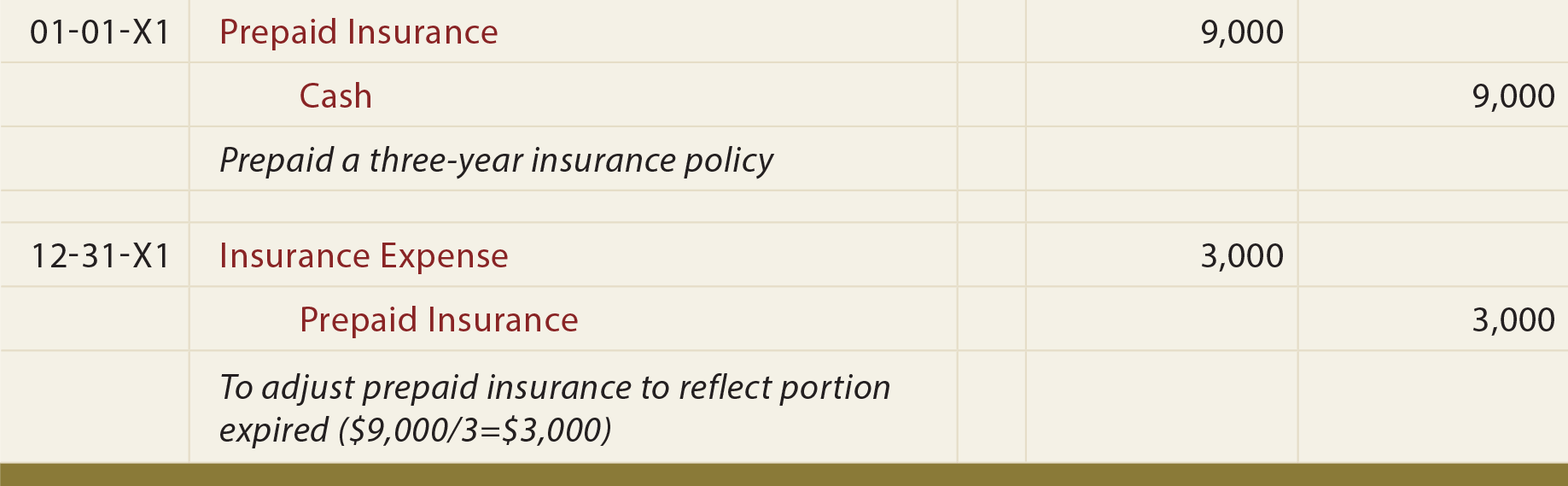

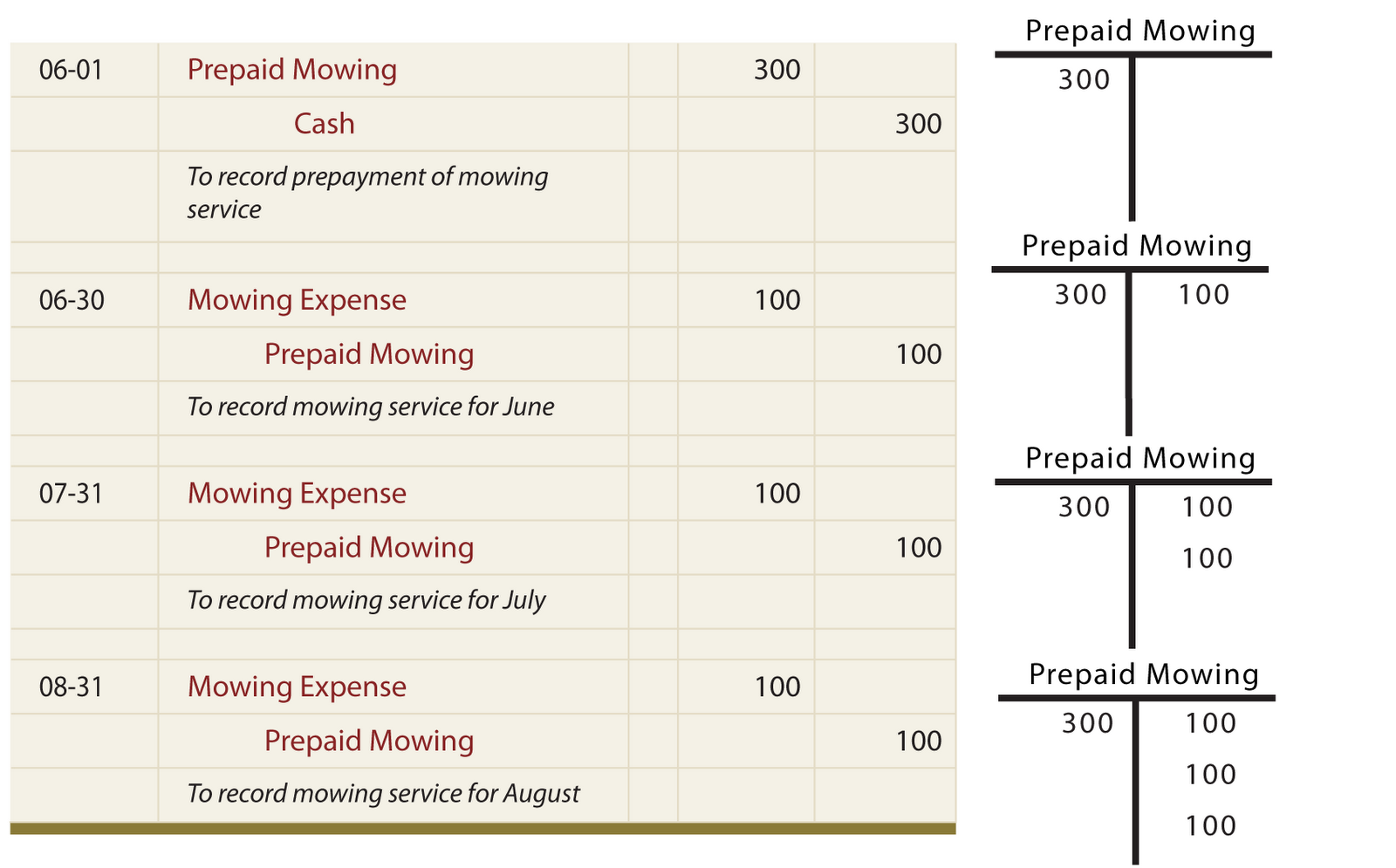

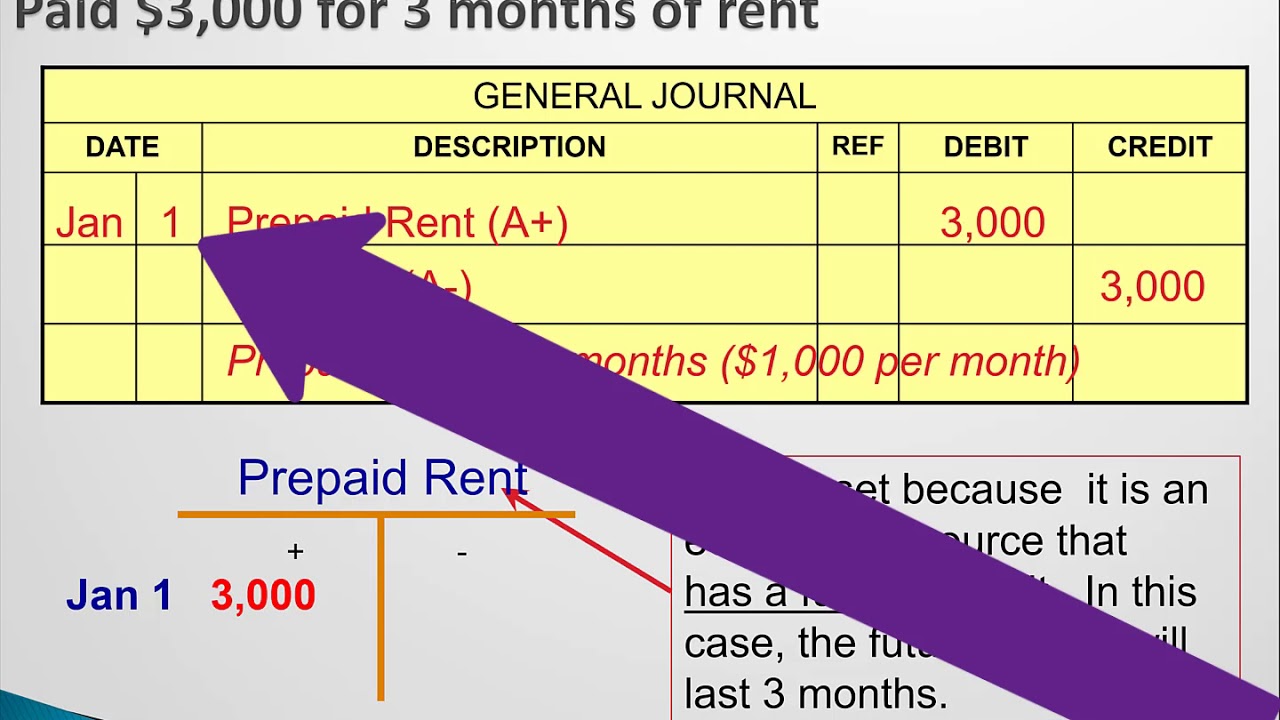

Prepaid Rent Expired Journal Entry - And it says that at this time when they paid the company included the entire amount in prepaid rent. A lessee’s rent annually is $24,000. Each month, you reduce the asset account by the portion you use. Web prepaid expenses may need to be adjusted at the end of the accounting period. Adjusting journal entry as the prepaid rent expires: Is prepaid rent an asset? They pay the lessor three months in advance on the. Web journal entry for prepaid spending. Web analyze the treatment of the amount paid as rent and insurance for the property by the company and pass the necessary journal entries recording the. Initial journal entry for prepaid rent:

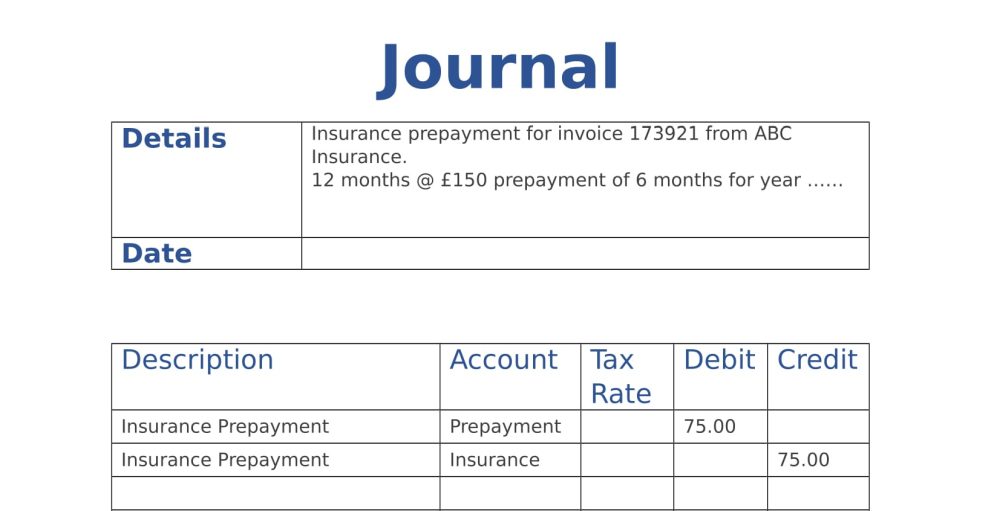

Journal Entry for Prepaid Insurance Online Accounting

Web prepaid expenses guide: If you don’t “catch up” and adjust for the amount you used, you. So, an entry needs to be made to..

The Adjusting Process And Related Entries

Initial journal entry for prepaid rent: Accounting, examples, journal entries, and more explained. Web the proper way to account for prepaid rent is to record.

Prepaid Expenses Entry Calculation In Excel Printable Templates

Web rent paid in advance i.e. Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset.

Journal Entry For Prepaid Expenses

Adjusting journal entry as the prepaid rent expires: In this journal entry, both. Initial journal entry for prepaid rent: Web journal entry when prepaid rent.

Journal Entry For Prepaid Expenses

Web okay, so the company paid 24,000 for 12 months of rent. And it says that at this time when they paid the company included.

Journal Entry For Advance Rent Received Info Loans

Web journal entry for prepaid spending. Web journal entry when prepaid rent actually applies. Web analyze the treatment of the amount paid as rent and.

Prepaid Salary Journal Entry

In this journal entry, both. The journal entry at the time of. Prepaid rent is the amount of rent paid by a firm in advance.

What is the Adjusting Entry for Prepaid Rent? YouTube

Web after one month, $1,000 of the prepaid amount has expired, and you have only 11 months of prepaid rent left. A prepaid account such.

Journal Entry of Prepaid/Advance Expenses & Prepaid Expired

Web analyze the treatment of the amount paid as rent and insurance for the property by the company and pass the necessary journal entries recording.

Web Journal Entry When Prepaid Rent Actually Applies.

Web prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within. Web the proper way to account for prepaid rent is to record the initial payment in the prepaid assets (or prepaid rent) account, using this entry: Web analyze the treatment of the amount paid as rent and insurance for the property by the company and pass the necessary journal entries recording the. The company can make prepaid expense journal entry by debiting prepaid expense account and crediting cash account.

Web The Payment Of Expense In Advance Increases One Asset (Prepaid Or Unexpired Expense) And Decreases Another Asset.

The second entry is to amortize prepaid assets to prepaid expenses when rent is actually consumed. Accounting for accrued rent with journal entries. Web prepaid expenses may need to be adjusted at the end of the accounting period. Initial journal entry for prepaid rent:

At The End Of Jan, One Of The Twelve Months Paid For The Insurance Have Expired.

Web journal entry for prepaid spending. Select the customer from the customer dropdown. And it says that at this time when they paid the company included the entire amount in prepaid rent. So, an entry needs to be made to.

Web After One Month, $1,000 Of The Prepaid Amount Has Expired, And You Have Only 11 Months Of Prepaid Rent Left.

Then, when the check is. Enter the sales info, such as the payment method. The journal entry at the time of. Web the journal entries for prepaid rent are as follows: