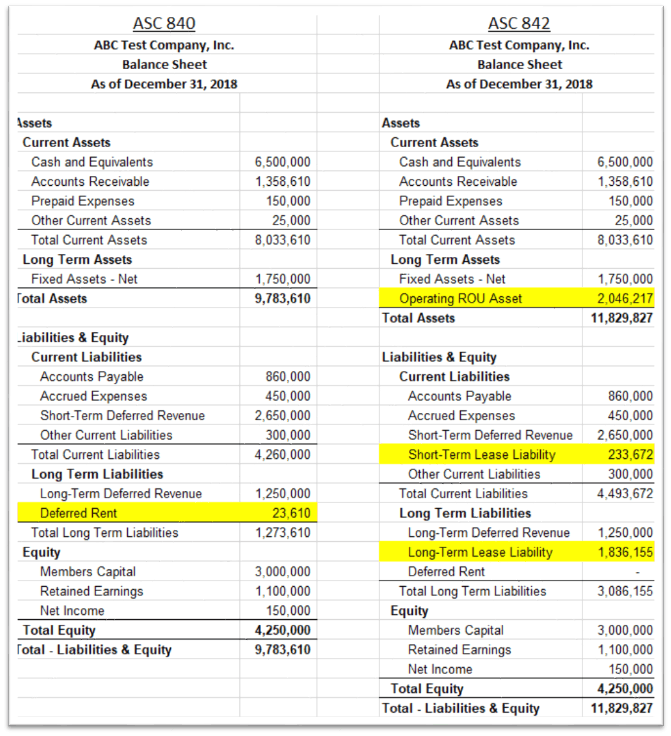

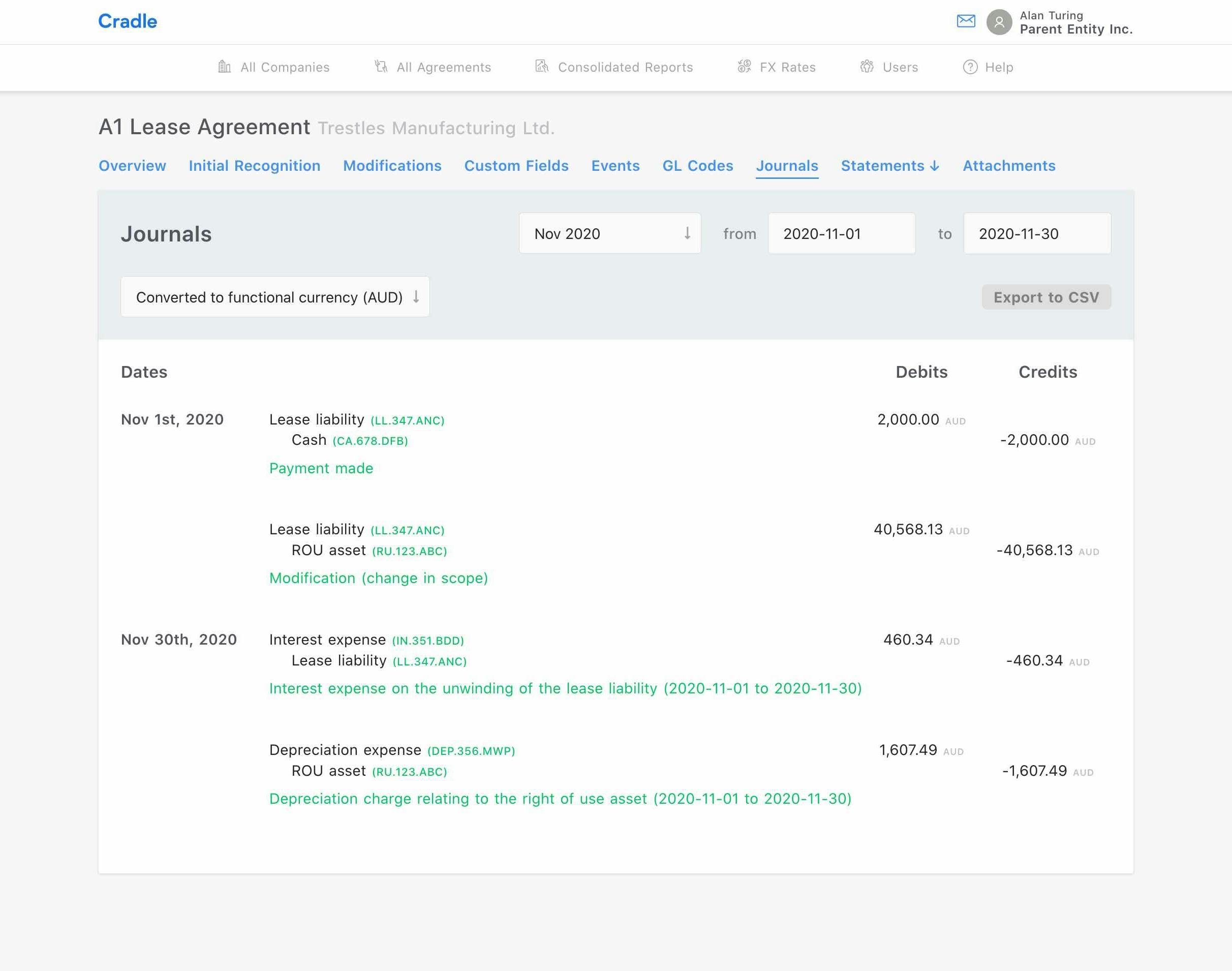

Asc 842 Monthly Journal Entries - We often just need a quick journal entry example to understand the concept or refresh our memory. Web see below for a scenario and subsequent journal entries: Lease accounting focus areas—watch the videos. These changes have shifted how private businesses evaluate leases, the information required for disclosure, and how they present their financial statements. Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. Common control arrangements, on november 30, 2022, and received 29 comment letters in response to the amendments in that proposed update. Web the board issued proposed accounting standards update, leases (topic 842): You should not act upon the information contained in this publication without obtaining specific professional advice. Details on the example lease agreement. On the asc 842 effective date,.

ASC 842 Guide

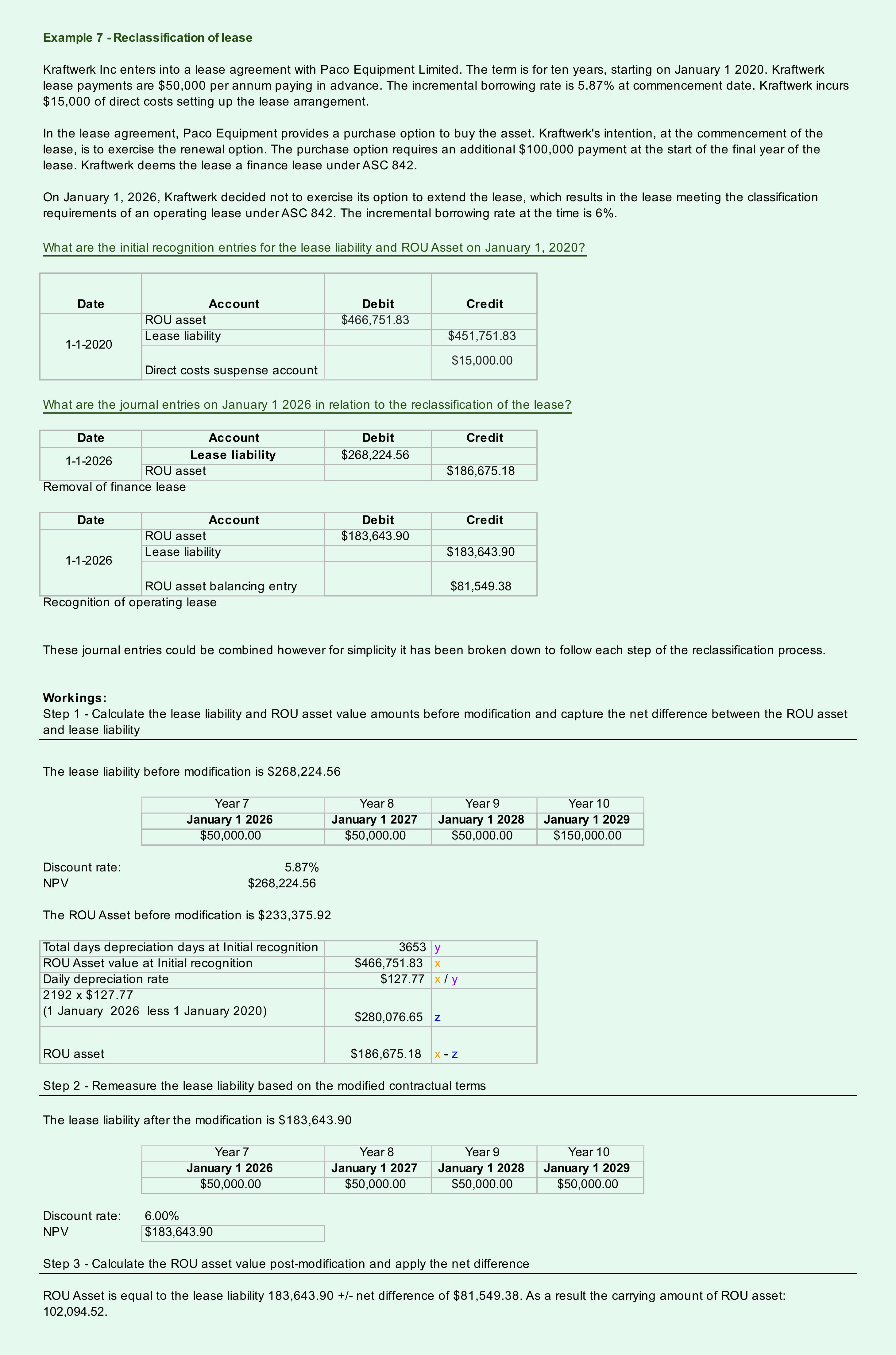

With implementation of the new standard, journal entries will change. For many businesses, navigating the complexities of asc 842 journal entries can be a daunting.

Asc 842 Lease Amortization Schedule Template

On the asc 842 effective date,. Web if you're curious as to what are the journal entries for an operating lease under asc 842 refer.

Asc 842 Operating Lease Excel Template

We often just need a quick journal entry example to understand the concept or refresh our memory. The new lease accounting standard, asc 842, has.

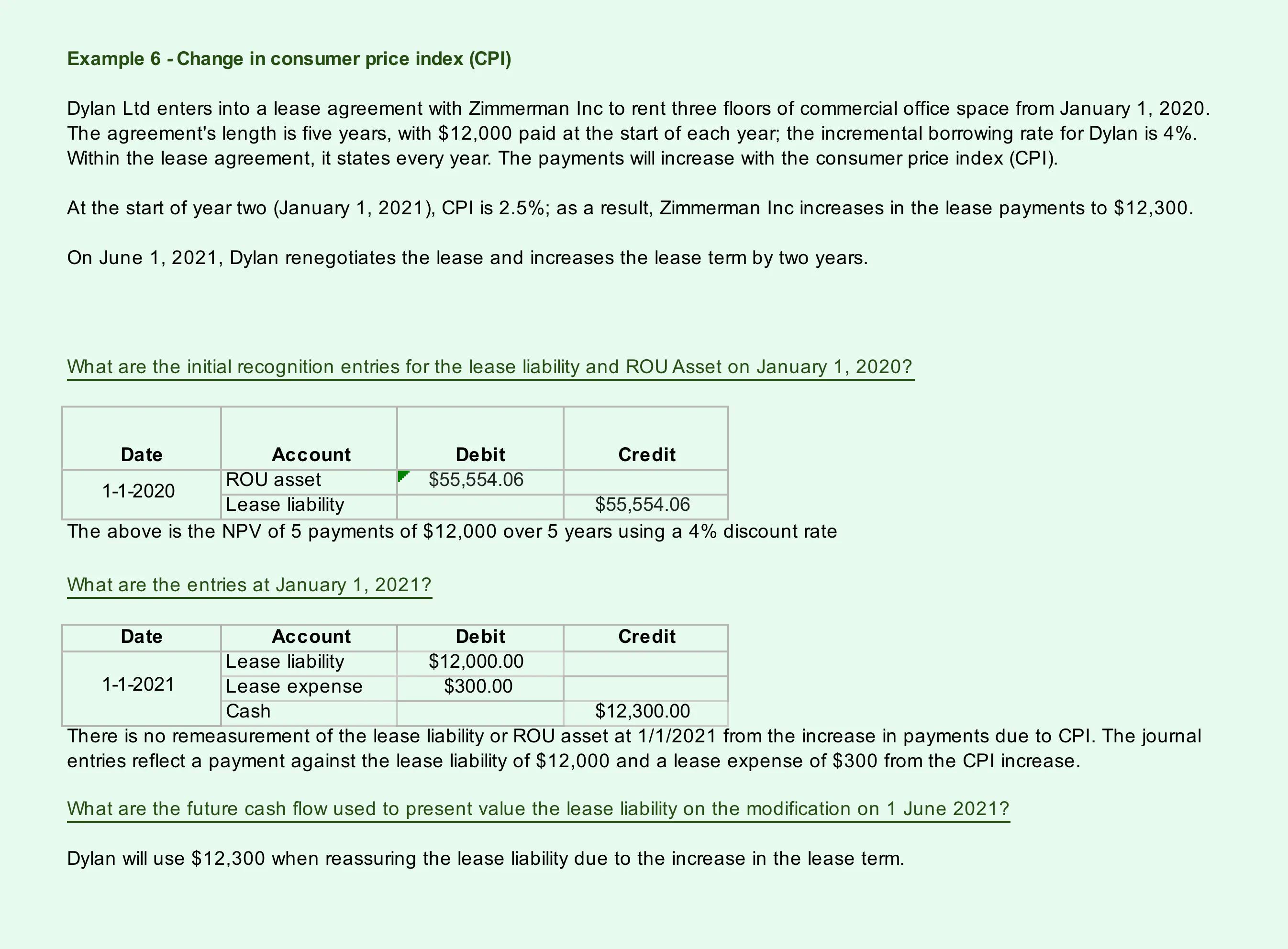

How to Calculate the Journal Entries for an Operating Lease under ASC 842

We often just need a quick journal entry example to understand the concept or refresh our memory. Web the fasb’s new standard on leases, asc.

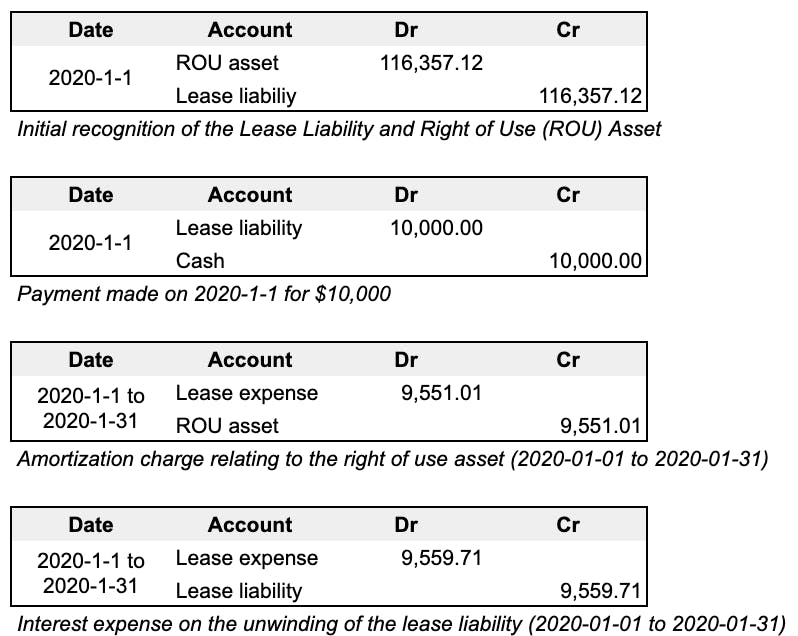

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

This article serves just that purpose. 8 years fair value/historical value of asset: Under asc 842, an operating lease is accounted for as follows: Web.

ASC 842 Summary of Balance Sheet Changes for 2020

Richard stuart, partner, national professional standards group, rsm us llp [email protected], +1 203 905 5027 july 2022 the fasb material is copyrighted by the financial.

ASC 842 Software

Web see below for a scenario and subsequent journal entries: Common control arrangements, on november 30, 2022, and received 29 comment letters in response to.

Asc 842 Template

Web asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. The board considered respondents’ comments in reaching the.

Leases 101 New Accounting Standard Asc 842 Part 2 Finacco

Determine the lease term under asc 840. Details on the example lease agreement. Asc 842 can be overwhelming; You should not act upon the information.

Web To Help Accounting Teams At Businesses And Nonprofits, Here Are Some Of The Basic Journal Entries You’ll Need To Use To Account For Operating Leases Under The New Lease Standard.

We often just need a quick journal entry example to understand the concept or refresh our memory. 8 years fair value/historical value of asset: Initial recognition of lease liability: Common control arrangements, on november 30, 2022, and received 29 comment letters in response to the amendments in that proposed update.

Continue To Hold The Asset And Depreciate It As Normal.

This spreadsheet will also be used for many of the quantitative disclosure requirements of the standard. Web a guide to lessee accounting under asc 842 prepared by: We’ll tackle accounting for operating leases under asc 842 much like the standard (or “topic”) released by the fasb does. As a result, the new journal entries required by asc 842 to recognize the lease commencement would look like the following:

$600 Year 1, $700 Year 2 Journal Entry At Commencement Of The Lease:

The lessee should record a lease liability on their balance sheet, equal to the present value of the lease payments over the lease term. This includes the following steps (how to record journal entries): 2 years useful life of asset: Accounting for operating leases at transition.

Web At A Glance.

This article serves just that purpose. Web operating lease accounting example and journal entries. 13, 2016, the iasb issued ifrs 16, leases, and on feb. Web asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements.