Gift Cards Accounting Journal Entry - Web accounting for initial gift card sales. Hence, the company expects to have total gift card redemptions of $2,160 ($2,400 × 90%) and estimated breakage of $240 ($2,400 × 10%). When the company sells the gift card to customers, they will receive cash as well as the obligation to customer. Enter the liability non claimed voucher to the balance sheet. It is not yet the revenue, the company records cash received and liability. Debit $50 to your expenses, and credit $50 to the asset account above. At the initial ‘sale’ of a gift card, a liability is recorded rather than an actual sale. Cr gift card liability (b/s) 100. Gift cards are a popular choice for employee rewards and gifts, but they can pose accounting challenges for businesses. Credit $50 to an income account, and debit $50 to an asset account (e.g.

gift card breakage revenue example YouTube

This means you’ll manually evaluate the balances that should be. Web in this article, we’ll go through all the key accounting considerations you need to.

Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown

Web the journal entry to record gift card breakage revenue is to debit deferred revenue and credit breakage revenue. There are varying treatments for the.

Gift Card Software Seamless Gift Card Sales ROLLER

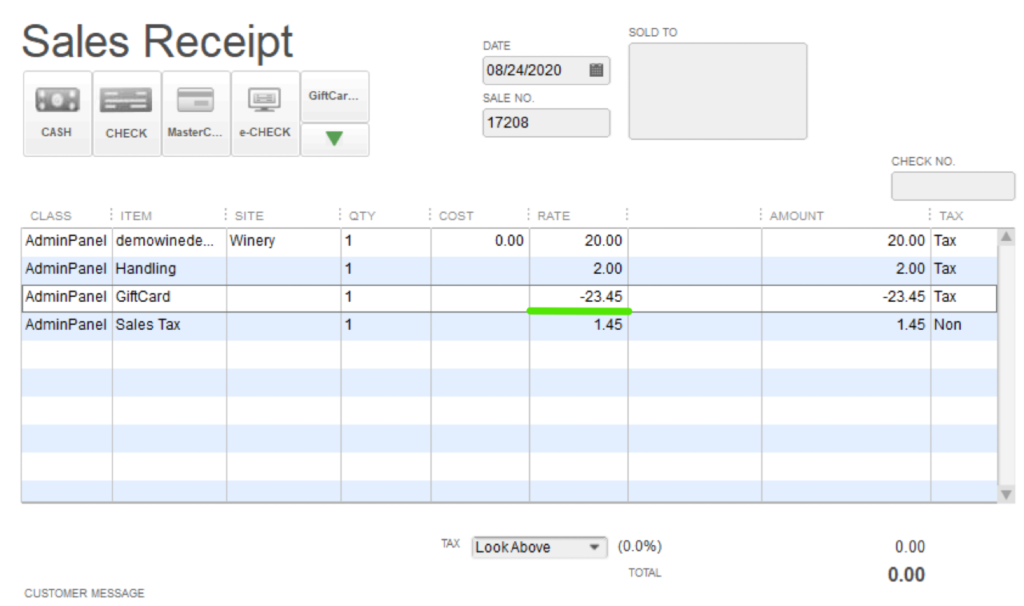

Web can anyone inform how the journal entry would look? Dt debtor ctrl acct 120. At the initial ‘sale’ of a gift card, a liability.

Bookkeeping for Gift Cards and Vouchers

Web journal entry for gift cards. Web what accounting guidance applies to gift card accounting and any new accounting pronouncements that occurred since the last.

How Do Gift Card Transactions Work? WGITS

This means you’ll manually evaluate the balances that should be. It represents the intent to do business in the future. During 2019 with the adoption.

Accounting For Gift Cards Double Entry Bookkeeping

Journal entry for credit purchase and cash purchase During 2019 with the adoption of asc 606, the method of recognizing. Web what accounting guidance applies.

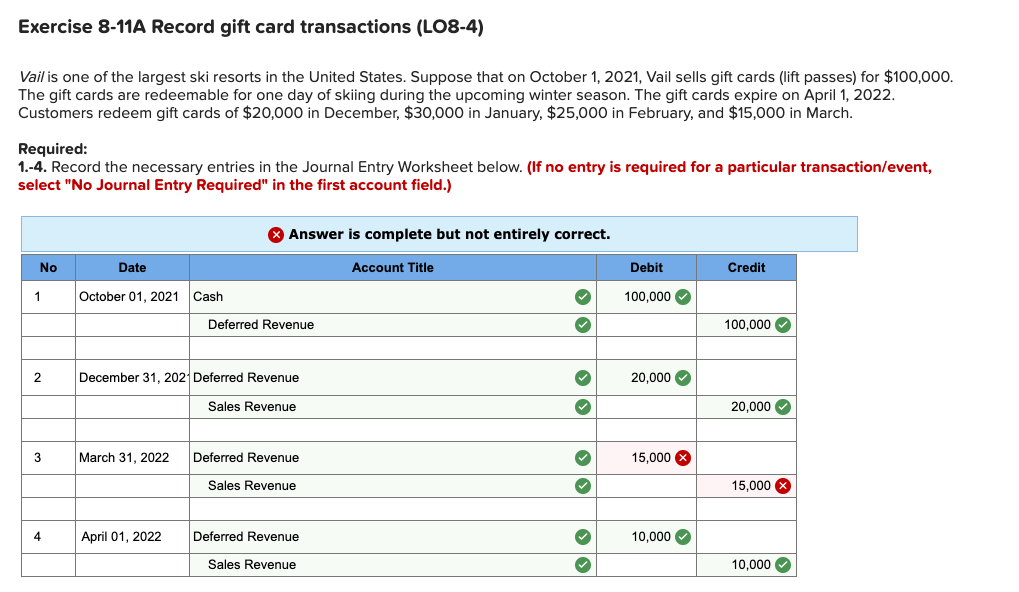

Solved Exercise 811A Record gift card transactions (LO84)

When you receive the $50 gift card: Web a tricky part of gift card accounting is the “breakage analysis” which can result in revenue recognition.

US Retail Gift Card Accounting Guidelines ASC 606

Upon customer prepayment, a contract liability is recognised, not revenue. Web the essential accounting for gift cards is for the issuer to initially record them.

journal entry format accounting accounting journal entry template

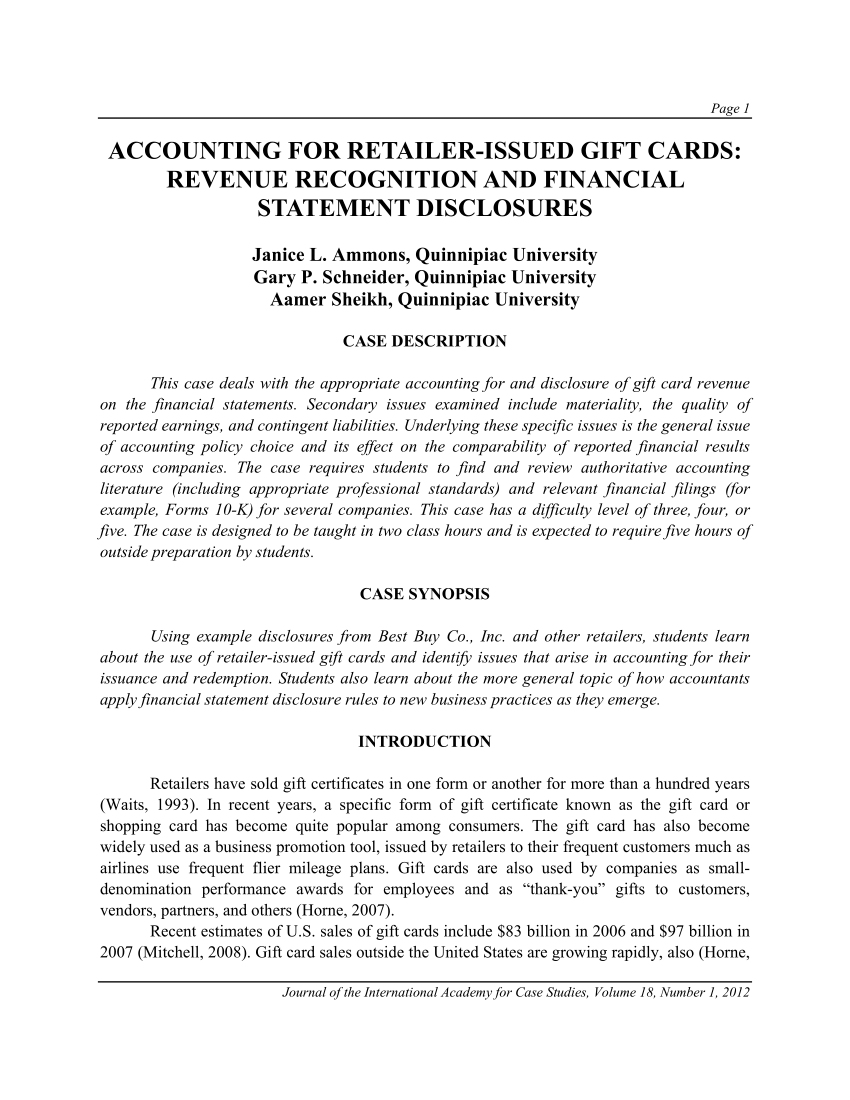

Web unresolved issues stemming from the reporting treatment of gift card sales and “breakage” (gift cards that consumers fail to redeem) potentially encroach upon several.

Web Journal Entry For Gift Cards.

Those that are affiliated with credit card companies such as visa and mastercard, and those that are not. The journal entry is debiting cash $ 200,000 and credit gift card liability $ 200,000. Web gift cards and financial reporting. Cr debtor ctrl acct 120.

Web A Tricky Part Of Gift Card Accounting Is The “Breakage Analysis” Which Can Result In Revenue Recognition Before A Gift Card Is Redeemed In Full.

Revenue is recognised when the promise is fulfilled. Journal entry for credit purchase and cash purchase Gift cards are a popular choice for employee rewards and gifts, but they can pose accounting challenges for businesses. When you receive the $50 gift card:

Credit $50 To An Income Account, And Debit $50 To An Asset Account (E.g.

If the customer does not exercise the contractual rights, those rights are referred to as breakage. It represents the intent to do business in the future. Web accounting for gift cards when giving them to employees as gifts. Web accounting for initial gift card sales.

Web Unresolved Issues Stemming From The Reporting Treatment Of Gift Card Sales And “Breakage” (Gift Cards That Consumers Fail To Redeem) Potentially Encroach Upon Several Accounting Regulations, Including Standards For Revenue Recognition And The Recognition Of Special Items.

Web in this article, we’ll go through all the key accounting considerations you need to make if you’re selling gift cards. Debit $50 to your expenses, and credit $50 to the asset account above. Dt debtor ctrl acct 120. When you spend the $50 gift card:

![Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

/illustrations/giftcard report.png?width=2100&height=2100&name=giftcard report.png)