Prepaid Expense Journal Entry - Web journal entries that recognize expenses related to previously recorded prepaid expenses are called adjusting entries. Web learn how to record prepaid expense and expense incurred with journal entries. See examples of prepaid expenses, such as rent, insurance, and taxes, and how they affect financial statements. Your guide to mastering prepaid expenses. Recorded as current assets in balance sheet, journal entries include asset and expense methods. See examples of prepaid expenses and how they affect the financial statements. A guide to prepaid expense accounting. Web prepaid expense journal entry. A business has an annual premises rent of 60,000 and pays the landlord quarterly in advance on the first day of each quarter. Mastering prepaid expenses equips you to make informed financial decisions, reduce taxable income, and maintain a healthy financial outlook in the dynamic world of business.

General Ledger Accountant Job Description Denver Recruiting Alfanny

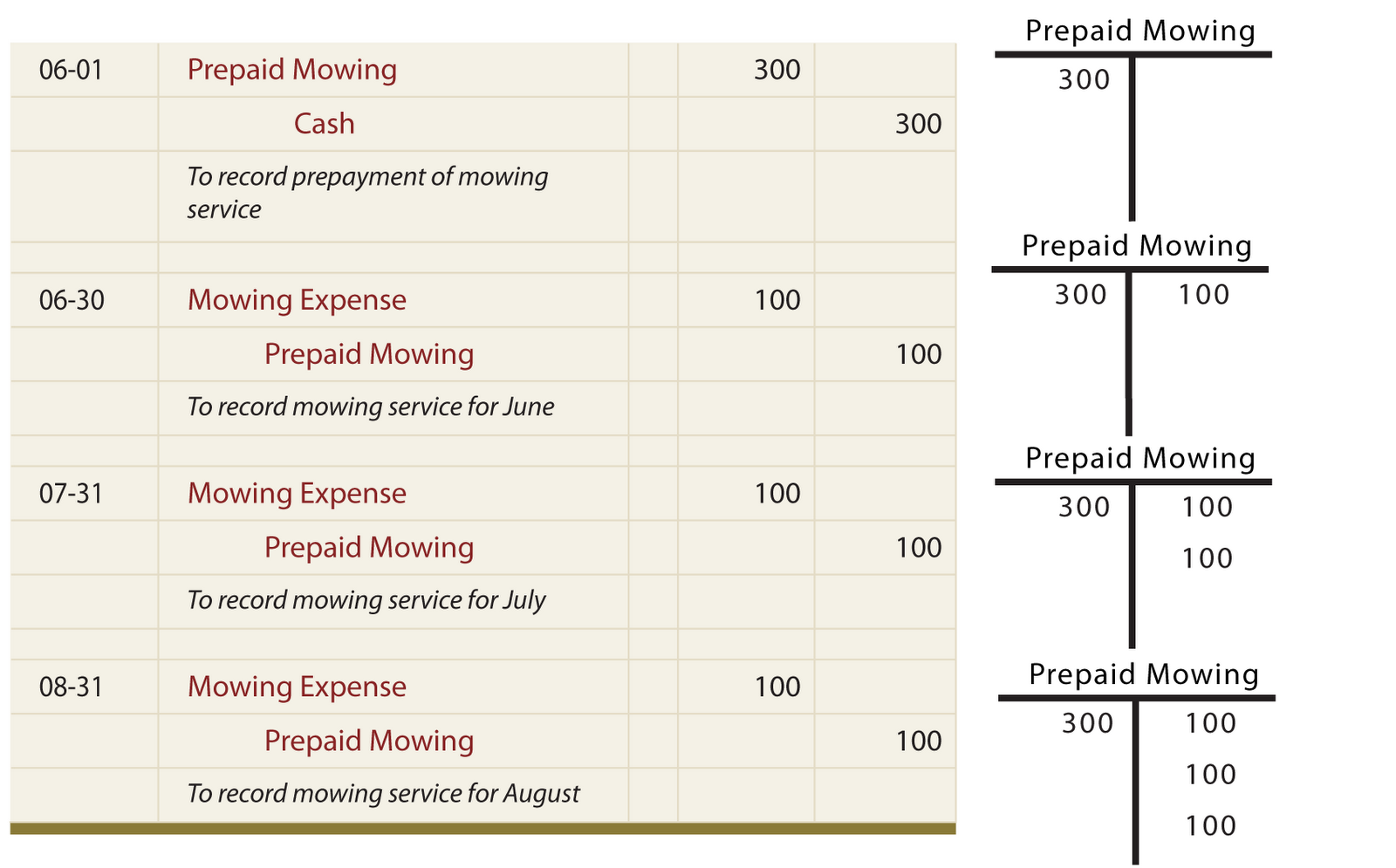

See an example of office supplies as a prepaid expense and how to adjust it at the end of the period. See examples of prepaid.

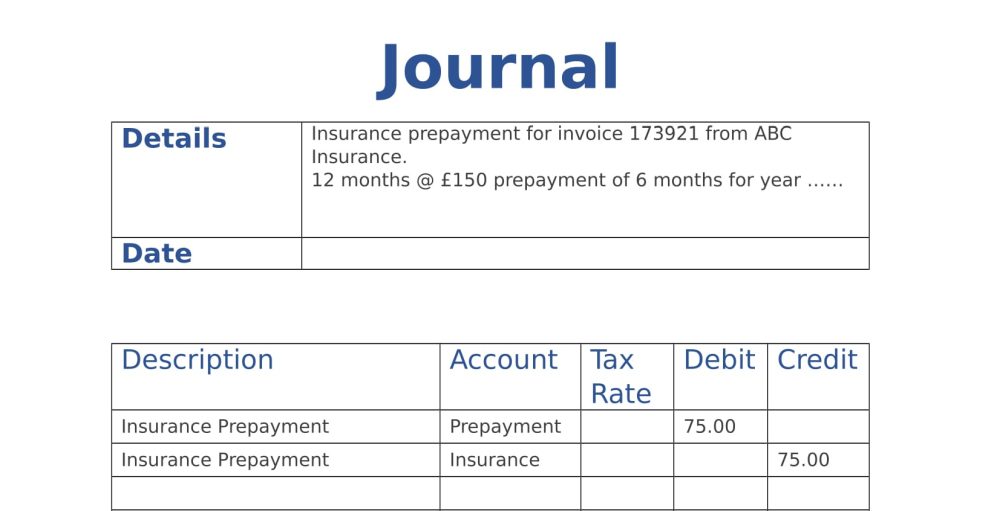

Journal Entry For Prepaid Expenses

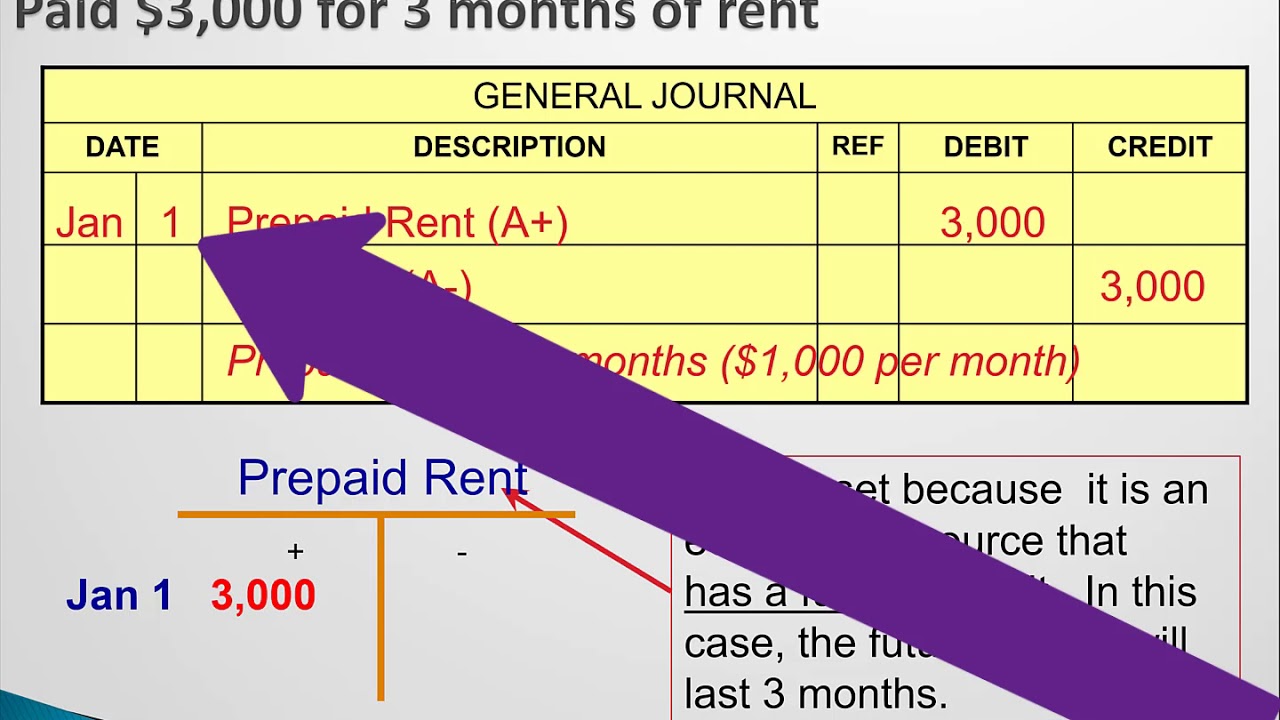

Web prepaid expenses are financial assets paid in advance for future goods or services. A business has an annual premises rent of 60,000 and pays.

Is rent expense a debit? Leia aqui Is rent expense a debit account

A business has an annual premises rent of 60,000 and pays the landlord quarterly in advance on the first day of each quarter. Find out.

Prepaid Expenses Journal Entry Meaning, Examples

Web journal entries for prepaid expenses. They do not record new business transactions but simply adjust. Web learn how to record prepaid expenses in the.

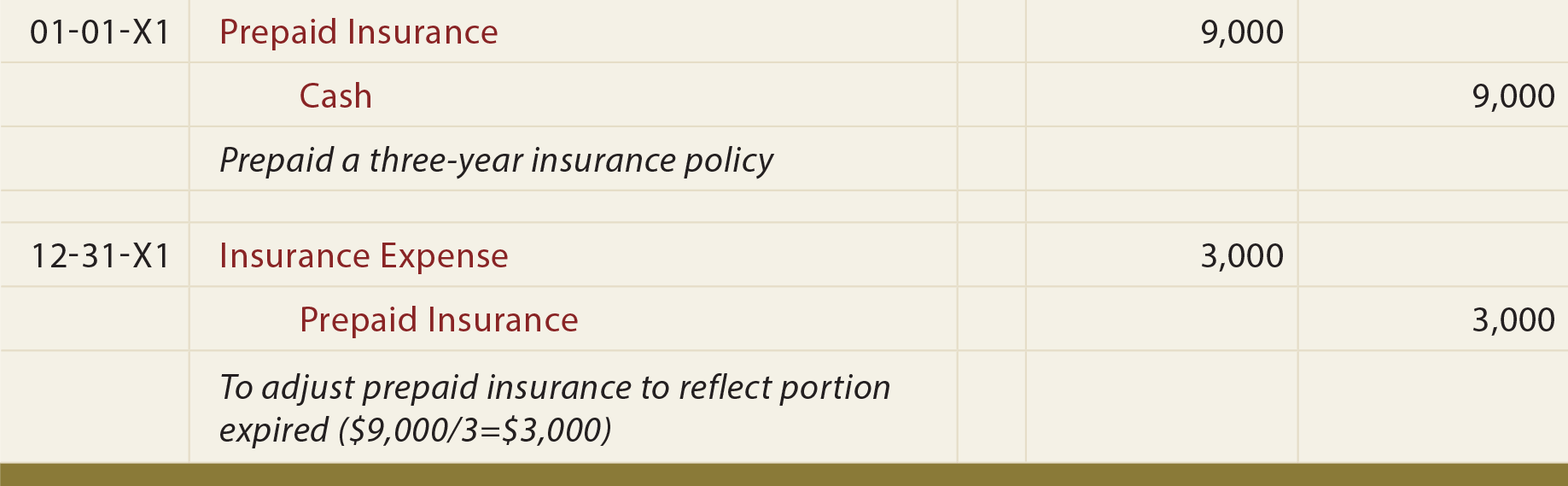

Insurance Expired During the Year Adjusting Entry

Web learn how to record prepaid expenses as an asset and an expense on the balance sheet and the income statement. A prepaid expense is.

Prepaid Expenses Journal Entry Meaning, Examples

Managed for cash flow, product/service security, cost control, and tax benefits. Initially, they are recorded as assets on the. A business has an annual premises.

Prepaid expense journal entry important 2022

Find out how prepaid expenses affect financial statements and see journal entries. A prepaid expense is a payment made in advance for goods or services.

Journal Entry for Prepaid Expenses

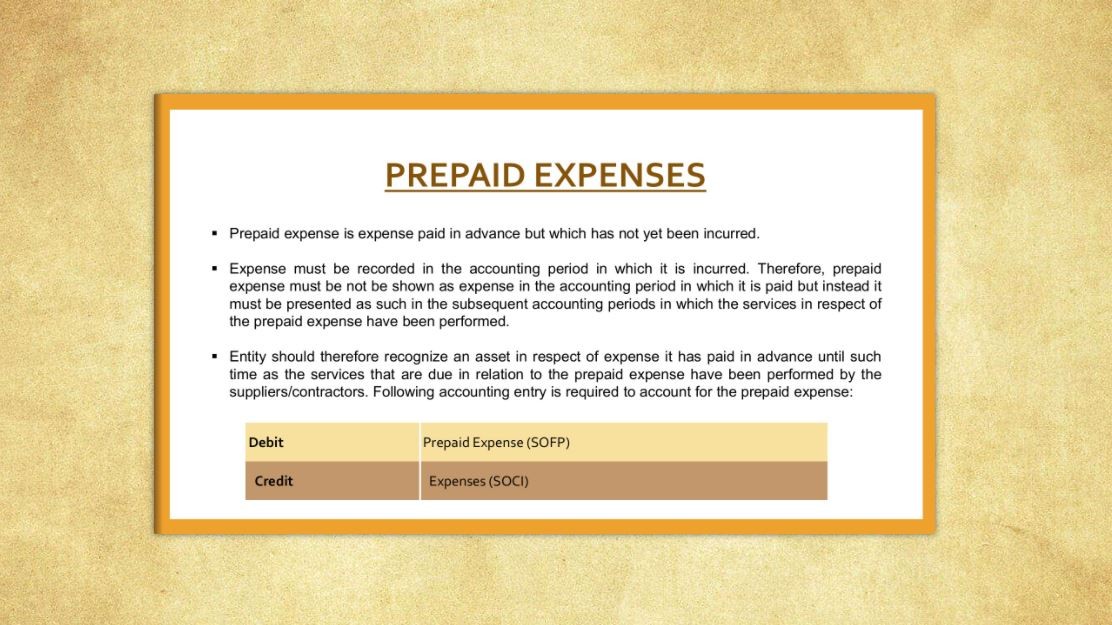

Prepaid expenses are payments made in advance for goods or services that will be received in the future. Web prepaid expense journal entry. What is.

Journal Entry For Prepaid Expenses

Web learn what prepaid expenses are, how to record them, and how to adjust them in your books. See examples of prepaid insurance and service.

Web Journal Entries For Prepaid Expenses.

Web when the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account. Web learn what prepaid expenses are, how they are recorded as assets and expensed, and see examples of prepaid rent and insurance. Recorded as current assets in balance sheet, journal entries include asset and expense methods. A guide to prepaid expense accounting.

On The 1 January It Pays The Next Quarter Rent Of 15,000 To Cover The 3 Months Of January, February, And March.

A business has an annual premises rent of 60,000 and pays the landlord quarterly in advance on the first day of each quarter. Also known as deferred expenses, recording these expenses is part of the accrual accounting process. Web learn how to record prepaid expenses in the journal with examples and quizzes. Web learn how to record prepaid expenses on the balance sheet with examples and explanations.

Web Learn What Prepaid Expenses Are, How To Record Them, And How To Adjust Them In Your Books.

The journal entry is increasing prepaid insurance on. Web understanding prepaid expenses and their journal entries ensures accurate financial reporting, providing a transparent view of your company’s financial health. See examples, definitions, and journal entries for prepaid expenses. See examples of prepaid expenses and how they affect the financial statements.

Prepaid Expenses Are Those Paid In Advance For A Benefit Yet To Be Received, Such As Rent, Insurance, Or Salary.

Examples include rent, insurance premiums. See how to pass journal entries for rent, insurance, and salary paid in advance. Web learn how to account for prepaid expenses under accrual and cash basis, and see common examples such as lease contracts, software subscriptions, and insurance premiums. See examples of prepaid insurance and service supplies with different methods and journal entries.