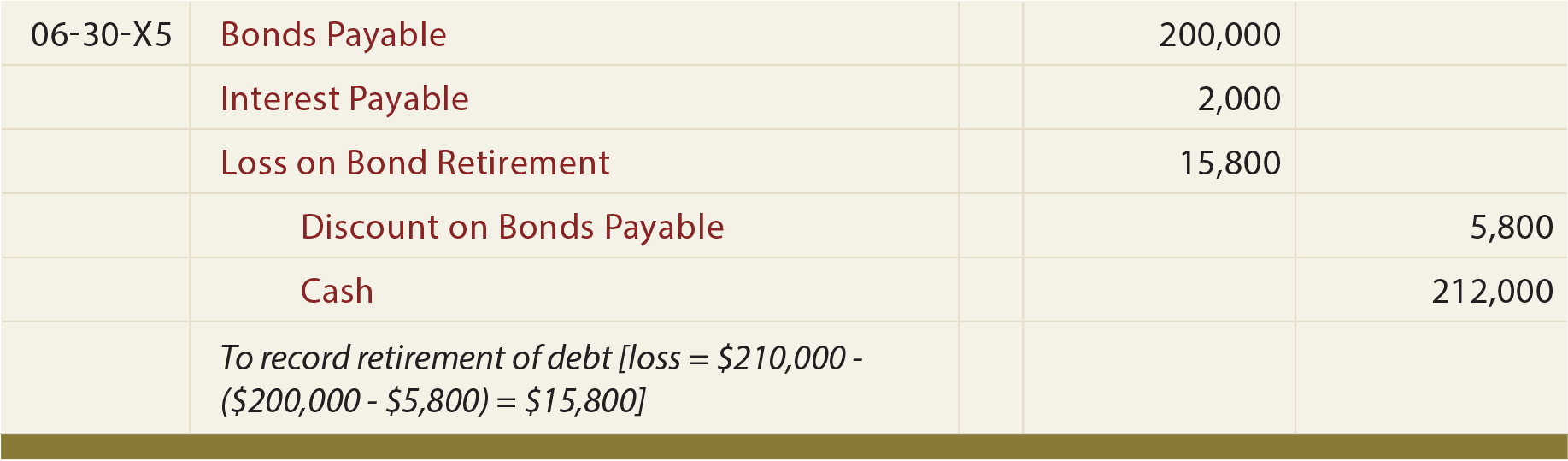

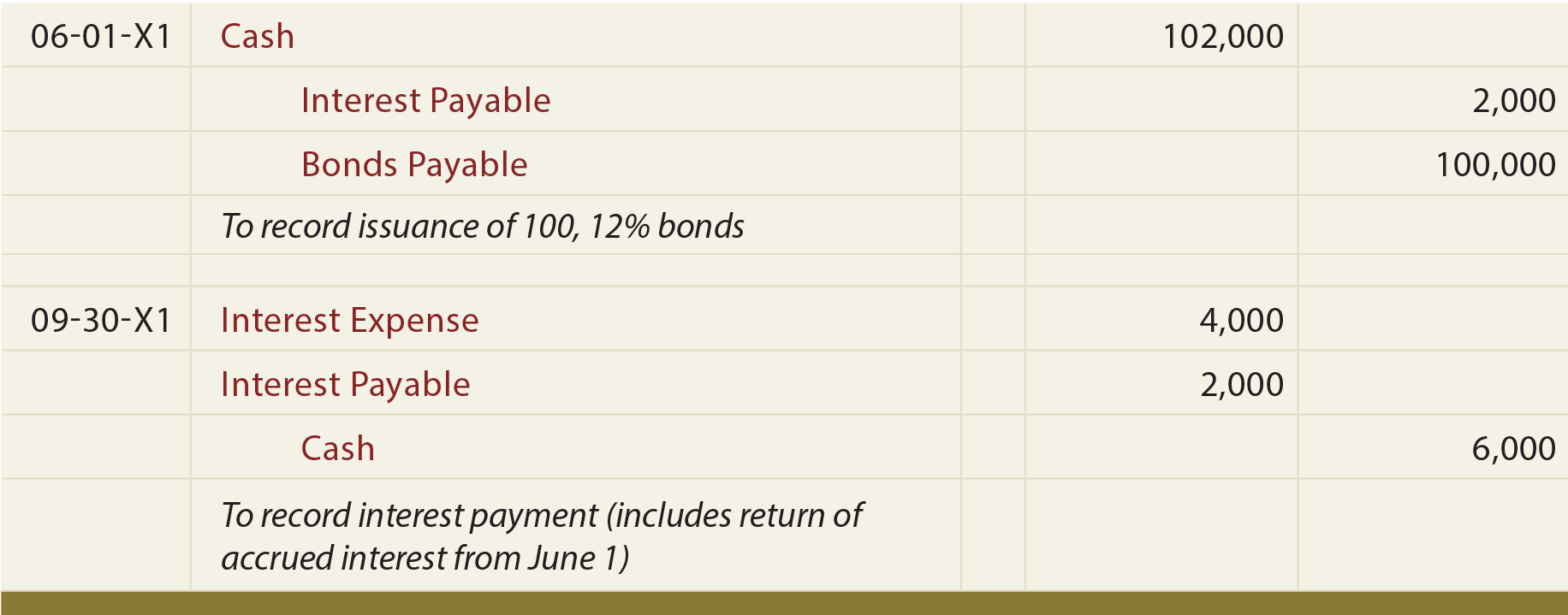

Journal Entry For Retirement Of Bonds - Bonds payable is debited and cash is credited. The company retires 45% of the bonds on september 1st, 2021 immediately after paying. At the maturity date, bonds are retired with no gain or loss. A company is usually required to call all of its bonds when it exercises a call option; Bond retirement means that the company buys back the bond that it previously sold, either at the maturity date or before the maturity. Web in this section, we will explore the journal entries related to bonds. Web the retirement of a bond means we will be closing the bond by paying out what is owed. Web see the below link for more resources, including as a list of all of my videos, practice exercises, excel templates, and study notes. When the bond matures, the company debits the bond payable account and credits the. Web the resulting journal entries are:

Financial Accounting Lesson 10.12 Early Retirement of Bond YouTube

To record this action, the company would debit bonds payable and credit cash. According to fasb statement no. Web company g should record the gain.

Early retirement of bonds journal entry Early Retirement

Web the resulting journal entries are: Web the retirement of a bond means we will be closing the bond by paying out what is owed..

Early Redemption of Bonds Wize University Introduction to Financial

Web the retirement of a bond means we will be closing the bond by paying out what is owed. However it can choose to retire.

Bonds Payable Lecture 2 Journal Entries YouTube

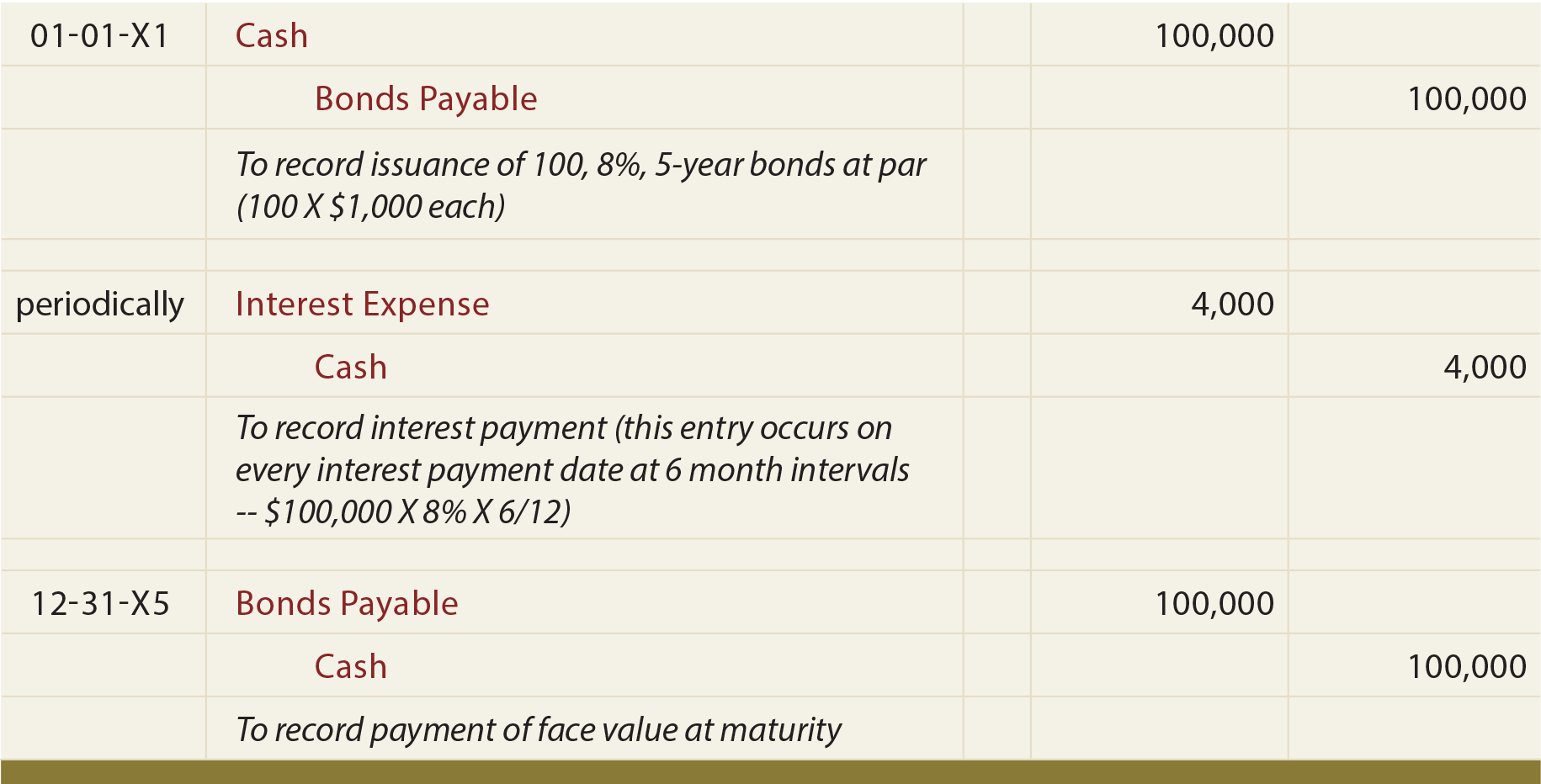

Earlier, we found that cash flows related to a bond include the following: Web retirement of bonds when the bonds were issued at par; When.

Bond Retirement Journal Entry to Retire a Bond YouTube

Web retirement of bonds when the bonds were issued at par at some point, a company will need to record bond retirement , when the.

bond retirement Journal Entry

When bonds are repaid at maturity, the journal entry is straightforward. 4, gains and losses from voluntary early retirement of bonds are extraordinary items, if.

Early retirement of bonds journal entry Early Retirement

Web the bonds mature in 10 years and at the time of issuance the market rate was 7%. To record bonds issued at face value..

Accounting For Bonds Payable

By obaidullah jan, aca, cfa and last modified on. Web retirement of bonds before maturity with a loss. In this article, we cover the bond.

Bonds Issued Between Interest Dates, Bond Retirements, And Fair Value

At the maturity date, bonds are retired with no gain or loss. 4, gains and losses from voluntary early retirement of bonds are extraordinary items,.

Web Retirement Of Bonds When The Bonds Were Issued At Par;

To record this action, the company would debit bonds payable and credit cash. Web retirement of bonds before maturity with a loss. When closing a bond at the end of the bond term, after all interest. Web company g should record the gain on early retirement of bonds of $3,000 using the following journal entry:

The Receipt Of Cash When The Bond Is.

When bonds are repaid at maturity, the journal entry is straightforward. We report such gains and. According to fasb statement no. Web this journal entry for the redemption of bonds will decrease both total assets (credit cash) and total liabilities (debit bonds payable) on the balance sheet by the same amount.

4, Gains And Losses From Voluntary Early Retirement Of Bonds Are Extraordinary Items, If Material.

The company retires 45% of the bonds on september 1st, 2021 immediately after paying. In this article, we cover the bond retirement journal entry. At the maturity date, bonds are retired with no gain or loss. Web the journal entry to record this transaction is:

A Company Is Usually Required To Call All Of Its Bonds When It Exercises A Call Option;

Bonds payable is debited and cash is credited. Web bond retirement journal entry overview. Web at the end of 5 years, the company will retire the bonds by paying the amount owed. Bond retirement means that the company buys back the bond that it previously sold, either at the maturity date or before the maturity.