Amortization Of Goodwill Journal Entry - Debit amortization expense, credit accumulated amortization. Goodwill does not have an expected life span and therefore is not amortized. Net property, plant and equipment: Web thomson reuters tax & accounting. Must record the amortization expense for the asset. Then, create a recurring journal entry to book the amortization expense: Rather, an entity’s goodwill is subject to periodic impairment testing. Web journal entry for goodwill on acquisition. To record the amortization expense, abc co. Web less accumulated depreciation and amortization:

[Solved] . Impaired Goodwill and Amortization of Patent On April 1, a

October 5, 2023 · 11 minute read. Goodwill does not have an expected life span and therefore is not amortized. A caveat is that under.

Goodwill Amortization A Quick Guide to Goodwill Amortization

What is amortization in accounting? Web what is goodwill amortization? Web less accumulated depreciation and amortization: The company can make the journal entry for the.

How to account for intangible assets, including amortization (3 of 5

Goodwill amortization refers to the gradual and systematic reduction in the amount of the goodwill asset by recording a periodic amortization charge. In 2001, a.

Amortization and Depletion Entries Data related to the acquisition of

Most intangible assets have a limited finite useful life over which the benefit from them will be derived. At the end of the year, abc.

Journal Entry for Amortization with Examples & More

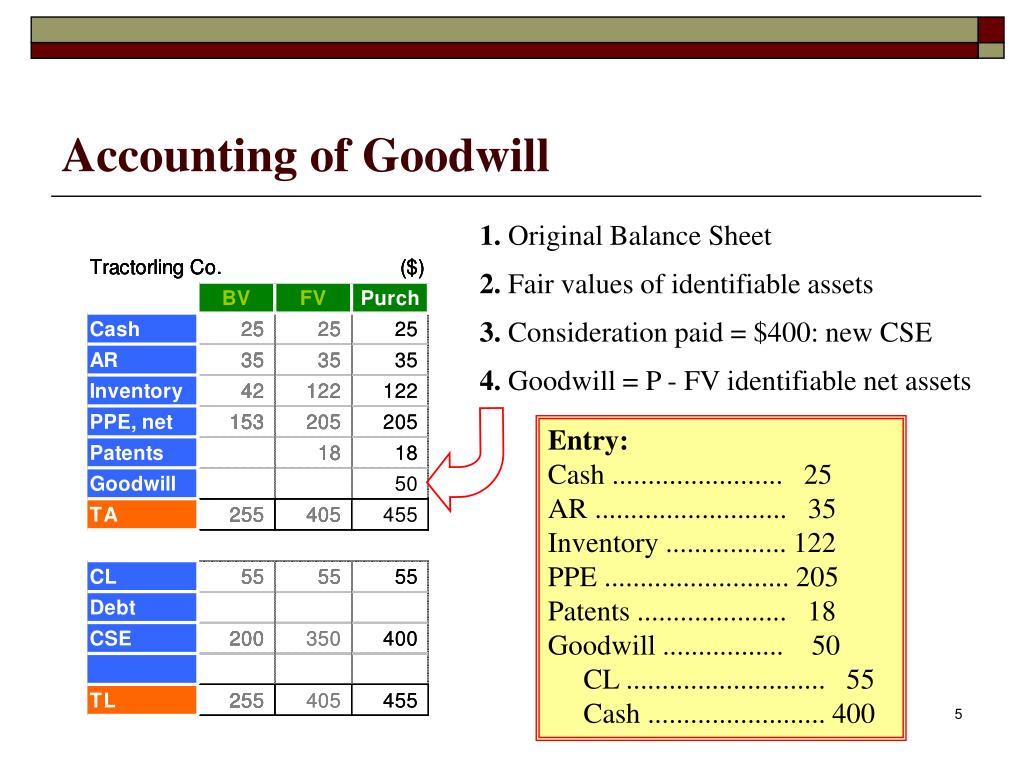

Goodwill in accounting refers to the intangible value of a business that is above and beyond its tangible assets, such as equipment or inventory. Web.

Intangibles

October 5, 2023 · 11 minute read. Learn the different methods to amortize an intangible asset. Uses the following double entry. A caveat is that.

PPT “Goodwill Valuation” PowerPoint Presentation, free download ID

You can book it monthly (~$60k/180) or annually (~$60k/15). The company can make the journal entry for the goodwill on acquisition by debiting the assets.

Accounting For Intangible Assets Complete Guide for 2023

Goodwill does not have an expected life span and therefore is not amortized. Goodwill in financial modeling in financial modeling for mergers and acquisitions (.

Admission Journal Entries for Goodwill YouTube

Web what is goodwill amortization? Web then, set up an 'amortization' expense account and an 'accumulated amortization' fixed asset account. Goodwill amortization refers to the.

It Occurs When A Company Purchases Another Company At A Price Greater Than The Fair Value Of Its Net Assets.

With ifrs, goodwill should be tested for impairment annually and when events or circumstances indicate impairment may exist. Web thomson reuters tax & accounting. What are the different amortization methods? Most intangible assets have a limited finite useful life over which the benefit from them will be derived.

Debit Amortization Expense, Credit Accumulated Amortization.

Web what is goodwill amortization? To record the amortization expense, abc co. Rather, an entity’s goodwill is subject to periodic impairment testing. Other intangibles, net of amortization:

Web Amortization Refers To An Accounting Technique That Is Intended To Lower The Value Of A Loan Or Intangible Asset Over A Set Period Of Time.

Goodwill does not have an expected life span and therefore is not amortized. Its calculation is similar to that of straight line depreciation for a tangible fixed asset. What is amortization in accounting? Net property, plant and equipment:

October 5, 2023 · 11 Minute Read.

The company can make the journal entry for the goodwill on acquisition by debiting the assets at the fair value and the goodwill account and crediting the liabilities at the fair value and the cash account. Goodwill in financial modeling in financial modeling for mergers and acquisitions ( m&a ), it’s important to accurately reflect the value of goodwill in order for the total financial model to. Goodwill in accounting refers to the intangible value of a business that is above and beyond its tangible assets, such as equipment or inventory. Web in electing to amortize goodwill, the apb noted, “amortizing the cost of goodwill and similar intangible assets on arbitrary bases in the absence of evidence of limited lives or decreased values may recognize expenses and decreases of assets prematurely, but delaying amortization of cost until a loss is evident may recognize the.