Deferred Cost Journal Entry - Assume that a newly formed company paid $600 on december 30 for liability insurance for the six months that begins on january 1. Deferred expenses represent money paid in advance of receiving a good or service or before the related revenue is earned. Web the deferral journal entry debits the designated deferred expense account and credits the expense account. The deferred cost journal entry also includes a link to the revenue arrangement in its related records subtab. Web a deferred expense is a cost that has been incurred but not yet consumed, and is recorded as an asset until the goods or services are used. Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting. In accounting, deferred revenue can affect your balance sheet and profit and loss statement. To accomplish this, the deferred expense is reported on the balance sheet as an asset or a contra liability until it is moved from the balance sheet to the income statement as an expense. The credit to the asset account called supplies reduces the balance from $7,700 which is the total of everything we bought during the year to $650 which is what we had left at the end of the year. The following deferred revenue journal entry outlines the most common journal entries in accounting.

How to use Excel for accounting and bookkeeping QuickBooks

Web deferred revenue journal entry. Web definition of deferred cost. Assume that a newly formed company paid $600 on december 30 for liability insurance for.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Web and from this analysis, you write the journal entry: Adjusting entries are often sorted into two groups: You need to understand how to recognize.

Deferred Tax Asset Journal Entry Example Balance Sheet Verkanarobtowner

When the expense is initially paid in advance, the “prepaid expense” account is debited to recognize the asset, and the “cash” account is credited. Accruals.

How To Find Net From Journal Entries

The credit to the asset account called supplies reduces the balance from $7,700 which is the total of everything we bought during the year to.

Deferred Tax Liabilities Explained With Reallife

For example, suppose a business provides web design services and invoices for. The “prepaid expense” (asset) account and the “cash” (or applicable payment method) account..

Types of Adjusting Entries with Examples Financial

Edited by ashish kumar srivastav. For accounting purposes, both prepaid expense and deferred expense amounts are. Web deferred revenue is money that you receive from.

Accounting Cycle 5 Adjusting Entries Part 4 Deferrals EXAMPLE YouTube

An example of a deferral would be a company paying for rent in advance. The credit to the asset account called supplies reduces the balance.

What is Deferral? Definition + Journal Entry Examples

Web the deferral journal entry debits the designated deferred expense account and credits the expense account. For accounting purposes, both prepaid expense and deferred expense.

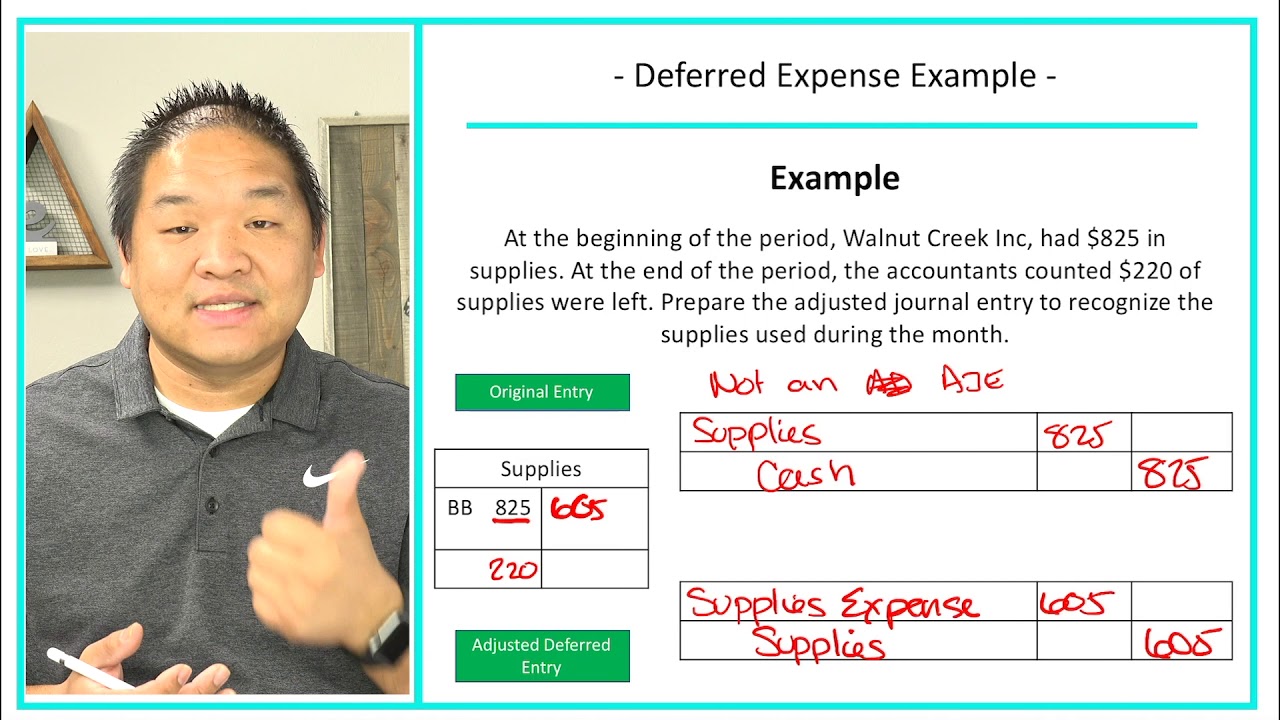

Financial Accounting Lesson 4.3 Deferred Expense Example YouTube

Web a deferred cost is a cost that you have already incurred, but which will not be charged to expense until a later reporting period..

The “Prepaid Expense” (Asset) Account And The “Cash” (Or Applicable Payment Method) Account.

Web a deferred expense refers to a cost that has occurred but it will be reported as an expense in one or more future accounting periods. Deferred revenue, also known as unearned revenue or unearned income, happens. Web a deferred expense is a cost that has been incurred but not yet consumed, and is recorded as an asset until the goods or services are used. The following deferred revenue journal entry outlines the most common journal entries in accounting.

Web The Deferral Journal Entry Debits The Designated Deferred Expense Account And Credits The Expense Account.

Edited by ashish kumar srivastav. Web and from this analysis, you write the journal entry: Web this can create an accounting entry on the balance sheet known as a prepaid expense or deferred expense. Thereafter, it is classified as an expense within the current accounting.

Web Deferred Revenue Is Money That You Receive From Clients Or Customers For Products Or Services That You Haven’t Delivered Yet.

This means that deferred revenue is a liability account showing your obligation to your customer. When the expense is initially paid in advance, the “prepaid expense” account is debited to recognize the asset, and the “cash” account is credited. Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting. Web deferred revenue journal entry.

The Credit To The Asset Account Called Supplies Reduces The Balance From $7,700 Which Is The Total Of Everything We Bought During The Year To $650 Which Is What We Had Left At The End Of The Year.

To accomplish this, the deferred expense is reported on the balance sheet as an asset or a contra liability until it is moved from the balance sheet to the income statement as an expense. Initially recorded as an asset, it appears on the balance sheet as a current asset and is usually consumed within one year. Adjusting entries are often sorted into two groups: The deferred cost journal entry also includes a link to the revenue arrangement in its related records subtab.