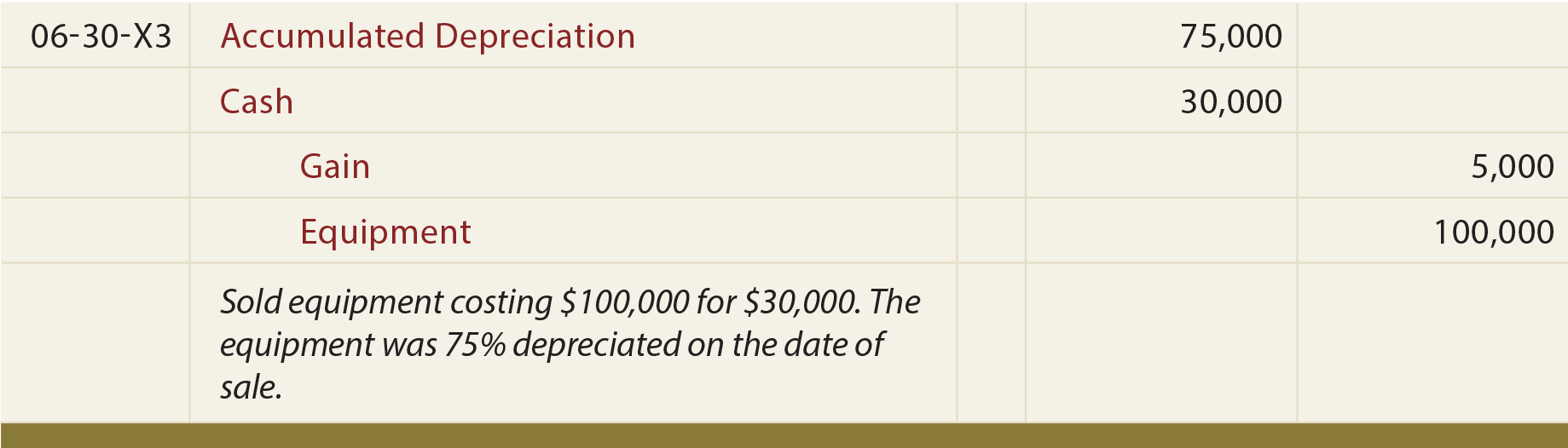

Gain On Sale Journal Entry - It is very common that an asset may not be sold at current book value, hence if it is sold for more. Web the journal entry will reflect the net gain on the sale of the asset and the associated cost of the asset. You will need to make the. Web learn how to record the gain on sale of fixed assets, which is the excess amount of sale proceed over the book value. Journalize exchange of a fixed asset for its book value : Web when the company abc purchases the bond for $10,000 at its face value, it can make the investment in bonds journal entry on january 1, 2020, as below: When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and. Account type = other income* account. Web the gain could also be determined by preparing the journal entry for the transaction: See the formula, the accounts, and the examples for the gain on sale of fixed asset.

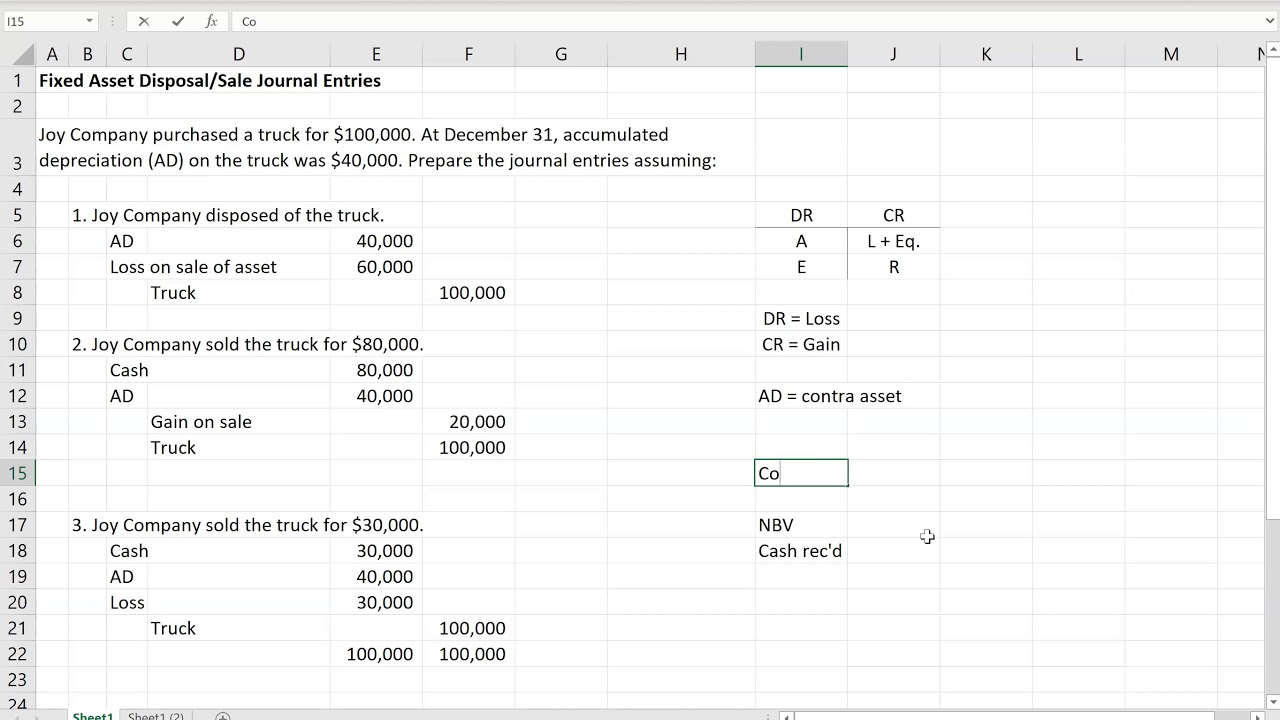

Fixed Asset Disposal And Sale Journal Entries Youtube Free Download

Web the equipment will be disposed of (discarded, sold, or traded in) on 10/1 in the fourth year, which is nine months after the last.

Entries for Sales and Purchase in GST Accounting Entries in GST

See the journal entry and an example of a. Web gain on sale. Web the journal entry for gain on sale of asset is recorded.

Fixed Asset Accounting Made Simple NetSuite

Debit accumulated depreciation for $43,600 (to remove the credit. The credit to the gain on sale will be equal to the proceeds. See the journal.

Sales Journal Definition, Explanation, Format and Entry Examples

Web journalize sale of a fixed asset at a loss : Web capital gains directly affect your balance sheet because they increase/decrease your cash and.

Disposal of PP&E

See the journal entry and an example of a. Web journalize sale of a fixed asset at a loss : See the journal entry format,.

How to use Excel for accounting and bookkeeping QuickBooks

When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed.

Gain on sale with leaseback GAAP vs IFRS YouTube

Web learn how to compare the cash received to the carrying value of the asset to determine the gain or loss on the sale. December.

Sale of Assets journal entry examples Financial

When you sell an asset for more or less than its book value, xero calculates the gain or loss on disposal and asks you which.

Gain on Sale journal entry examples Financial

See examples of asset sale scenarios with different amounts and depreciation methods. See the formula, the accounts, and the examples for the gain on sale.

Web The Gain Could Also Be Determined By Preparing The Journal Entry For The Transaction:

Account type = other income* account. Web the journal entry will reflect the net gain on the sale of the asset and the associated cost of the asset. Web a sale and leaseback, or more simply, a leaseback, is a contract between a seller and a buyer where the former sells an asset to the latter and then enters into a. Web learn how to record a gain or loss on sale of an asset using a journal entry.

Web The Journal Entry To Dispose Of Fixed Assets Affects Several Balance Sheet Accounts And One Income Statement Account For The Gain Or Loss From Disposal.

Web the journal entry for gain on sale of asset is recorded in the general ledger and helps track the increase in profit as a result of selling an asset. Web journalize sale of a fixed asset at a loss : Web learn how to record the gain on sale of fixed assets, which is the excess amount of sale proceed over the book value. Web in the case of profits, a journal entry for profit on sale of fixed assets is booked.

The Credit To The Gain On Sale Will Be Equal To The Proceeds.

It is very common that an asset may not be sold at current book value, hence if it is sold for more. Journalize sale of a fixed asset at a gain : Web learn how to compare the cash received to the carrying value of the asset to determine the gain or loss on the sale. When you sell an asset for more or less than its book value, xero calculates the gain or loss on disposal and asks you which account to post it.

December 10, 2018 05:29 Pm.

Web how gains and losses are calculated. In which type of account do i record the net gain? Web at the time of sale, you will recognize the gain with reference to the last revaluation date i.e. Debit accumulated depreciation for $43,600 (to remove the credit.