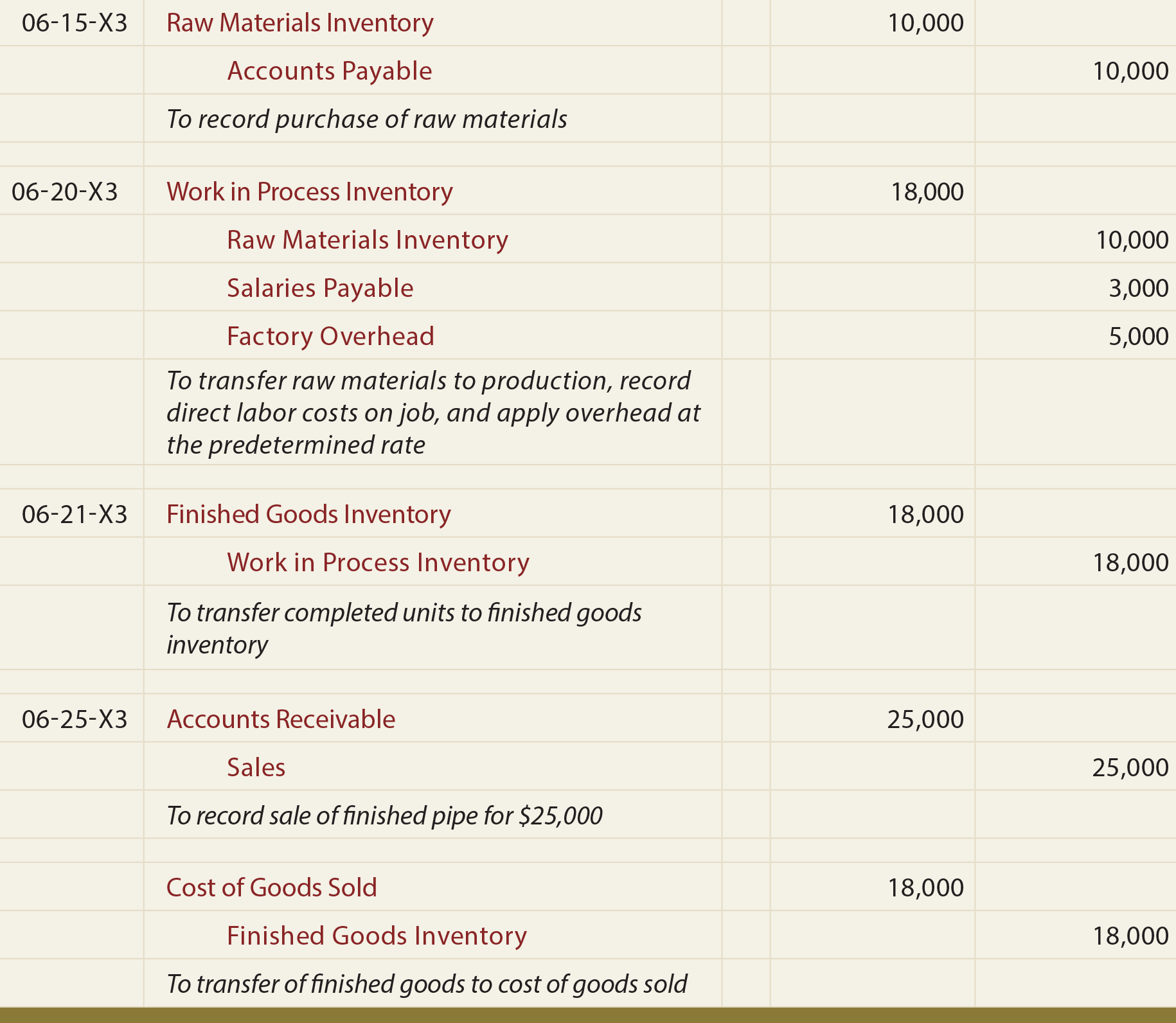

The Journal Entry To Apply Overhead Cost To Processing Department - To recap, the factory overhead account is not a typical account. It does not represent an asset, liability,. Web the journal entry to reflect this is as follows: If the overhead was overapplied, and the actual. Web the journal entry to reflect manufacturing overhead costs being applied to products going through the finishing department is as follows: 106, $ 16,000 to job no. In the example, assume that there was an indirect material cost for water of. Web the adjusting journal entry is: Web the estimated annual overhead cost is $340,000 per year. When each job and job order cost.

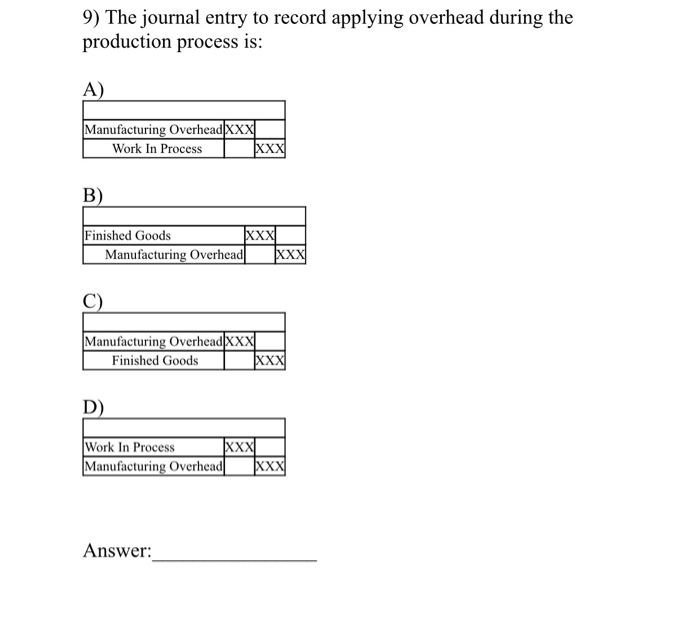

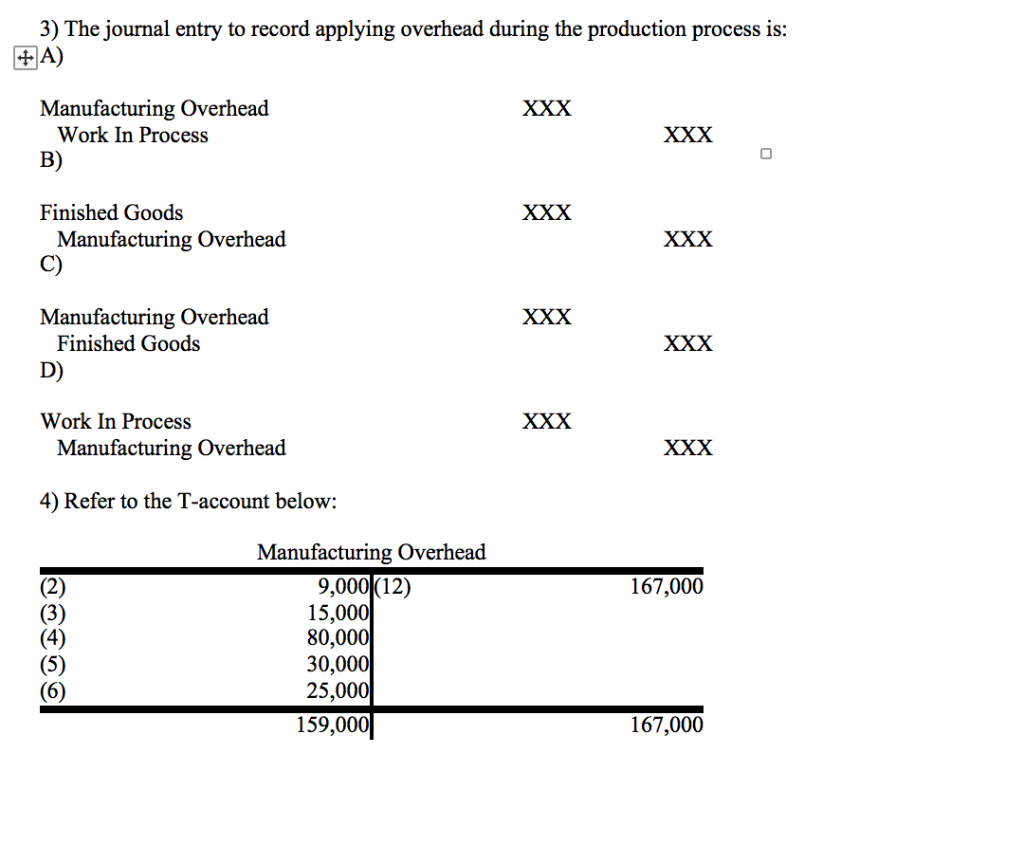

Solved 9) The journal entry to record applying overhead

When this journal entry is. In the example, assume that there was an indirect material cost for water of. Web a typical entry to record.

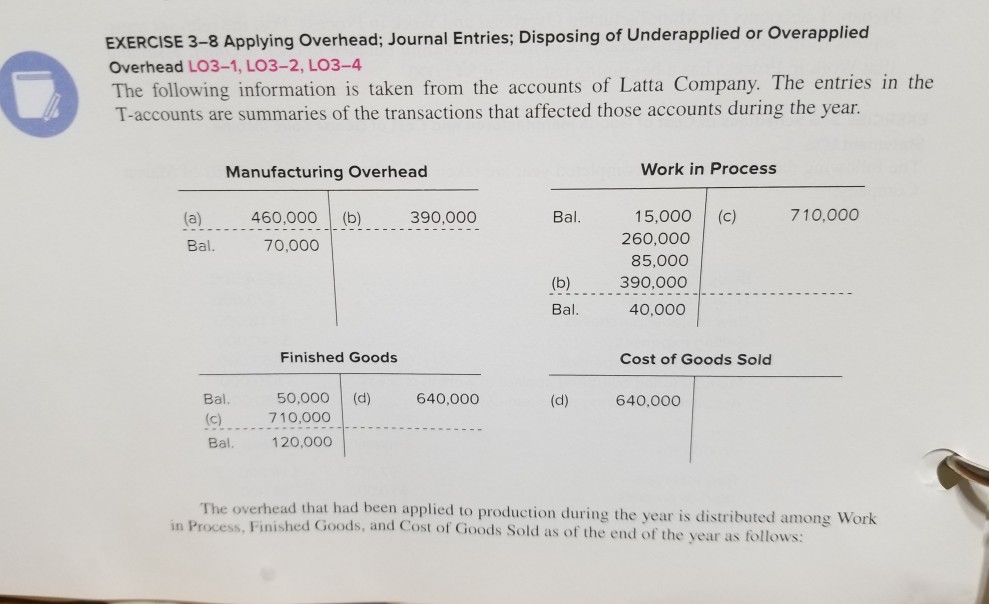

Solved EXERCISE 38 Applying Overhead; Journal Entries;

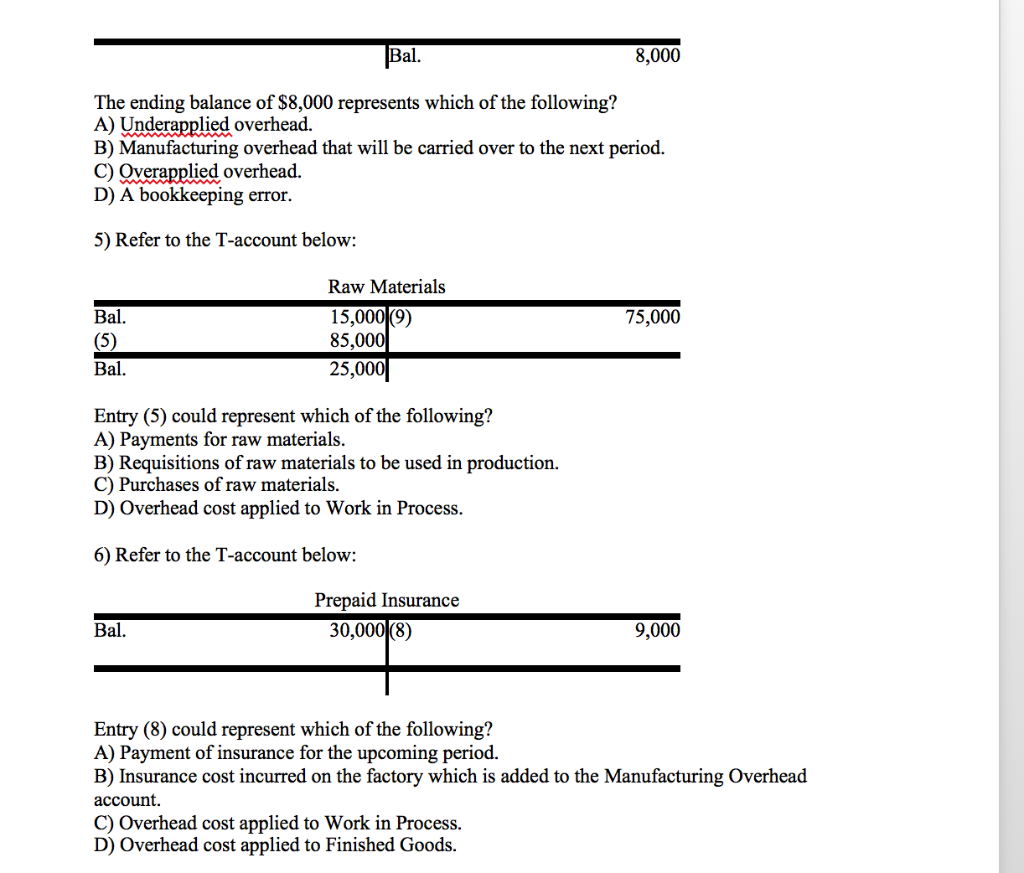

Web the overhead costs are applied to each department based on a predetermined overhead rate. If the overhead was overapplied, and the actual. Assume manufacturing.

Underapplied Manufacturing Overhead Journal Entry YouTube

In the example, assume that there was an indirect material cost for water of $400 in. When each job and job order cost. B) debit.

Process Costing Journal Entries YouTube

Web the estimated annual overhead cost is $340,000 per year. Web the journal entry to record direct materials costs in processing department #1 is debit.

The Journal Entry to Record Labor Costs Credits

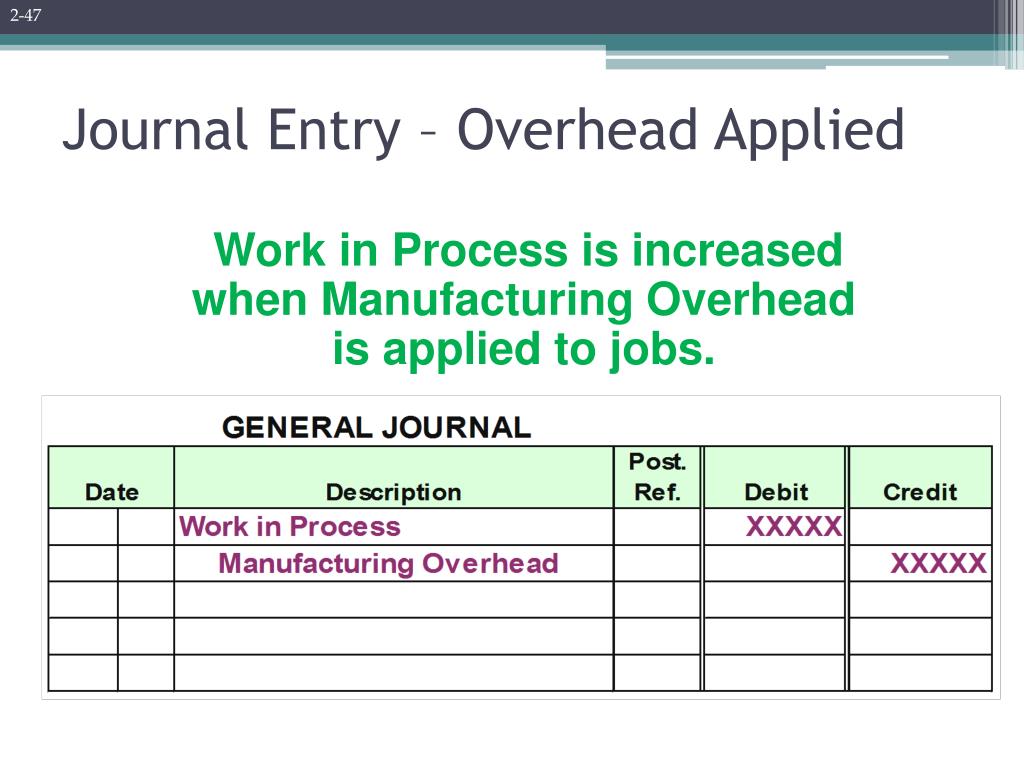

Assume manufacturing overhead costs (often simply called overhead costs) are being applied. The overhead used in the allocation is an estimate due to the timing..

PPT Chapter 2 PowerPoint Presentation, free download ID6956792

Web the journal entry to reflect manufacturing overhead costs being applied to products going through the finishing department is as follows: Web the overhead costs.

Solved 3) The journal entry to record applying overhead

Web the estimated annual overhead cost is $340,000 per year. Assume manufacturing overhead costs (often simply called overhead costs) are being applied. B) debit work.

Solved 3) The journal entry to record applying overhead

Web the overhead costs are applied to each department based on a predetermined overhead rate. Web 1) the journal entry to apply overhead to work.

Solved Process cost journal entries In October, the cost of materials

Web the overhead costs are applied to each department based on a predetermined overhead rate. Application of underapplied overhead to cost of goods sold. Assume.

Overhead Assigned To Job A = 1,600 X 5 = $8,000.

Web the journal entry to reflect manufacturing overhead costs being applied to products going through the finishing department is as follows: It was also estimated that the total machine hours will be 34,000 hours, so the allocation rate is computed as: Web the overhead costs are applied to each department based on a predetermined overhead rate. When this journal entry is.

B) Debit Work In Process;

106, $ 16,000 to job no. Web the estimated annual overhead cost is $340,000 per year. When each job and job order cost. It does not represent an asset, liability,.

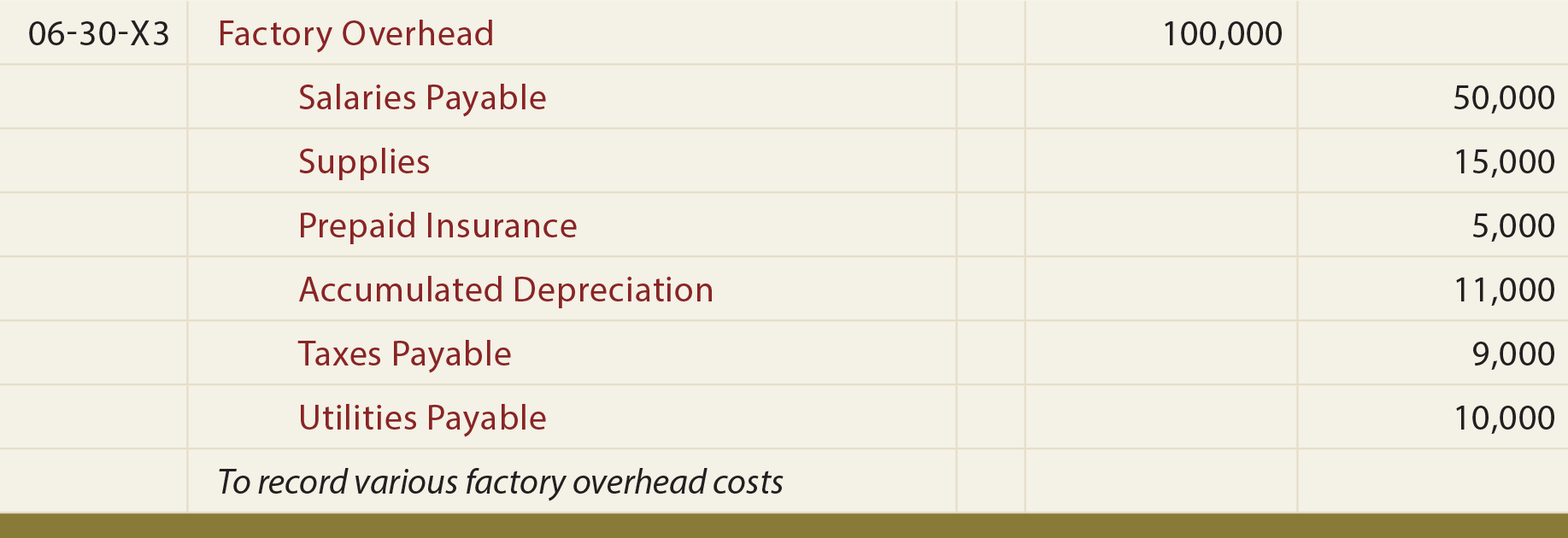

Web A Typical Entry To Record Factory Overhead Costs Would Be As Follows:

To recap, the factory overhead account is not a typical account. The process of determining the manufacturing. Web 1) the journal entry to apply overhead to work in process is: Web the journal entry to reflect this is as follows:

Assume Manufacturing Overhead Costs (Often Simply Called Overhead Costs) Are Being Applied.

In the example, assume that there was an indirect material cost for water of. Journal entry to move work in process costs into finished goods. Web the journal entry to record direct materials costs in processing department #1 is debit blank_____. The overhead used in the allocation is an estimate due to the timing.