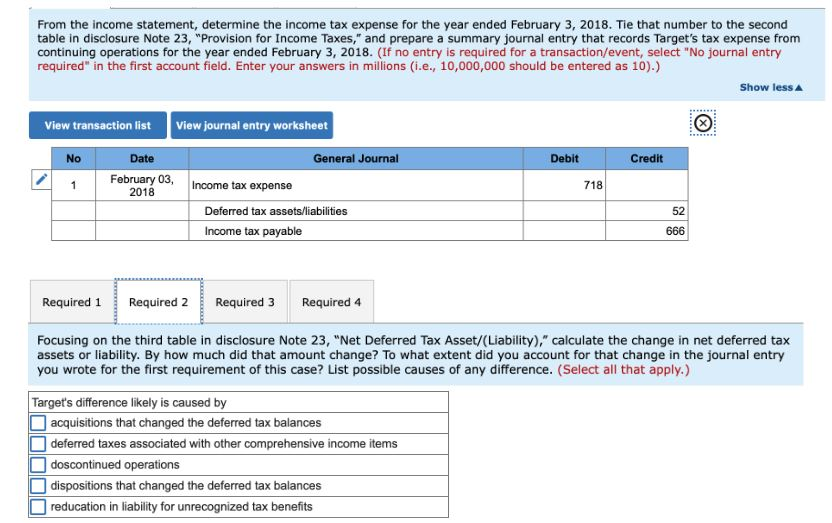

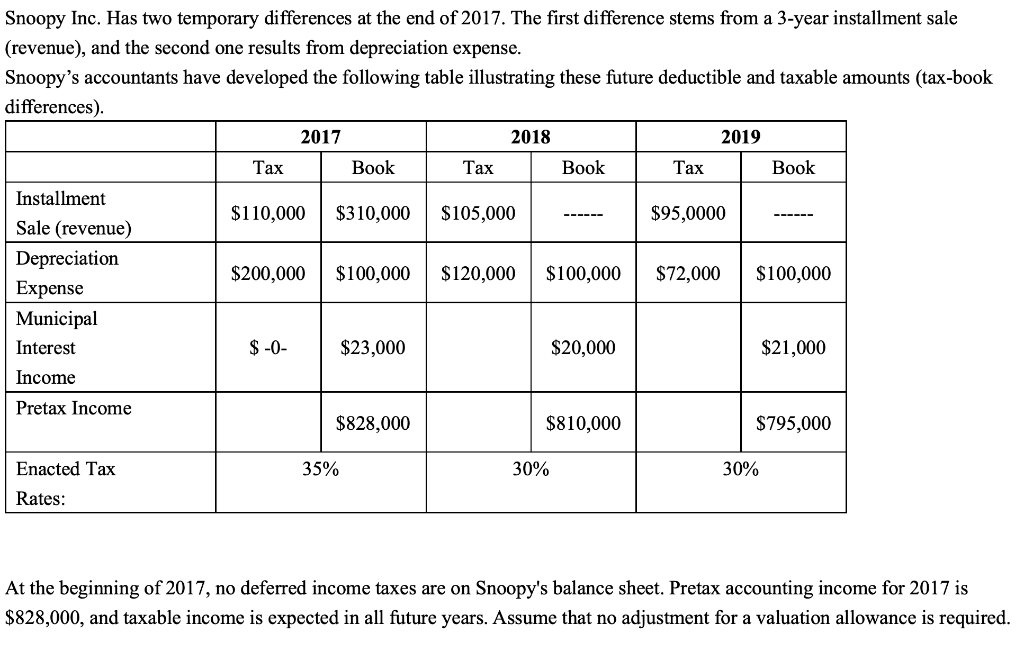

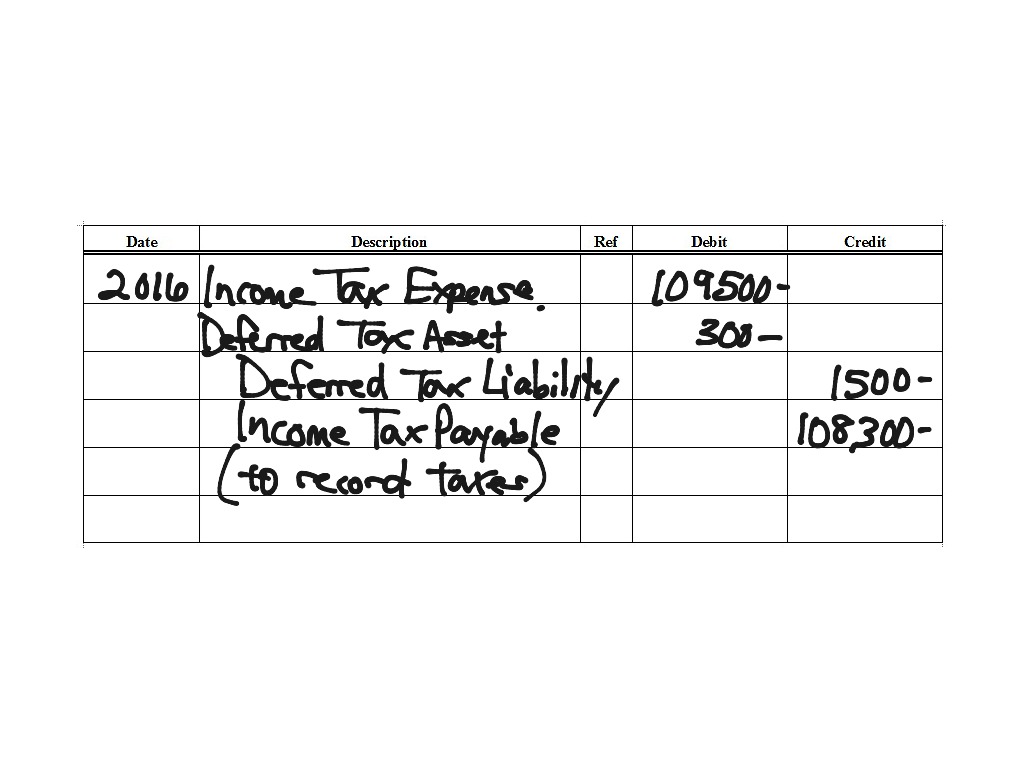

Income Tax Journal Entry - Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense account with a. This provision being a liability, showed at. The following are the journal entries recorded earlier for printing. How to account for income taxes. Web income taxes are determined by applying the applicable tax rate to net income of a business calculated in accordance with the accounting rules given in the. Income tax is paid by the business on the profit earned during the year. Web the adjusting entry for an accrued expense updates the taxes expense and taxes payable balances so they are accurate at the end of the month. Web journal entry examples. We discuss what end of year journal entries might be required. The income tax expense will be present on the income statement and the income tax.

Journal Entry For Tax Provision

Web accounting entry will be as under: Web income taxes are determined by applying the applicable tax rate to net income of a business calculated.

Journal Entry for Tax Refund How to Record

Web this has been a guide to what is income tax accounting. Income tax expense is the amount of tax owed on taxable income, while.

Tax Expense Journal Entry Journal Entries for Normal Charge

We explain it with the key terms used with example, journal entries, advantages & disadvantages. Web the journal entry is debiting income tax expense and.

Casual Journal Entry For Tax Payable Financial Statement

Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense.

Payroll Journal Entry Example Explanation My Accounting Course

Web the adjusting entry for an accrued expense updates the taxes expense and taxes payable balances so they are accurate at the end of the.

Journal Entry For Tax Payable

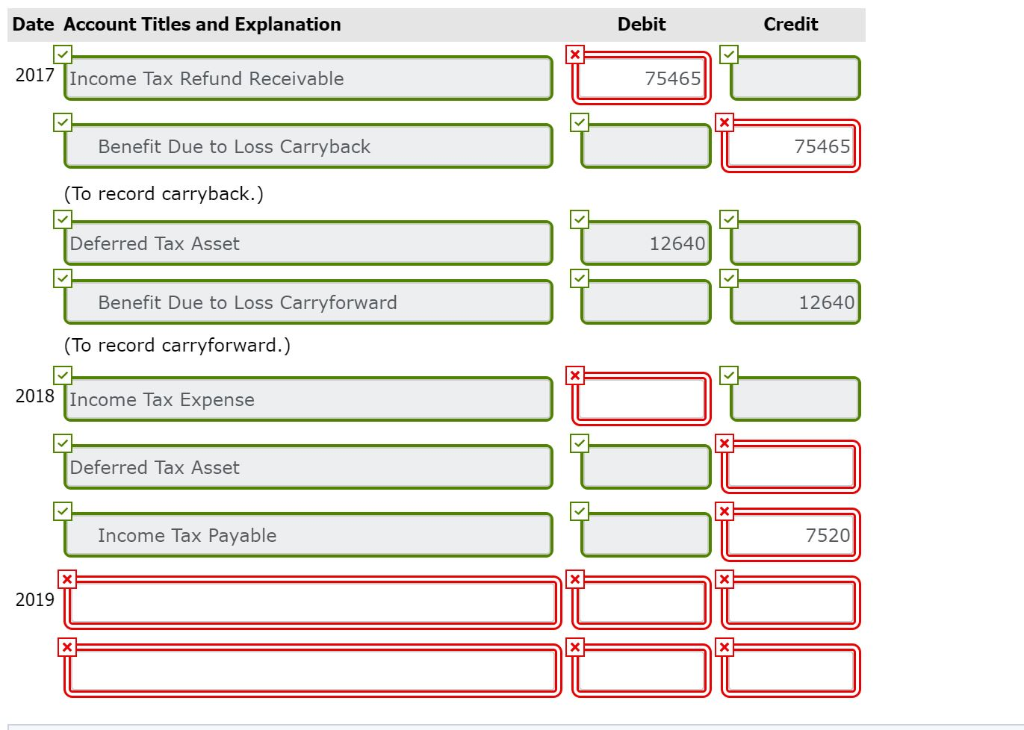

Web learn how to record a journal entry for income tax refund in your business accounting books. Income tax is paid by the business on.

Tax Paid Journal Entry Class 11 Journal Entry of Tax

15k views 7 years ago lightboard videos. Web this has been a guide to what is income tax accounting. Web the journal entry is debiting.

E198B Tax Journal Entries Financial Accounting ShowMe

Web the journal entry is debiting income tax expense and crediting income tax payable. Web accounting for income taxes should be easy right? How to.

Journal Entry For Tax Payable

We discuss what end of year journal entries might be required. Subtract the total deductions from the gross pay to find the net pay—the amount.

Web Journal Entry For Income Tax In Case Of A Sole Proprietorship Contains 2 Steps As Follows;

Now that we have calculating current tax, and deferred tax, let's wrap things up by doing the journal. On december 31, 20×1, entity a estimated the income. The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and. Web learn how to record a journal entry for income tax refund in your business accounting books.

The Following Are The Journal Entries Recorded Earlier For Printing.

Find out the differences between tax expense and tax payable,. Web the adjusting entry for an accrued expense updates the taxes expense and taxes payable balances so they are accurate at the end of the month. We explain it with the key terms used with example, journal entries, advantages & disadvantages. Web learn how to record income tax expense and provision for income tax in the books of a business.

We Discuss What End Of Year Journal Entries Might Be Required.

The income tax expense will be present on the income statement and the income tax. Web journal entry examples. This provision being a liability, showed at. How to account for income taxes.

The Core Of Accounting Lies In Recording Financial Transactions Correctly, And The Journal Entry Process Serves As The Building.

Web below are sample journal entries: Income tax is paid by the business on the profit earned during the year. Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense account with a. Web income taxes are determined by applying the applicable tax rate to net income of a business calculated in accordance with the accounting rules given in the.