Journal Entry For Repayment Of Loan - On december 31, 2022, the interest accrued on the loan must be recognized. Web start recording loan payment journal entries now. Web you can also skip using journal transactions to account for your loan if you import your bank transactions into wave. The journal entry is : With the latest action, the administration said it has. The company abc can make the journal entry for the loan given to employee on jan 1, 2021, as below: Web loan payment journal entry. This is the exact opposite of the first journal entry above. The first is a debit to the loan account, which reduces the balance of the loan. Company abc is making a loan to its business partner for $ 70,000.

Journal Entries of Loan Accounting Education

*assuming that the money was due to be paid to abc bank ltd. Web the journal entry to recognize the receipt of the loan funds.

Receive a Loan Journal Entry Double Entry Bookkeeping

As at december 31, 2022, interest in the amount of $30,000 [$600,000 x 5%] has been accrued on the royal trust bank loan. Web start.

Journal entry for Loan Payable Output Books

The first is a debit to the loan account, which reduces the balance of the loan. If you are the company loaning the money, then.

Loan Journal Entry Examples for 15 Different Loan Transactions

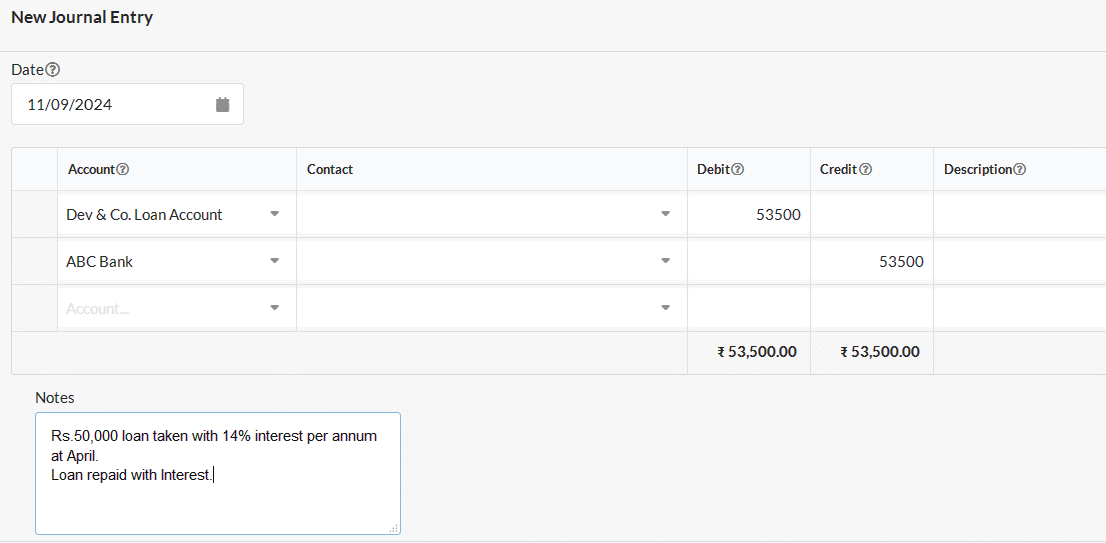

Web go to the +new and select journal entry. 5.post journal entry, at the time of loan repayment. Web washington (ap) — the biden administration.

LOAN REPAYMENT AND INTEREST JOURNAL ENTRY ENGLISH EIKV YouTube

It involves recording your initial loan, the loan interest, and the payments you make on both. This transaction is typically used when a loan is.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

The journal entry is : A business applies to a bank and receives a loan of 25,000. It increases (or occurs) on the credit side.

Shareholder Loan Repayment Journal Entry Info Loans

Web journal entries for a loan receivable involve debiting loan receivable and credit cash. Principal and interest repayment chart (as given by bank) unlock 50%.

Bank Loan Repaid Journal Entry Info Loans

The second is a credit to the cash account, which decreases the balance of the cash account. A business applies to a bank and receives.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web go to the +new and select journal entry. Asked on june 22, 2022. The second is a credit to the cash account, which decreases.

A Business Applies To A Bank And Receives A Loan Of 25,000.

Now the journal entry for repaying the loan is as follows: It is recorded in the accounting books of the lender. Web loan payment journal entry. The company abc can make the journal entry for the accrued interest receivable on jan 1, 2021, as below:

When Conditions For Loan Forgiveness Have Been Met, A Journal Entry Must Be Made To Recognize The Amount Forgiven As Income To The Business.

Web go to the +new and select journal entry. Web in 2018, milan was taken over by american fund elliott management after previous owner li yonghong missed the deadline to repay part of a loan. The first is a debit to the loan account, which reduces the balance of the loan. Bank (or cash) is an asset.

Company Abc Is Making A Loan To Its Business Partner For $ 70,000.

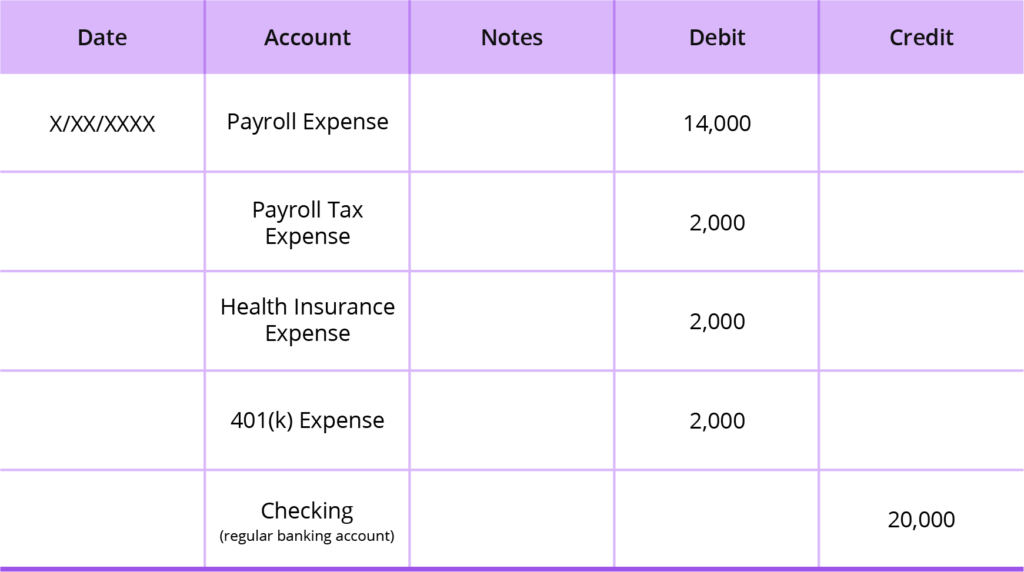

Web washington (ap) — the biden administration is canceling student loans for another 160,000 borrowers through a combination of existing programs. Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest expense (an expense account) credit of $4,000 to cash (an asset account) controls over loan payment accounting When the company makes a payment to bank, they need to reverse the interest payable $ 5,000 and credit cash $ 5,000. Web the compound journal entry for loan repayment including both principal and interest are as follows:

Web Receive A Loan Journal Entry.

Assumed that total repayment including the interest is $ 167,500 where the principal is $ 125,000 and the interest is $ 42,500. Web the journal entry is debiting interest expense $ 5,000 and crediting interest payable $ 5,000. My boss has two companies: With the latest action, the administration said it has.