Shareholder Distribution Journal Entry - $ 100,000 x 30% = $ 30,000. Web august 29, 2023 03:45 pm. Web you should distribute it from there to each shareholder by writing a check and assigning the shareholder's equity account on the expenses tab of the check. See an example of a $500,000 cash dividend declared on december 20, 2021 and paid on january 10, 2022. An owners draw is a money draw out to an owner from their business. Web the journal entry to record the stock dividend declaration requires a decrease (debit) to retained earnings and an increase (credit) to common stock dividends distributable. Last updated august 29, 2023 3:45 pm. Web owners withdrawal journal entry. So, the transaction is recorded by debiting the. I would set up an equity type account called shareholder distributions, to keep it separate.

Current developments in S corporations

What is an owner’s draw? Web settings > chart of accounts > new > equity > save account under 'equity' > tax form section 'partner.

Journal Entry For Stock Dividend Paid Why Some Options Trade Are

Web you should distribute it from there to each shareholder by writing a check and assigning the shareholder's equity account on the expenses tab of.

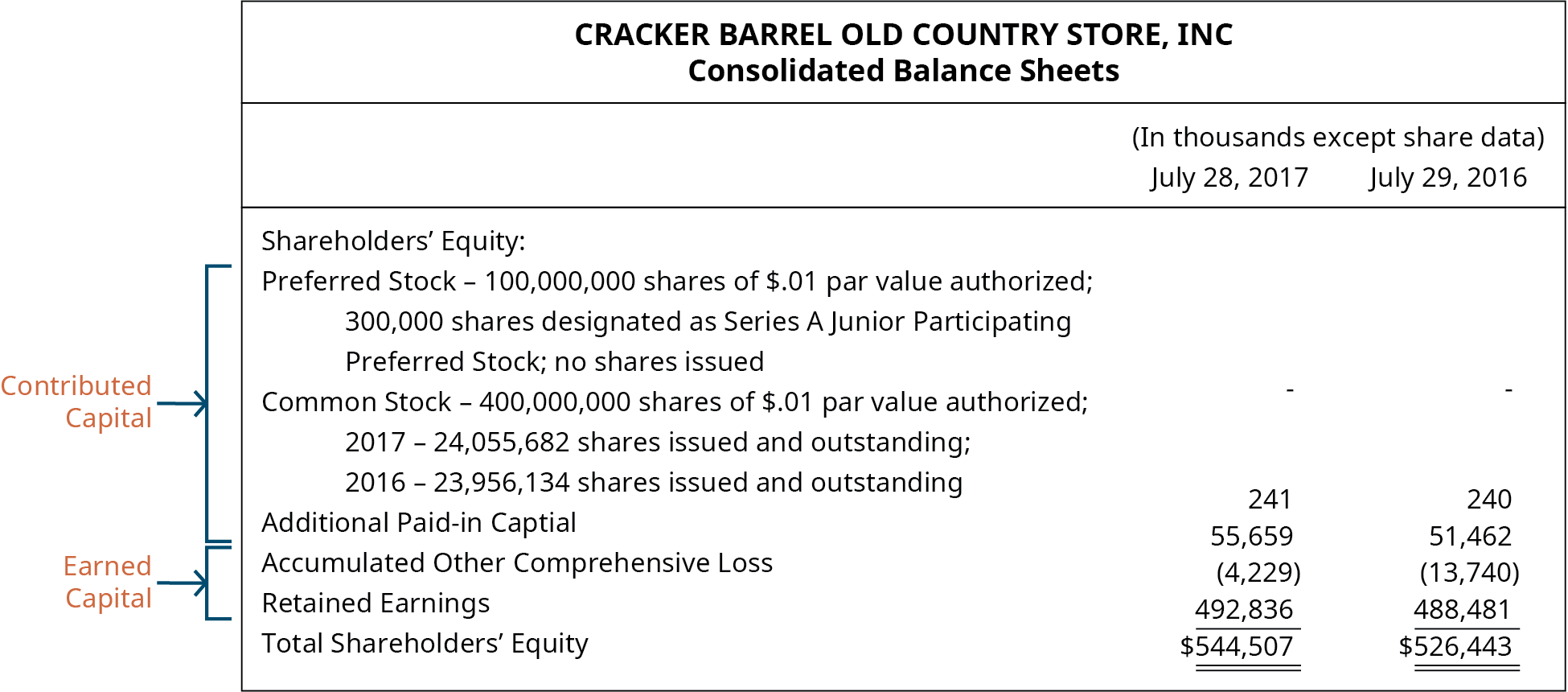

PPT Shareholders’ Equity PowerPoint Presentation, free download ID

Web your entry will be credit loan (to return it to 0) and debit shareholder distribution (equity) for further reading. Web learn how to record.

journal entry format accounting accounting journal entry template

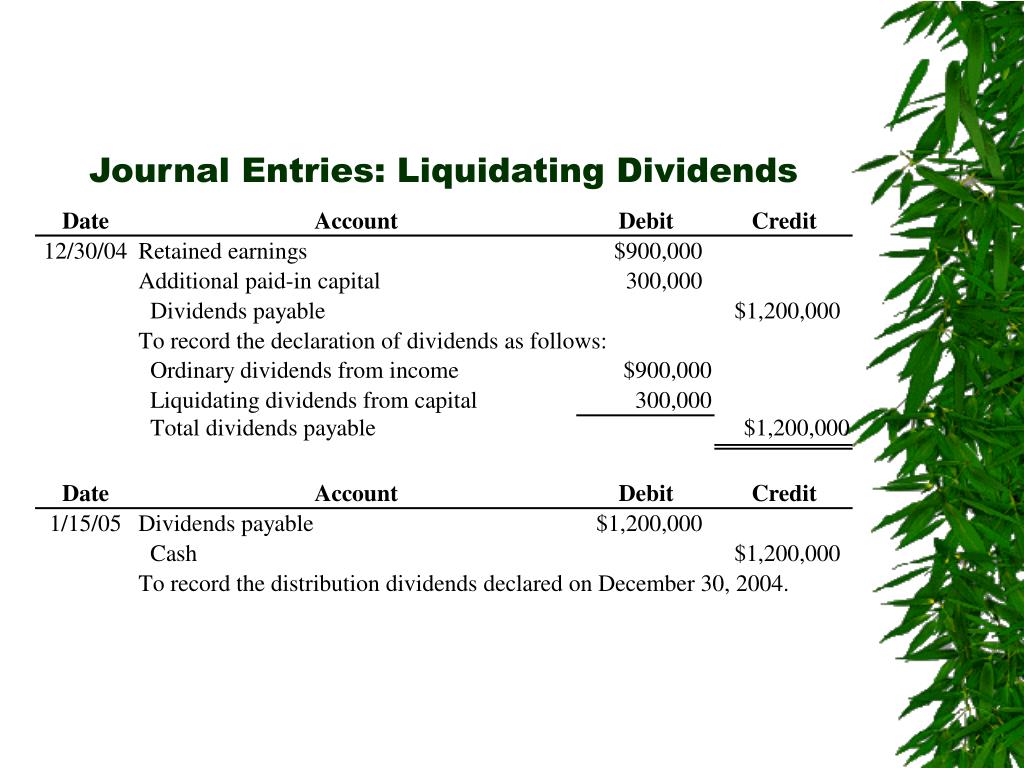

Web what are journal entry examples of dividends payable? So, the transaction is recorded by debiting the. Web settings > chart of accounts > new.

Dividends Payable Accounting Journal Entry

Journal entry with a withdraw / shareholder distribution / accounting for beginners. 6.8k views 4 years ago accounting for beginners / basics / tutorial. Web.

Journal Entry with a WithDraw / Shareholder Distribution / Accounting

So, the transaction is recorded by debiting the. S corp shareholder distributions are the earnings by s corporations that are paid out or passed through.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web the journal entry to record the stock dividend declaration requires a decrease (debit) to retained earnings and an increase (credit) to common stock dividends.

Accounting for Share Capital Accountancy Knowledge

Journal entry with a withdraw / shareholder distribution / accounting for beginners. What is the process to post shareholder distributions to retained earnings. Web settings.

Shareholder Loan Repayment Journal Entry Info Loans

Web owners withdrawal journal entry. What is the process to post shareholder distributions to retained earnings. Web the journal entry is debiting a net income.

$ 100,000 X 30% = $ 30,000.

So, the transaction is recorded by debiting the. Web distribution journal entry is to record the payment of earnings to the members or partners of the entity. Web it's not a journal entry; What is the process to post shareholder distributions to retained earnings.

This Is The Journal Entry For Cash Distribution To Shareholders.

Web you should distribute it from there to each shareholder by writing a check and assigning the shareholder's equity account on the expenses tab of the check. Last updated august 29, 2023 3:45 pm. Web by jason watson, cpa. See an example of a $500,000 cash dividend declared on december 20, 2021 and paid on january 10, 2022.

Web The Process Of Distributing Funds To Owners Involves Debiting Capital And Crediting Cash.

What is an owner’s draw? See the formula, the example and the explanation of the accounting process. A look at owner’s distributions accounts. Web settings > chart of accounts > new > equity > save account under 'equity' > tax form section 'partner distributions' (technically, this isn't correct but it's as close as.

Posted Friday, November 3, 2023.

Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. Web your entry will be credit loan (to return it to 0) and debit shareholder distribution (equity) for further reading. Web updated june 24, 2020: 6.8k views 4 years ago accounting for beginners / basics / tutorial.