Transfer Money From Personal Account To Business Account Journal Entry - Sometimes, the owner of the company may withdraw the cash directly from the company for personal use without waiting for the dividend payment. Record a business expense paid for personally. Web by angie mohr. The journal entry is debiting cash $ 100,000. You'll need the recipient's full name and. There will be a paper trail for the transactions, which will make irs happy. Dr cash cr revenue that's it. These include explaining the differences between the account types, the top 3 companies that facilitate this account transfer, and the reasons you may want to transfer funds. There is no need to include your personal accounts with your business reporting. Owner's equity, cash asset, and as cash from.

Accounting Journal Entries For Dummies

Web to complete the process, simply log into your business account and enter your personal account details. Web to make a journal entry: Web direct.

Journal entries Meaning, Format, Steps, Different types, Application

Create a quick transfer during reconciliation. Web i sometimes transfer money from my personal account to my business. Web to transfer money from your wamo.

Accounting Journal Entries For Dummies

Record personal expenses paid with business funds or cash withdrawals as drawings with spend money transactions. To delete a transfer between accounts. However, if your.

Accounting Journal Entries For Dummies

Web can i just transfer money from my business account to my personal account? Sometimes, the owner of the company may withdraw the cash directly.

What is basic journal entry? Leia aqui What are basic journal entries

Transactions between a business owner and her company must be accounted for properly for many reasons. Sometimes, the owner of the company may withdraw the.

Accounting Journal Entries For Dummies

Enter partner's equity or owner's equity on the second line. However, it is essential to consider legalities, tax implications, and documentation requirements to ensure compliance..

What is a Journal Entry in Accounting? Sage Software

So when receiving cash, company needs to record debt to the owner. You can transfer funds to any bank account in the uk, and the.

journal entry format accounting accounting journal entry template

Record personal expenses paid with business funds or cash withdrawals as drawings with spend money transactions. Record a personal expense paid for with business funds..

Spreadsheets contributed us the possible to input, revise, and

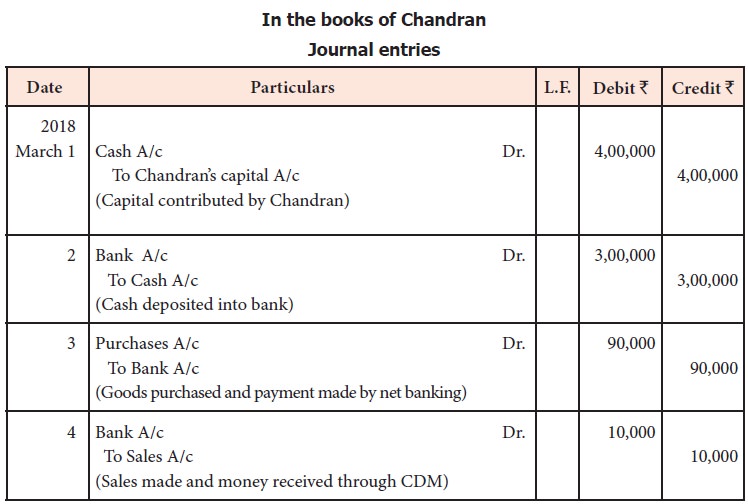

Dr cash cr revenue that's it. Web please prepare a journal entry for money transfer from a personal account to company account. To delete a.

I Transferred Money From My Personal Account But I Don't See Where I Classify That As A Loan From Me To.

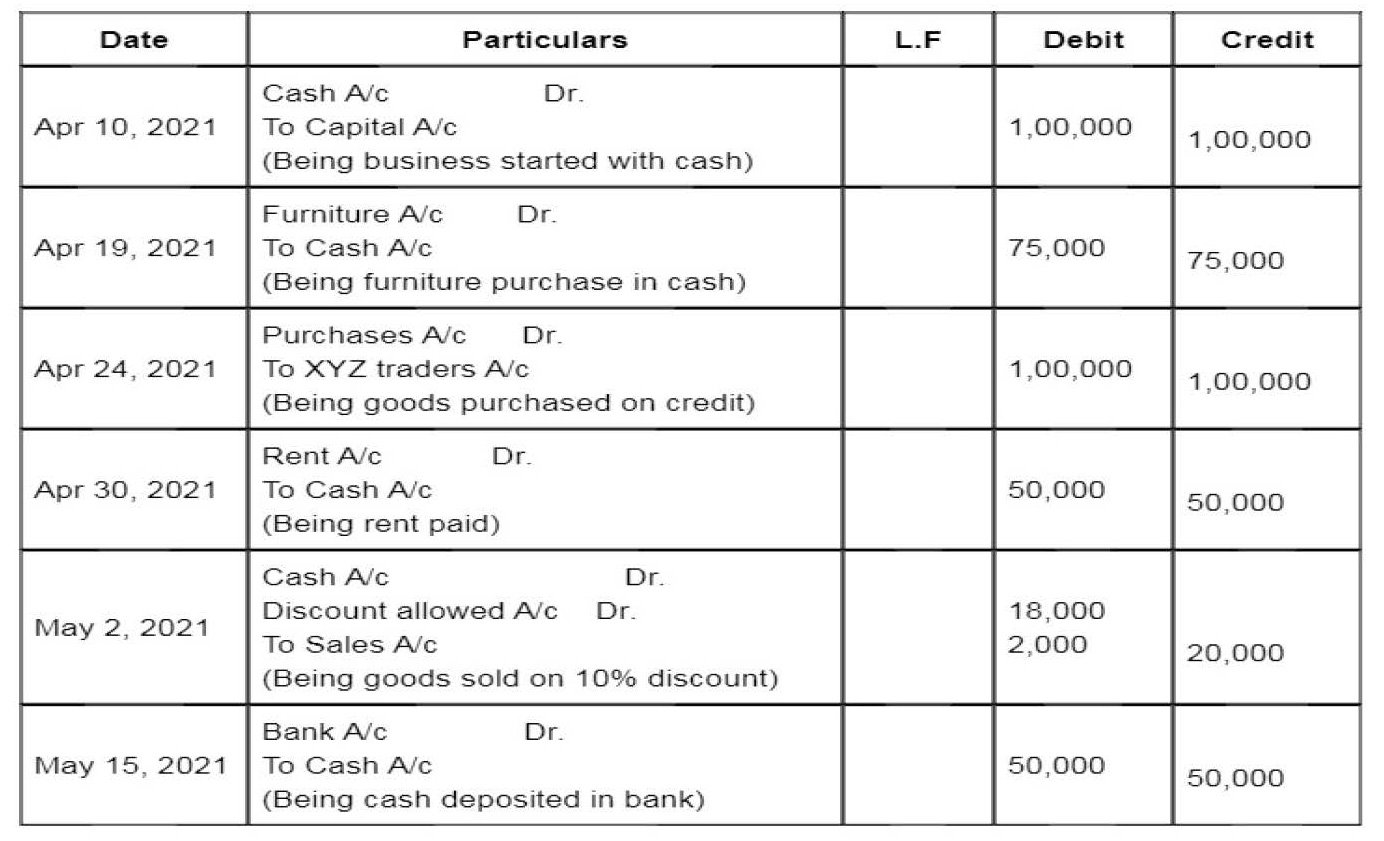

Web moving money between a checking account and a savings account will credit cash and debit cash, making a gl transaction unnecessary, unless the amounts in the two bank accounts are tracked as two separate gl accounts. Record a business expense paid for personally. Sometimes, the owner of the company may withdraw the cash directly from the company for personal use without waiting for the dividend payment. Web there may be circumstances, however, where it is appropriate to allow transfers between a business account and a personal account.

Enter The Amount In The Debits.

Web this is not too complicated. Create a transfer money transaction to record the movement of funds between your accounts. However, if your personal account isn't connected, i'd suggest using a clearing account to temporarily put the funds from there. There will be a paper trail for the transactions, which will make irs happy.

Record Personal Expenses Paid With Business Funds Or Cash Withdrawals As Drawings With Spend Money Transactions.

When you transfer the funds from your personal account to your business account the journal entry would be: Make sure to keep a record of the transaction to account for taxes that must be paid for the transfer. Web direct bank deposit. Web to complete the process, simply log into your business account and enter your personal account details.

I Just Added My Personal Account To Quickbooks.

Dr cash cr revenue that's it. So when receiving cash, company needs to record debt to the owner. To accurately record how much money the company owes the owner or vice versa, every transfer of cash or transaction must be reported. Record a personal expense paid for with business funds.