Write Off Accounts Receivable Journal Entry - It’s important to note that the. Web under the allowance method, if a specific customer’s accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. One method of recording the bad debts is referred to as the direct write off method which involves removing the specific. The journal entry is debiting bad debt expenses and. An accounts receivable balance represents an amount due to cornell university. You can also use the. This will be a credit to the asset account. There might be several journal entries pertaining to different transactions. [q1] the entity concludes that $1,200 of its accounts receivable cannot be collected in the. Web 5 minutes of reading.

Accounts receivable

[q1] the entity concludes that $1,200 of its accounts receivable cannot be collected in the. Web create a journal entry to write off the appropriate.

Recovering Writtenoff Accounts Wize University Introduction to

The journal entry is debiting bad debt expenses and. Web steps to write off ar: It can be to an. There might be several journal.

EXCEL of Corporate Accounts Receivable and Accounts Payable Details

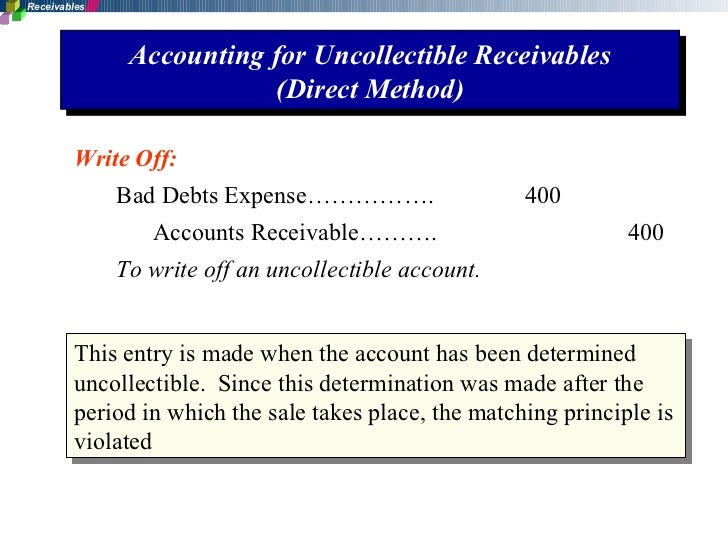

Web direct write off method. Web for proper recording of accounts that get written off, one has to make the following standard journal entries in.

Accounts Receivable Journal Entry Example Accountinguide

Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: Web write.

Journal Entries Format

As the name suggests, this method will directly remove accounts receivable to bad debt expenses. Web create a journal entry to write off the appropriate.

Image result for direct write off method of accounting for

[q1] the entity concludes that $1,200 of its accounts receivable cannot be collected in the. As the name suggests, this method will directly remove accounts.

Journal Entry Problems and Solutions Format Examples MCQs

One method of recording the bad debts is referred to as the direct write off method which involves removing the specific. An accounts receivable balance.

Example of the direct write off and the allowance methods for Accounts

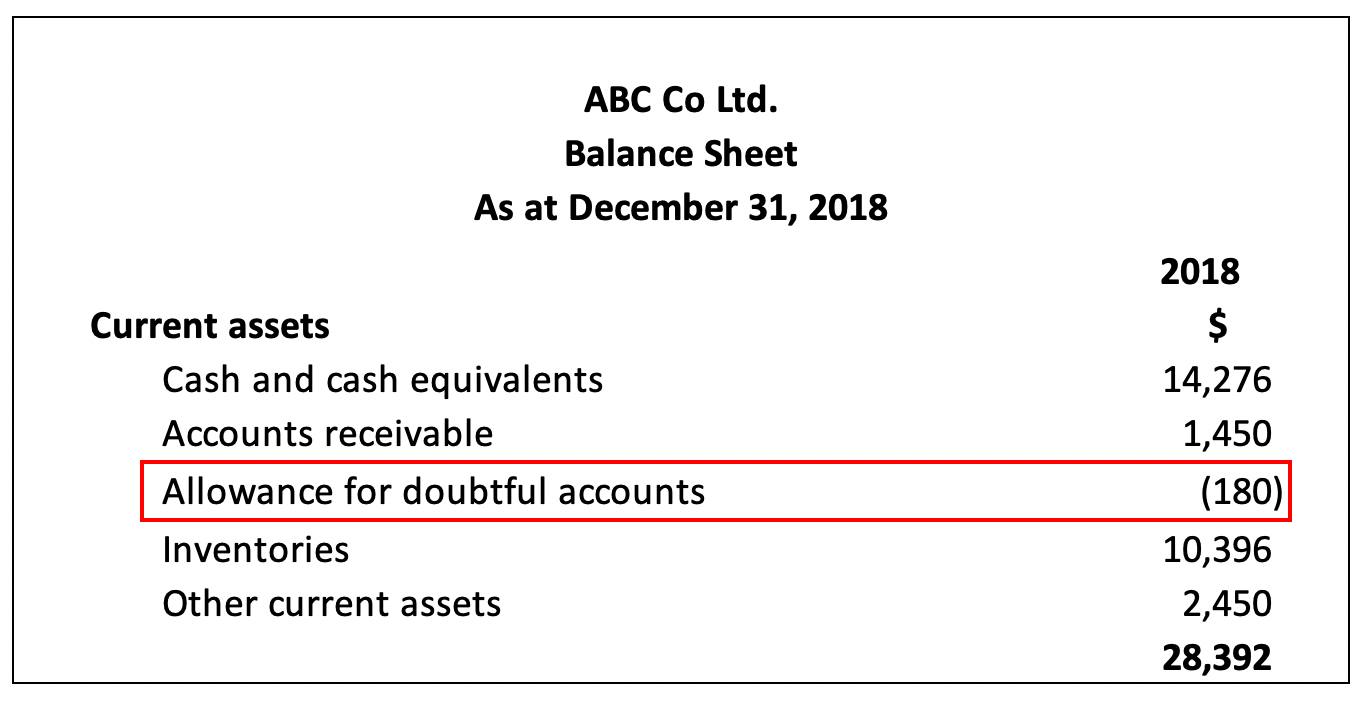

Web create a journal entry to write off the appropriate amount of the asset. Web when the company writes off accounts receivable under the allowance.

What is Accounts Receivables Examples, Process & Importance Tally

The basic and common journal entries relating to. As the name suggests, this method will directly remove accounts receivable to bad debt expenses. There are.

This Method Violates The Gaap Matching Principle Of Revenues And Expenses Recorded In The Same.

One method of recording the bad debts is referred to as the direct write off method which involves removing the specific. Web kinds of journal entries for accounts receivable. The visual below also includes the journal entry necessary to. Web 5 minutes of reading.

The Journal Entry Is Debiting Bad Debt Expenses And.

It can be to an. It’s important to note that the. This will be a credit to the asset account. Web to record cash received after an accounts receivable has been written off;

This Involves Assessment, Internal Approval, Accounting Entries, And Adjusting The Allowance For Doubtful Accounts.

Web steps to write off ar: Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: Web create a journal entry to write off the appropriate amount of the asset. The basic and common journal entries relating to.

You Can Also Use The.

[q1] the entity concludes that $1,200 of its accounts receivable cannot be collected in the. Debit the bad debts expense concerning the. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. Web when the company writes off accounts receivable under the allowance method, it can make journal entry by debiting allowance for doubtful accounts and crediting accounts receivable.