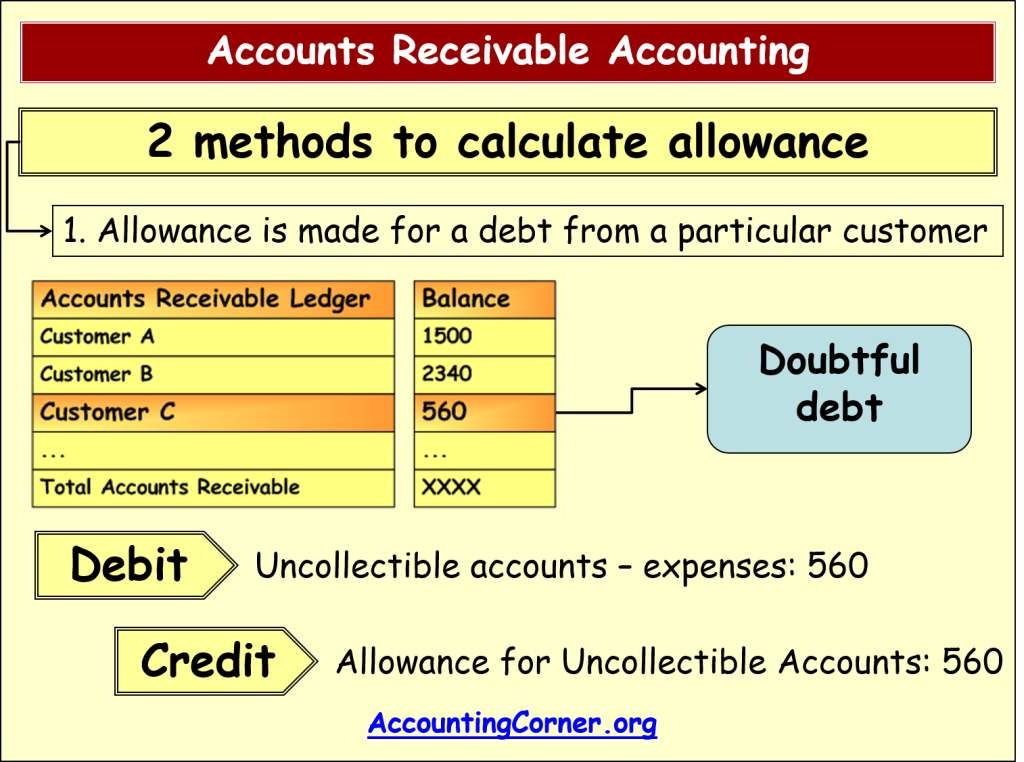

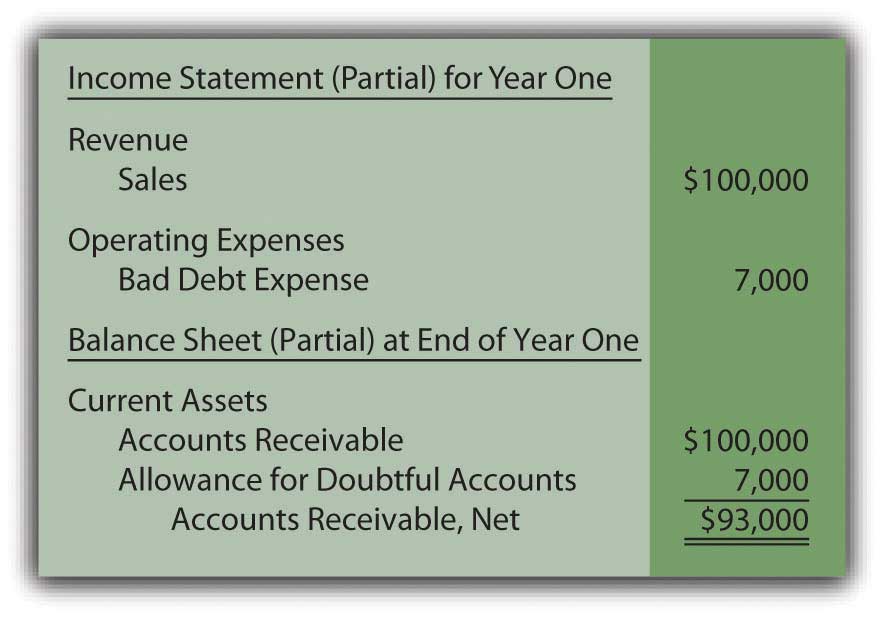

Uncollectible Accounts Journal Entry - Web learn how to compute and journalize bad debt expense as a percentage of receivables using the balance sheet method. A credit to accounts receivable (to remove the amount that. Web therefore, the adjusting journal entry would be as follows. Web when a specific customer’s account is identified as uncollectible, the journal entry to write off the account is: Allowance for doubtful accounts → credit; Web the following entry would be needed to write off a specific account that is finally deemed uncollectible: When a specific customer has been identified as an uncollectible account, the following journal entry would occur. Web what does uncollectible accounts receivable mean? Allowance for doubtful accounts $2,000. Web uncollectible accounts, which is more commonly known as bad debt expense, is included in the calculation of profits (or losses).

PPT Uncollectible Accounts Receivables PowerPoint Presentation, free

Bad debt expense is the loss that incurs from the uncollectible accounts where the customers. See examples, formulas, and journal entries for. Allowance for doubtful.

Uncollectible Accounts Written Off Accounting Methods

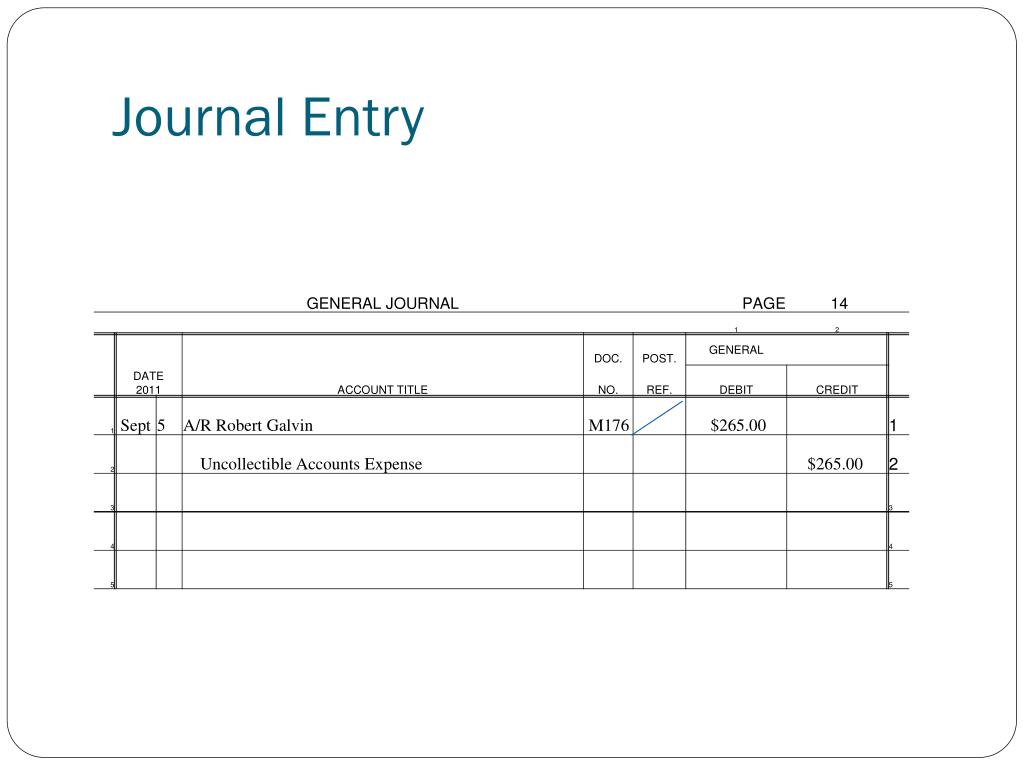

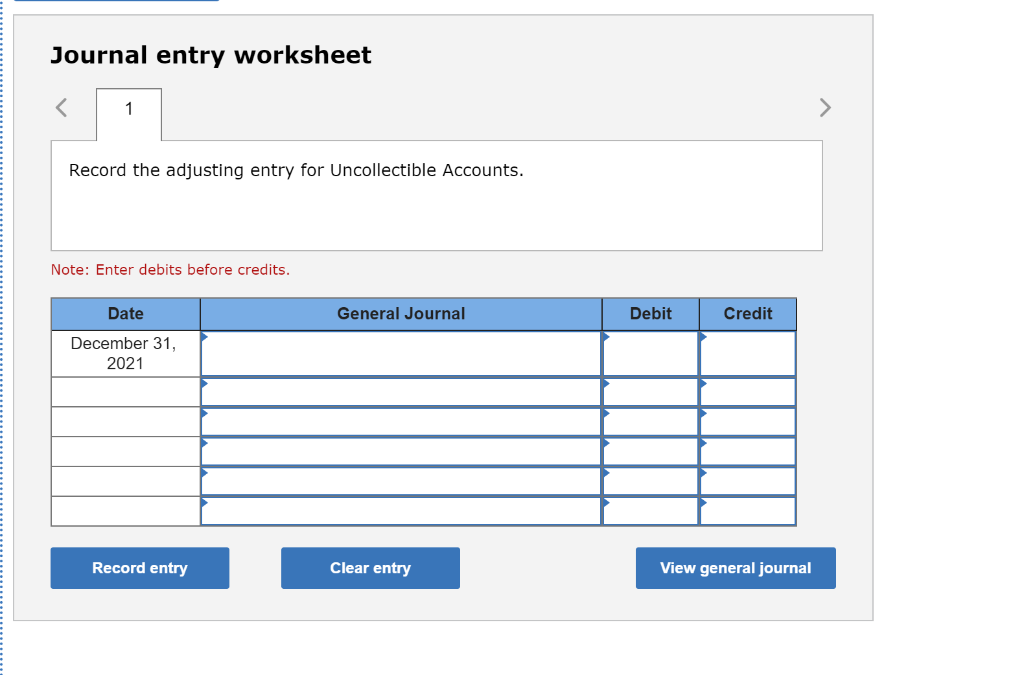

Bad debt expense → debit; Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Web when.

uncollectible accounts receivable journal entry /part 2/ YouTube

If the balance to be collected was. Web what does uncollectible accounts receivable mean? Web when a specific customer’s account is identified as uncollectible, the.

Uncollectible Accounts Methods Accounting Methods

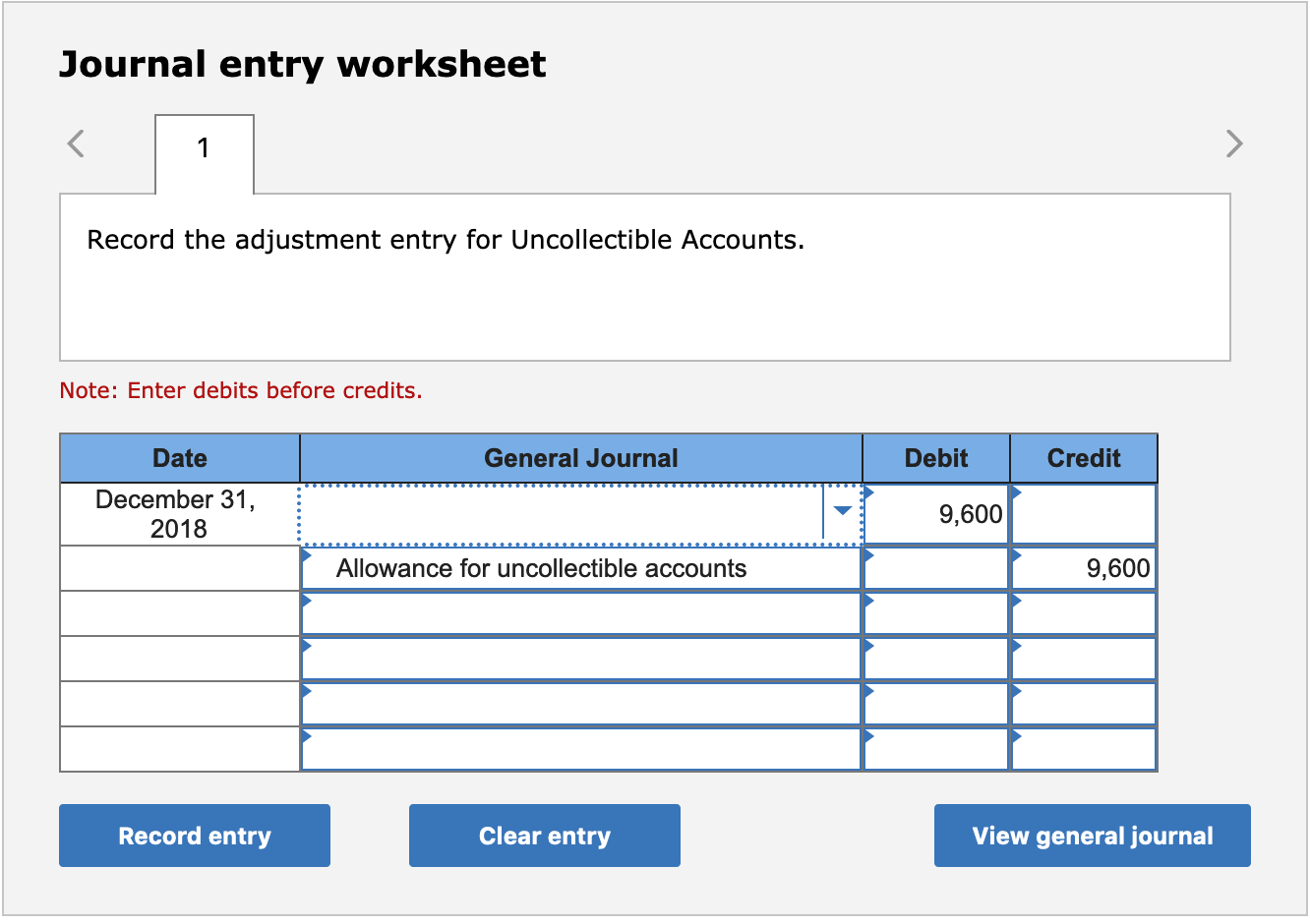

Allowance for doubtful accounts decreases (debit) and. See examples, formulas, and journal entries for. Bad debt expense → debit; Allowance for doubtful accounts → credit;.

Allowance For Uncollectible Accounts Journal Entry Accounting Methods

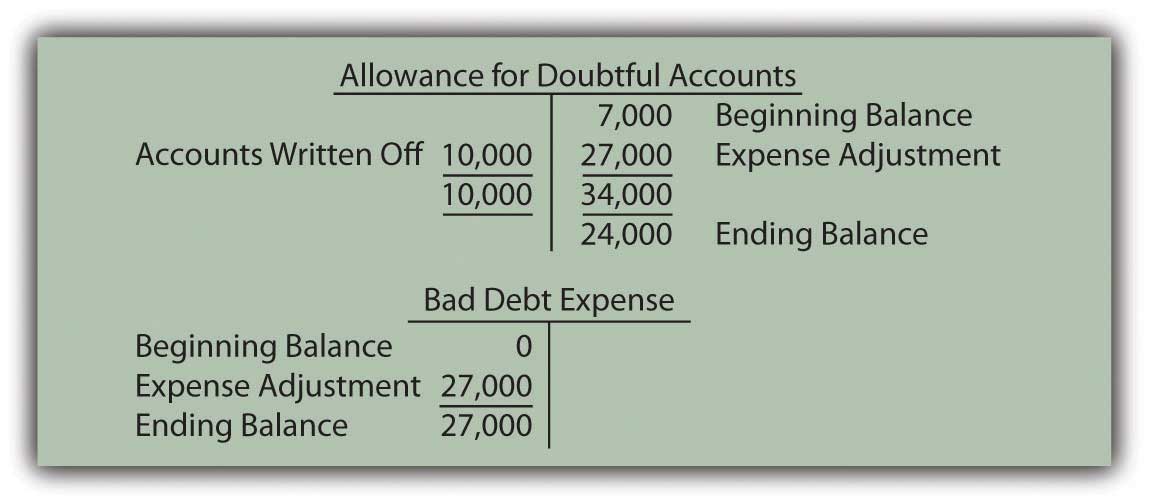

Web the journal entries for recording the uncollectible a/r are as follows: In business, losses due to uncollectible accounts tend to occur when we extend.

Uncollectible Accounts Receivable Example Accounting Methods

See examples, formulas, and journal entries for. Web the journal entry to record the allowance for doubtful accounts would be: Web uncollectible accounts refer to.

Uncollectible Accounts Example Accounting Methods

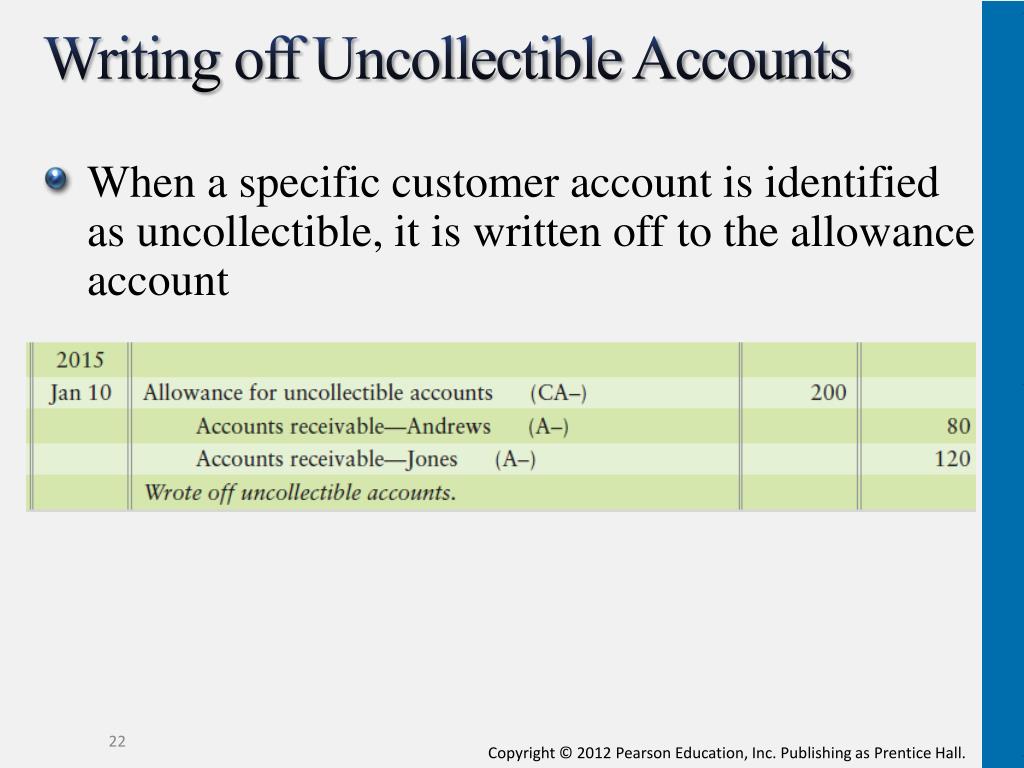

When the company writes off accounts receivable,. Web uncollectible accounts refer to those receivables (full amount due) that a business or company is unable to.

Estimating the Amount of Uncollectible Accounts

See examples, formulas, and journal entries for. When a specific customer has been identified as an uncollectible account, the following journal entry would occur. Bad.

Accounting for Uncollectible Accounts

Web the journal entries for recording the uncollectible a/r are as follows: Allowance for doubtful accounts → credit; Web therefore, the adjusting journal entry would.

Bad Debt Expense → Debit;

Allowance for doubtful accounts → credit; Web the following entry would be needed to write off a specific account that is finally deemed uncollectible: Web the journal entry to record the allowance for doubtful accounts would be: Web the journal entries for recording the uncollectible a/r are as follows:

When The Company Writes Off Accounts Receivable,.

Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. Web uncollectible accounts, which is more commonly known as bad debt expense, is included in the calculation of profits (or losses). Allowance for doubtful accounts decreases (debit) and. If the balance to be collected was.

See Examples, Formulas, And Journal Entries For.

Web under the allowance method, if a specific customer’s accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. A credit to accounts receivable (to remove the amount that. In business, losses due to uncollectible accounts tend to occur when we extend credit to. Web uncollectible accounts refer to those receivables (full amount due) that a business or company is unable to collect from the customer.

Web Therefore, The Adjusting Journal Entry Would Be As Follows.

Web what does uncollectible accounts receivable mean? Bad debt expense is the loss that incurs from the uncollectible accounts where the customers. Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. When a specific customer has been identified as an uncollectible account, the following journal entry would occur.