Sales Credit Journal Entry - All six of these are shown in figure 1 below: Instead of receiving cash immediately, the seller extends credit to the buyer, allowing them to pay for the goods or services at a later date. Web this article has guided what sales journal is and its definition. Web this is journalized as follows: How to record entry of sales credit? Journal entries of unearned revenue;. Recording sales of goods on credit, credit terms with discounts. [debit] accounts receivable for $1,050. How to record a credit sale with credit terms. Web the sales journal entry is:

Sales Journal Entry How to Make Cash and Credit Entries

Credit the sales revenue account to recognize the income earned. Purchase return or return outwards account: How to record entry of sales credit? Web for.

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

All six of these are shown in figure 1 below: Web accounting and journal entry for credit sales include 2 accounts, debtor and sales. When.

Credit Sales Journal Entry Examples Financial

Debit the accounts receivable account to record the amount owed by the customer. Credit sales involve a risk that the buyer might not eventually pay.

Sales Credit Journal Entry What Is It, Examples, How to Record?

Credit the sales revenue account to reflect the income. Debit the cash account to increase the asset. Sales are recorded as a credit to the.

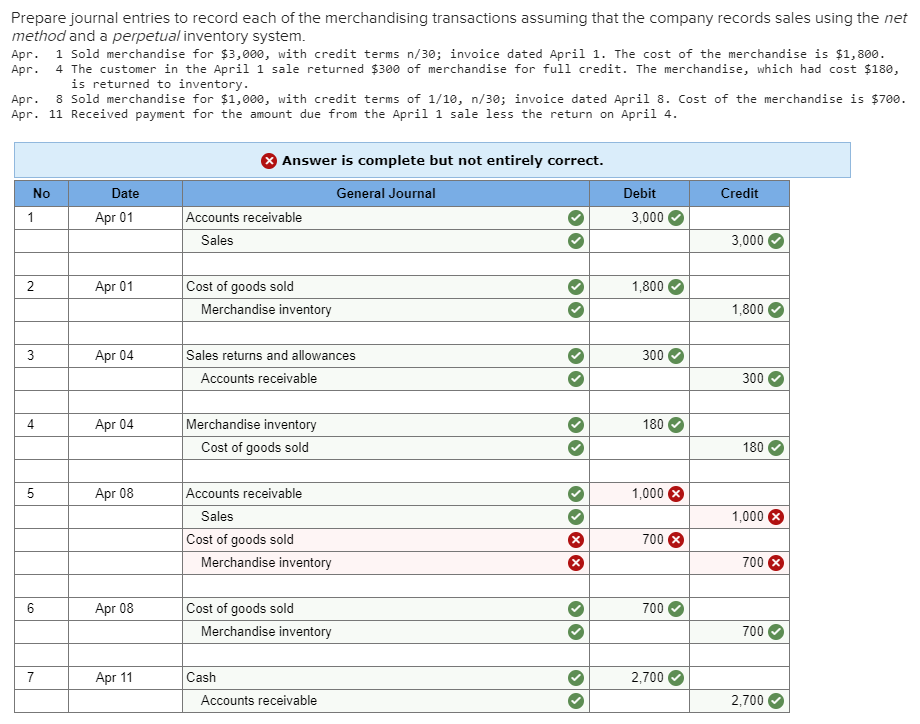

2.4 Sales of Merchandise Perpetual System Financial and Managerial

Credit the sales revenue account to reflect the income. The amount of the sale is typically recorded in the journal as well. Web this is.

Fantastic Sales And Cash Receipts Journal Template Superb Receipt

Web a credit sales journal entry is a type of accounting entry that is used to record the sale of merchandise on credit. Credit sales.

Sales Journal Definition, Explanation, Format and Entry Examples

Credit sales involve a risk that the buyer might not eventually pay when the amount is due. When goods/services are sold in credit, the transactions.

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

The journal entries would be as follows: Web the journal entries would be as follows: Web this article has guided what sales journal is and.

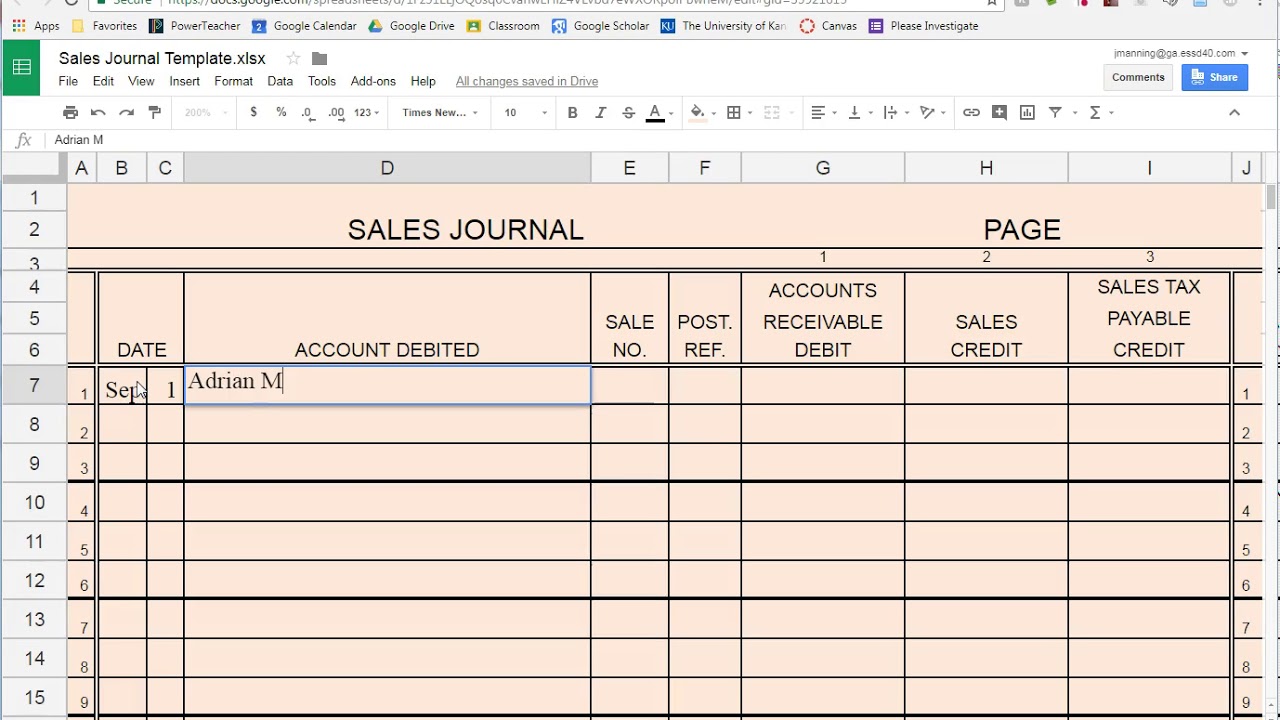

Sales Journal Template

Credit the sales revenue account to reflect the income. Web the sales journal entry is: Web accounting and journal entry for credit sales include 2.

Credit Sales Refer To Sales Transactions Where The Payment Is Deferred To A Future Date.

Web this is journalized as follows: Web what is a sales credit journal entry? When goods/services are sold in credit, the transactions are known as credit sales, i.e., when the customer promises to pay in future, credit sales occur. The six main parts of a sales journal are data, account debited, invoice number, post reference, accounts receivables, and cost of goods sold.

Web A Sales Journal Entry Is A Journal Entry In The Sales Journal To Record The Sale Of Inventory On Credit.

Debit the cash account to increase the asset. The person who owes the money is called a “debtor” and the amount owed is. [debit] accounts receivable for $1,050. The amount of the sale is typically recorded in the journal as well.

When Companies Offer Goods Or Services On Credit, They Often Do So With Stipulated Conditions For The Payment Of The Amount Owed;

Web the journal entries would be as follows: The entry is made by debiting the accounts receivable and crediting the sales account. Web the credit sales journal entry is an entry in a company’s sales journal which is used to record the sale of goods or services on credit. These entries also reflect any changes to accounts, including sales tax payable accounts, costs of goods sold and inventory.

This Results In Bad Debts Expense, Which Is Estimated Based On The Creditworthiness Of The Buyer And The.

Recording sales of goods on credit, credit terms with discounts. The credit sale of inventory affects accounts receivable, revenue accounts, inventory, and the cost of goods sold account. The sales journal is simply a chronological list of the sales invoices and is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties. The major way by which companies generate revenue is through the sale of goods or the provision of services.