The Journal Entry To Record Depreciation Expense For Equipment Is - Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear, normal usage or technological changes, etc., where the depreciation account will be debited, and the. Construct the journal entry to record the disposal of property. Adjusting entries are recorded in the general journal using the last. Web record new equipment costs on your business’s balance sheet, typically as property, plant, and equipment (pp&e). Monthly depreciation = 10,000/12 months = $ 833.33 per year. Web depreciation is recorded in the company’s accounting records through adjusting entries. Web depreciation expense is recorded to allocate costs to the periods in which an asset is used. We simply record the depreciation on debit and accumulated depreciation on credit. Credit to the balance sheet account accumulated depreciation;. Web the journal entry for depreciation is:

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Web the journal entry for depreciation is: Web what is the journal entry to record depreciation expense? The journal entry for depreciation expense is: Web.

What is the journal entry for depreciation? Leia aqui What is

Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. At month end, abc needs to. Web at the.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web jul 7, 2023 bookkeeping by adam hill. Credit to the balance sheet account accumulated depreciation;. Web the journal entry to record depreciation expense for.

Journal Entry for Depreciation Example Quiz More..

Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. Web record new equipment costs on your business’s balance.

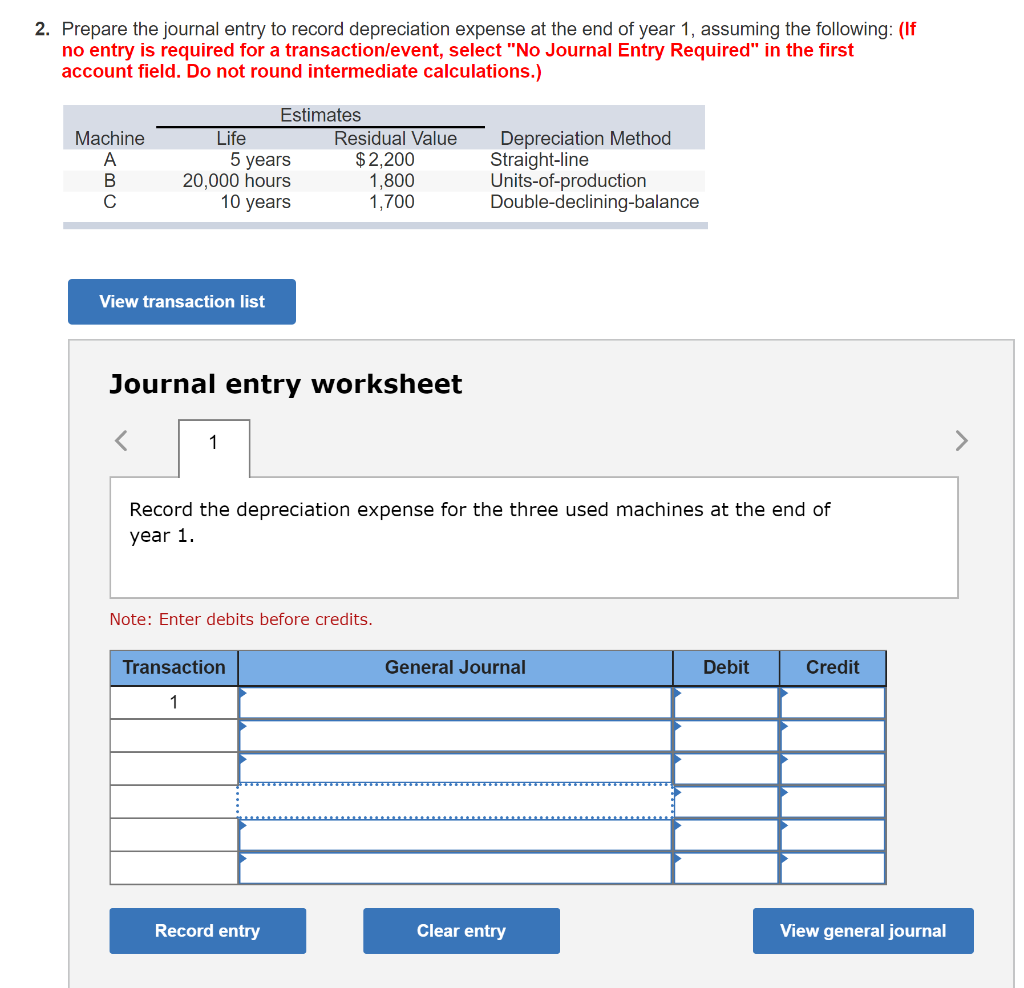

Solved Prepare the journal entry to record depreciation

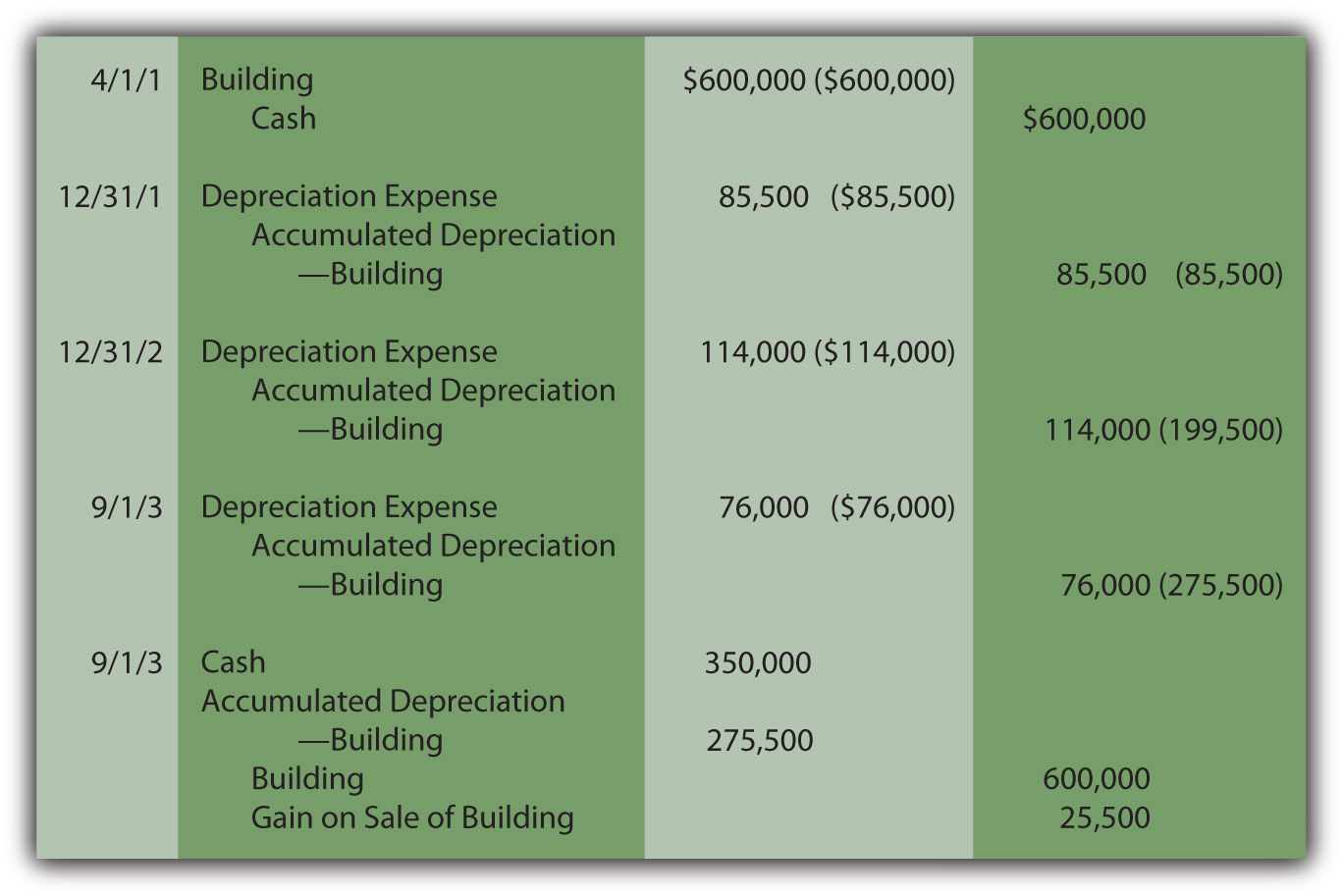

Construct the journal entry to record the disposal of property. Monthly depreciation = 10,000/12 months = $ 833.33 per year. Instead, depreciation is merely intended.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

At month end, abc needs to. Adjusting entries are recorded in the general journal using the last. Web the journal entry to record this expense.

Solved 2. Prepare the journal entry to record depreciation

Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. Web the journal entry to record depreciation expense for.

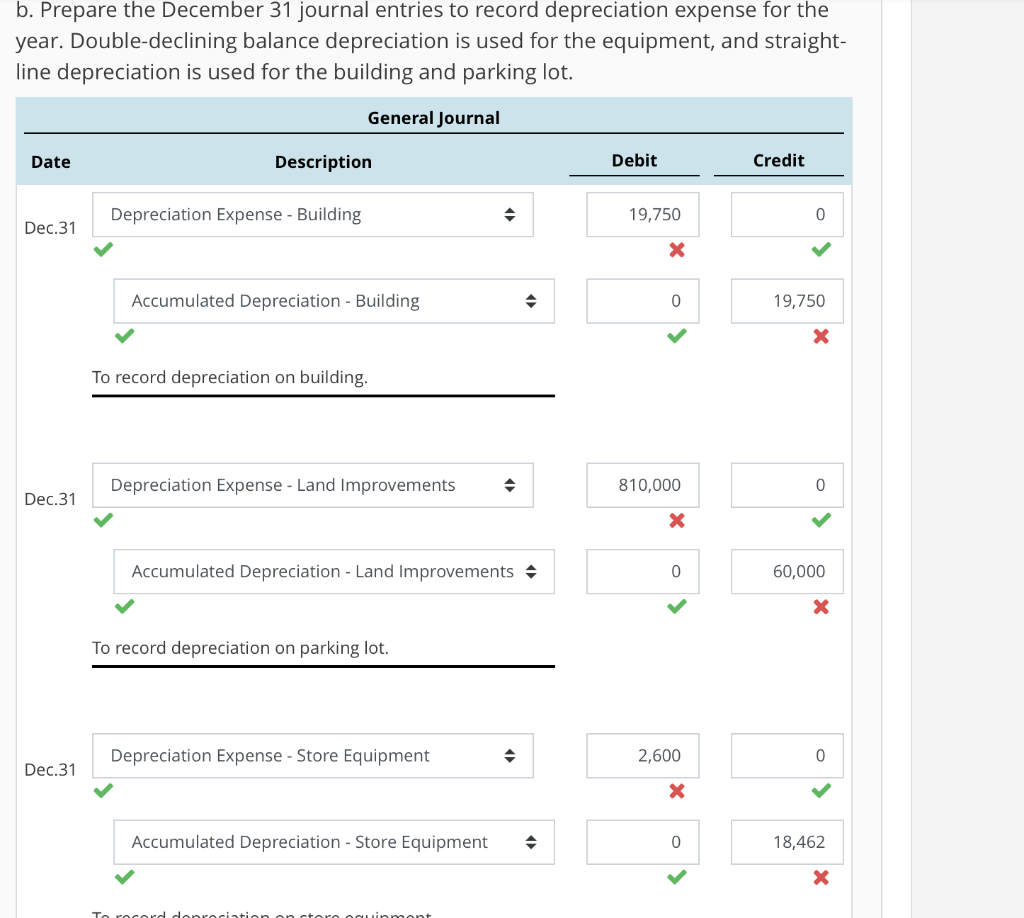

Solved b. Prepare the December 31 journal entries to record

Construct the journal entry to record the disposal of property. Web at the end of the year after you've talked to your accountant, create a.

Examples of How to Record a Journal Entry for Expenses Hourly, Inc.

Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life. Web at the end of.

The Journal Entry For Depreciation Expense Is:

Web depreciation expense is recorded to allocate costs to the periods in which an asset is used. $1,950 ÷ 12 = $162.50. Construct the journal entry to record the disposal of property. Web jul 7, 2023 bookkeeping by adam hill.

Debit To The Income Statement Account Depreciation Expense;

Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life. Web the journal entry to record depreciation expense for equipment is: Web record new equipment costs on your business’s balance sheet, typically as property, plant, and equipment (pp&e).

Monthly Depreciation = 10,000/12 Months = $ 833.33 Per Year.

And, record new equipment on your. Web the journal entry to record this expense is straightforward. Web understand the need to record depreciation for the current period prior to the disposal of property or equipment. Web the journal entry for depreciation is:

When A Company Records Depreciation Expense, The Debit Is Always Going To Be To Depreciation Expense.

The adjusting entry for a. Web at the end of the year after you've talked to your accountant, create a journal entry to record the lost value. Adjusting entries are recorded in the general journal using the last. Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation.