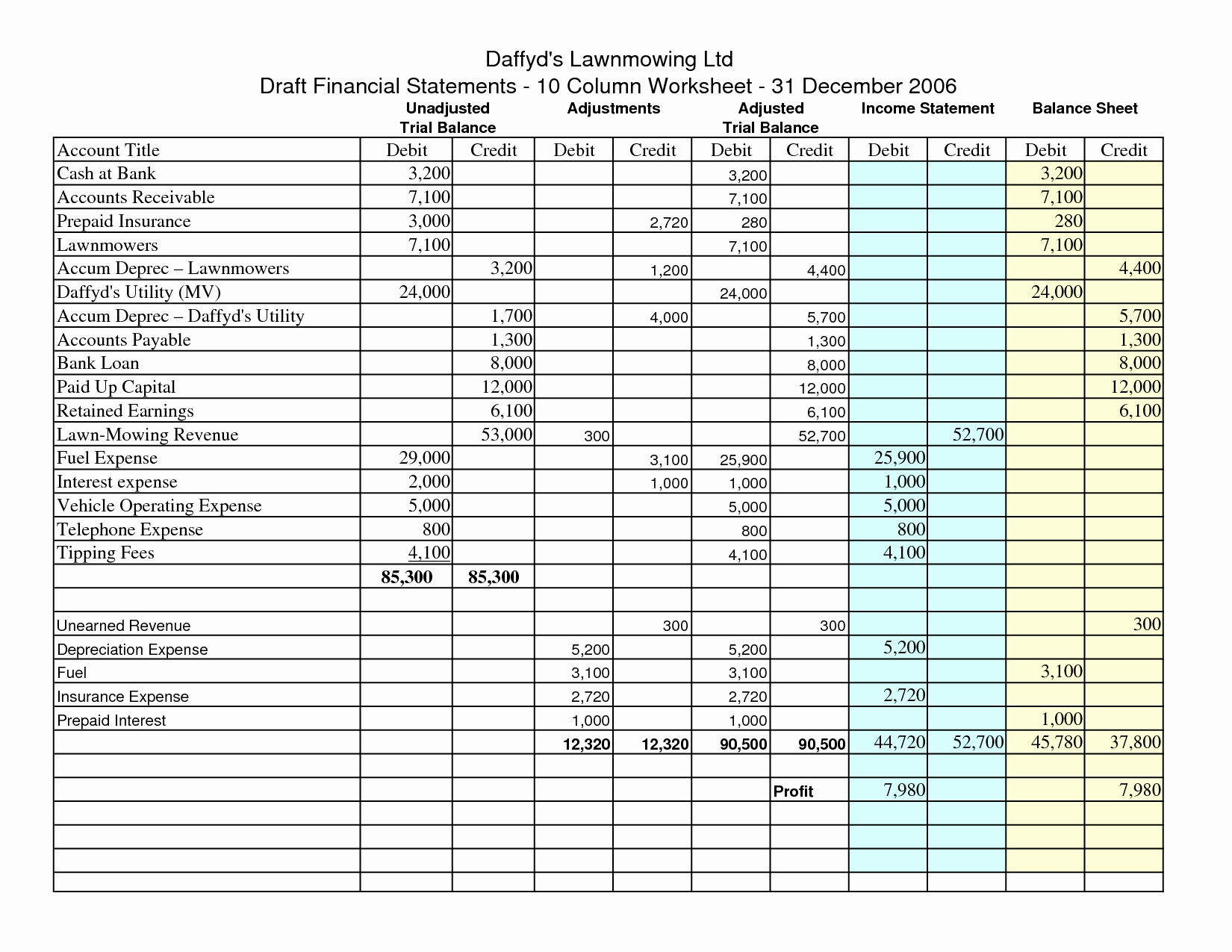

Freight In Accounting Journal Entry - Delivery expense increases (debit) and cash decreases (credit) for the shipping cost amount of $100. Accounting for freight costs is a complicated process that shouldn’t be reduced to simple percentages. Shipping point, the purchaser is responsible for. Merchandise inventory increases (debit), and cash decreases (credit), for the entire cost of the purchase,. Is the buyer or the seller paying freight charges? Web v2 principles of accounting — financial accounting. In this case, the journal entry for fob. Web in accounting, freight expenses are categorized into freight out for customer shipments and freight in for supplier receipts. Purchase considerations for merchandising businesses. These costs impact the income statement.

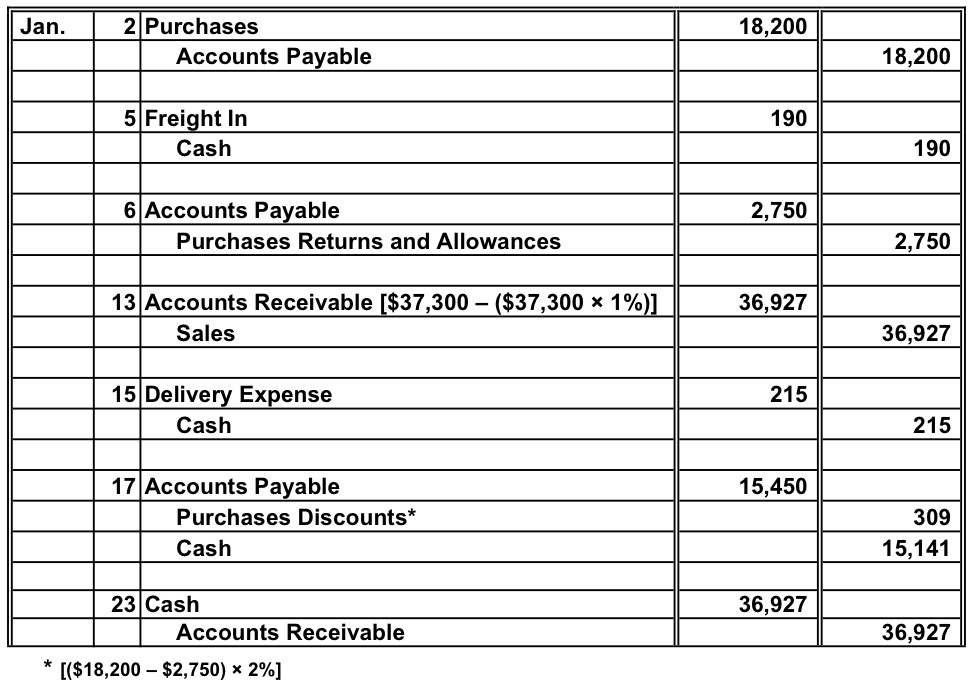

[Solved] Merchandising operations accounting journal entries Problem

Like the purchase account, the. For businesses that ship cargo on a regular basis, freight expense will be a significant cost for the business. Merchandise.

Perpetual Inventory System Journal Entry

If goods are sold f.o.b. Web v2 principles of accounting — financial accounting. Web updated march 3, 2023. In this case, the journal entry for.

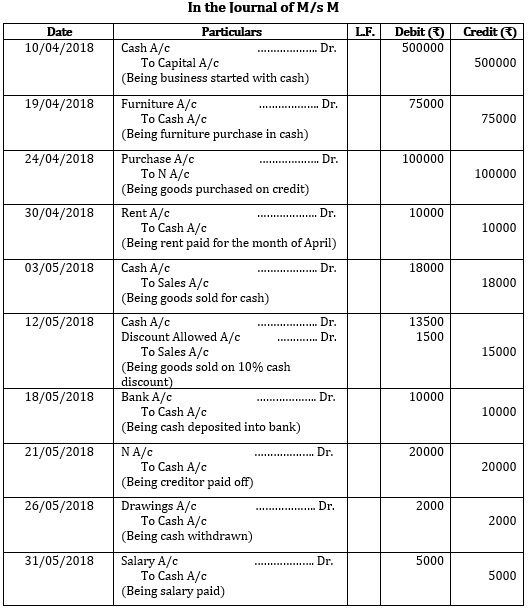

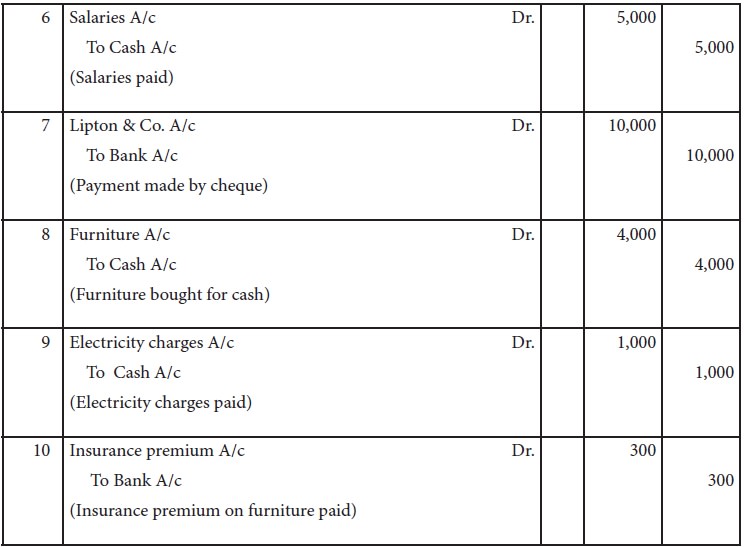

journal entry format accounting accounting journal entry template

For businesses that ship cargo on a regular basis, freight expense will be a significant cost for the business. Ensuring companies and customers receive their.

Accounting Questions and Answers Appendix EX 634 Journal entries

For businesses that ship cargo on a regular basis, freight expense will be a significant cost for the business. Ensuring companies and customers receive their.

Periodic Inventory System Journal Entries Double Entry Bookkeeping

Web to learn how to record freight charges in accounting, first determine the classification for the freight charges. Merchandise inventory increases (debit), and cash decreases.

Journal Entries Accounting Examples

Web v2 principles of accounting — financial accounting. It doesn’t matter what vertical a. For businesses that ship cargo on a regular basis, freight expense.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Like the purchase account, the. Web v2 principles of accounting — financial accounting. If goods are sold f.o.b. In this podcast episode, we discuss the.

Paid freight journal entry CArunway

These costs impact the income statement. Web how to record freight expenses in accounting. It doesn’t matter what vertical a. Web fob accounting deals with.

Journal entries Meaning, Format, Steps, Different types, Application

Is the buyer or the seller paying freight charges? Purchase considerations for merchandising businesses. Accounting for freight costs is a complicated process that shouldn’t be.

Is The Buyer Or The Seller Paying Freight Charges?

Fob means free on board and is an abbreviated term used in. Goods in transit indicates the. Shipping point, the purchaser is responsible for. Web updated march 3, 2023.

What Is Goods In Transit?

Web in accounting, freight expenses are categorized into freight out for customer shipments and freight in for supplier receipts. For businesses that ship cargo on a regular basis, freight expense will be a significant cost for the business. Delivery expense increases (debit) and cash decreases (credit) for the shipping cost amount of $100. If goods are sold f.o.b.

This Means That The Company Needs To Allocate This Cost Into The Different Types Of Merchandise Inventory.

Ensuring companies and customers receive their goods safely and timely is an important part of helping businesses operate efficiently and successfully. Purchase considerations for merchandising businesses. Delivery expense increases (debit) and cash decreases (credit) for the shipping cost amount of $100. Merchandise inventory increases (debit), and cash decreases (credit), for the entire cost of the purchase,.

In This Case, The Journal Entry For Fob.

It doesn’t matter what vertical a. These costs impact the income statement. Like the purchase account, the. In this podcast episode, we discuss the accounting issues related to freight in and freight out.