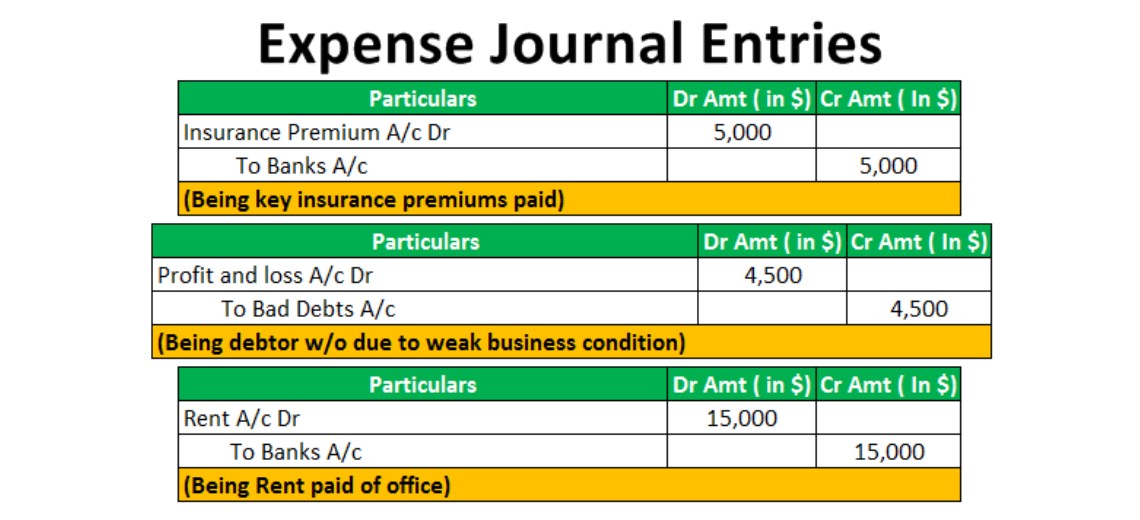

Capitalizing Expenses Journal Entry - The journal entry is debiting fixed assets and credit accounts payable or cash. In the example the total interest for the period was 44,750 and the amount to be capitalized calculated as 17,141. Web it records the startup costs using the following entry: When the company spends on the capitalized expense, they need to record the fixed assets and credit cash or accounts payable. Web the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Web last updated january 24, 2023. Web capitalization period is the time period during which interest expense incurred on a qualifying asset is eligible for capitalization. Let us compare gaap with the international. Web prepare a journal entry to capitalize the total costs you've calculated. Web examples of capitalized costs include expenses incurred to put fixed assets to use, software development costs, and intangible assets costs.

Examples of How to Record a Journal Entry for Expenses Hourly, Inc.

Web it records the startup costs using the following entry: Debit capitalized contract costs (asset): Web last updated january 24, 2023. Let us compare gaap.

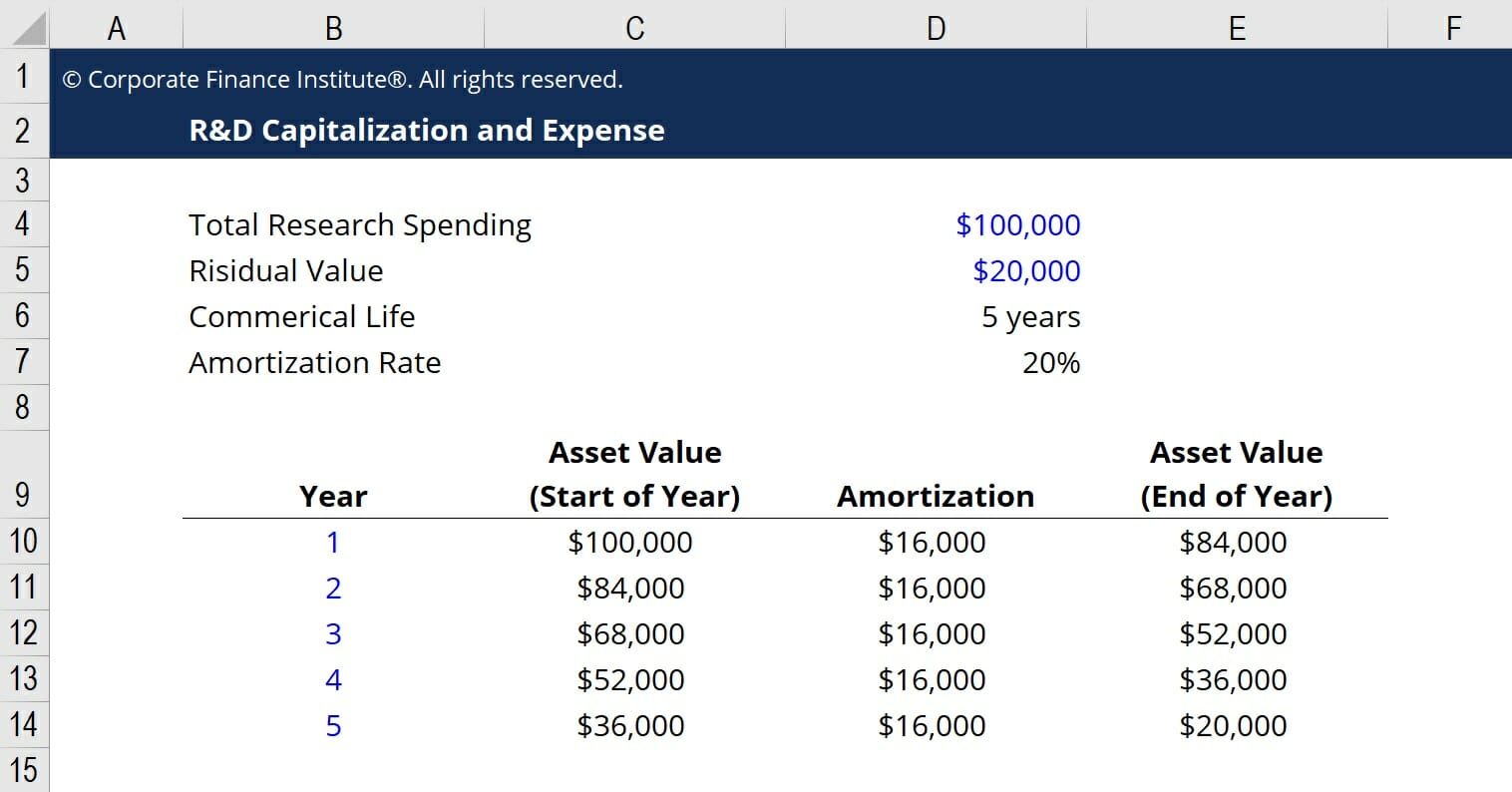

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation

When the company spends on the capitalized expense, they need to record the fixed assets and credit cash or accounts payable. Web examples of capitalized.

Journal entry for outstanding expenses JEthinomics

Web capitalized interest journal entry. Let us compare gaap with the international. Startup costs for tax purposes. Web it records the startup costs using the.

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation

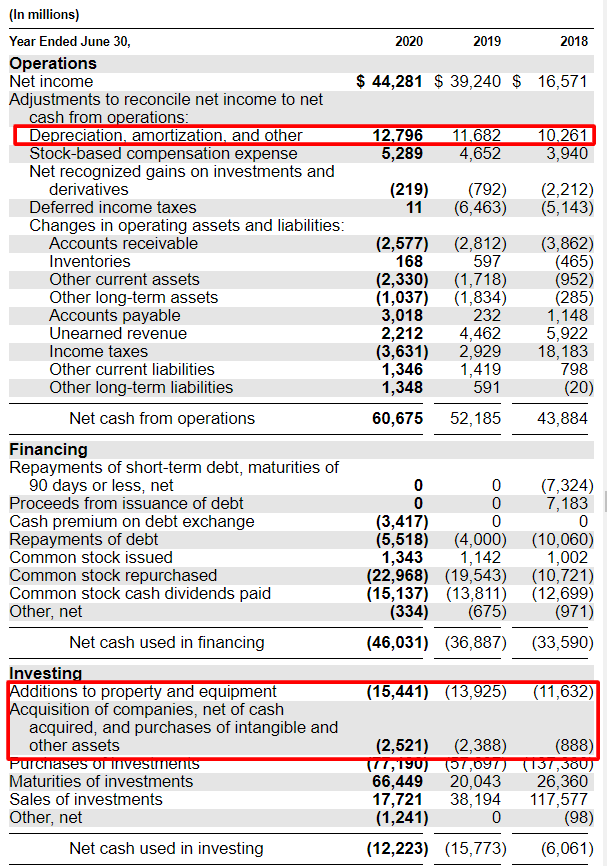

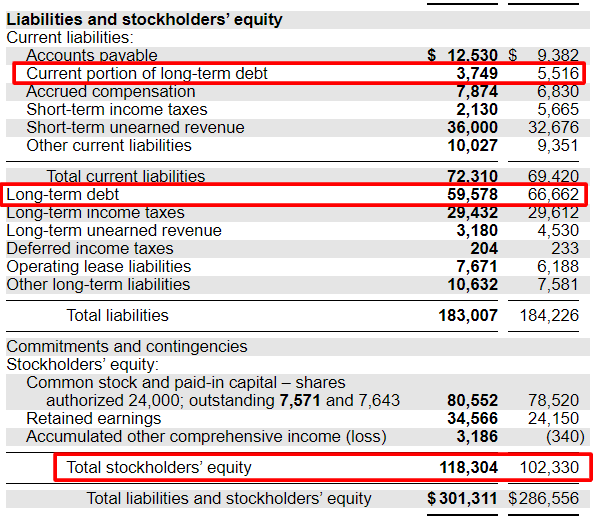

Web the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Web below, we analyze the practice of capitalizing r&d.

Accounting for Share Capital Accountancy Knowledge

Web examples of capitalized costs include expenses incurred to put fixed assets to use, software development costs, and intangible assets costs. Web below, we analyze.

General Journal Entries Accounting

Web the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Web a practical guide to capitalisation of borrowing costs..

18 Capital and Revenue Expenditure part 2 How to Make Journal

Web below, we analyze the practice of capitalizing r&d expenses on the balance sheet versus expensing them on the income statement. Web the journal entry.

R&D Capitalization vs Expense How to Capitalize R&D

Startup costs for tax purposes. Web capitalization period is the time period during which interest expense incurred on a qualifying asset is eligible for capitalization..

Capitalizing Versus Expensing Costs Learn accounting, Bookkeeping

Web the journal entry for this capitalization process typically involves a debit to r&d capitalized and a credit to either cash or accounts payable depending.

Web The Capitalize Vs Expense Accounting Treatment Decision Is Determined By An Item’s Useful Life Assumption.

Web when to capitalize vs expense payments made. Debit capitalized contract costs (asset): What are capitalized software costs? Web the first entry to capitalize the contract costs is:

Startup Costs For Tax Purposes.

Each month, an amortization of the cost. Web journal entry of an asset capitalization records the acquisition of the asset on the balance sheet, debiting the fixed asset account, and crediting either cash or. When the company spends on the capitalized expense, they need to record the fixed assets and credit cash or accounts payable. Web the journal entry for this capitalization process typically involves a debit to r&d capitalized and a credit to either cash or accounts payable depending on the payment.

In The Example The Total Interest For The Period Was 44,750 And The Amount To Be Capitalized Calculated As 17,141.

Increase the general ledger asset account with a debit on the first line of the entry. Guidance in question and answer format addressing the challenges of applyiing ias 23r, including how to treat specific. Web last updated january 24, 2023. Web examples of capitalized costs include expenses incurred to put fixed assets to use, software development costs, and intangible assets costs.

Web Prepare A Journal Entry To Capitalize The Total Costs You've Calculated.

Web it records the startup costs using the following entry: Web capitalization period is the time period during which interest expense incurred on a qualifying asset is eligible for capitalization. Let us compare gaap with the international. Web capitalize expense journal entry.