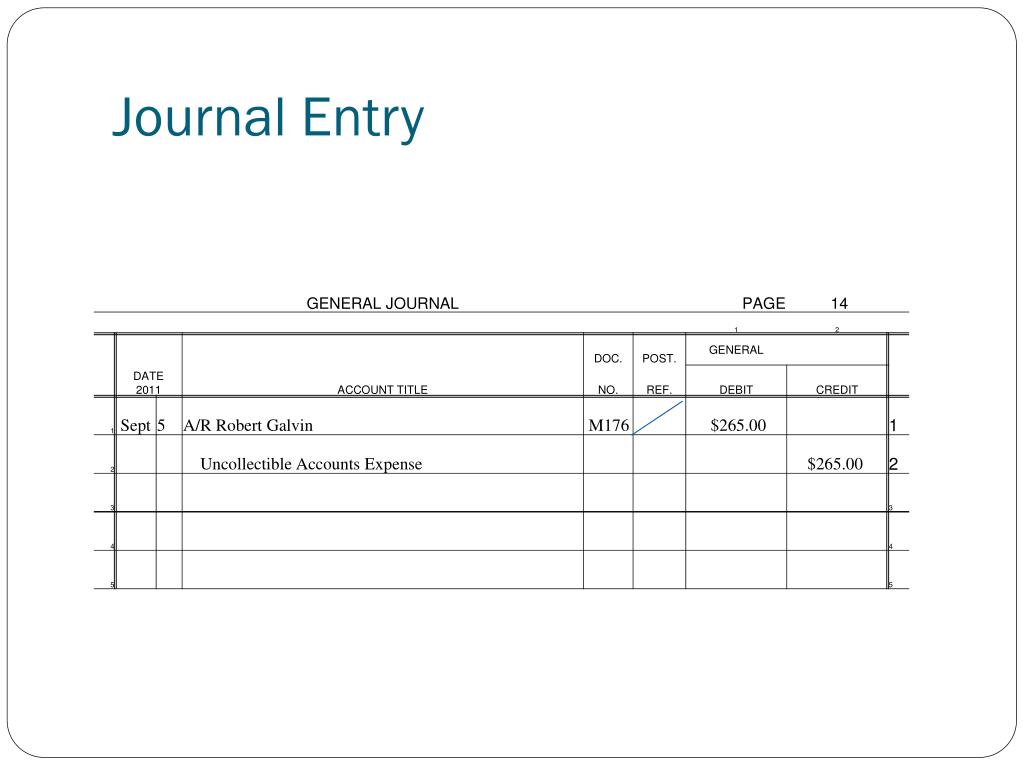

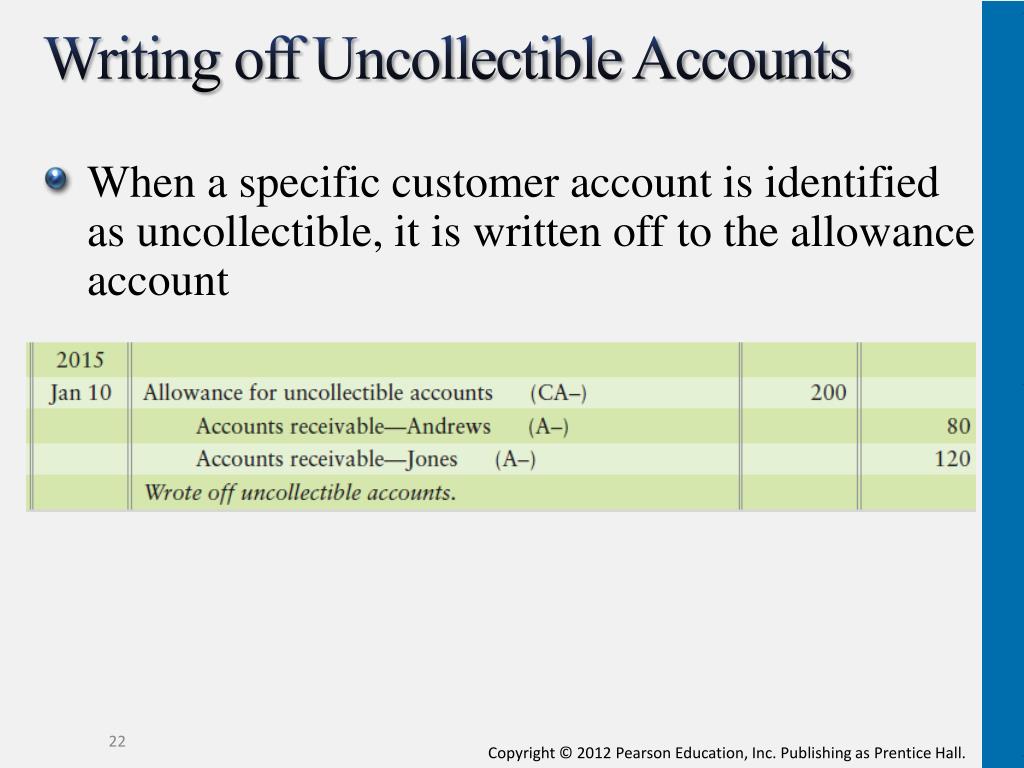

Journal Entry For Uncollectible Accounts - Bad debt expense → debit; The debit part of the entry is. Pave estimates that 25% of the uncollected accounts will be uncollectible. Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. See different methods such a… Uncollectible receivables refer to money that a business is owed by its clients but, due to various. One method of recording the bad debts is referred to as the direct write off method which involves removing the. Web a credit entry is made to allowance for uncollectible accounts, thereby adjusting the previous balance to the new, desired balance. Web if it does, you'll have to make some general journal entries to reflect the payment.

PPT Uncollectible Accounts Receivables PowerPoint Presentation, free

Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Web please prepare a journal entry to.

How to Calculate Bad Debt Expense? Get Business Strategy

Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Web when a specific customer has been identified as an.

(Solved) Entries for uncollectible accounts, using direct writeoff

Allowance for doubtful accounts decreases (debit) and. Allowance for doubtful accounts decreases (debit) and. Web bad debt expense is the loss that incurs from the.

Allowance For Uncollectible Accounts Journal Entry Accounting Methods

Allowance for doubtful accounts → credit; Under this technique, a specific account receivable is removed from the accounting records at the time it is finally.

uncollectible accounts receivable journal entry /part 2/ YouTube

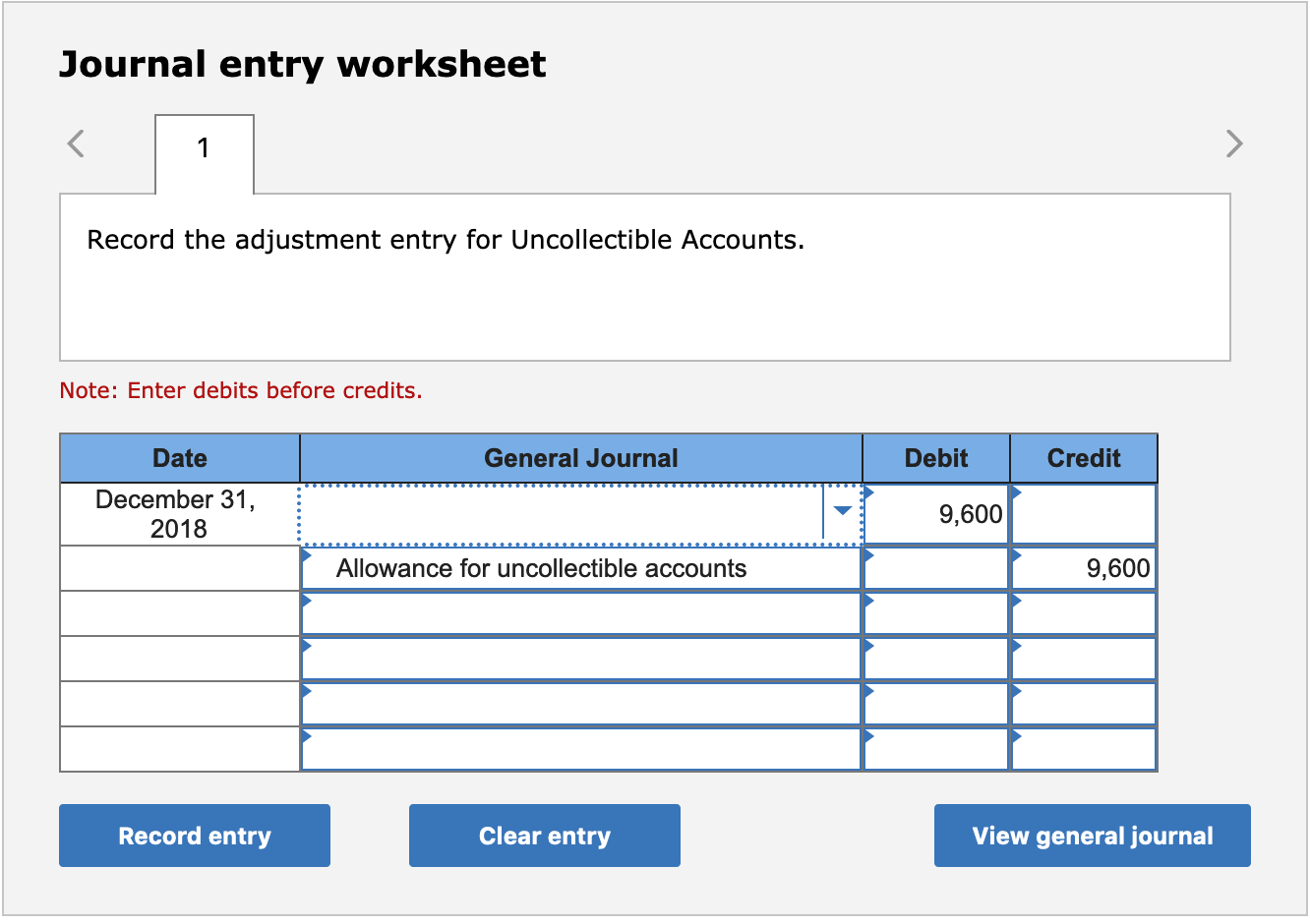

Web a credit entry is made to allowance for uncollectible accounts, thereby adjusting the previous balance to the new, desired balance. Web when a specific.

Allowance For Uncollectible Accounts Journal Entry Accounting Methods

Web once the estimated amount for the allowance account is determined, a journal entry will be needed to bring the ledger into agreement. Allowance for.

Uncollectible Accounts Methods Accounting Methods

Allowance for doubtful accounts decreases (debit) and. The company should estimate loss and make. Allowance for doubtful accounts → credit; Allowance for doubtful accounts decreases.

Uncollectible Accounts Example Accounting Methods

Web please prepare a journal entry to write off an uncollectible account. Hey, there are worse things that could happen than having to account for.

Uncollectible Accounts Written Off Accounting Methods

Bad debt expense → debit; Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Web a.

Abc Has Realized That The Customer Was Bankrupt, So The Receivable Will Be Uncollectible.

Pave estimates that 25% of the uncollected accounts will be uncollectible. The company should estimate loss and make. Bad debt expense → debit; The summary journal entries required to record the sales, cash collections, and the $12,500 in uncollectible accounts.

Allowance For Doubtful Accounts Decreases (Debit) And.

Allowance for doubtful accounts decreases (debit) and. Web the adjusting entry for uncollectible accounts is essential in order to match bad debts with the sales of the period that gave rise to the bad debts. Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. One method of recording the bad debts is referred to as the direct write off method which involves removing the.

Web Journal Entries To Record Original Estimate.

When you decide to write off an account,. Web we can make the journal entry for uncollectible accounts under the allowance method by debiting the bad debt expense account and crediting the allowance for doubtful. Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible.

Web When The Company Writes Off Accounts Receivable Under The Allowance Method, It Can Make Journal Entry By Debiting Allowance For Doubtful Accounts And Crediting.

Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Web bad debt expense is the loss that incurs from the uncollectible accounts where the customers did not pay the amount owed. Web a credit entry is made to allowance for uncollectible accounts, thereby adjusting the previous balance to the new, desired balance. Learn how to estimate and record uncollectible accounts using the allowance method, which complies with the matching principle.

![[Solved] Required 1. Record the adjusting entry for unco](https://media.cheggcdn.com/media/4f9/4f952ae3-97f8-4765-9e21-457f03da4e96/phpxM8s8T)