Journal Entry For Refund Received - Web if a vendor provides you with a refund because you returned faulty goods after you paid for them or they sent you a refund for a credit note, record the refund amount to ensure. Web the journal entry for this refund is: Web journal entry for the cash refund. Locate and click the general journal entry option in the company menu. In business, we usually need to return the damaged goods that we have purchased back to. The customer has decided to return the product and has met the requirements in your return policy, so you've agreed to issue. Set the date for the date you issued the refund. Web the journal entry should include the date, description, and amount of the refund. You can also record any late fees or. Web the difference with a cash refund is that instead of making a credit entry to accounts receivable, the company would credit cash by the amount of the purchase.

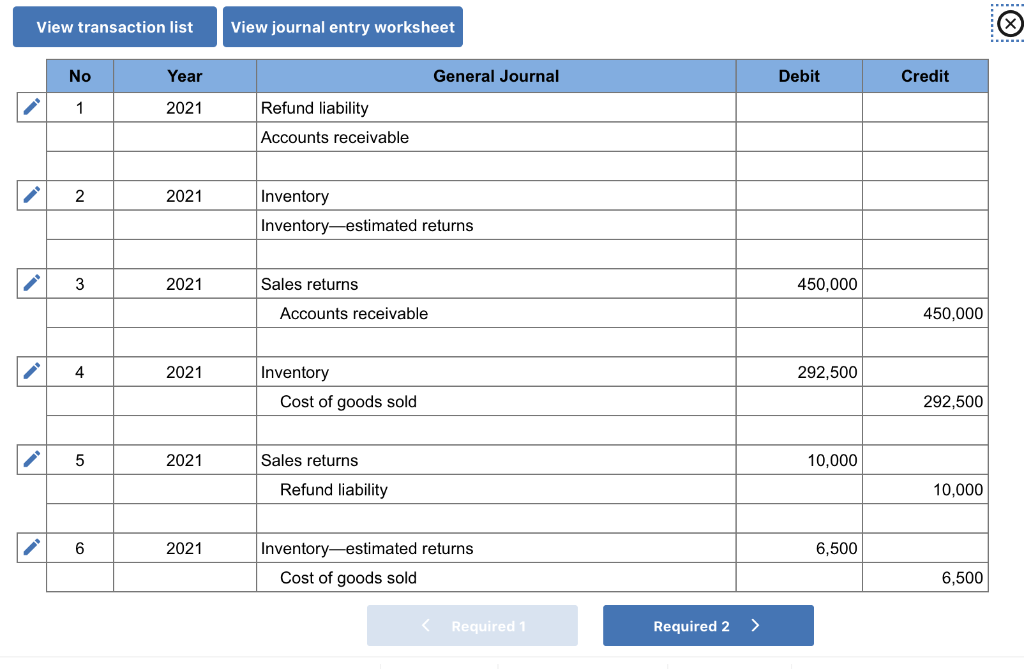

Perpetual Inventory System Journal Entry

Web if a vendor provides you with a refund because you returned faulty goods after you paid for them or they sent you a refund.

Accounts Receivable Journal Entry

Filed quarterly gst return and you are expecting refund from cra? Web if a vendor provides you with a refund because you returned faulty goods.

Accounting for Sales Return Journal Entry Example Accountinguide

For example, on march 31st, 2022, abc inc. This entry is made to recognize the return of. Communicate with the customer about the overpayment as.

Journal Entry for Tax Refund How to Record

You can also record any late fees or. Web what will be treatment in tax if refund is receivable as per last year balancesheet now.

Journal Entry

November 28, 2020 07:18 pm. Set the date for the date you issued the refund. The $600 debit to cash or accounts receivable is the.

What Is An Accounting Journal Entry

Web what is the purchase return journal entry? Web if a vendor provides you with a refund because you returned faulty goods after you paid.

Accounting Journal Entries For Dummies

Web what is the purchase return journal entry? Web in the first entry, we debit the accounts receivable account and credit the purchase returns and.

Tax Refund Accounting Tax Refund Journal Entry

Web what is the purchase return journal entry? Web if the registration fee refers to an amount you are refunding because someone had originally registered.

03 GST ITC Set Off Rules And Journal Entries GST Payment Journal

Returns are a normal part of running a business. Web the journal entry should include the date, description, and amount of the refund. You can.

Web In The First Entry, We Debit The Accounts Receivable Account And Credit The Purchase Returns And Allowances Account.

Set the date for the date you issued the refund. Web the journal entry for this refund is: Web journal entry for the cash refund. When you receive a refund from a vendor, you must.

In Business, The Company May Receive A Refund From Its Vendor Or Supplier Due To Various Reasons Such As The Return Of Goods Or A Mistake Of Overcharged.

For example, on march 31st, 2022, abc inc. Returns are a normal part of running a business. The customer has decided to return the product and has met the requirements in your return policy, so you've agreed to issue. Web record payments to or refunds from the ato using either a spend money transaction or bill, or a receive money transaction or invoice.

Post A Debit To The Cash.

Web if a customer wants to bring back an item, you need to make sales returns and allowances journal entries. Web how you record the erc as a journal entry depends on when you claimed the credit and if you received it as a refund. The $600 debit to cash or accounts receivable is the refund amount from the supplier. In business, we usually need to return the damaged goods that we have purchased back to.

Web If A Vendor Provides You With A Refund Because You Returned Faulty Goods After You Paid For Them Or They Sent You A Refund For A Credit Note, Record The Refund Amount To Ensure.

November 28, 2020 07:18 pm. I've got just the steps you'll need in recording the refund, @hotlocks. Web the difference with a cash refund is that instead of making a credit entry to accounts receivable, the company would credit cash by the amount of the purchase. Web what is the purchase return journal entry?