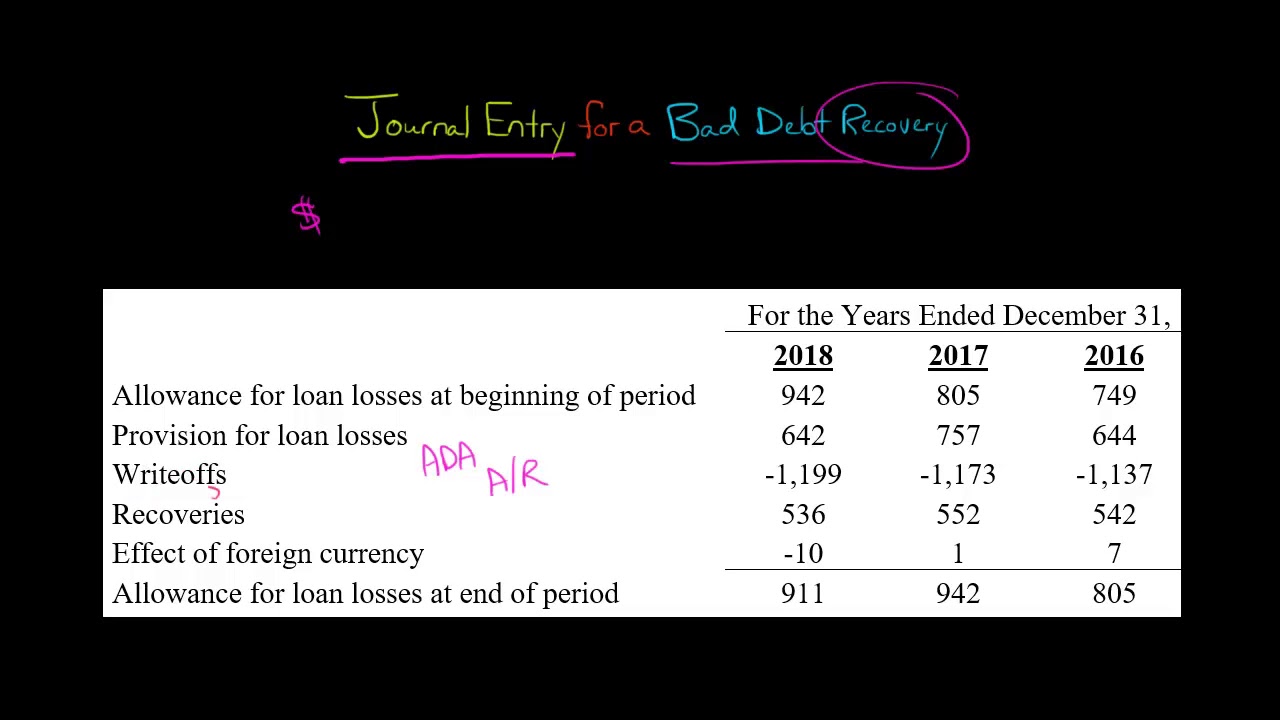

Bad Debts Recovered Journal Entry - 19k views 3 years ago accounting for beginners. Web unfortunately, it doesn’t always work out that way. Web bad debt expense is the loss that incurs from the uncollectible accounts where the customers did not pay the amount owed. What does the phrase recovering a bad debt mean? Web as the business uses the allowance method, the journal entry to record the bad debt recovery is done in two steps as follows: What is the bad debt expense in accounting? Bad debts may be recovered after the customer’s account has been written off from the balance sheet. The company should estimate loss and make bad debt expense journal entry at the end of the accounting period. If that happens, you'll have to adjust your accounts for what you had already written off as uncollectible. How to calculate bad debt expense.

Understand how to enter Bad Debts Recovered transactions using the

When the amount that is earlier written as bad debts, is now recovered, it is called bad debts recovered. 19k views 3 years ago accounting.

Bad Debts Recovered How to pass Journal Entry CBSE Board 11th Class

First, the company can make the journal entry for bad debt recovery by debiting the accounts. Show the bad debts recovered journal entry. Instead, bad.

Bad Debt Recovered Explained with Journal Entry Example YouTube

The main reason that it is recorded as the other income since it is not the main source of income that the company generates from.

What are Bad debt recovered Example Journal Entry Tutor's Tips

The bad debt expense is recorded by adjusting the allowance account. If your small business accepts credit sales, you run the risk of encountering something.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

A customer has been invoiced 200 for goods and the business has decided the debt will not be paid and needs to post a bad.

LEC11JOURNAL ENTRIES6 COMPOUND AND SIMPLE ENTRIESENTRIES FOR BAD

We show how to record a bad debt. If your small business accepts credit sales, you run the risk of encountering something called a “bad.

Journal Entry for Recovery of Bad Debts AccountingCapital

The process begins with identifying the specific account or asset that needs to be written off. Web b) bad debt recovery refers to a payment.

Journal Entry for a Bad Debt Recovery YouTube

Recovery of bad debts faqs. The main reason that it is recorded as the other income since it is not the main source of income.

Bad Debts Recovered Journal entry CArunway

The company should estimate loss and make bad debt expense journal entry at the end of the accounting period. If that happens, you'll have to.

Your Books Must Reflect The Recovered Amount.

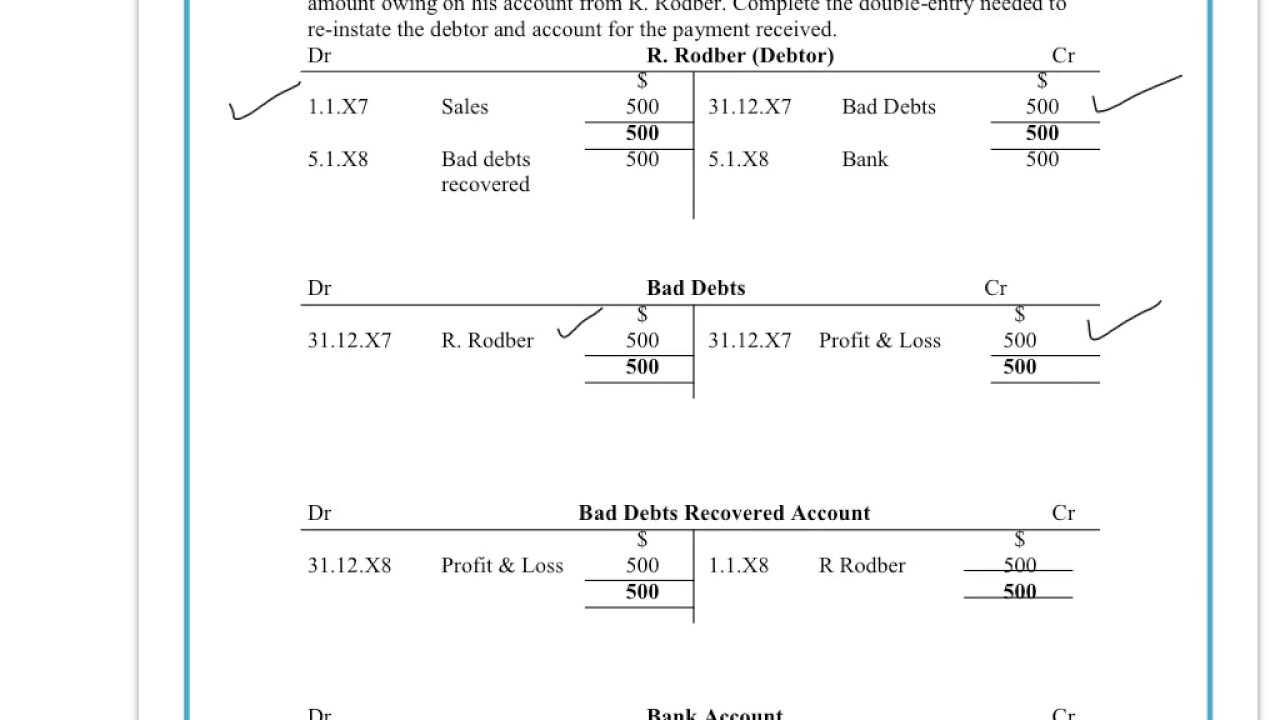

In rare cases, you'll write off a debt as uncollectible only to have the customer pay it after you've already written it off. Reinstate the accounts receivable balance. This identification is often based on a thorough review of outstanding. Web first, the entry to write off the debt as shown in section 2 must be reversed as follows:

It Involves Determining The Amounts That Cannot Be Collected From Consumers And Appropriately Reflecting Them.

Show the bad debts recovered journal entry. What does the phrase recovering a bad debt mean? When can a bad debt be written off? The company should estimate loss and make bad debt expense journal entry at the end of the accounting period.

It Is Important To Note That The Recovery Of A Bad Debt Does Not Necessarily Mean That The Money Is Immediately Received.

Web last updated january 23, 2024. Web bad debt recovery refers to a payment received for a debt that had previously been written off and considered uncollectible. Recovery of bad debts faqs. A customer has been invoiced 200 for goods and the business has decided the debt will not be paid and needs to post a bad debt write off.

Bad Debts May Be Recovered After The Customer’s Account Has Been Written Off From The Balance Sheet.

We show how to record a bad debt. In this accounting lesson, we explain what bad debt and bad debt recovered are. The closing journal entry for bad debts recovered would be as follows; Legal counsel should be sought to navigate these processes effectively.