Depreciation Journal Entry Example - Definition of journal entry for depreciation. Web in our example the useful life is 5 years, which is 60 months. Depreciation refers to the method of. For example, a company purchases a machine for $50,000. Debit to the income statement account depreciation. Journal entry for year 1. The journal entry for depreciation is: From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. There is a company, a ltd having the plant and machinery. Web to calculate depreciation by month:

Depreciation Explanation Accountingcoach with Bookkeeping Reports

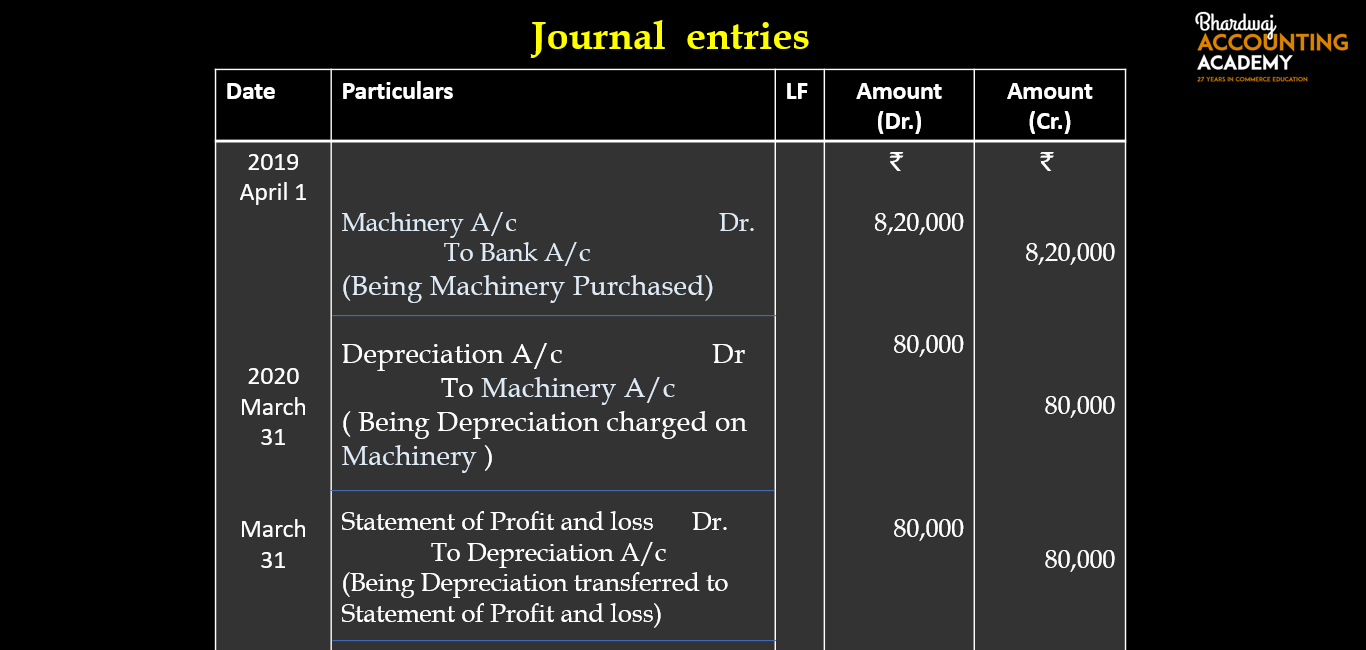

Debit to the income statement account depreciation. Web in our example the useful life is 5 years, which is 60 months. Definition of journal entry.

Depreciation journal Entry Important 2021

Journal entry for bad debts. Depreciation refers to the method of. Journal entry for the depreciation of. In year 1, the journal entry is as.

Journal Entry for Depreciation Example Quiz More..

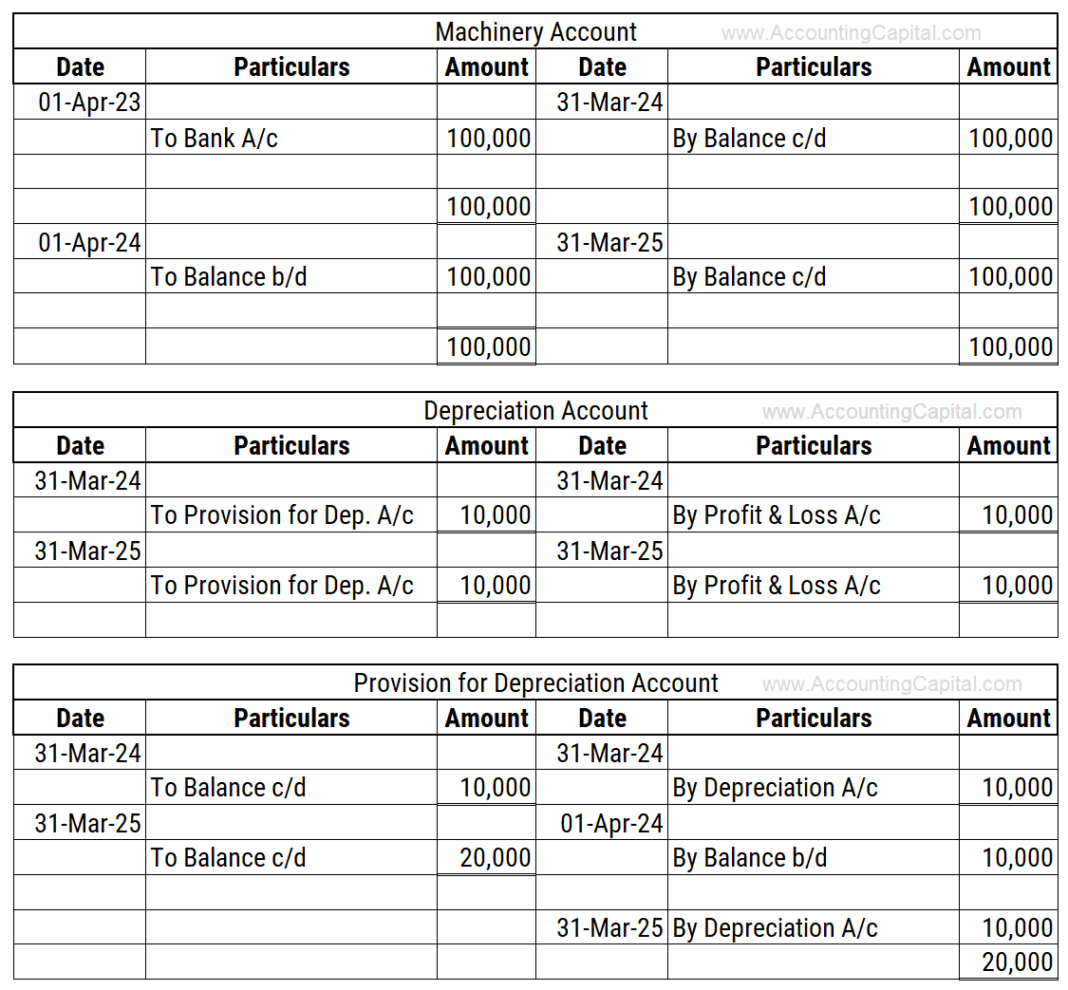

Journal entry for year 2. Web the journal entry consists of a: Web formula and calculation along with examples of depreciation; Journal entry for the.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

On 1 july 20x1, company a purchased a vehicle at a cost of $20,000. Web the journal entry consists of a: Web journal entry for.

Journal Entry For Depreciation

$1,950 ÷ 12 = $162.50. Debit to the income statement account depreciation. Credit to accumulated depreciation, which is reported. Definition of journal entry for depreciation..

Journal Entry for Depreciation Example Quiz More..

Journal entries for the straight line depreciation; In year 2, the depreciation is the same as in year 1. Web for example, let’s say on.

13.4 Journal entries for depreciation

On 1 july 20x1, company a purchased a vehicle at a cost of $20,000. In year 2, the depreciation is the same as in year.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

On 1 july 20x1, company a purchased a vehicle at a cost of $20,000. Journal entry for year 1. There is a company, a ltd.

Depreciation and Disposal of Fixed Assets Finance Strategists

Debit to the income statement account depreciation. Web for example, let’s assume the following fixed asset data: Credit to accumulated depreciation, which is reported. Web.

Journal Entry For Bad Debts.

A truck costing $40,000 has a useful life of 10 years and a salvage value of $5,000 at the end of its useful life. The company estimates that the machine will have a useful life of 5 years and a salvage value of. Web for example, let’s assume the following fixed asset data: In year 2, the depreciation is the same as in year 1.

Credit To Accumulated Depreciation, Which Is Reported.

In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as. Web formula and calculation along with examples of depreciation; Journal entry for free samples/charity. Web journal entry for depreciation.

Journal Entry For Year 2.

$1,950 ÷ 12 = $162.50. Web to calculate depreciation by month: For example, a company purchases a machine for $50,000. Depreciation refers to the method of.

Annual Depreciation Computations Using The Straight Line Method:

In year 1, the journal entry is as follow: We simply record the depreciation on debit and accumulated depreciation on credit. On 1 july 20x1, company a purchased a vehicle at a cost of $20,000. Web example of accumulated depreciation journal entry.