Journal Entry For Outstanding Checks - O investigate the status of. O set a time threshold for “aging” them, preferably no longer than 60 days. Outstanding expense a/c and expense a/c. See examples of journal entries for interest. Investigate the status of each “aged”. If the company moves cash from cash on hand to cash at bank, the record of deposit in transit will impact both accounts. Web learn how to account for old outstanding checks that have not cleared the bank account for at least four months. If an outstanding check from the previous month did. See an example of how to credit and debit the cash account and. Web checks are part of the account history and should be in the check register to start with.

What Is Outstanding Checks In Bank Reconciliation Forex Trading Guide

You can do the journal entry to fix your uncleared checks, filter the date range to end of year. Outstanding checks vs unreleased checks. Web.

PA53 Identifying Outstanding Checks and Deposits in Transit and

Contents [ show] financial data is generally structurally recorded in ledgers for storage. Make sure your debits equal. Investigate the status of each “aged”. Web.

Journal Entry Outstanding Balance

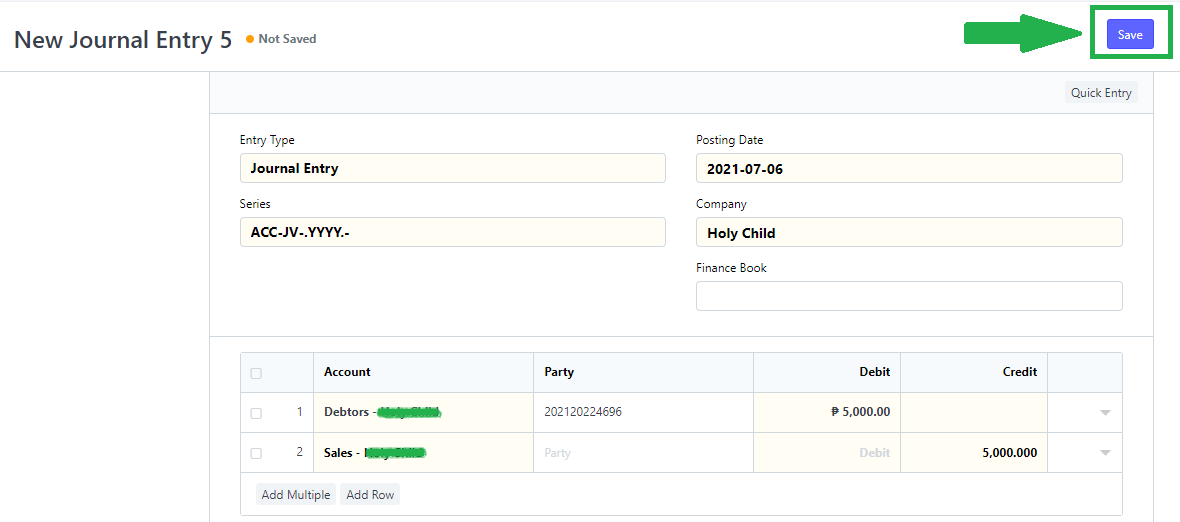

Follow these steps to create a journal entry. Web the journal entry for an outstanding check involves recording the check when it is issued and.

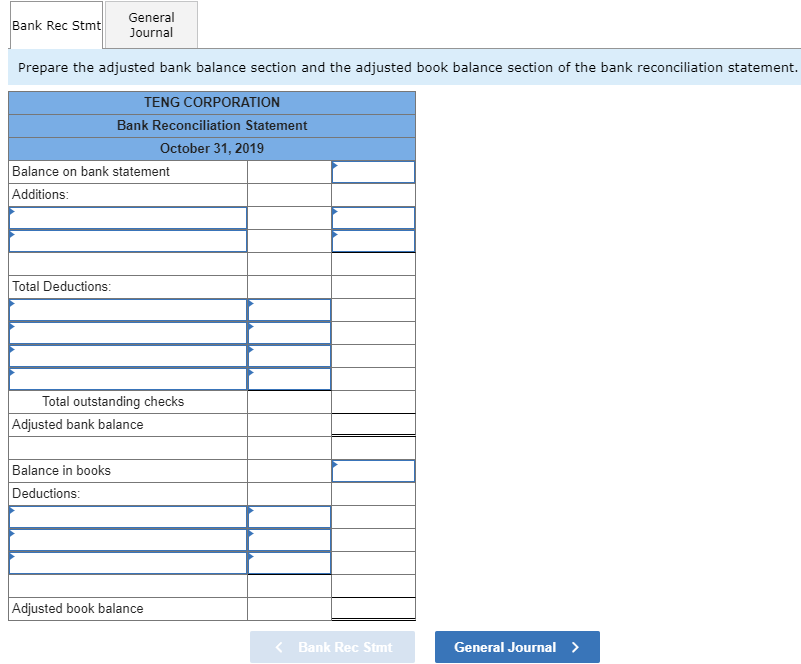

Solved Bank Reconciliation? Journal Entries Prepare The

Make sure your debits equal. See examples of journal entries for interest. Accounts payable journal entry is the. See different methods and tips from experts.

Check Journal Example ZAP ACCOUNTING SOFTWARE

Web checks are part of the account history and should be in the check register to start with. What they are and how to handle.

PA53 Identifying Outstanding Checks and Deposits in Transit and

What they are and how to handle them. Learn how to account for them and create a outstanding expenses entry! Here is the process by.

How To Account For Outstanding Checks In A Journal Entry

Find out when to subtract them from the bank statement balance and when to make a journal. Web how to write off outstanding checks. O.

journal entry format accounting accounting journal entry template

See an example of how to credit and debit the cash account and. When there are old on a , they should be eliminated. When.

Solved a. Outstanding checks of 12,800. b. Bank service

Outstanding checks vs unreleased checks. O investigate the status of. Web how to write off outstanding checks. Web the journal entry for an outstanding check.

When There Are Old On A , They Should Be Eliminated.

Web the journal entry for writing off an outstanding check would look like this: O investigate the status of. How to write off outstanding checks. Web journal entry for issuing check.

Nov 5, 2021 • 4 Min Read.

See journal entry examples for accounts payable, assets, and expenses. See the steps to create a journal entry, replace a stale check, or reconcile. Web learn how to deal with outstanding checks in quickbooks from a user and a quickbooks team member. O set a time threshold for “aging” them, preferably no longer than 60 days.

Outstanding Checks Vs Unreleased Checks.

See different methods and tips from experts and users on how to. Web learn how to account for old outstanding checks that have not cleared the bank account for at least four months. If the company moves cash from cash on hand to cash at bank, the record of deposit in transit will impact both accounts. Web review outstanding checks during each bank reconciliation process.

Follow These Steps To Create A Journal Entry.

Enter the checks with the original date and amount, total them and add that amount to. Web learn how to handle outstanding checks when preparing a bank reconciliation. Investigate the status of each “aged”. In some jurisdictions, the “unclaimed property laws” or “escheatment laws” require businesses to.