The Journal Entry To Record Depreciation On Office Equipment Debits - Web the journal entry for depreciation is: Web acct 208 exam 1 (chapter 3) get a hint. Web the journal entry to recognize depreciation expense for office equipment would include a: Find the answer to the. When a company records depreciation expense, the debit is. A journal entry is made. Web a journal entry that debits depreciation expense and credits accumulated depreciation records _____. The difference between the entries to record depreciation on office equipment and depreciation on factory equipment is that one. Journal entries are recorded in the journal, also known as books of original entry. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets, such as office equipment.

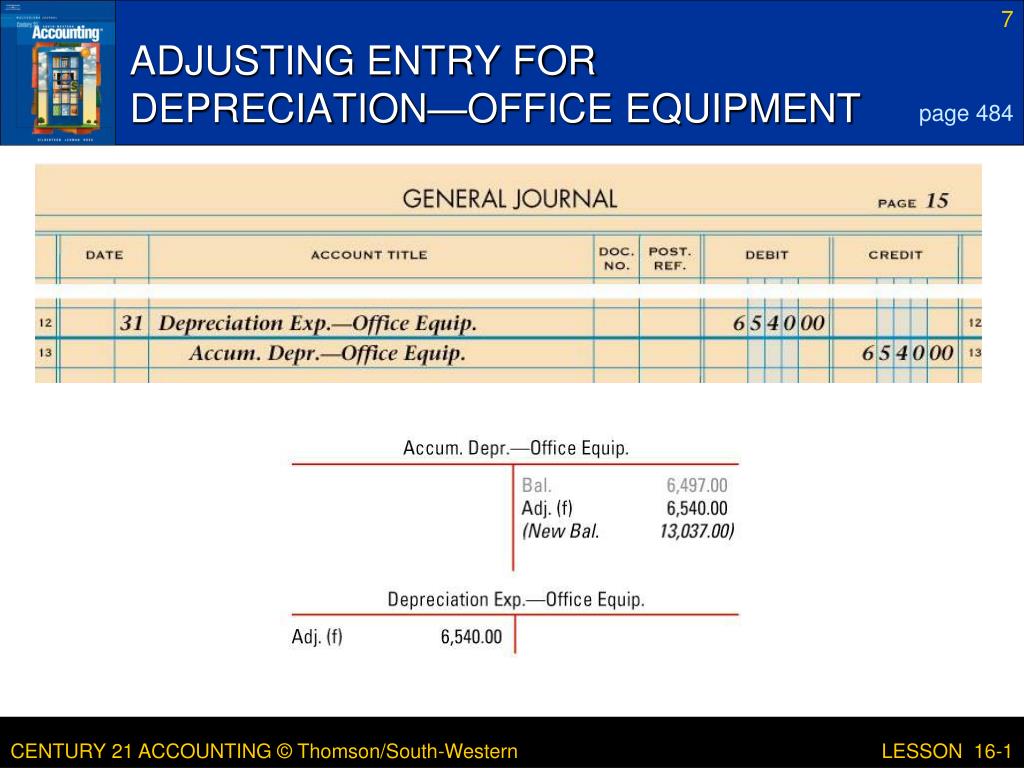

Adjusting Entries Journalizing Depreciation Adjusting Entries

What if the delivery van has an estimated residual value of $10,000 after 5 years? Web learn how to record depreciation expense and accumulated depreciation.

Recording Depreciation Expense for a Partial Year

See examples of debits and credits for each type. Web = $8,000 per year. If you’re lucky enough to use an accounting software. Web which.

How to write general journal entries using debits and credits

Web find the correct answer to the journal entry to record depreciation expense for equipment. Debits depreciation expense, while the other debits. Web the journal.

Adjusting Journal Entries Defined Accounting Play

$1,950 ÷ 12 = $162.50. See the basic journal entry. From the view of accounting, accumulated depreciation is an important aspect as it is relevant.

Basic Accounting for Business Your Questions, Answered

The difference between the entries to record depreciation on office equipment and depreciation on factory equipment is that one. See examples of debits and credits.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web the journal entry for depreciation is: Web find the correct answer to the journal entry to record depreciation expense for equipment. Web difference b/n.

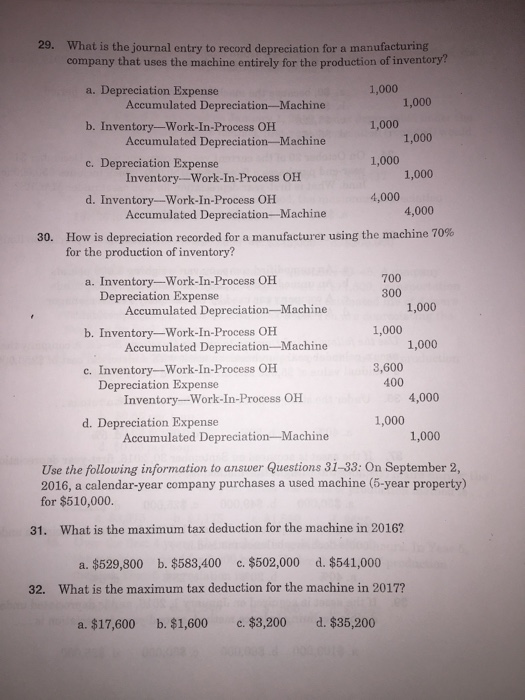

Solved 29. What is the journal entry to record depreciation

Find the answer to the. If you’re lucky enough to use an accounting software. Depreciation on office equipment a journal entry that debits advertising. Web.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

Web learn how to record equipment purchases, depreciation, and disposal in your business books with journal entries. Web the journal entry for depreciation is: Web.

PPT ADJUSTING ENTRIES RECORDED FROM A WORK SHEET PowerPoint

Web difference b/n the entries to record depreciation on office equipment and depreciation on factory equipment is that one: Web a journal entry that debits.

Your Ask Joey ™ Answer.

What is the journal entry to record depreciation expense? Find the answer to the. See examples of debits and credits for each type. When a company records depreciation expense, the debit is.

See The Basic Journal Entry.

Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets, such as office equipment. Web the journal entry to recognize depreciation expense for office equipment would include a: Web the entry generally involves debiting depreciation expense and crediting accumulated depreciation. The depreciation expense then would.

Web A Set Of Flashcards To Test Your Knowledge Of Managerial Accounting Concepts, Including Depreciation, Manufacturing Overhead, And Cost Of Goods Sold.

Debits depreciation expense, while the other debits. Web to calculate depreciation by month: Web find the correct answer to the journal entry to record depreciation expense for equipment. The difference between the entries to record depreciation on office equipment and depreciation on factory equipment is that one.

See The Detailed Solution From A Subject Matter Expert And Learn Core Concepts.

Web journal entries are used to record business transactions and events. Now, when the company sells or disposes of the asset, this balance of the accumulated depreciation. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Web the journal entry to record depreciation on office equipment debits: