Cost Of Goods Sold Journal Entry - You credit the finished goods inventory, and debit cost of goods sold. Opening inventory plus purchases and production costs minus closing inventory. To record the cost of goods sold, we need to find its value before we process a journal entry. Web what is the journal entry to record the cost of goods sold at the end of the accounting period? Web cost of goods sold on an income statement. Web accounting for costs of goods sold in financial statements: Cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or. With the information in the example, we can calculate the cost of. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by. Instead, as the sporting good store’s accountants, we’ll just use t accounts to describe the entry:

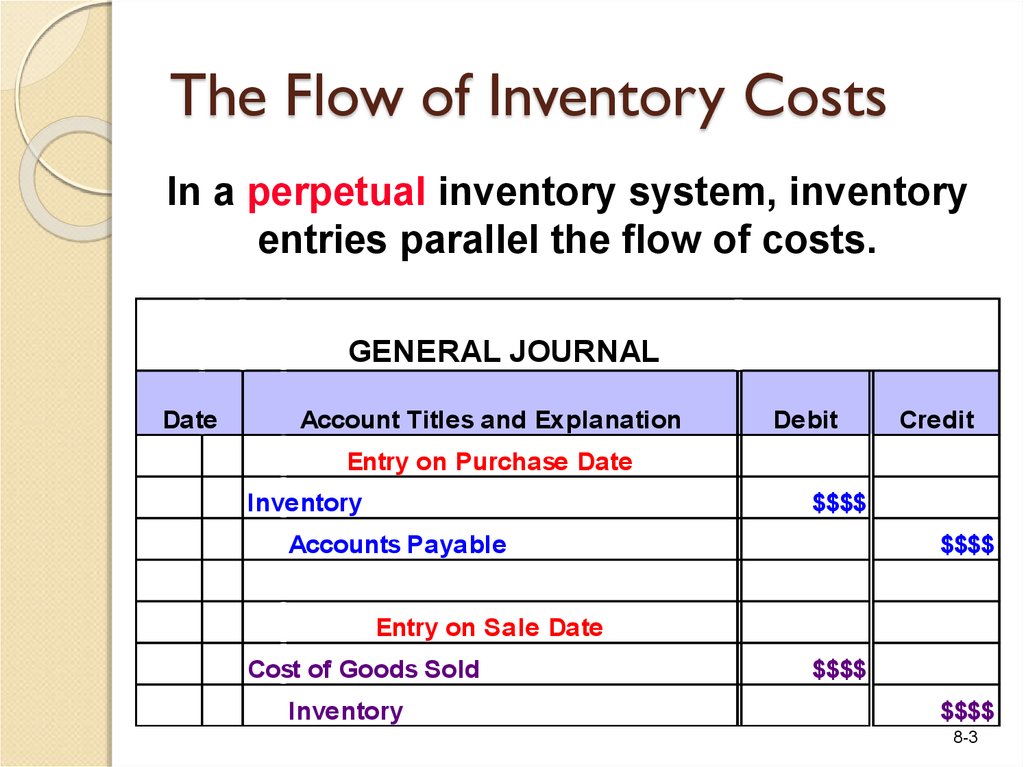

Inventories and the Cost of Goods Sold online presentation

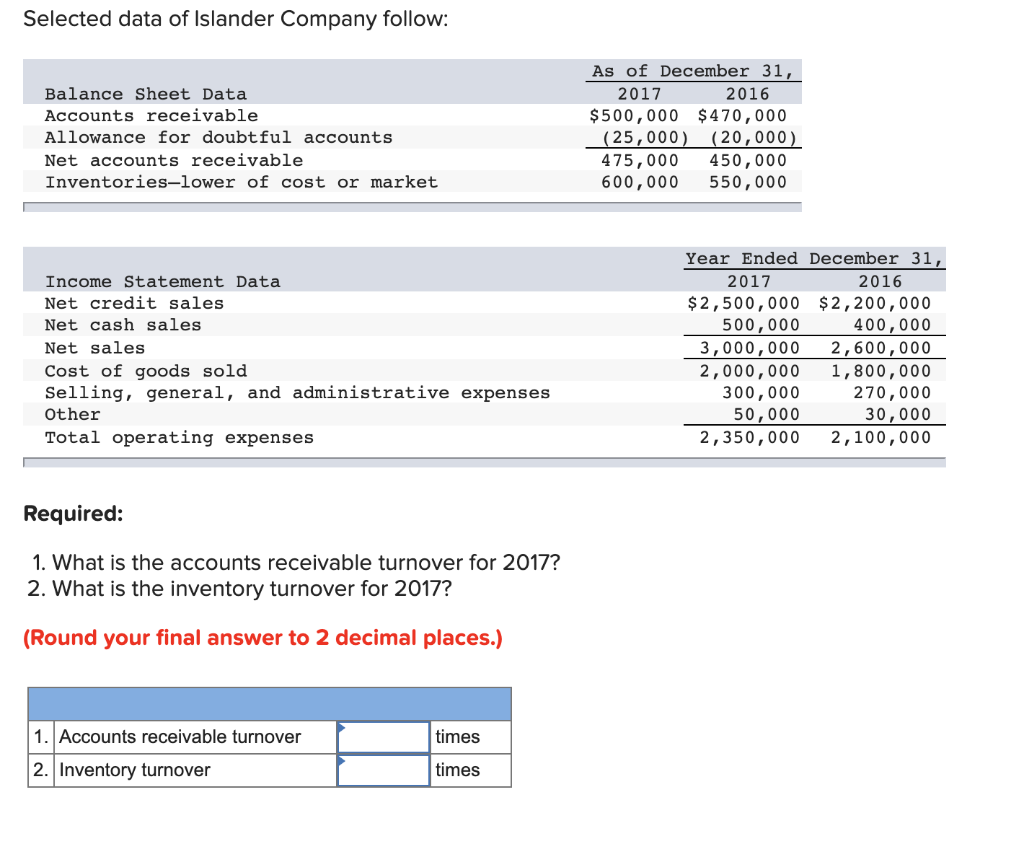

Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by. Sales revenue minus cost of goods sold is a.

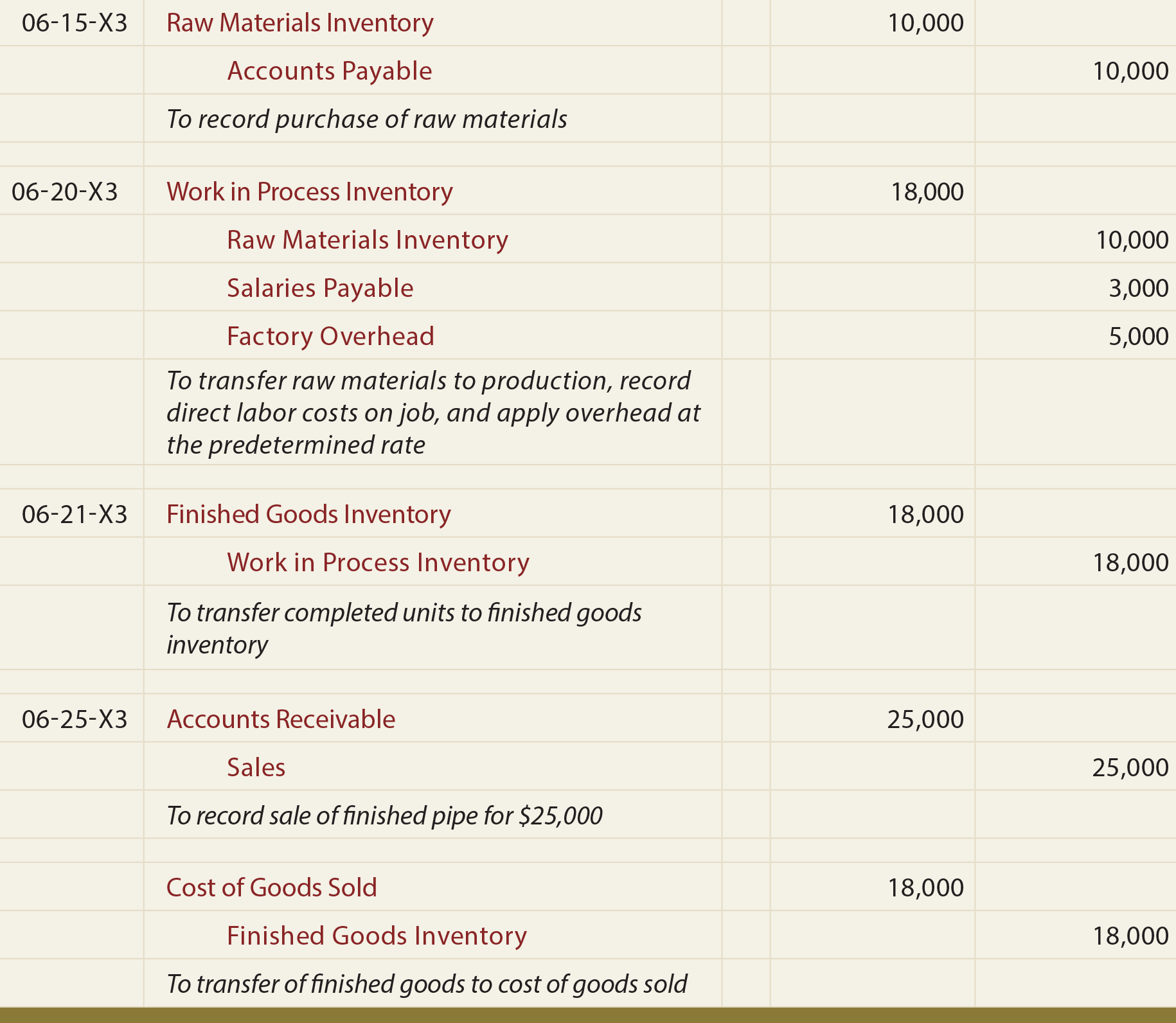

The Journal Entry to Record Labor Costs Credits

The cost of goods sold formula is: Sales revenue minus cost of goods sold is a business’s gross profit. You then credit your inventory account..

6.2 Calculate The Cost Of Goods Sold And Ending Inventory Using The 4C0

Web cost of goods sold with journal entry examples. You should record the cost of goods sold as a business expense on your income statement..

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web how to record a cost of goods sold journal entry steps & examples | personal accounting. Sales revenue minus cost of goods sold is.

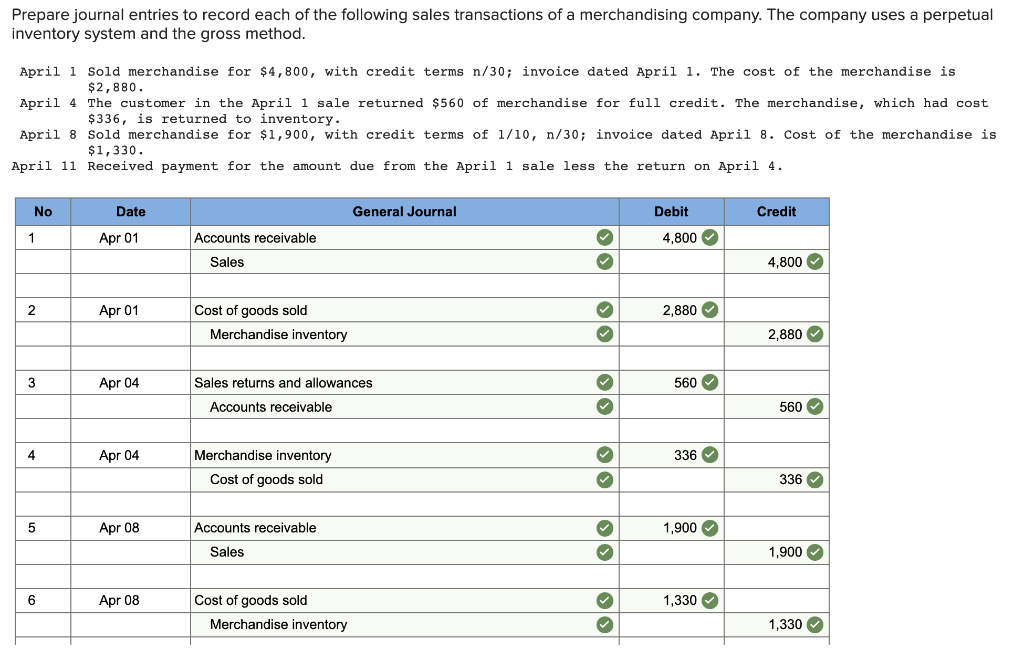

[Solved] Prepare the journal entries to record the following

With the information in the example, we can calculate the cost of. The actual amount of beginning inventory owned by the company is properly valued.

How to Record a Cost of Goods Sold Journal Entry insurance1health

The cost of goods sold entry records the total of all. Home » how to record a cost of goods sold journal entry steps &..

Cost of Goods Sold Journal Entries Video & Lesson Transcript

With the information in the example, we can calculate the cost of. What we have now learned is that using the periodic inventory system the.

How To Find Cost Of Goods Sold Ending Inventory Haiper

When a company purchases identical. The actual amount of beginning inventory owned by the company is properly valued and reflects the balances in the various.

Solved Prepare journal entries to record each of the

What is cost of goods sold (cogs)? What is cost of goods sold (cogs)? You then credit your inventory account. You should record the cost.

Cost Of Goods Sold (Cogs) Refers To The Direct Costs Of Producing The Goods Sold By.

The actual amount of beginning inventory owned by the company is properly valued and reflects the balances in the various inventory asset accounts in the. Web cost of goods sold on an income statement. The cost of goods sold entry records the total of all. Under cogs, record any sold.

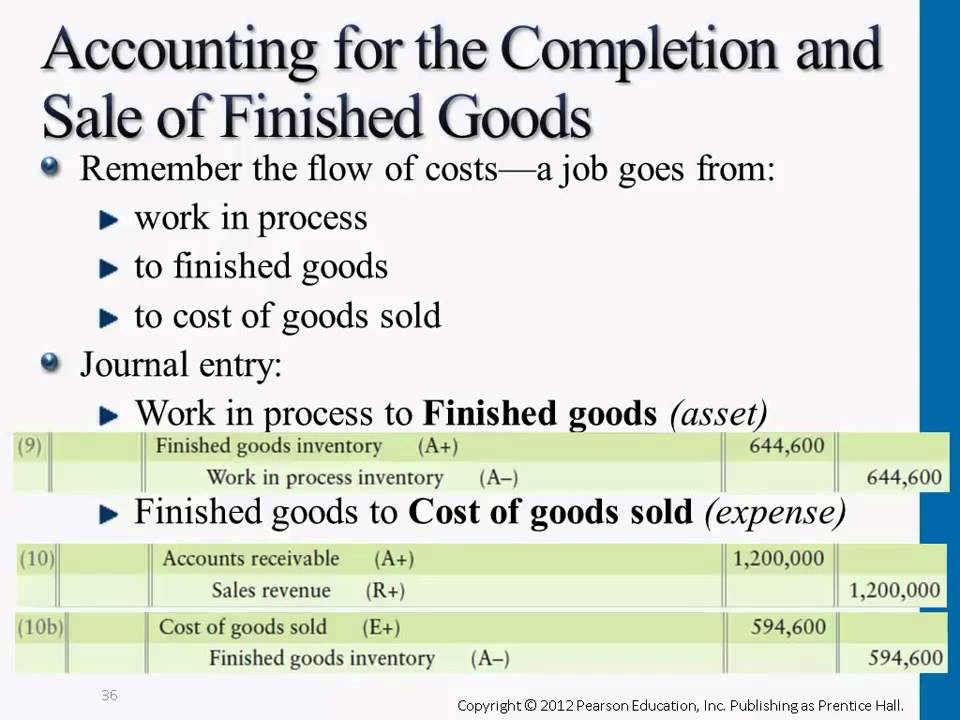

This Action Transfers The Goods From Inventory To Expenses.

Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web when recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to ensure they’re booking the correct costs. Next, let’s record the sale of. Verify the beginning inventory balance.

Cost Of Goods Sold (Cogs) Measures The “ Direct Cost ” Incurred In The Production Of Any Goods Or.

What is cost of goods sold (cogs)? Web simply put, cogs accounting is recording journal entries for cost of goods sold in your books. What we have now learned is that using the periodic inventory system the cost of goods sold. You should record the cost of goods sold as a debit in your accounting journal.

The Cost Of Goods Sold Formula Is:

Opening inventory plus purchases and production costs minus closing inventory. Web cost of goods sold with journal entry examples. Web the cost of goods sold (cogs) formula calculates the direct expenses incurred by a company in producing or acquiring the goods it sells during a specific period. The components of cost of goods sold can be broken down into four key parts: