Journal Entry For Vehicle Purchase With Trade In - New 2023 vehicle purchase $76,580.70 hst $11,485.13, trade in allowance $13,800.00. “you can spend two years at business school,” he. The aim of this paper is to give the reader an understanding of how to correctly record the purchase of a. See the journal entry, the gain or loss calculation, and an example with numbers. The journal entry to record this: I am not an accountant so please be patient and detailed on your suggestions. Web what about a purchase without a loan (cash) with a trade in. What if you paid part cash and traded in an existing van that is included as an asset on your books? October 19, 2023 03:06 pm. Purchase price is $43351.13 (includes fees) loan amount is $48617.72.

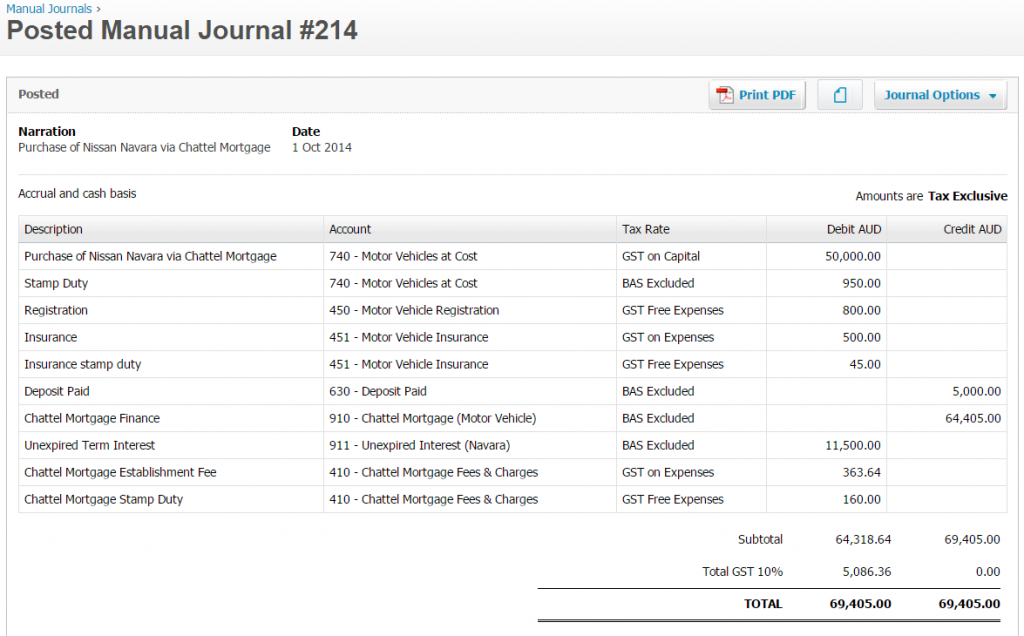

how to record hire purchase motor vehicle Brian Coleman

In business, equipment is often exchanged (e.g., an old. Cost price of old truck = $35k. Web cost price of new truck = $40k. Web.

Insurance Claim Journal Entry

See the journal entry, the gain or loss calculation, and an example with numbers. I am not an accountant so please be patient and detailed.

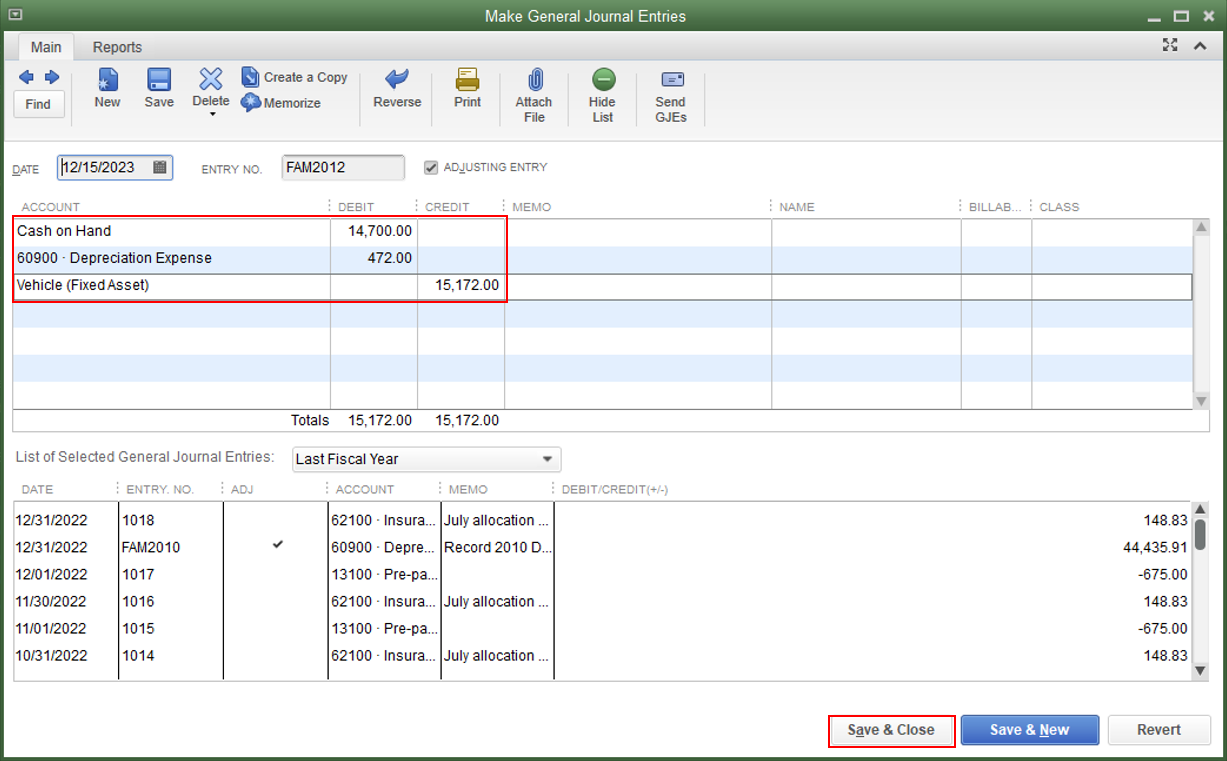

How to Enter, Setup Record a Vehicle Purchase in QuickBooks

Traded in car, received $21,000 for it, but. Journal entries for vehicle purchase with trade in. New 2023 vehicle purchase $76,580.70 hst $11,485.13, trade in.

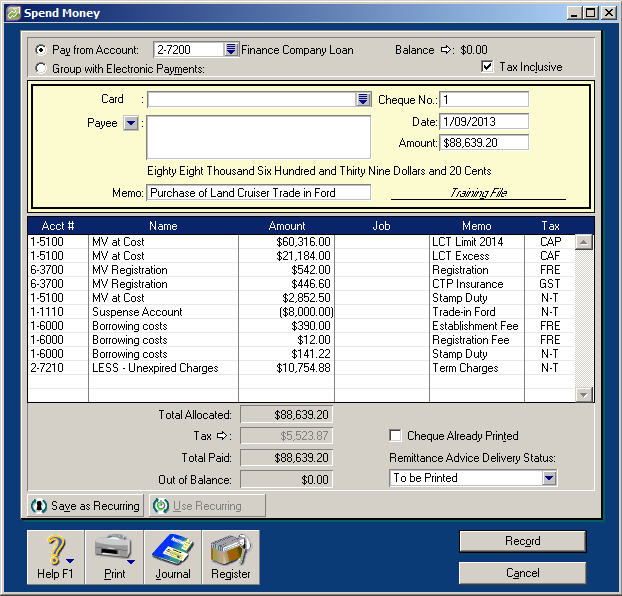

Accounting Record A Vehicle Purchase With A Loan, TradeIn, And Down

Web cost price of new truck = $40k. Web the initial journal entry for the purchase of a fixed asset on credit is just step.

Car Purchase Journal Entry Stephen Anderson

Web a fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a.

Accounting for Trade in Vehicle

Journal entries for vehicle purchase with trade in. New 2023 vehicle purchase $76,580.70 hst $11,485.13, trade in allowance $13,800.00. And a sub account for. Traded.

How to Record a Vehicle Trade in QuickBooks Desktop & Online?

Web in buying a car, my father believed, a person can learn all he will ever need to know about commerce and the human condition..

Journal Entries In Quickbooks Online Farmer Lextre

Web cost price of new truck = $40k. Help for recording double entries for purchasing a vehicle with partly trade in and party cash. Web.

Journal Entry for Vehicle TradeIn a Comprehensive Guide

“you can spend two years at business school,” he. October 19, 2023 03:06 pm. The aim of this paper is to give the reader an.

Web Cost Price Of New Truck = $40K.

The entry should be made at the time of purchase and should include the details. In business, equipment is often exchanged (e.g., an old. October 19, 2023 03:06 pm. What if you paid part cash and traded in an existing van that is included as an asset on your books?

Go To The + New Button;

Web my client traded a car in to purchase a new one: Purchase price is $43351.13 (includes fees) loan amount is $48617.72. New 2023 vehicle purchase $76,580.70 hst $11,485.13, trade in allowance $13,800.00. Accum depreciation of old truck = $25k.

Web A Fixed Asset Trade In Journal Entry Is Used To Post The Acquisition Of A New Motor Vehicle In Exchange For Cash And A Trade In Allowance On An Old Vehicle.

See the journal entry, the gain or loss calculation, and an example with numbers. Traded in car, received $21,000 for it, but. Web the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor vehicle in accounting. This would be a classic exchange transaction.

Web Sometimes A New Car Purchase Is Accompanied By A “Trade In” Of An Old Car.

Calculate and post partial year depreciation create the new fixed asset account, new car; Web what about a purchase without a loan (cash) with a trade in. Web you can create a journal entry to record the purchased vehicle transaction in quickbooks online. Web the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash).