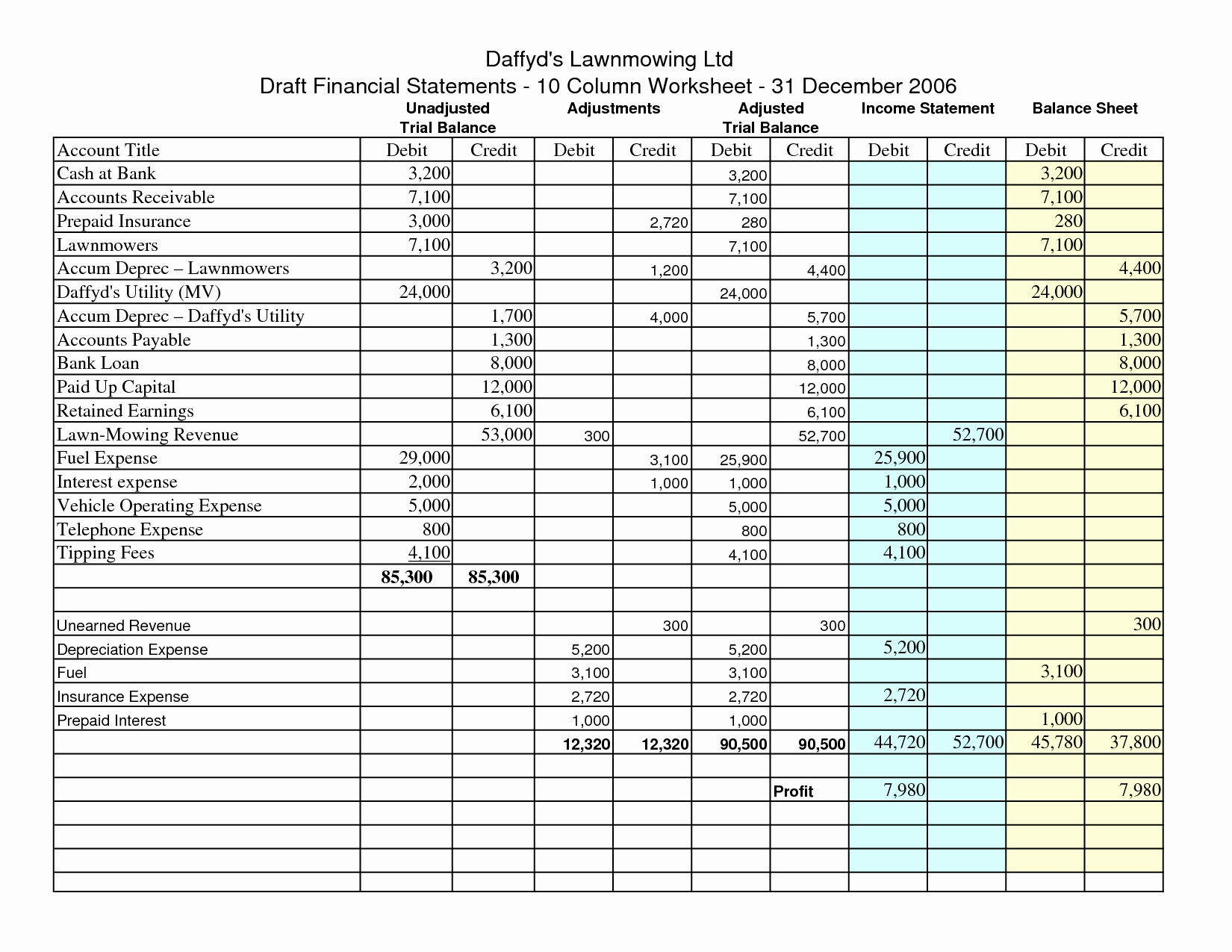

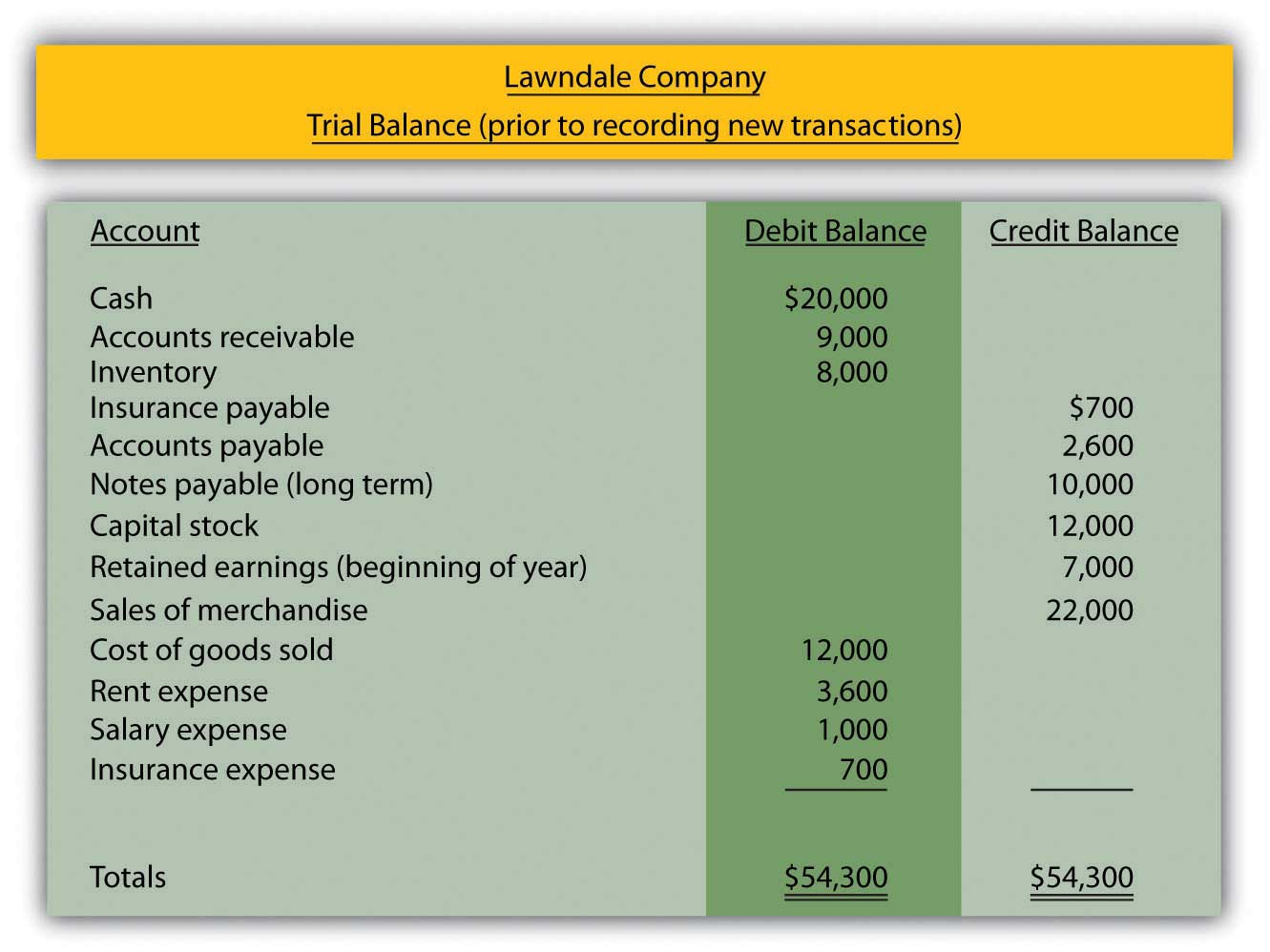

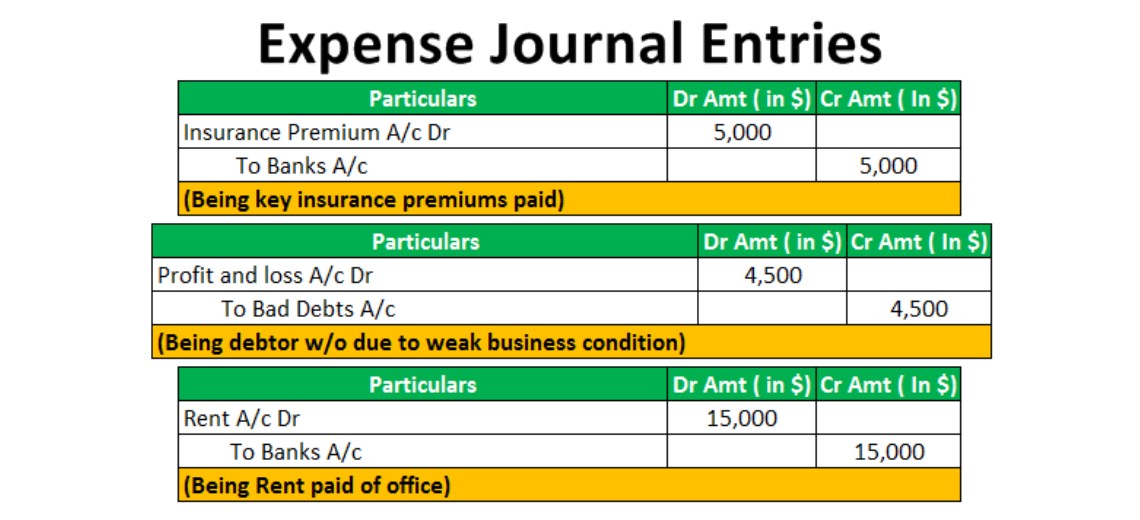

Journal Entry For Expenses - They help small business owners and accountants track every penny, whether it’s for buying supplies, paying employees (payroll expense), or getting insurance (prepaid expenses). Web here is an additional list of the most common business transactions and the journal entry examples to go with them. Web expense journal entries are the critical accounting entries that reflect the expenditures incurred by the entity. Web expense accounting refers to identifying expenses in the current accounting period, which involves a lot of judgment and accounting data analysis. Adjusting entries ensure that expenses and revenue for each accounting period match up—so you get an accurate balance sheet and income statement. Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for your bookkeeping and accounting operation. Web journal entries are crucial for keeping a clean financial record. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they were incurred and how much they cost. Journal entries are the base of accounting. An accrued expense is an expense that has been incurred within an accounting period but not yet paid for.

Basic Journal entry rule of EXPENSES [STEP BY STEP Guide] YouTube

Web expense accounting refers to identifying expenses in the current accounting period, which involves a lot of judgment and accounting data analysis. Web whenever an.

Simple accounting software dowload with journal entry bettabestof

Adjusting entries ensure that expenses and revenue for each accounting period match up—so you get an accurate balance sheet and income statement. Examples of expense.

journal entry format accounting accounting journal entry template

Web expense accounting refers to identifying expenses in the current accounting period, which involves a lot of judgment and accounting data analysis. Web expense journal.

Accounting Journal Entries For Dummies

Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the.

Journal Entry Examples

Close expense accounts to income summary. If you use accrual accounting, you’ll need to make adjusting entries to your journals every month. An accrued expense.

Accrued expenses journal entry and examples Financial

Web whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked..

Accounting Journal Entries For Dummies

Web whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked..

300 utility bill with cash. On in 2021 Journal entries, Accounting

They help small business owners and accountants track every penny, whether it’s for buying supplies, paying employees (payroll expense), or getting insurance (prepaid expenses). Web.

Journal entry for outstanding expenses JEthinomics

Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the.

They Help Small Business Owners And Accountants Track Every Penny, Whether It’s For Buying Supplies, Paying Employees (Payroll Expense), Or Getting Insurance (Prepaid Expenses).

Web the company makes this journal entry to recognize the incurred expense as well as the obligation existed at the end of the period. As an expense account is an income statement account, it has a natural debit balance. Web journal entries are crucial for keeping a clean financial record. Business expenses can include a range of things, like rent, payroll, and inventory.

Web Expense Journal Entries Are The Critical Accounting Entries That Reflect The Expenditures Incurred By The Entity.

It includes booking invoices, creating new vendors in the system, vat accounting, accruals, prepaid, vendor ledger analysis, timely payments, etc. Examples of expense journal entries. Journal entries are the base of accounting. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they were incurred and how much they cost.

Likewise, This Journal Entry Increases Both The Expense (Debit) In The Income Statement And The Liability (Credit) In The Balance Sheet.

Web here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for your bookkeeping and accounting operation. Web here is an additional list of the most common business transactions and the journal entry examples to go with them. Adjusting entries ensure that expenses and revenue for each accounting period match up—so you get an accurate balance sheet and income statement. An accrued expense is an expense that has been incurred within an accounting period but not yet paid for.

Web Expense Accounting Refers To Identifying Expenses In The Current Accounting Period, Which Involves A Lot Of Judgment And Accounting Data Analysis.

Web whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked. If you use accrual accounting, you’ll need to make adjusting entries to your journals every month. Close expense accounts to income summary.

![Basic Journal entry rule of EXPENSES [STEP BY STEP Guide] YouTube](https://i.ytimg.com/vi/lQnM_JjzfaQ/maxresdefault.jpg)