Income Tax Payable Journal Entry - Web the following is the journal entry for the payment made to the creditor: Record interest expense paid on a mortgage or loan and update the loan balance. The amount of liability will be based on its profitability during a given period and the applicable tax rates. Deferred tax assets and liabilities are normally recorded with the offsetting entry to the p&l (deferred tax expense). That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the money went. Now, you can record the journal entry in your accounting system. Web there have been no income tax instalments paid in advance; Debit income tax expense $14,250.00. To record accounts payable, the business needs to pass a journal entry that debits the expense or asset account and. For companies that use the cash basis for both financial and tax reporting, income tax expense equals income tax payable, the actual amount of tax to be paid.

Journal Entry for Tax Refund How to Record

Web the journal entry for income tax payable is a debit to the income tax expense account and a credit to the income tax payable.

Provision For Tax Journal Entry

Adjust your books for inventory on hand at period end. At the end of the accounting period the business needs to accrue the estimated income.

Casual Journal Entry For Tax Payable Financial Statement

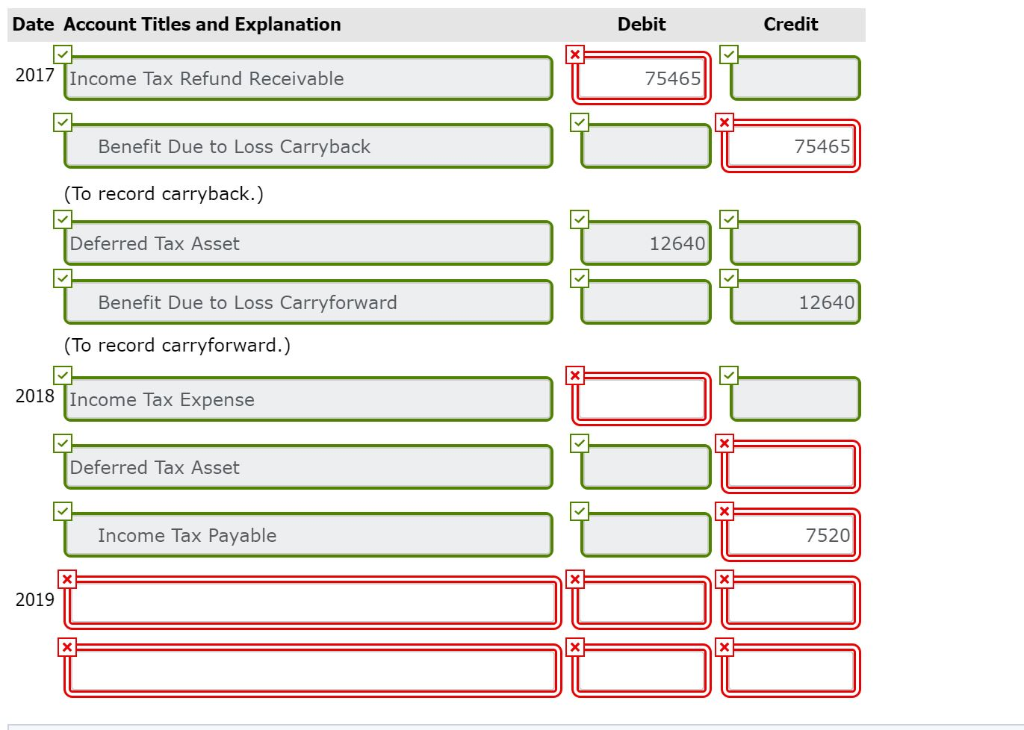

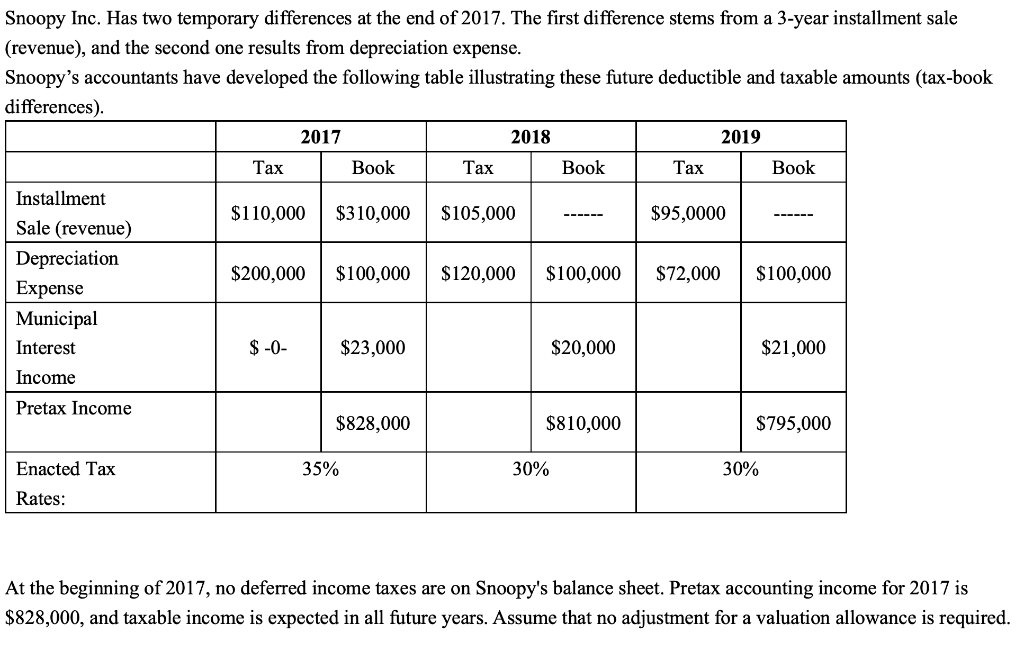

Prepare a journal entry to record this transaction. Payment of income tax liability upon filing: For companies that use the cash basis for both financial.

Sales Tax Payable Journal Entries YouTube

The amount of liability will be based on its profitability during a given period and the applicable tax rates. On december 31, 20×1, entity a.

Journal Entry For Tax Payable

How should accounts payables be recorded? Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting differences in the timing of.

Journal Entries Accounting

Accrued income tax journal entry. Web how to account for income taxes. Journal entries are rightly called the backbone of the modern accounting system as.

Journal Entry For Tax Payable

That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the.

Payroll Journal Entry Example Explanation My Accounting Course

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web there have.

Casual Journal Entry For Tax Payable Financial Statement

Web journal entries for deferred tax liability. Increase in income taxes payable (liability): The company tax rate is 28.5% and thus the projected tax payable.

On December 31, 20×1, Entity A Estimated The Income Taxes Expense For 20×1 As $260,000.

Journal entries record the entire spectrum of monetary transactions. Record interest expense paid on a mortgage or loan and update the loan balance. Web a journal entry is a record of a business transaction. Web the journal entry for income tax payable is a debit to the income tax expense account and a credit to the income tax payable account.

At The End Of The Accounting Period The Business Needs To Accrue The Estimated Income Tax Expense Due, The Accrued Income Tax Payable Journal Entry Is As Follows:

The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and determine the tax expense for the current period. Web the journal entry for the provision for income taxes involves two accounts, income tax expense, and income tax payable. For companies that use the cash basis for both financial and tax reporting, income tax expense equals income tax payable, the actual amount of tax to be paid. We account for this by the following end of year journal entries:

Web Income Tax Payable Is A Term Given To A Business Organization’s Tax Liability To The Government Where It Operates.

The income tax expense account is debited with the provision for income taxes, while the income tax payable account is. Credit income tax payable $14,250.00. To record accounts payable, the business needs to pass a journal entry that debits the expense or asset account and. The amount of liability will be based on its profitability during a given period and the applicable tax rates.

Web The Current Income Tax Payable Or Receivable Is Recorded With The Offset To The P&L (Current Tax Expense).

Increase in income taxes expense (expense): Web preparing the journal entry to record the recognition or discharge of deferred income taxes consists of three steps: Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. How should accounts payables be recorded?