Sales Revenue Journal Entry - All six of these are shown in figure 1 below: Web guide to deferred revenue journal entry. A journal entry must be made each time a business makes a sale. A sales revenue journal entry records the income earned from selling goods or services, debiting either cash or. See the accounts, debits, and credits involved in each type of entry and a cheat sheet to remember them. To make a journal entry, you enter the details of a transaction into your company’s books. Web journal entries for revenue. Web what is a sales revenue journal entry in accounting? This journal entry needs to record three events, which are the recordation of. Web accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to record sales transactions that.

Unearned Revenue Journal Entry Double Entry Bookkeeping

Web accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to record sales.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Ifrs 15 journal entries [scenario: Web sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to.

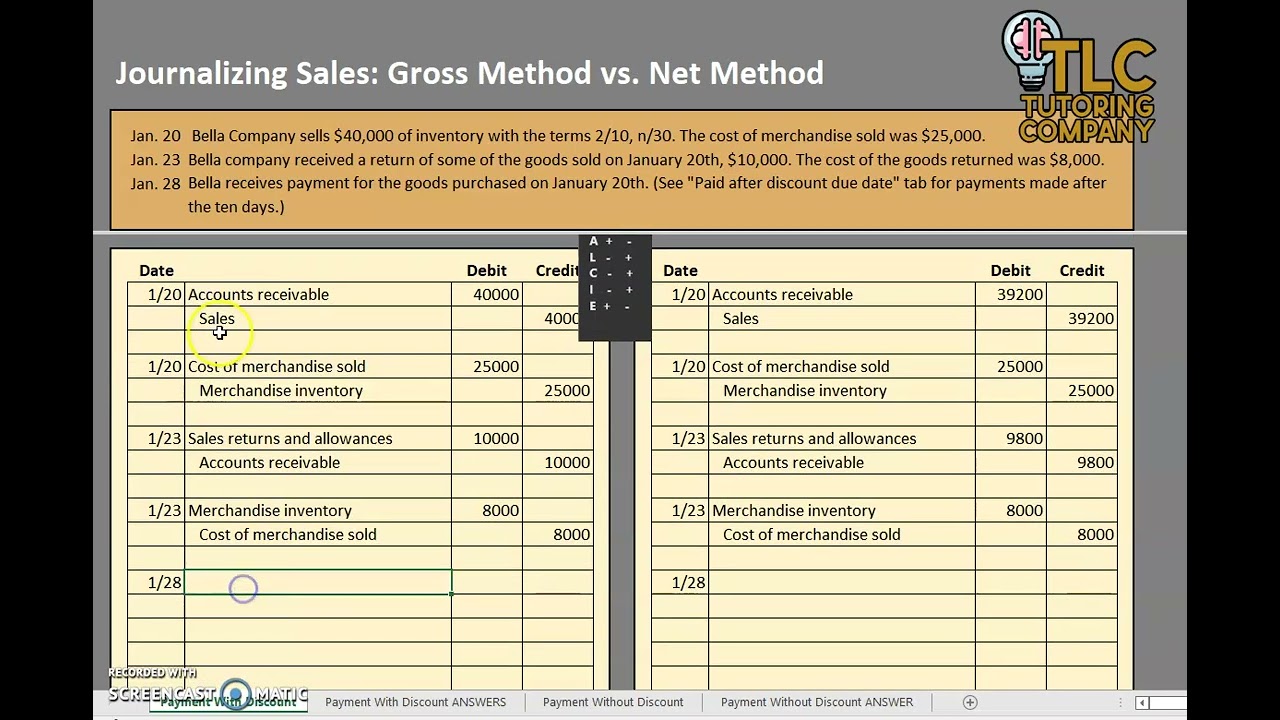

Gross Method vs. Net Method (Recording Journal Entries for Sales) YouTube

Web a journal entry in accounting is how you record financial transactions. Revenue received in advance journal entry. Web there are six main parts of.

Sales Journal Entry How to Make Cash and Credit Entries

Journal entry example of debit and credit accounts: Web given below is the format of the sales journal entry. This column is used to mention.

Sales Revenue in Accounting Double Entry Bookkeeping

When sales are made on credit, the journal entry for accounts receivable is debited, and the sales account is. Web what is a sales revenue.

Accounting for Sales Return Journal Entry Example Accountinguide

These entries also reflect any changes to. The credit sale of inventory affects accounts receivable, revenue accounts,. Web the double entry bookkeeping journal entry to.

What Is Unearned Revenue? QuickBooks Global

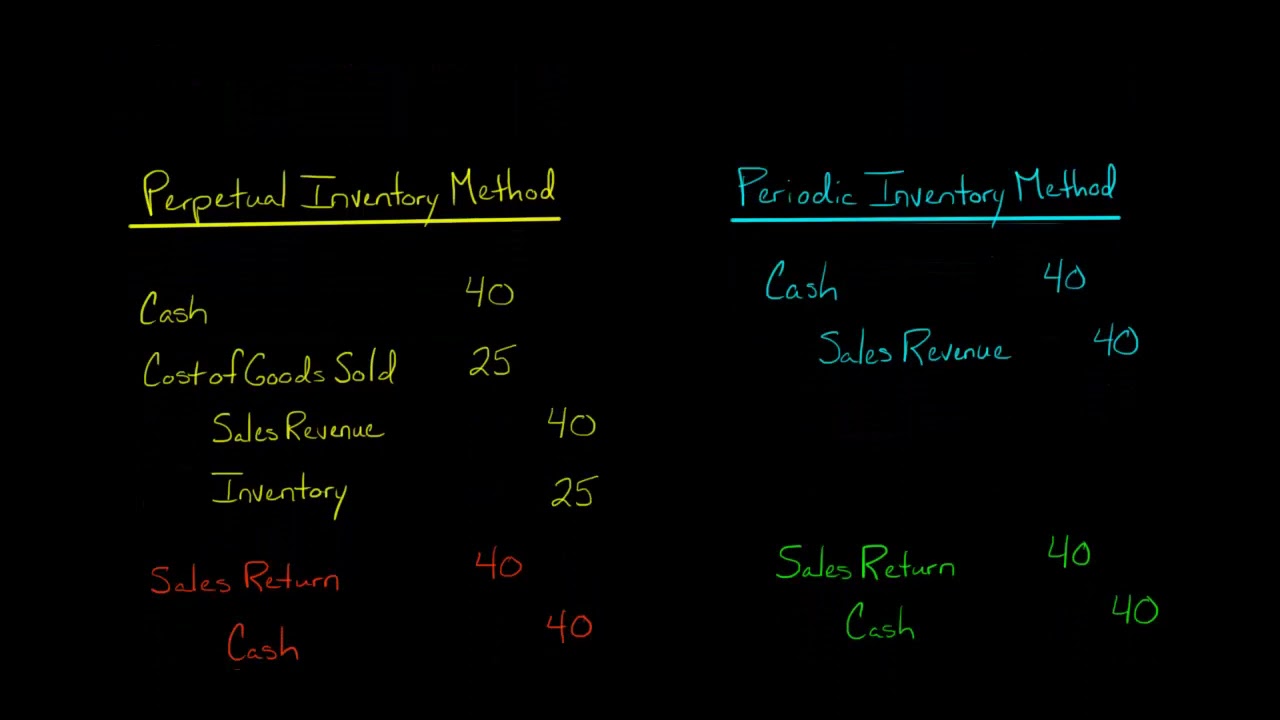

The six main parts of a sales. Sales returns and allowances journal entry under the perpetual. Web a sales journal entry records the revenue generated.

Journal Entry for Sales Return YouTube

Web what is a sales revenue journal entry in accounting? Learn how to make a sales journal entry for cash, credit card, or returned sales..

How To Record Net In Journal Entry

This column is used to mention the date on which the entity sold the goods. Sales returns and allowances journal entry under the perpetual. When.

This Column Is Used To Mention The Date On Which The Entity Sold The Goods.

When sales are made on credit, the journal entry for accounts receivable is debited, and the sales account is. Web a sales journal entry records the revenue generated by the sale of goods or services. Web sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client. Accrued revenue is a current asset recorded for sales products shipped or services delivered that have not yet been billed to the customer or paid yet.

This Journal Entry Needs To Record Three Events, Which Are The Recordation Of.

Basic format of a sales journal. Learn how to make a sales journal entry for cash, credit card, or returned sales. Web the double entry bookkeeping journal entry to show the revenue received in advance is as follows: Web there are six main parts of the entry format of a sales journal.

Web Here Are Examples Of Journal Entries Of A Sales Transaction With And Without The Sales Tax:

Web accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to record sales transactions that. Ifrs 15 journal entries [scenario: Web a sales journal entry is a journal entry in the sales journal to record the sale of inventory on credit. To make a journal entry, you enter the details of a transaction into your company’s books.

Web Journal Entries For Revenue.

The six main parts of a sales. Web the first entry is to recognize the sale revenue that the company makes by debiting accounts receivable or cash and crediting sales revenue account. A journal entry must be made each time a business makes a sale. Web given below is the format of the sales journal entry.