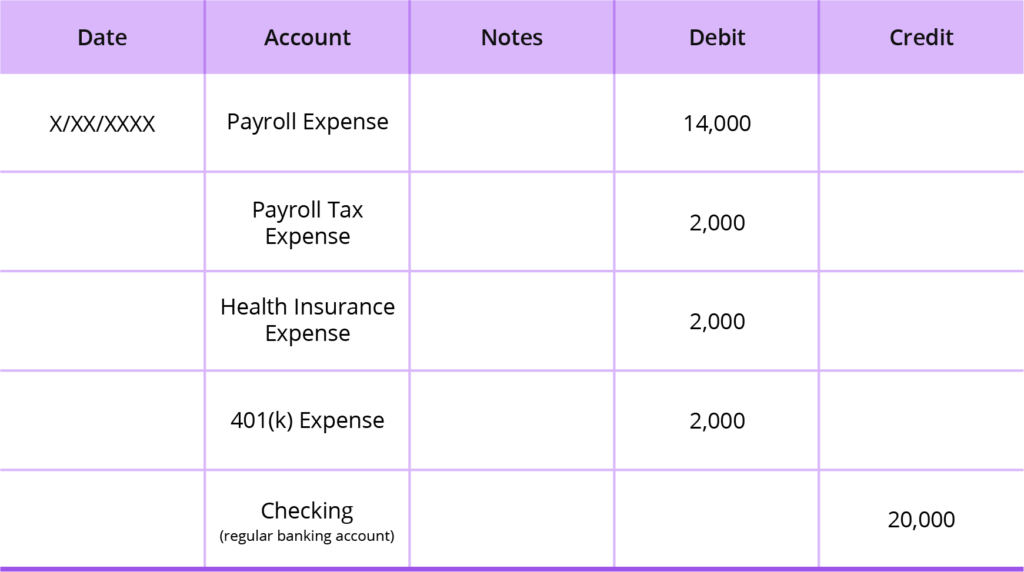

Journal Entry For Loan Payment - The money is paid direct to the bank account of the business. To receive a loan the. Debit of $1,500 to loans payable. For the first line under account,. Web when making loan payments, a journal entry can be used to reduce the loan amount from the balance sheet, debiting the loan payable account and crediting the cash paid. Web the journal entry is debiting loan receivable and credit cash. Credit of $2,000 to cash. You can record the original. Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest. It involves recording your initial loan, the loan.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

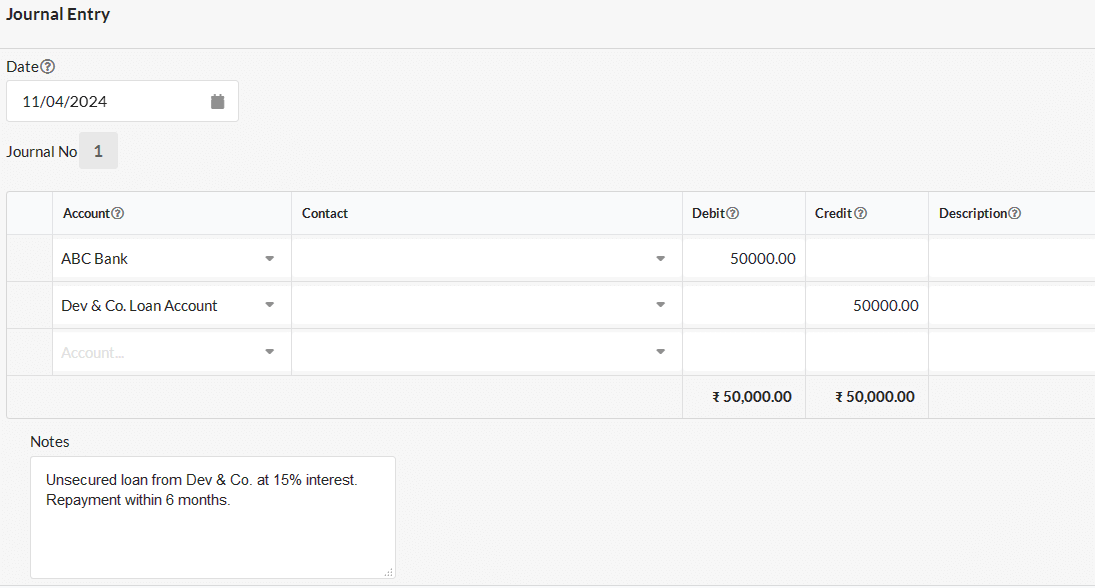

At the end of the first year. Bank (or cash) is an asset. To apply the loan to the proper asset accounts, create a journal.

Bank Loan Repaid Journal Entry Info Loans

When recording your loan and loan repayment in your general. The money is paid direct to the bank account of the business. What does a.

Receive a Loan Journal Entry Double Entry Bookkeeping

Web loan repayment journal entry explained. Loan payable is the liability account, so loan payment will reduce the loan balance. Web start recording loan payment.

Journal Entries of Loan Accounting Education

Web create a journal entry for the loan. Web now the journal entry for repaying the loan is as follows: The money is paid direct.

Loan Journal Entry Examples for 15 Different Loan Transactions

When you use bookkeeping software. Web the company’s entry to record the loan payment will be: The loan receivable will be recorded as assets on.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

The loan receivable will be recorded as assets on the balance sheet. Assets increase on the debit side. When the company sells goods to the.

Basic Accounting for Business Your Questions, Answered

You can record the original. Assets increase on the debit side. The money is paid direct to the bank account of the business. When the.

journal entry format accounting accounting journal entry template

Web the journal entry is debiting interest expense $ 5,000 and crediting interest payable $ 5,000. Web making a journal entry to show a loan.

Shareholder Loan Repayment Journal Entry Info Loans

Web the company’s accountant records the following journal entry to record the transaction: A business applies to a bank and receives a loan of 25,000..

Web Create A Journal Entry For The Loan.

Assets increase on the debit side. The money is paid direct to the bank account of the business. Web the journal entry is debiting interest expense $ 5,000 and crediting interest payable $ 5,000. If you buy a fixed asset and you finance it with a loan or installment plan, you must record it in your accounts.

Web On Jan 1, 2020.

The credit balance in the. *assuming that the money was due to be paid to abc bank ltd. When recording your loan and loan repayment in your general. It is important to realize that in each of these journals there are two debit entries.

Web Receive A Loan Journal Entry.

Web we can make the journal entry for loan payment with interest by debiting the loan payable account and the interest payable account and crediting the cash account. Debit of $1,500 to loans payable. Loan payable is the liability account, so loan payment will reduce the loan balance. Web loan payment journal entry.

Web The Company’s Accountant Records The Following Journal Entry To Record The Transaction:

Credit of $2,000 to cash. Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest. At the end of the first year. A business applies to a bank and receives a loan of 25,000.