Journal Entry Rent Expense - Web the journal entry is used to match the amount of the rental expense to the income statement. Decrease in assets (cash) by $1,500: Dr rent expense (profit and loss account) cr accruals (balance sheet) the above double entries are required to recognise. Bank / cash.$200 probably the easiest part of working out the. Web this article discusses what rent expense is and how the new lease accounting standard, asc 842, affects the presentation of rent expense in the financial statements. Accounting for prepaid rent with journal entries. Rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at the end of its accounting period. Web rent expense is a fixed operating cost for businesses using properties such as offices, retail spaces, or factories, impacting financial stability. Web the journal entry would be: Web if you are a tenant, you will record a journal entry like the following—a debit entry to a rental expense account and a credit entry to a creditors account.

How to Adjust Journal Entry for Unpaid Salaries

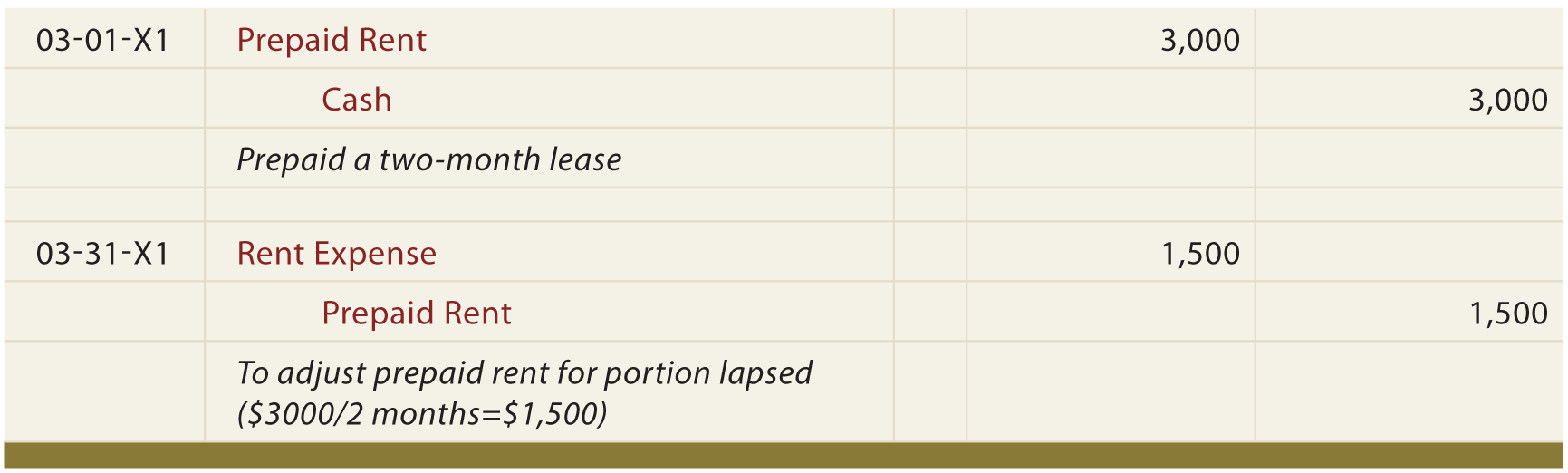

Web in accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future.

Journal entries for lease accounting

Accounting for prepaid rent with journal entries. Web in accounting, the rent paid in advance is an asset, not an expense, as the amount paid.

Journal entry for outstanding expenses JEthinomics

Decrease in assets (cash) by $1,500: Rent of ₹10,000 is paid every month, in cash. Company abc is in the. Web here is an example.

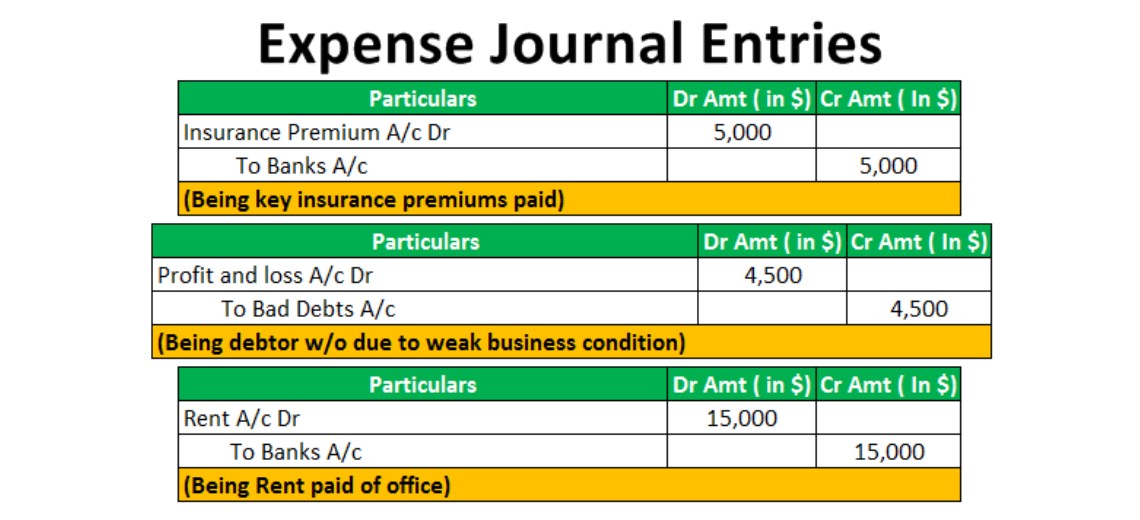

Rent Expense Journal Entry

Web here is an example of what that prepaid rent journal entry would look like: Web this article discusses what rent expense is and how.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web in accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future.

Journal Entries Accounting

Rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at the end of its accounting period. Web here is.

Prepaid Expenses Entry Calculation In Excel Printable Templates

Web in accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future.

Accrued expenses journal entry and examples Financial

Web the journal entry is debiting rental expenses and credit cash. Web as now the expense has been incurred, the rent expense account will be.

journal entry format accounting accounting journal entry template

Record the necessary journal entry for the month ending march 2023. Rental costs, subject to contracts,. Web in the first scenario, the is paid rent.

Record The Necessary Journal Entry For The Month Ending March 2023.

The company abc makes this. Web as now the expense has been incurred, the rent expense account will be debited. Web this article discusses what rent expense is and how the new lease accounting standard, asc 842, affects the presentation of rent expense in the financial statements. Rent of ₹10,000 is paid every month, in cash.

Web Increase In Expenses (Rent Expense) By $1,500:

Web the journal entry is debiting rental expenses and credit cash. Web prepare a journal entry to record this transaction. Accounting for prepaid rent with journal entries. Company abc is in the.

Dr Rent Expense (Profit And Loss Account) Cr Accruals (Balance Sheet) The Above Double Entries Are Required To Recognise.

Accounting for accrued rent with journal entries. Bank / cash.$200 probably the easiest part of working out the. Decrease in assets (cash) by $1,500: Is prepaid rent an asset?

A Lessee’s Rent Annually Is $24,000.

Web the journal entry for a rent accrual is as follows: The journal entry is used to record the amount of money spent on rental. Web this journal entry is made to eliminate the rent payable on the balance sheet that we have recorded in the prior period. Web the journal entry would be: