Paid Loan Journal Entry - Web updated may 09, 2024. Web the journal entry to recognize the receipt of the loan funds is as such: The loan receivable will be recorded as assets on the balance sheet. Web on wednesday, the biden administration announced an additional $7.7 billion in loan debt relief was approved for 160,500 borrowers. It involves recording your initial loan,. Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the. Based on the loan schedule, the. Interest due ₹500 on loan taken is paid. Web according to the fed’s preferred measure, inflation has tumbled from 7.1% in june 2022 to 2.7% in march. That same gauge showed, though, that prices accelerated.

Bank Loan Repaid Journal Entry Info Loans

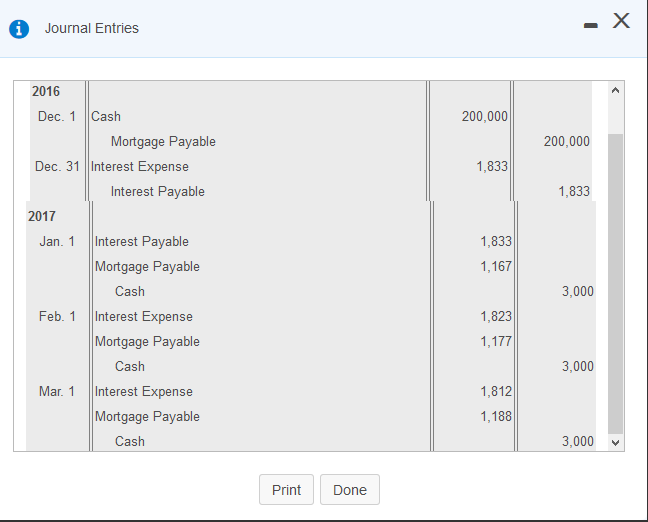

Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account.

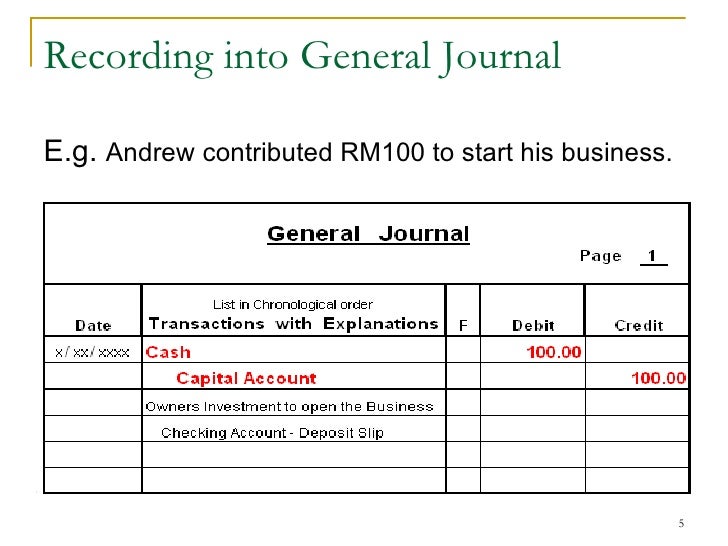

Journal Entry Examples

Web may 29, 2024. Show journal entry for loan payment in year 1 & year 2. Debit of $3,000 to loans payable (a liability account).

Journal Entries of Loan Accounting Education

Web what is a journal entry? Web please prepare journal entry for paid interest on loan. Based on the loan schedule, the. Web we.

What Is The Journal Entry For A Loan Payment

Web may 29, 2024. On december 31, 2022, the interest accrued on the loan must be. Web what is a journal entry? Web the.

Mortgage Payable Journal Entry

Web what is the loan journal entry? Web the company’s accountant records the following journal entry to record the transaction: Based on the loan schedule,.

What Is The Journal Entry For Payment Of Salaries Info Loans

This will bring the total amount. Web the company can make the journal entry for the loan received from the bank by debiting the cash.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Abc plc received a bank loan of $100,000 on 1 january 20x1. Show journal entry for loan payment in year 1 & year 2. Web.

Journal Entry Examples

Web may 29, 2024. In this journal entry, both. Web the company’s accountant records the following journal entry to record the transaction: At the end.

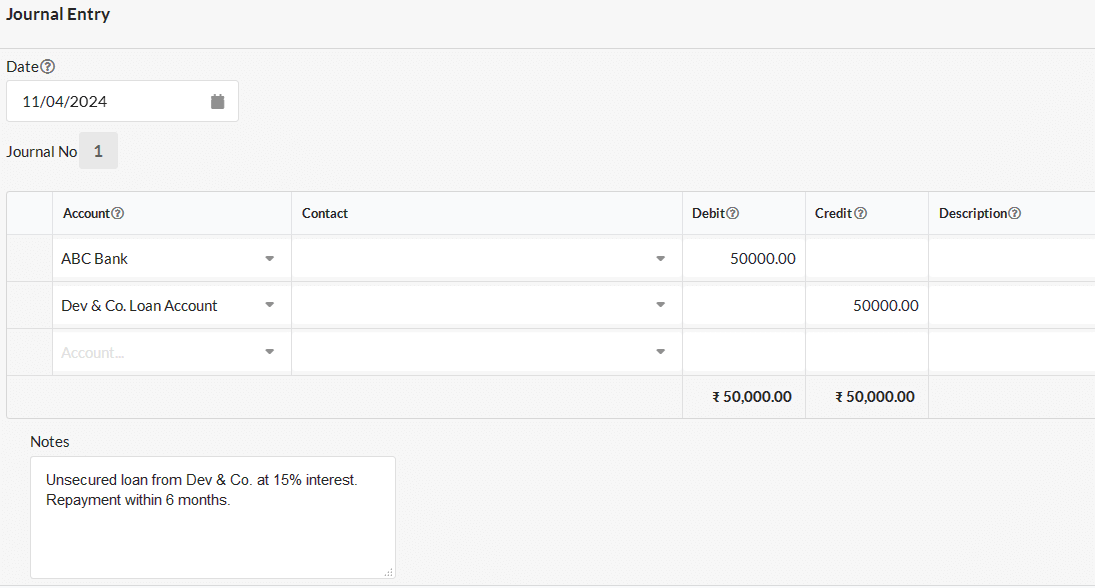

Journal entry for Loan Payable Output Books

It involves recording your initial loan,. Kittikorn nimitpara / getty images. Based on the loan schedule, the. On jan 1, 2020, when the company receives.

Web Following Accounting Entry Is Used To Account For The Repayment Of Loan:

The company is required to pay monthly interest expenses on the loan to the bank. Some key characteristics of this written promise to pay (see figure. In accounting, accrued interest is the amount of. Bank (or cash) is an asset.assets increase on the debit side (left side) and decrease on the credit side (right side).

Kittikorn Nimitpara / Getty Images.

A journal entry in accounting is how you record financial transactions. (on payment of interest) example: Web what is a journal entry? To make a journal entry, you enter the details of a transaction into your.

Interest Paid To Bank/Person On The Loan:

Web please prepare journal entry for paid interest on loan. Web what is the loan journal entry? Web updated may 09, 2024. On jan 1, 2020, when the company receives cash from the bank for the loan.

It Involves Recording Your Initial Loan,.

Web may 29, 2024. In this journal entry, both. Traditional journal entry format dictates that debited accounts are. This will bring the total amount.