How To Record Bank Loan In Journal Entry - Web the company’s accountant records the following to record the transaction: Web after that, you'll have to enter a journal entry by going to the company menu, and then select make general journal entries. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. To make a journal entry, you enter the details of a transaction into your company’s books. The accounting records will show the. When the company abc borrows $100,000 money from the bank on january 1, 2020, it can make the journal entry as below: A loan journal entry can be recorded in different ways in bookkeeping software, here are three of them: Web recording bank loans and long term borrowings amanda white. *assuming that the money was deposited directly in the firm’s bank. This will bring the total amount of debt.

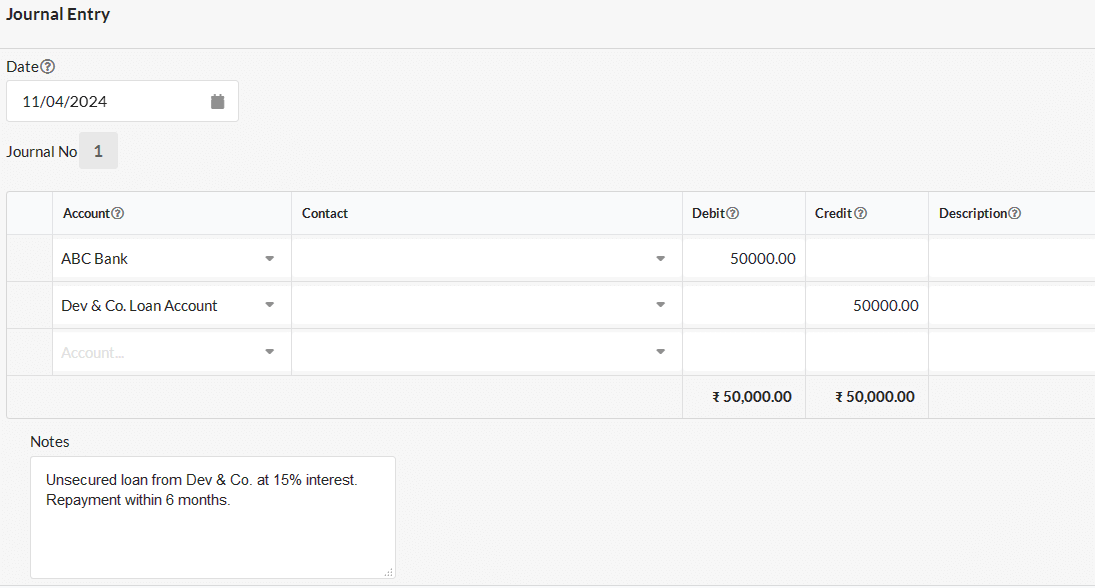

Journal entry for Loan Payable Output Books

Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest expense (an expense. Web here are the 34 business records trump.

What Is The Journal Entry For A Loan Payment

The loan carries an interest rate of 5% per year and must be repaid in. To start a business, the owners may. Web on wednesday,.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web in this journal entry, both total assets and total liabilities on the balance sheet of the company abc will increase by $50,000. When the.

Journal Entries of Loan Accounting Education

Received a $600,000 loan from royal trust bank on january 1, 2022. Web the company’s accountant records the following to record the transaction: How to.

10. Journal Entries Recording of Banking Transactions in Journal Part

Web here are four steps to record loan and loan repayment in your accounts: Web the outstanding amount of loan could change due to receipt.

How to Record Loan Received Journal Entry? (Explanation and More

Web journal entry for loan borrowed from bank; Web a journal entry in accounting is how you record financial transactions. Interest due ₹500 on loan.

Receive a Loan Journal Entry Double Entry Bookkeeping

Web start recording loan payment journal entries now. Web in this journal entry, both total assets and total liabilities on the balance sheet of the.

Loan Journal Entry Examples for 15 Different Loan Transactions (2023)

Company abc is making a loan to its business partner for $ 70,000. Web start recording loan payment journal entries now. When recording your loan.

Journal Entry Examples

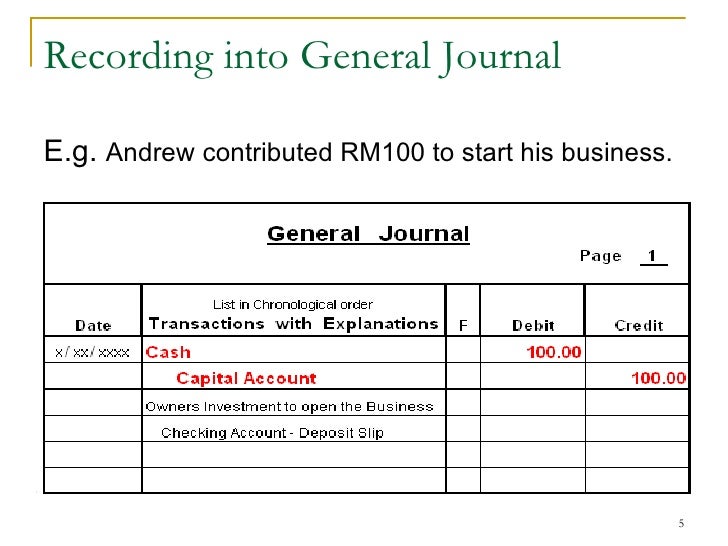

It is important to realize that in each of these journals there are two debit entries. Web how to do journal entries for loan transactions..

After 3 Months, The Business Partner Pays Back The Loan $ 70,000.

Web determine the interest rate charged for a $300,000 loan. Web the outstanding amount of loan could change due to receipt of another loan installment or repayment of loan. The notes payable account could have been substituted for loan payable Web a journal entry in accounting is how you record financial transactions.

How To Record Transactions Related To Long Term Loans Process.

Interest calculation needs to account for the changes in outstanding. Web the company’s accountant records the following to record the transaction: Web here are four steps to record loan and loan repayment in your accounts: Web journal entry for loan borrowed from bank;

Firstly The Debit To The Interest Expense Records.

The loan carries an interest rate of 5% per year and must be repaid in. Web on january 1, 2020. *assuming that the money was deposited directly in the firm’s bank. Interest paid to bank/person on the loan:

What Collateral Does The Bank Require To Secure The Loan?

When the company abc borrows $100,000 money from the bank on january 1, 2020, it can make the journal entry as below: Determine your overall payback amount if you were to repay. It is important to realize that in each of these journals there are two debit entries. Web on wednesday, the biden administration announced an additional $7.7 billion in loan debt relief was approved for 160,500 borrowers.