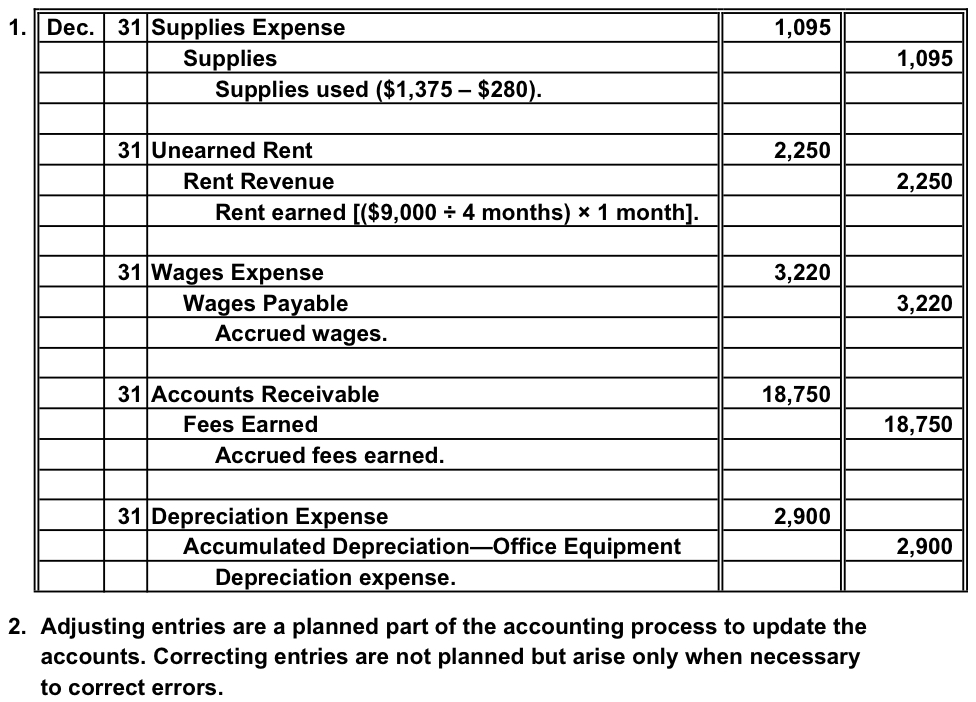

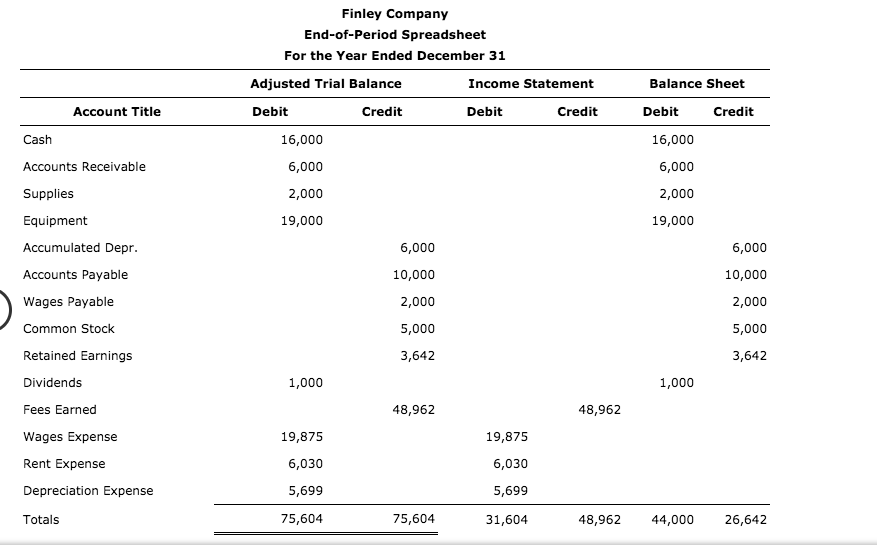

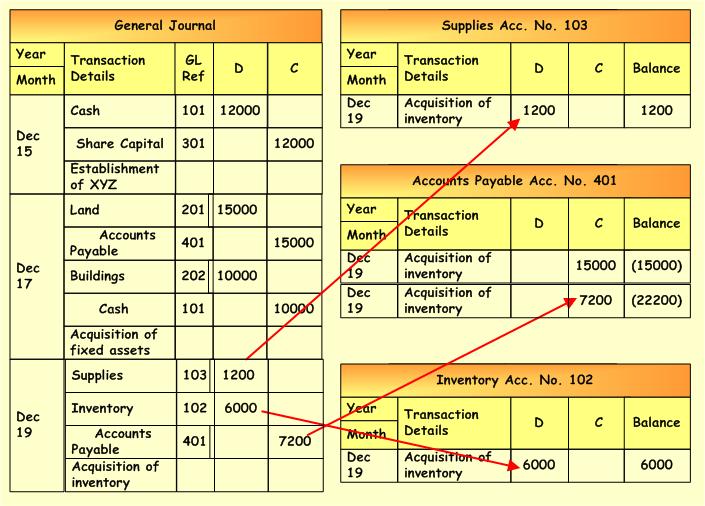

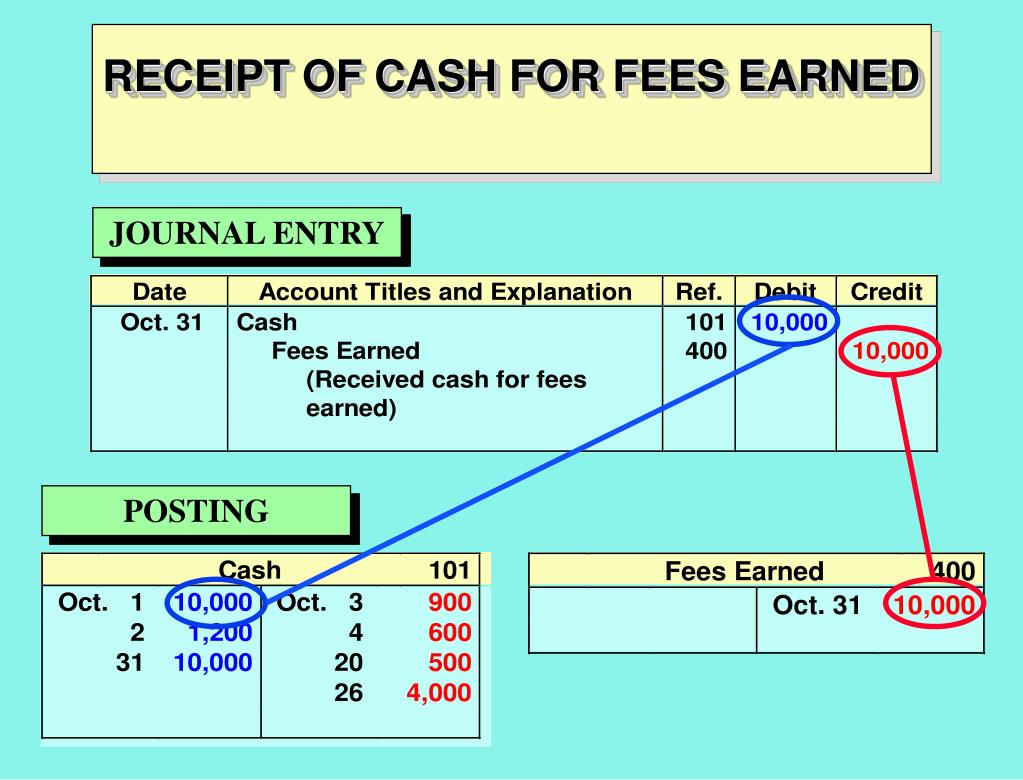

Journal Entry For Fees Earned - Journal entry for accrued income. Web journal entry for consulting fees. Web this article has been a guide to what is unearned revenue. Web the adjusting entry for deferred revenue updates the unearned fees and fees earned balances so they are accurate at the end of the month. Web enter the amount in the debit column of the general journal. It happens when the company has performed service for the customers. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they. Unearned fees revenue earned during the year, $11,080. When you see earned, you should always think revenue unless the. Every entry contains an equal debit and credit along with the.

Lasicamping Blog

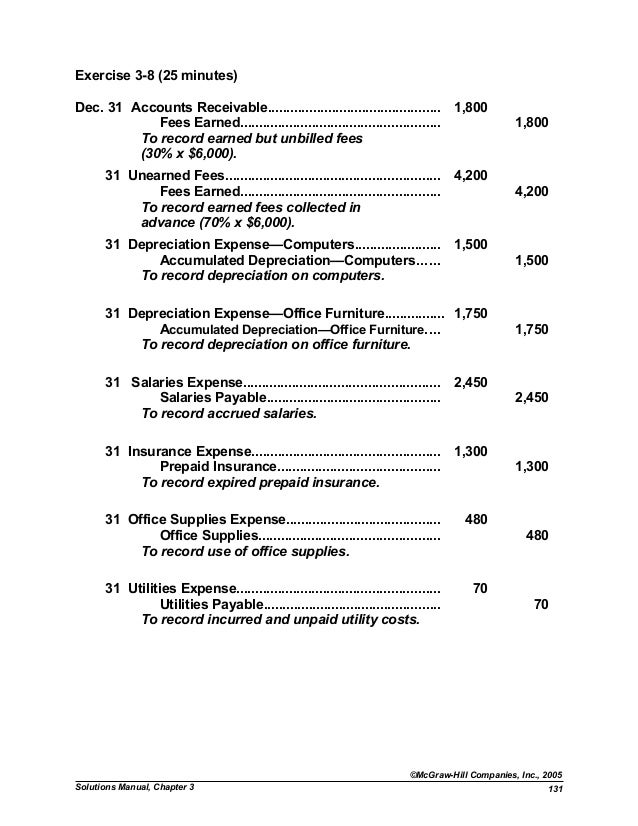

Click here to download journal entry problems. Unearned fees revenue earned during the year, $11,080. Here we explain its journal entries, examples, and how to.

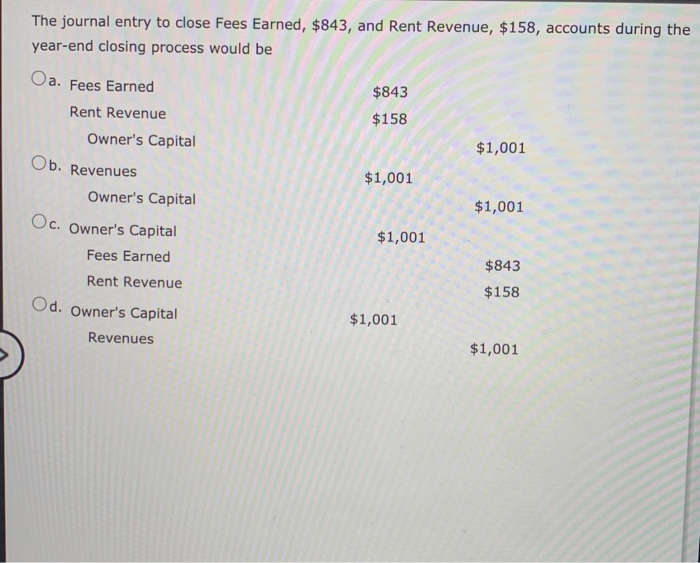

Solved The journal entry to close revenues would be credit

Web enter the amount in the debit column of the general journal. The recognition of expense will depend on. The company has to record the.

General Journal And General Ledger Entries Accounting Corner

Web the adjusting entry for deferred revenue updates the unearned fees and fees earned balances so they are accurate at the end of the month..

Accounting Journal Entries For Dummies

Unbilled revenue is the amount that a company earns after goods or services are delivered but not yet billed. Web a received cash on account.

Received cash fees earned journal entry and with it can you put a baby

Here we explain its journal entries, examples, and how to record unearned revenues in detail. It contains the fee revenue. The company has to record.

Solved The journal entry to close Fees Earned, 843, and

The company has to record the consulting fees as the operating expense on the income statement. Web what is the journal entry for accrued income?.

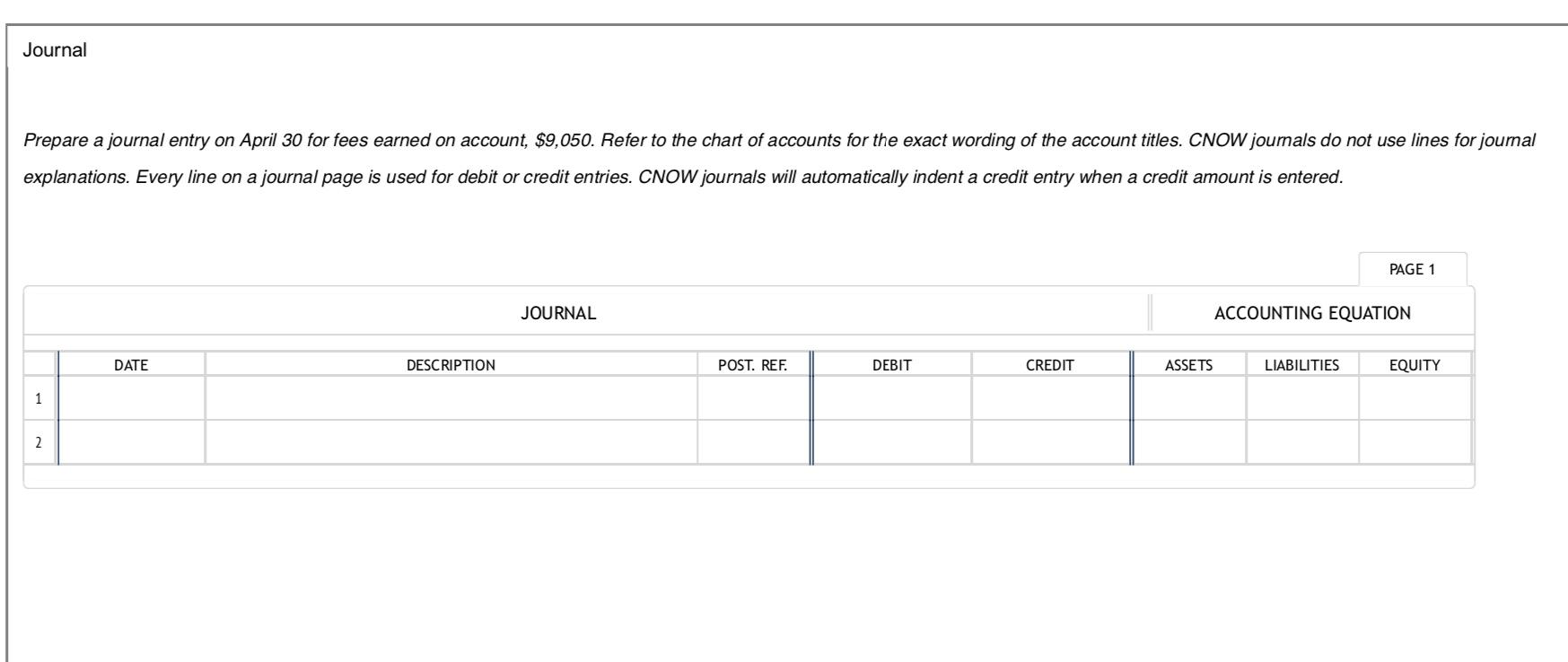

Solved Prepare a journal entry on April 30 for fees earned

Unearned fees revenue earned during the year, $11,080. Web at the end every accounting period, unearned revenues must be checked and adjusted if necessary. Web.

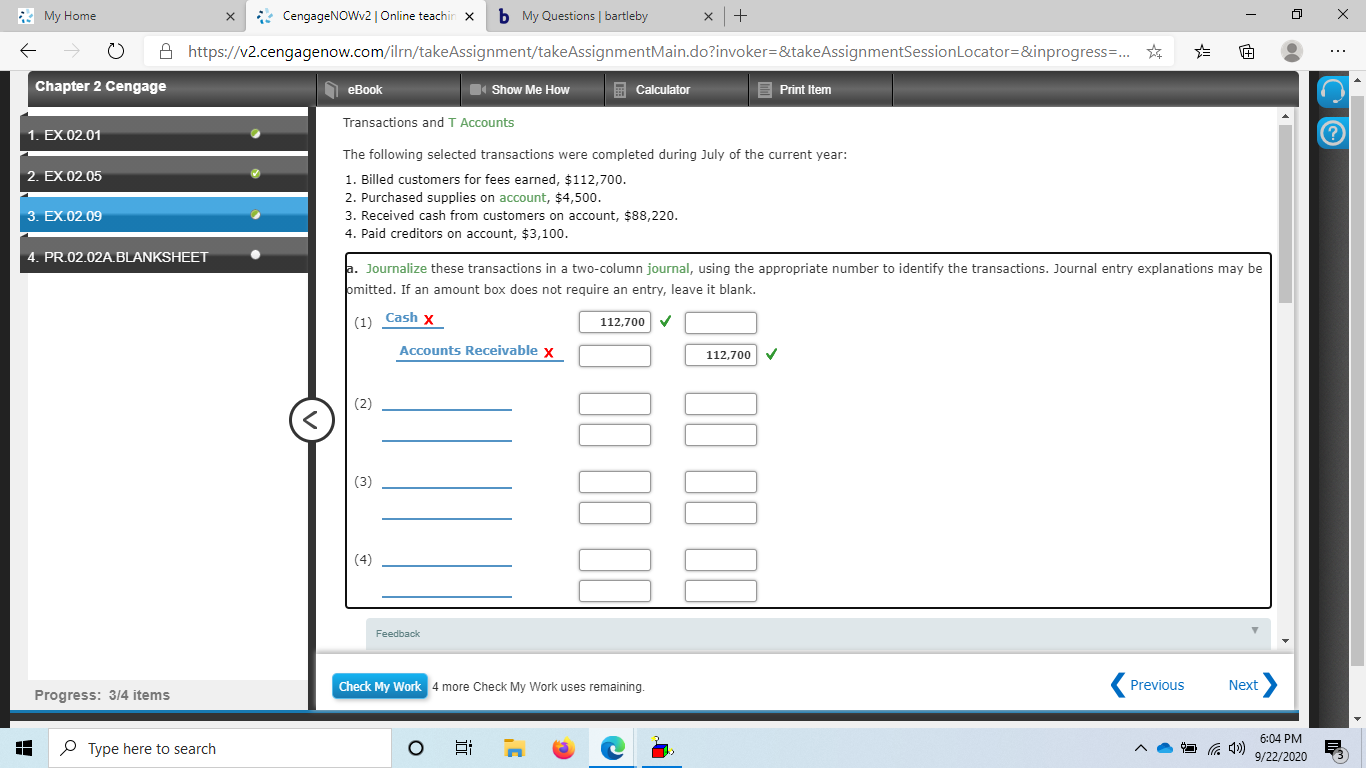

Answered Billed customers for fees earned,… bartleby

When you see earned, you should always think revenue unless the. Web this article has been a guide to what is unearned revenue. Fees earned.

Journal Entries Accounting

Here we explain its journal entries, examples, and how to record unearned revenues in detail. Web at the end every accounting period, unearned revenues must.

Web What Is The Journal Entry For Accrued Income?

The journal entry is debiting accounts receivable and credit fees earned. For example, if the amount received is $600, enter $600 in the debit column of the journal. Under the accrual basis of. It is income earned during a particular accounting period but not received until the end of.

The Recognition Of Expense Will Depend On.

The company has to record the consulting fees as the operating expense on the income statement. When you see earned, you should always think revenue unless the. The following are the journal entries recorded earlier for printing. Web a received cash on account journal entry is needed when a business has received cash from a customer and the amount is not allocated to a particular customer.

Web An Accounting Journal Entry Is The Written Record Of A Business Transaction In A Double Entry Accounting System.

Here we explain its journal entries, examples, and how to record unearned revenues in detail. Web at the end every accounting period, unearned revenues must be checked and adjusted if necessary. The adjusting entry for unearned revenue depends upon the journal entry. Web enter the amount in the debit column of the general journal.

Unbilled Revenue Is The Amount That A Company Earns After Goods Or Services Are Delivered But Not Yet Billed.

Journal entry for accrued income. Web the adjusting entry for deferred revenue updates the unearned fees and fees earned balances so they are accurate at the end of the month. Record decrease in unearned fees revenue by debit unearned fees revenue 11080. Web this article has been a guide to what is unearned revenue.