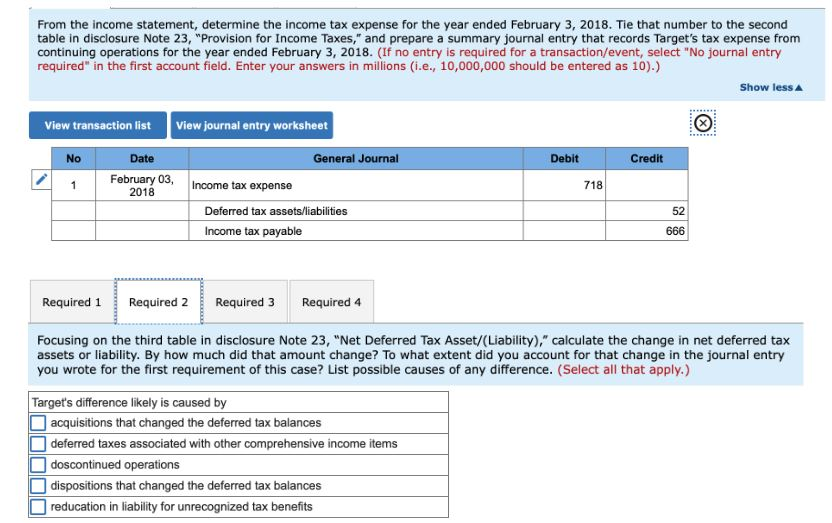

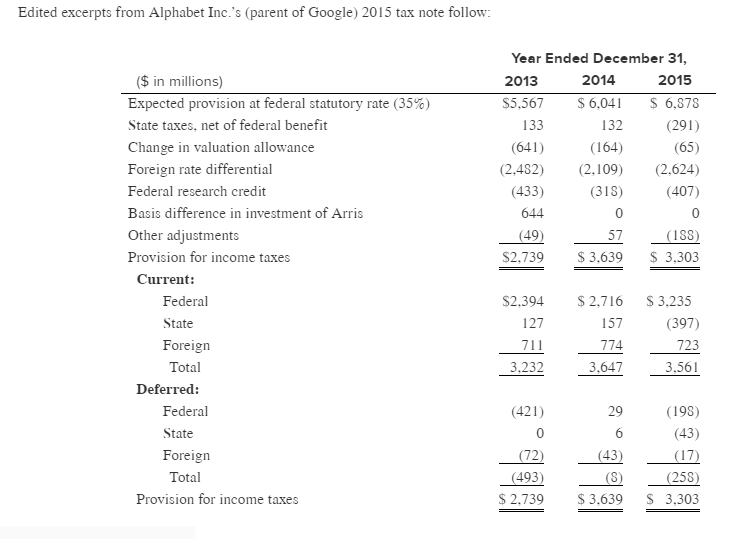

Tax Provision Journal Entry - Get more accurate and efficient results with the power of ai, cognitive computing, and machine learning. Web tax provision process. Before going to understand the taxation. The endgame of a tax provision is clear—to produce the income. Web the journal entries page lets you configure how calculations and other data appear in the output journal entries reports. Web the asc 740 income tax provision consists of current and deferred income tax expense. Web in this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the financial statements. Web the actual taxation entries are most important things as they clears the balance sheet picture and gives real result. We discuss what end of year journal entries might be required. Web these journal entries capture the recognition and utilization of deferred tax assets and liabilities over time.

Journal Entry For Tax Provision

Current income tax expense (benefit) includes the income tax payable (receivable) for. Web tax accounting perspectives. Web provisions journal entry. The concept of income tax.

Provision For Tax Journal Entry

If income tax rate is 30%. The endgame of a tax provision is clear—to produce the income. This entry is made to reflect the income.

Journal Entry for Tax Paid by Cheque davistakey1939 Davis

The configurable je module provides a flexible. Taxes are amounts levied by governments on businesses and individuals to finance their expenditures, to fight business cycles,.

Provisions in Accounting Meaning, Accounting Treatment, and Example

Web these journal entries capture the recognition and utilization of deferred tax assets and liabilities over time. Before going to understand the taxation. The endgame.

Entries for TDS Receivable and Provision for Tax Chapter 8 TDS Recei

Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700. The endgame of a tax provision.

Journal Entry For Tax Provision

The process begins by adjusting the. Web because tax practitioners often create or audit the income tax provision and related disclosures, it is important for.

Blt 134 chapter 4

Web because tax practitioners often create or audit the income tax provision and related disclosures, it is important for tax students and professionals to understand.

Tax Expense Journal Entry Journal Entries for Normal Charge

Current income tax expense (benefit) includes the income tax payable (receivable) for. The process begins by adjusting the. Web accounting for taxes. Web journal entry.

Journal Entry Problems and Solutions Format Examples MCQs

Web accounting for income taxes should be easy right? Understanding the income tax provision process. Web tax provision process. Web the journal entry to record.

Web A Powerful Tax And Accounting Research Tool.

The process begins by adjusting the. Web the journal entry to record provision is: Web tax accounting perspectives. Web the actual taxation entries are most important things as they clears the balance sheet picture and gives real result.

Understanding The Income Tax Provision Process.

Current income tax expense (benefit) includes the income tax payable (receivable) for. Miar company has reported the following figures for current year end: Web in this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the financial statements. Web provisions journal entry.

Ultratax Cs Provides A Full.

Web tax provision process. Web the estimation is then booked as a journal entry. Key components of the provision calculation. Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700.

Before Going To Understand The Taxation.

This implies that sandra co. Web accounting for taxes. We discuss what end of year journal entries might be required. Taxes are amounts levied by governments on businesses and individuals to finance their expenditures, to fight business cycles, to.