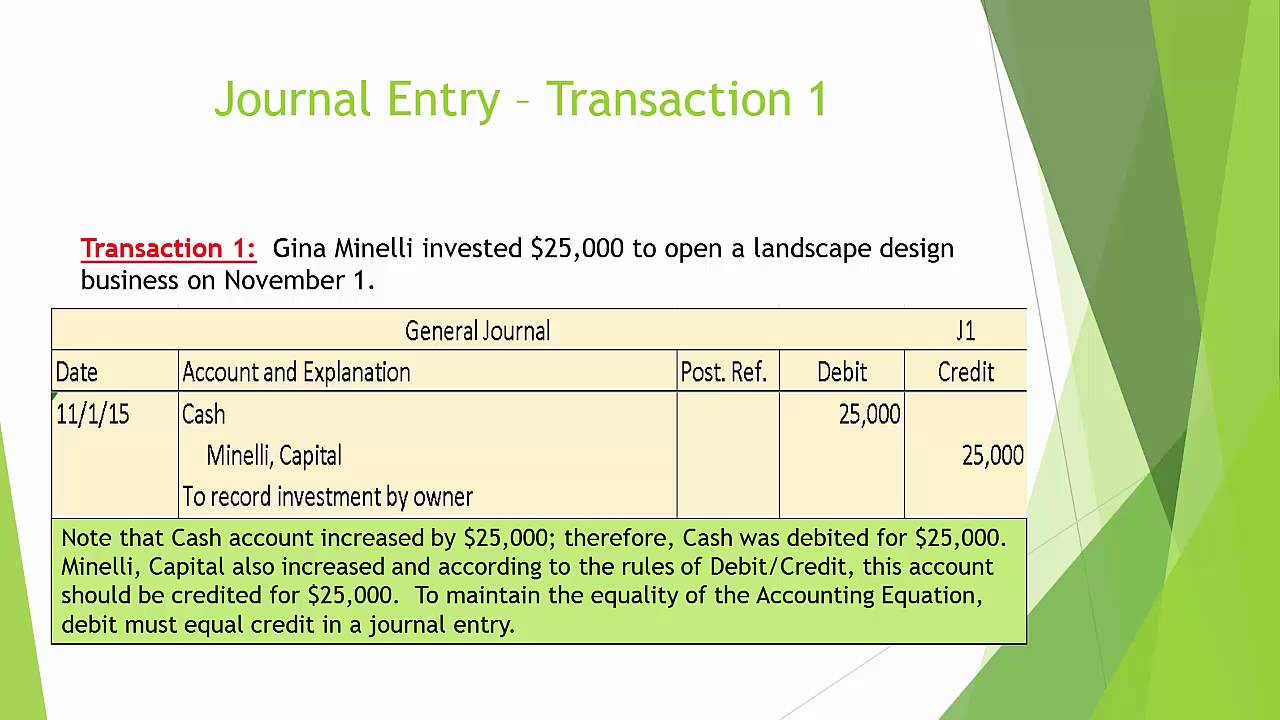

Transactions are recorded in the journal in chronological order, i.e. In other words, a journal is similar to a diary for a business. To make.

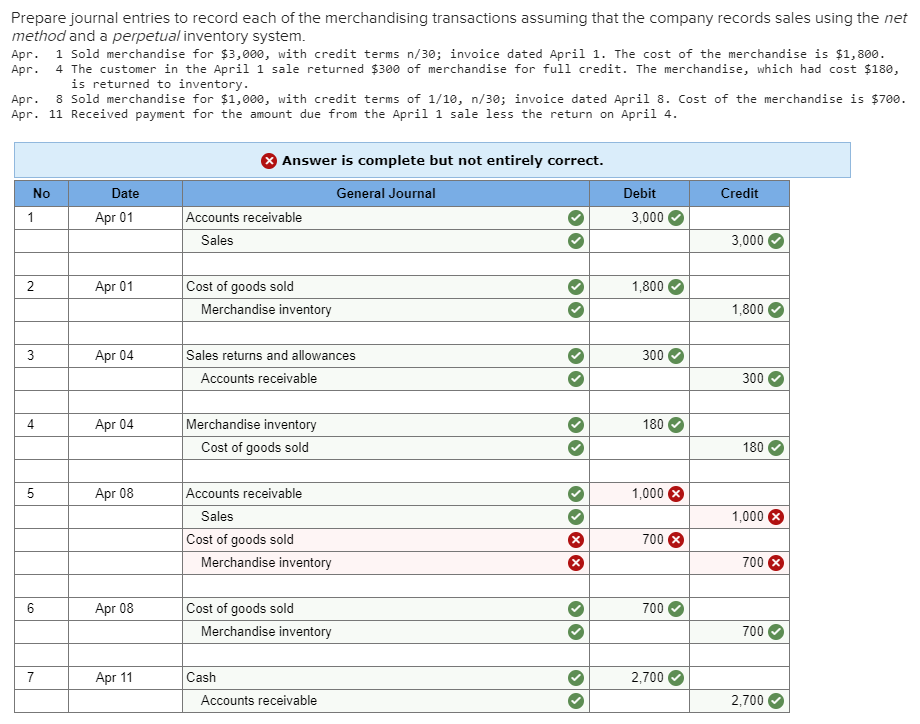

Solved Prepare journal entries to record each of the

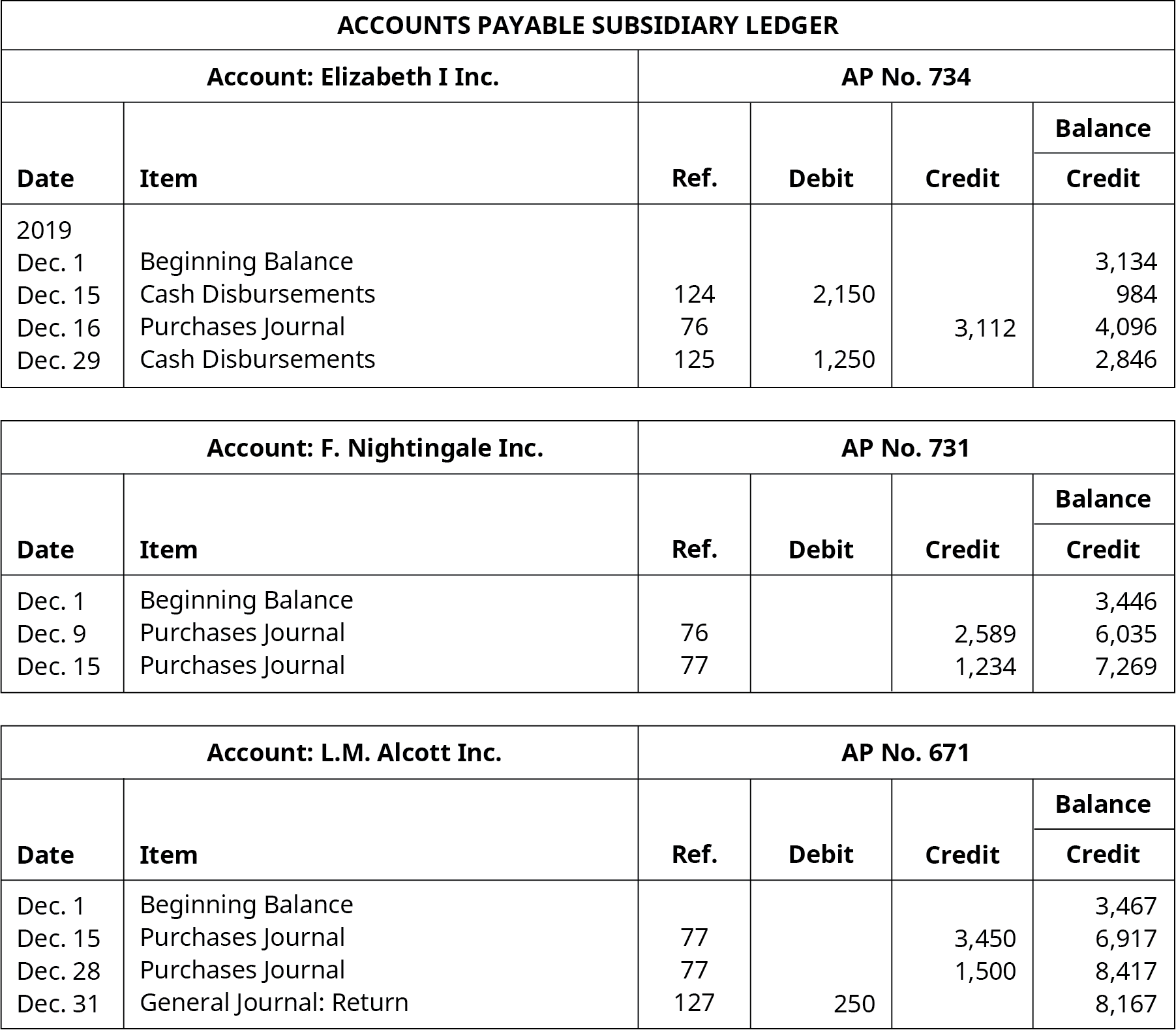

Eventually, they are used to create a full set of financial statements of the company. Web a journal entry records financial transactions that a business.

Recording Transactions into a Sales Journal YouTube

A simple journal looks like this: When you enter information into a journal, we say you are journalizing the entry. Web a cash receipts journal.

General Journal in Accounting Double Entry Bookkeeping

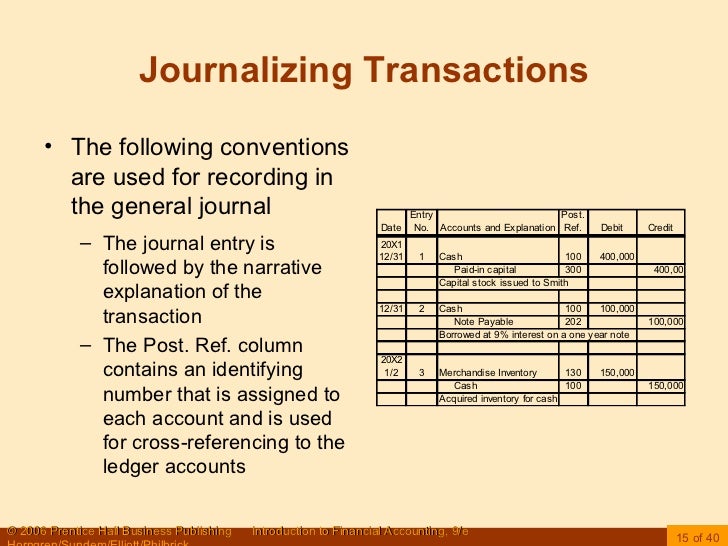

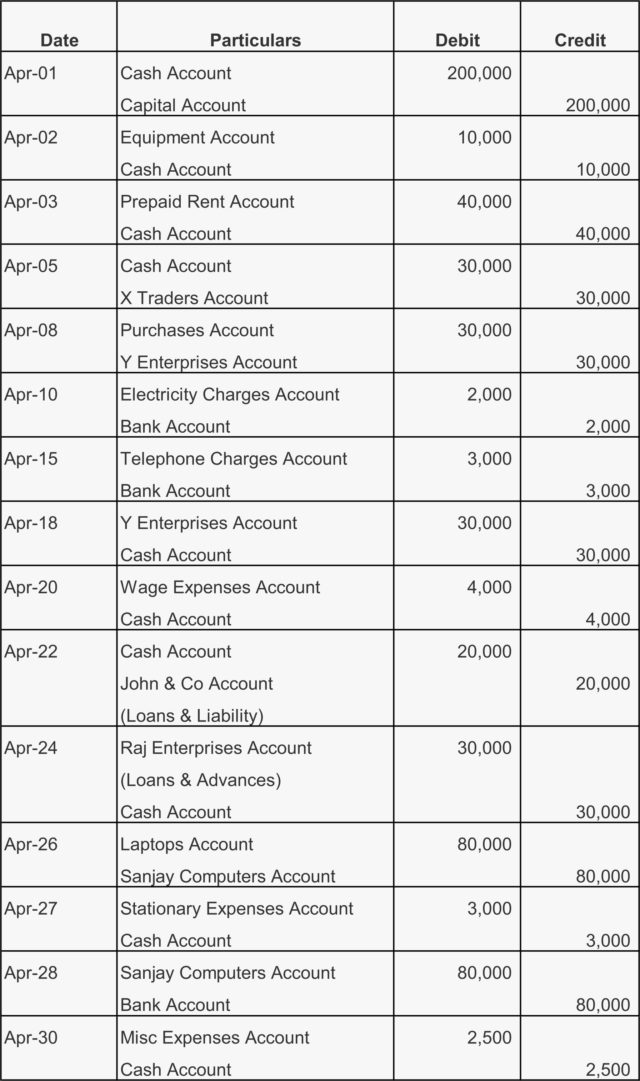

More detail for each of these transactions is provided, along with a few new transactions. Journalizing transactions is the process of keeping a record of.

Video 3 Recording Transactions in the General Journal YouTube

Web the first step is to record transactions in a journal. It records all payroll transactions within a company, ensuring every aspect of payroll—from salaries.

How to Record Journal Entries in Accounting Waytosimple

These transactions all get recorded in the company book, called the general journal. Journaling the entry is the second step in the accounting cycle. A.

Record transactions in journal YouTube

The information recorded in a journal is used to reconcile accounts. Your journal gives you a running list of business transactions. Web a journal entry.

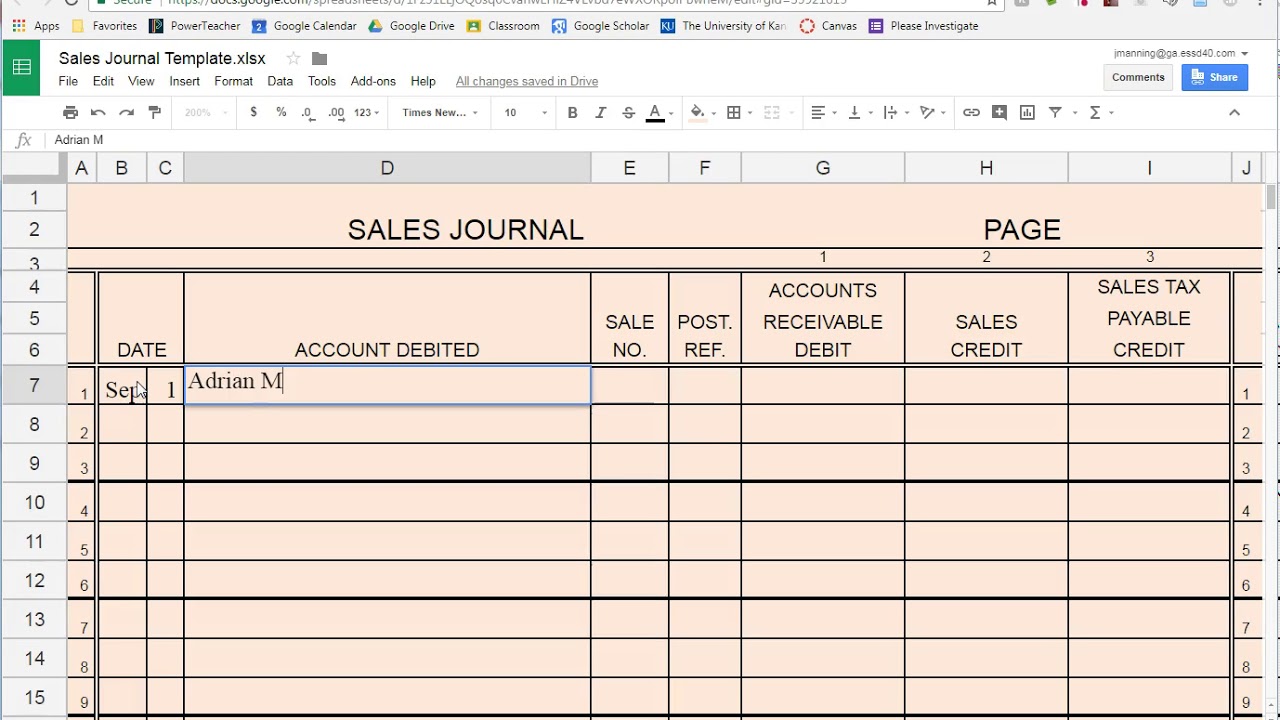

Part Three Analyzing Transactions Recorded in Special Journals

3 sales on credit to vj armitraj, ltd., amount of $7,200, invoice # 317745 Web under the accrual basis of accounting, income is recorded when.

Web The Most Basic Method Used To Record A Transaction Is The Journal Entry, Where The Accountant Manually Enters The Account Numbers And Debits And Credits For Each Individual Transaction.

These types of entries also show a record of an item leaving your inventory by moving your costs from the inventory account to the cost of goods sold account. In this transaction, the services have been fully rendered (meaning, we made an income; Journal entries are the very first step in the accounting cycle. Web record the following transactions in the sales journal and cash receipts journal:

Scroll Down To See This Week's Noteworthy Activity Or.

This course is part of introduction to financial accounting: Web the following section uses the kids learn online (klo) transactions recorded in chapter 2 of the aaa textbook to demonstrate how to record transactions in the journal, post information to the ledger, prepare a trial balance and financial statements. Web we will analyze and record each of the transactions for her business and discuss how this impacts the financial statements. The major sources of cash receipt in a business include:

Trump Became The First U.s.

A journal entry shows all the effects of a business transaction as expressed in debit (s) and credit (s) and may include an explanation of the transaction. Web each week the business journal compiles public records on real estate transactions, business formations, liens, lawsuits and bankruptcies. Some of the listed transactions have been ones we have seen throughout this chapter. Web a journal is a chronological record of transactions.

Web The First Step Is To Record Transactions In A Journal.

The individual accounts each (like rent expense and cash) have a ledger where transactions are entered. In the second step of the accounting cycle, your journal entries get put into the general ledger. 14.3 record transactions and the effects on financial statements for cash dividends, property dividends, stock dividends, and stock splits; 14.4 compare and contrast owners’ equity versus retained earnings