Journal Entry For Credit Card Payment - January 26, 2019 07:00 am. Devon coombs, cpa, discusses accounting journal entries and double entry accounting for accounts receivable (a sale on credit. Record purchases by credit card. When a credit card processor submits a credit card statement to a company, the company is essentially. Credit card processors usually deduct merchant fees from the original payment made by your customer. Should i use debit or credit? What is the journal entry to fix a credit card payment made from my personal checking account on accident? You’re then left with the net amount and have to account for this merchant fee. As an accountant, you have to figure out what entries make the most sense for each type of transaction using what you learn in this course. Credit your accounts receivable account

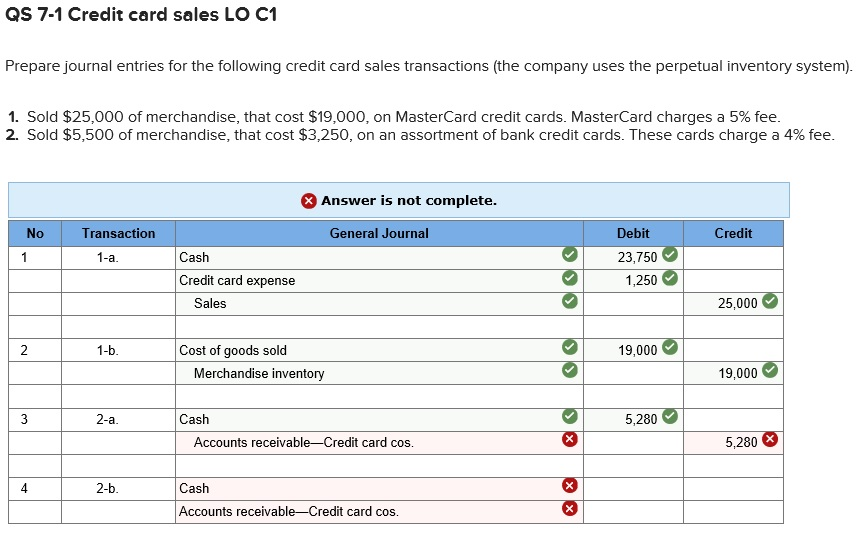

Solved QS 71 Credit card sales LO C1 Prepare journal

In the first journal entry, you must: The company makes a purchase and paid using a credit card. Web the journal entry is debiting cash.

Sales Credit Journal Entry What Is It, Examples, How to Record?

Credit accounting, it’s important to understand that they actually work together. Debit your accounts receivable account; The two scenarios shown in figure 1 for the.

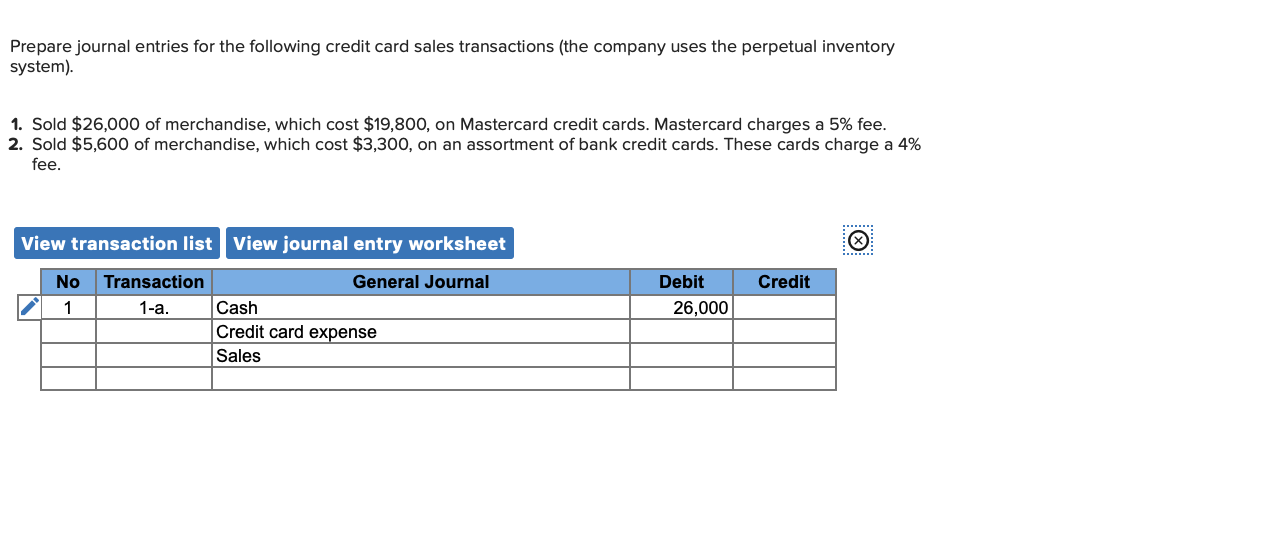

Solved Prepare journal entries for the following credit card

January 26, 2019 07:00 am. Devon coombs, cpa, discusses accounting journal entries and double entry accounting for accounts receivable (a sale on credit. When you.

How do you match a deposit to a receipt when the credit card refund is

How do i enter a payment on my account that was a credit card transaction? Should i use debit or credit? As an accountant, you.

Journal Entry for Credit Card System Loaner YouTube

Credit your accounts receivable account February 09, 2024 11:55 am. Accounting journal scenarios for payment of credit card. Web the recording of a credit card.

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

Web make two separate journal entries for credit card purchases with delayed payment. The debt is typically noted as an increase in the expense account,.

Explain the Revenue Recognition Principle and How It Relates to Current

Accounting journal scenarios for payment of credit card. Bank fund under credit card dr. Web us quickbooks community. The two scenarios shown in figure 1.

Journal Entry Format.pdf Debits And Credits Corporations

The journal entry is debiting assets or. Web with the total sales of $5,000 in the example here, we can determine the credit card fee.

Journal Entry Debits And Credits Cheat Sheet

Web the recording of a credit card transaction as a journal entry involves the debiting of an expense and the crediting of a balance. So,.

Accounting Journal Scenarios For Payment Of Credit Card.

When a credit card processor submits a credit card statement to a company, the company is essentially. The first journal entry is not a compound journal entry. Last updated january 26, 2019 7:00 am. Before getting into the differences between debit vs.

(It Shows As Liability In The Balance Sheet) ( Now, This Fund Is Not Deposit Your Saving Bank Account But You Have The Right On This Fund.

Web the recording of a credit card transaction as a journal entry involves the debiting of an expense and the crediting of a balance. February 09, 2024 11:55 am. Under money out (if you’re in business view), or other (if you’re in accountant view), select pay down credit card. Select the bank account you paid the credit card with.

This Means You Will Only Debit One Account And Credit One Account.

( it shows as asset in the balance sheet) credit card payable cr. Record purchases by credit card. The two scenarios shown in figure 1 for the accounting journal entry are when the credit card holders pay cash immediately and when the credit card holders pay at a later date. The bank fee for the credit cards is 3.5%.

The Entry To Record The Sales Will Include A Credit To Sales Revenues Of $120,000 And Debits To.

Web when you receive the payment in january, you would make the following entry: Rules of debit and credit. The original amount i posted as a daily sales aje does not match, as the merchant fee (4%) needs to be accounted for. Web with the total sales of $5,000 in the example here, we can determine the credit card fee to be $150 ($5,000 x 3%) as of july 1.