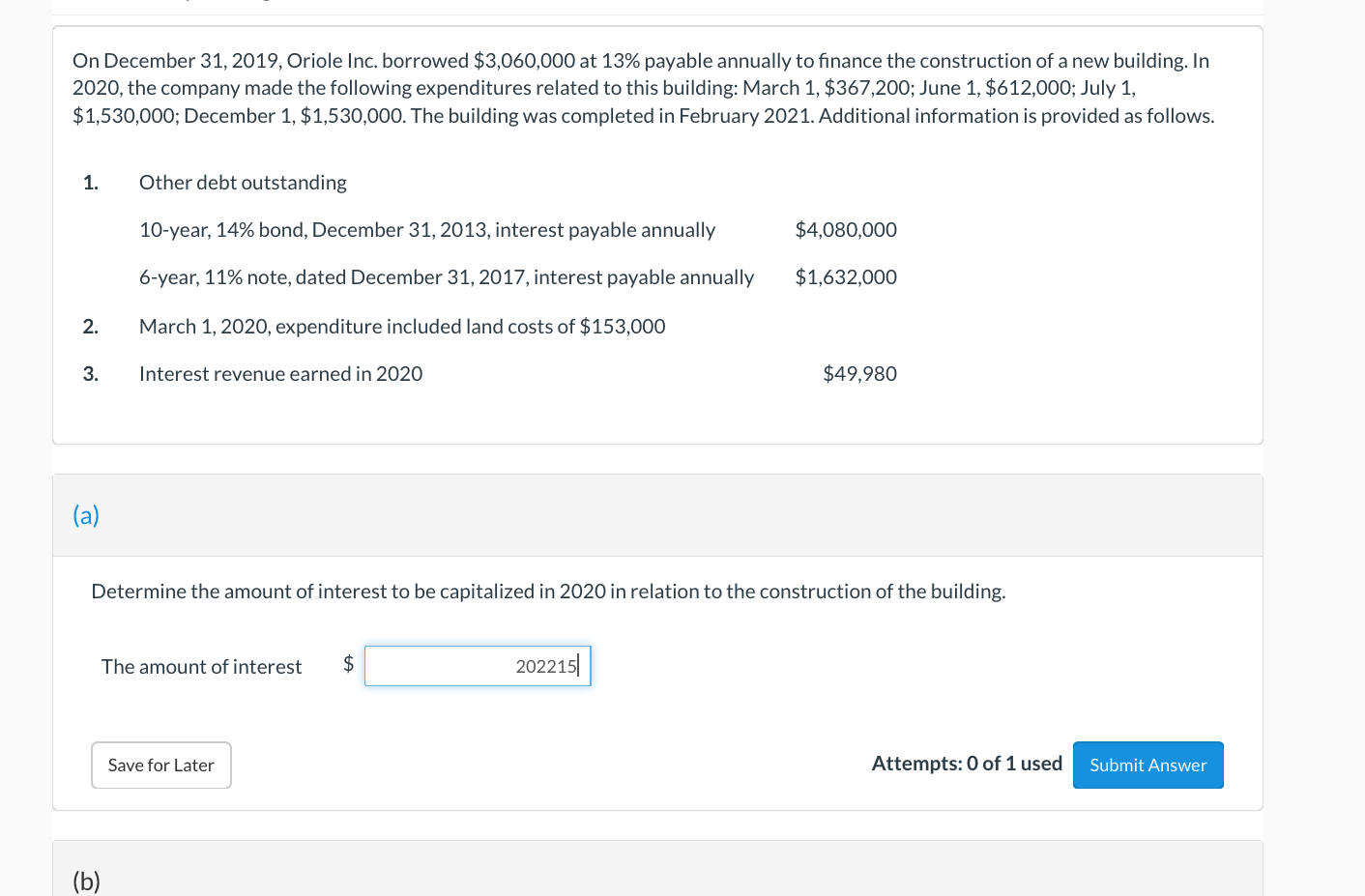

Capitalized Interest Journal Entry - Download our free pdf at the end. Author david kuot view bio. Applicability expenditure base interest rates example capitalization of interest cost during the construction of assets faqs. Explore how it works and the. Instructor adam gifford view bio. (interest provided at 10% on 100,000 at the end of the year) Pik notes enable a company to defer interest payments (i.e., cash payment of interest) until the bond matures. When companies raise debt, lenders expect to be compensated through periodic or scheduled interest payments along with the principal. Web updated on april 24, 2023. Journal entry for interest on drawings.

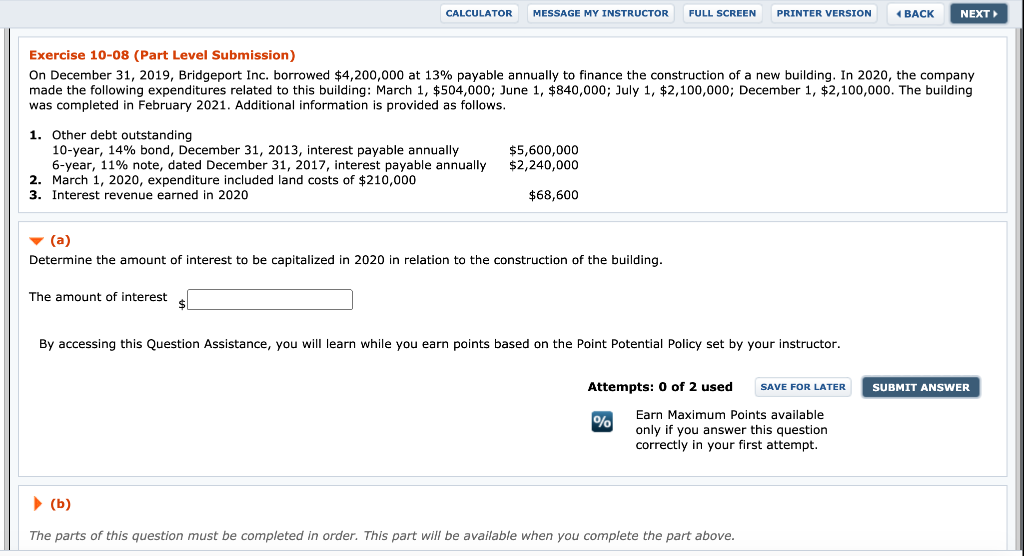

Solved B. Prepare the journal entry to record the

Web harold averkamp, cpa, mba. Web journal entry for interest on capital is; Journal entry for interest on drawings. The capitalization of interest is required.

Finance Lease Journal Entries businesser

The following are the journal entries recorded earlier for printing plus. Author david kuot view bio. Web capitalized interest is interest expense that is incurred.

Basic Journal entry rule for CAPITAL [STEP BY STEP Guide] YouTube

What is the difference between accrued interest and capitalized interest? When companies raise debt, lenders expect to be compensated through periodic or scheduled interest payments.

How to make journal entries for interest on capital in accounting

Web capitalized interest is interest expense that is incurred while an asset is being developed or constructed and added to the final value of the.

Invested In The Business As Capital Journal Entry Business Walls

Web the normal entry for interest on a loan is to dr finance costs cr interest payable. Explore how it works and the. Consider the.

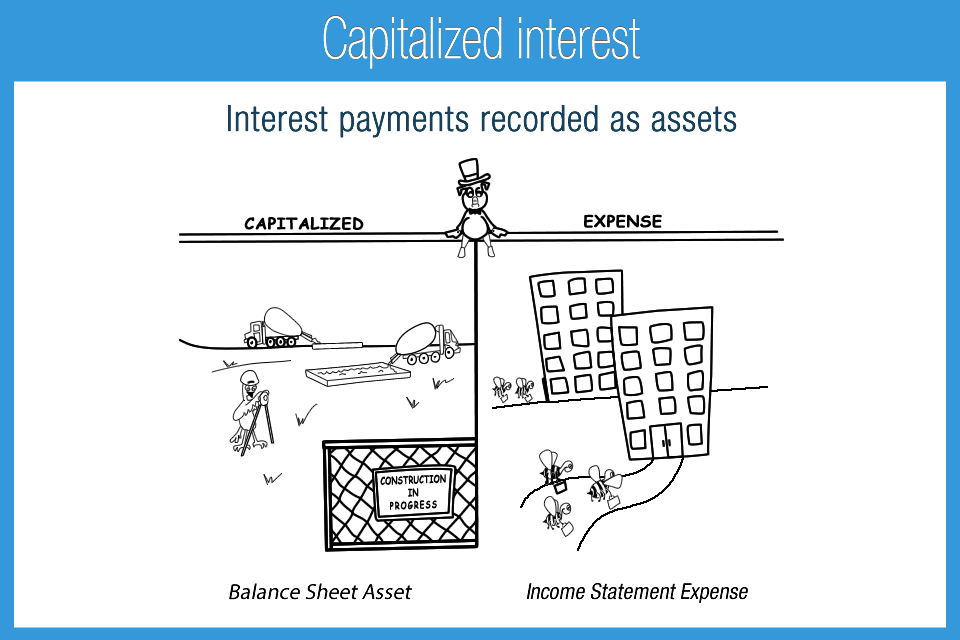

Capitalization Interest Accounting Play

Web harold averkamp, cpa, mba. If we meet the criteria for capitalisation then the debit entry is to ppe as opposed to finance costs. Capitalized.

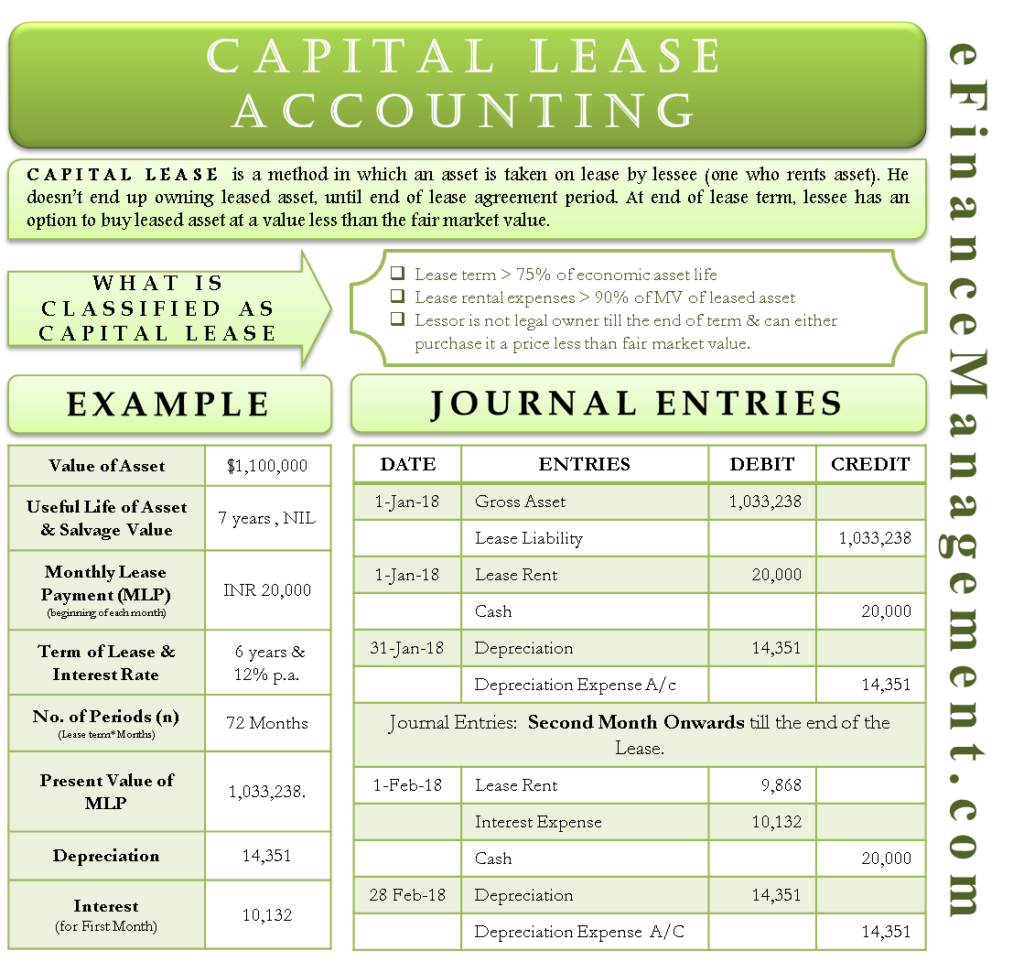

Capital Lease Accounting With Example and Journal Entries

The cumulative amount of expenditures during the asset’s construction. Download our free pdf at the end. If we meet the criteria for capitalisation then the.

Solved Prepare the journal entry to record the

Download our free pdf at the end. Explore how it works and the. Pik notes enable a company to defer interest payments (i.e., cash payment.

Interest on capital & Interest on drawing Journal Entries tutorlive

Instructor adam gifford view bio. Web harold averkamp, cpa, mba. Web capitalized interest is the cost of borrowing incurred by the company to acquire or.

Web The Entry To Record Capitalized Interest Is A Debit To The Capitalized Asset Account And Credit To Cash (Assuming The Interest Is Paid);

Discover what capitalized interest in business is, its importance, and its purpose. On january 3, 2019, issues $20,000 shares of common stock for cash. Instructor adam gifford view bio. Two weird accounting processes, demystified!.

Web Journal Entry For Interest On Capital.

Journal entry for business started (in cash) when a business commences and capital is introduced in form of cash. Consider the following note payable transactions of hernandez video productions. Journal entry for interest on drawings. As soon as we do not capitalise the borrowing costs, we go back to the original entry to finance costs.

Web Journal Entry For Amortization Includes A Debit To The Amortization Expense A/C And A Credit To The Intangible Asset A/C.

If we meet the criteria for capitalisation then the debit entry is to ppe as opposed to finance costs. The following are the journal entries recorded earlier for printing plus. Journalize the company’s payment of the note plus interest on december 31, 2021. What is the difference between accrued interest and capitalized interest?

Web Capitalized Interest Is The Cost Of Borrowing Incurred By The Company To Acquire Or Construct The Long Term Asset To Be Used In The Business And Is Added To The Value Of The Asset To Be Shown In The Balance Sheet Of The Company Instead Of Showing It As An Interest Expense In The Company’s Income Statement.

Capitalized interest is part of an asset’s total cost base. The capitalization of interest is required under the accrual basis of accounting, and results in an increase in the total amount of fixed assets appearing on the balance sheet. The cumulative amount of expenditures during the asset’s construction. What is “paid in kind (pik) interest”?

![Basic Journal entry rule for CAPITAL [STEP BY STEP Guide] YouTube](https://i.ytimg.com/vi/QDkDDbSHIR8/maxresdefault.jpg)